Mergers and innovation: fewer players, more ideas?

Is market consolidation detrimental to innovation? Conversely, do mergers create benefits to society by increasing innovation that brings better outcomes for consumers? While merger assessment has historically focused on static price and cost effects, regulators are increasingly being asked to consider whether a transaction will create the right incentives for product development and innovation over a longer time horizon. The Oxera Economics Council met to discuss this topic in November 2016.

A number of recent decisions by European competition authorities have triggered debate on the relationship between mergers and innovation. This debate is embedded in the wider question of whether increased competition is likely to increase or decrease innovation.

These cases have shown how understanding the impact of the merger on innovation and efficiencies arising in the future rather than the short term (namely, dynamic efficiencies) is far from straightforward. In some cases, mergers have been found to harm dynamic efficiency by reducing the incentives for the merging parties and their rivals to innovate.1 In others, the merging parties have claimed that the transaction would benefit dynamic efficiency through increased investment.2

Inspired by the discussion at the Oxera Economics Council in November 2016, this article looks at some of these questions in the context of the literature and the frameworks developed in such cases.

What is the relationship between competition and innovation?

The debate on the assessment of mergers in dynamic markets has its roots in a wider discussion of the effect of competition on innovation. Much of this debate goes back to the work of two economists (Schumpeter and Arrow) in the early and mid-20th century, whose conclusions result in two apparently conflicting theories on the relationship between competition and innovation.

According to Schumpeter,3 where there are low levels of competition in a market, innovation generates rewards for the innovator in the form of higher margins, which in turn increase the incentives to engage in further research and development (R&D). It follows that, despite the low levels of competition, the innovator will need to continue to invest and innovate in order to maintain its market lead. In other words, advocates of a Schumpeterian view argue that less competition will lead to more innovation, as long as competition for the market remains.

Conversely, Arrow’s theory proposes that competition enhances innovation, as firms under competitive pressure will strive to innovate in order to outperform competitors and escape the competition.4

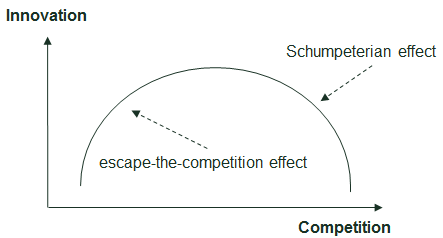

Following the theoretical work of Schumpeter and Arrow, a large body of empirical literature has tested these arguments in different industries. While the results of this literature are mixed, many studies highlight the non-linear nature of the relationship between competition and innovation. In particular, several studies show that the relationship between competition and innovation resembles an inverted ‘U’—i.e. that for low levels of competition, innovation initially increases as competition becomes more intense; and after reaching its peak, innovation declines as competition intensifies further.5 This relationship is illustrated in Figure 1.

Figure 1 The relationship between innovation and competition

However, despite being an intuitive framework, for a number of reasons the inverted U-curve does not provide a practical tool for assessing the effect of a change in competition on the level of innovation in an industry. First, the empirical studies that advocate the existence of the U-curve are based on a comparison of data from several industries at a particular point in time.6 Hence, such a framework will not be able to identify where a particular industry lies on the curve, and will therefore fail to provide useful guidance on what happens when the level of competition in a specific industry changes—which is the key question in merger control.

This apparent dichotomy between Schumpeter’s and Arrow’s approaches has been criticised by authors such as Shapiro for being too simplistic. Shapiro (2013) argues that, in order to understand the relationship between innovation and competition in a specific market, one should focus on the incentive and ability of firms to engage in innovation.7 The incentives to innovate can be assessed using three principles.

- Contestability: the extent to which the incumbent position(s) can be challenged. For innovation to flourish, the market needs to remain contestable. If market shares are ‘sticky’, more competition translates into more contestability (and thus more innovation) only when firms are neck-and-neck. When firms are in a leader/follower state, less contestability is likely to translate into less innovation.

- Appropriability: the extent to which an innovator can benefit from its investment. A firm that is able to appropriate the benefits of its innovation will have stronger incentives to invest in the first place than a firm whose innovation can be rapidly imitated. In markets where the appropriability of the benefits from innovations is high, more competition is likely to be associated with more innovation, as firms will have an incentive to innovate in order to escape from competitors. Conversely, where the appropriability of the benefits of innovations is low, more competition is likely to be associated with less innovation, as firms will be unlikely to invest in new projects that could be also beneficial to competitors.

