Is net neutrality not neutral?

Net neutrality has now climbed into the top ten list of regulatory priorities in Europe for 2010, having been addressed by the US Federal Communications Commission in late 2009. Does EU-style access regulation undermine the case for net neutrality? This was the issue discussed by the Oxera Economics Council in Brussels on March 19th 2010.

Introduction

The term ‘net neutrality’ has become shorthand for an ongoing debate about whether and how the provision and transport of Internet content should be regulated in the face of increasing use of complex Internet applications that create congestion over the networks. More specifically, it encompasses a wide-ranging debate over what limits, if any, should be imposed on network operators and Internet service providers (ISPs) in how they price or manage traffic through their networks.[i]

A strict definition of the net-neutrality principle states that all Internet content and applications should be treated equally, and therefore that ISPs should not be permitted to implement pricing schemes or manage Internet traffic in ways that discriminate in terms of price or quality of transport according to the type of content or application, or the origin or destination of Internet traffic. A deviation from this strict definition of the net-neutrality principle could therefore involve ISPs implementing:

- price-discrimination schemes on the basis of content or applications, such as:

- charging (some) content providers a fee for the delivery of their Internet traffic;

- making available to content providers higher-priced, premium quality of service (QoS) standards;

- charging end-users higher prices for using specific types of content;

- network practices aimed at prioritising or managing specific types of Internet traffic, irrespective of the discriminatory practice used.

These are not trivial issues. Proponents of net neutrality claim that their interpretation of the principle of openness and non-discrimination has allowed innovation at the edges of the network—the myriad of content providers from giants such as Google and Amazon to individual users launching websites with multimedia content—leading to considerable consumer benefit.

However, network operators and ISPs already implement a variety of network management practices to ensure a smooth consumer experience on the Internet. The trend towards the production and use of more bandwidth-hungry content (high-definition TV, file sharing) and time-sensitive applications (voice over Internet protocol (VoIP), live video streaming, online gaming) is only making the issues of traffic management more, not less, critical.

The discussion at the Oxera Economics Council aimed to further advance the thinking on the economic issues of net neutrality, including what are the welfare-maximising pricing structures, and competition concerns potentially arising from any additional charges imposed on content producers. From an economic perspective, do we need net neutrality regulation?

What is at stake?

A number of network operators, both fixed and mobile, have publicly opposed net neutrality . They have claimed that, in order to support the increasing number of high-bandwidth Internet services, significant network investment must be made and, therefore, they should be free to experiment