- Synergies: the extent to which combining complementary assets will produce incentives to increase innovation. Some firms cannot innovate in isolation, especially in industries where value is created by systems that incorporate multiple components, and where alternative methods are not viable (such as patent pools, or joint R&D agreements). In these cases, increasing market concentration by combining complementary assets could be a way to create synergies and spur innovation.

The relationship between competition and innovation therefore depends on the dynamics of each market, and might follow either Schumpeter’s or Arrow’s predictions in each case.

How do we assess harm to innovation in merger control?

In a merger situation, competition authorities need to take a view on whether the change in market concentration after the merger is likely to affect innovation. This implies that, in addition to considerations of the impact on price and quality, the authorities need to understand whether the merger is likely to hamper the incentives of the merging parties or their rivals to innovate, and hence affect future price and quality.

In horizontal mergers (i.e. mergers between rival firms), the key concern is decreased incentives to innovate post merger—which could take the form of lower investment, or the elimination of competing pipeline products that might otherwise have entered the market.

For example, concerns about product development were identified in Novartis/GSK, Pfizer/Hospira and GE/Alstom.8 In order to remedy these mergers’ potential negative effects on R&D, in some cases authorities asked for the divestment of overlapping pipeline products or innovation facilities, including staff members.9

More recently, the European Commission has raised concerns in relation to the Dow/Du Pont transaction on the basis that it could reduce innovation in the whole market, rather than product development in specific markets alone.10 While the Commission is expected to take a final decision on the merger by early April 2017, commentators have viewed this approach as having the potential to lower the threshold for intervention in similar markets.11

The loss of potential innovation is most likely to arise in horizontal mergers, as a result of the loss of competitive constraint from a rival. Nevertheless, the Commission has also explored whether the innovative power of the parties raised foreclosure concerns in a number of vertical mergers. Both the Intel/McAfee and ARM/Giesecke & Devrient/Gemalto12 cases raised concerns about the merging parties’ ability to leverage their strong position as innovators upstream in order to harm competitors in the downstream market.

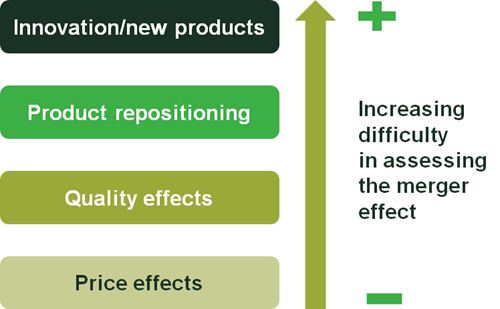

The challenge that authorities and practitioners face is to forecast the effect on innovation, by comparing the evolution that the market is likely to undergo following the merger, with the market evolution if the merger does not go ahead. This challenges the traditional framework on two grounds. First, the competitive conditions prevailing before the merger might not be the right counterfactual. Second, most of the tools available for understanding market outcomes arising from the merger are static and focus on price effects that are expected to occur in the short term (in terms of market shares, upward pricing pressure indices, price concentration, etc.). Adapting the current frameworks to account for effects on quality, product repositioning or, most importantly, innovation and the introduction of new products, is increasingly difficult. This is illustrated in Figure 2.

Figure 2 Assessing the merger effect with current tools

There therefore does not appear to be a one-size-fits-all framework for assessing mergers in innovative markets. Instead, each new case is shaping the future of merger assessments.

How do we assess dynamic efficiencies in merger control?

Some types of merger may give rise to efficiency benefits that could outweigh any harm arising from the merger. However, while the identification of the harm rests with the competition authority, the burden of proof on the efficiencies lies with the merging parties.

In competition assessment, efficiencies are usually defined as either static (arising in the short term) or dynamic (arising in the more distant future). Static efficiencies focus mostly on reductions in marginal costs that might arise from the merger, whereas dynamic efficiencies include the diffusion of know-how, more efficient use of IP, and increased R&D and investment. Dynamic efficiencies might enable firms to improve their performance on a potentially continual basis, and as such they might contribute a much wider benefit. For instance, mergers may encourage the development of new products or help to reduce costs by combining assets and expertise that are not easily transferred between separate companies. A merger might also eliminate the duplication of R&D efforts, or make it easier to obtain finance for R&D or investment projects. Furthermore, as has been claimed by the parties in recent mobile merger cases,13 a merger could increase investment and improve the existing infrastructure.

In terms of the assessment, however, it can be arduous for the parties to convince the Commission that dynamic efficiencies will outweigh anticompetitive effects, for several reasons. The EU Horizontal Merger Guidelines consider only those efficiencies in merger assessment that are verifiable, passed on and merger-specific.

In the context of dynamic efficiencies, the threshold implied by these criteria is often very high. First, some of these dynamic efficiencies might develop over a long period, and their occurrence may sometimes be seen as speculative and not easily verifiable. In particular, dynamic efficiencies can occur in the form of fixed cost reductions, quality improvement, service improvement, or new product development whose implications might be hard to forecast at the time of the merger. Second, even if efficiencies are quantified, it is often challenging to provide clear evidence that the benefits will be both merger-specific and passed on to consumers.14

In addition, even if these positive benefits did occur, it is not straightforward to weigh the efficiencies against a potential price increase, which would ultimately be required in order for a deal to be approved.

Despite the level of interest in the assessment of these dynamic efficiencies, there are still very few studies to date that empirically test the relationship between competition and innovation or investment.15

One exception is the recent cross-country analysis by Genakos, Valletti and Verboven on the effect of consolidation on price and investment.16 This study, which uses data from the mobile telecommunications industry, finds a positive relationship between concentration and investment of the merging parties, as measured by the level of capital expenditure. However, it finds no relationship between the level of total investment in the industry and concentration, although it does find that price is expected to increase as a result of the higher concentration post merger.

While this study provides some important empirical evidence on the link between concentration and investment, it does not attempt to weigh the harm from the predicted increase in price against the benefits from increased investment by the merging parties. Furthermore, the extent to which its results can be generalised to other industries remains an open question.

Motta and Tarantino (2016) propose a theoretical analysis of the effect of mergers and investments.17 They find no support for the claim that mergers will result in higher investment incentives by increasing profitability. In certain scenarios, if synergies in the form of economies of scope are large enough, the merging firms will increase their investments and this may outweigh the detrimental effect on prices, illustrating Shapiro’s third principle. In most cases, however, the analysis shows that types of agreement that are less detrimental to competition may be preferable to a merger.

Nevertheless, from the competition authorities’ perspective, the available literature has yet to develop a framework that could be used in merger cases to assess the balance between dynamic efficiencies and consumer benefits on the one hand, and an increase in price resulting from a merger on the other.

A clear research agenda, and more interesting cases to come

In dynamic markets, merger control has the additional objective of preserving the potential for innovation. This requires a focus on keeping the markets contestable and ensuring that the right incentives to innovate will remain in the market post merger.

In recent cases, competition authorities seem to have increased the level of scrutiny on the merging parties’ product development pipelines. The assessment focuses on considering the potential for future competition alongside current competition between the parties, as well as the effect of the merger on incentives to innovate. The European Commission, in particular, will have to decide on an increasing number of transactions where innovation is likely to be a key focus of the investigation, as in the cases of Dow/Du Pont, ChemChina/Syngenta and Bayer/Monsanto.18

In some of these upcoming mergers, a key question will be how to balance any short-term harm against potential long-term efficiencies arising from the transaction. One should therefore resist the temptation to focus only on established mechanisms that are easier to measure (static price-cost effects) and overlook aspects that are important but hard to measure using the current tools (dynamic effects on innovation). At the same time, a clear framework needs to be established to assess whether a transaction is likely to result in harm to dynamic efficiency and innovation.

The debate on the impact of mergers on innovation incentives is still wide open, and there is room for both academics and practitioners to develop new tools and frameworks to apply to practical cases.

The Oxera Economics Council is a group of prominent European academics, specialising in microeconomics and industrial organisation, that meets with Oxera twice a year to discuss pressing economic issues facing policymakers. In November 2016 the Council welcomed senior officials of DG Competition to debate policy issues arising from the assessment of efficiencies in merger control, in particular with respect to dynamic efficiencies. This article does not reflect the views of the Council or its members.

1 For instance, European Commission, Case No COMP/M.7275, Novartis/GlaxoSmithKline oncology business, Commission decision of 28 January 2015; European Commission, Case No COMP/M.7559, Pfizer/Hospira, Commission decision of 4 August 2015; European Commission, Case No COMP/M.7278, General Electric/Alstom (thermal power – renewable power and grid business), Commission decision of 23 February 2015.

2 For instance, European Commission, Case No COMP/M.6992, Hutchinson 3G UK/ Telefonica UK, Commission decision of 11 May 2016; European Commission, Case No COMP/M.7758, Hutchinson 3G Italy/ Wind JV, Commission decision of 14 October 2016.

3 Schumpeter, J. (1942), Capitalism, Socialism, and Democracy, third edition, Harper Perennial.

4 Arrow, K.J. (1962), ‘Economic Welfare and the Allocation of Resources for Invention’, in R. Nelson (ed.), The Rate And Direction Of Economic Activities: Economic And Social Factors.

5 For example, see Aghion, P., Blundell, R., Griffith, R., Howitt, P. and Prantl, S. (2009), ‘The Effects of Entry on Incumbent Innovation and Productivity’, Review of Economics and Statistics, 91:1, pp. 20–32.

6 For example, see Aghion, P., Bloom, N., Blundell, R., Griffith, R. and Howitt, P. (2005), ‘Competition and innovation: an inverted-U relationship’, The Quarterly Journal of Economics, 120:2, pp. 701–28.

7 Shapiro, C. (2013), Competition and Innovation: Did Arrow hit the bull’s eye? The rate and direction of incentive activity revisited, MIT Press.

8 European Commission, Case No COMP/M.7275, Novartis/GlaxoSmithKline oncology business, Commission decision of 28 January 2015. European Commission, Case No COMP/M.7559, Pfizer/Hospira, Commission decision of 4 August 2015. European Commission, Case No COMP/M.7278, General Electric/Alstom (thermal power – renewable power and grid business), Commission decision of 23 February 2015.

9 European Commission (2016), ‘EU merger control and innovation’, Competition policy brief, April.

10 European Commission (2016), ‘Mergers: Commission opens in-depth investigation into proposed merger between Dow and DuPont’, press release, 11 August, Case No COMP/M.7932.

11 For example, see Toplensky, R. (2017), ‘Dow and DuPont seek to address Brussels’ antitrust concerns’, Financial Times, 5 February.

12 European Commission, Case No COMP/M.5984, Intel/McAfee, Commission decision of 26 January 2011. European Commission, Case No COMP/M.6564, ARM/Giesecke & Devrient/Gemalto, Commission decision of 6 November 2012.

13 For instance, European Commission, Case No COMP/M.6992, Hutchinson 3G UK/ Telefonica UK, Commission decision of 11 May 2016; European Commission, Case No COMP/M.7758, Hutchinson 3G Italy/ Wind JV, Commission decision of 14 October 2016.

14 For a review of the assessment of efficiencies in recent merger cases, see Buehler, B. and Federico, G. (2016), ‘Recent developments in the assessment of efficiencies of mergers in the EU’, Competition Law & Policy Debate, 2:1, pp. 64–75.

15 One of the main reasons for this gap is the challenge of identifying a causal relationship between competition and innovation—i.e. while market structure might have an effect on innovation, the reverse might also be true.

16 Genakos, C., Valletti, T. and Verboven, F. (2015), ‘Evaluating Market Consolidation in Mobile Communications’, Centre on Regulation in Europe (CERRE), 15 September.

17 Motta, M. and Tarantino, E. (2016), ‘The effect of a merger on investments’, Centre for Economic Policy Research Discussion paper series, DP11550.

18 European Commission, Case No COMP/M.7962, ChemChina/Syngenta; Case No COMP/M.8084, Bayer/Monsanto; both ongoing.

Download

Related

Future of rail: how to shape a resilient and responsive Great British Railways

Great Britain’s railway is at a critical juncture, facing unprecedented pressures arising from changing travel patterns, ageing infrastructure, and ongoing financial strain. These challenges, exacerbated by the impacts of the pandemic and the imperative to achieve net zero, underscore the need for comprehensive and forward-looking reform. The UK government has proposed… Read More

Investing in distribution: ED3 and beyond

In the first quarter of this year the National Infrastructure Commission (NIC)1 published its vision for the UK’s electricity distribution network. Below, we review this in the context of Ofgem’s consultation on RIIO-ED32 and its published responses. One of the policy priorities is to ensure… Read More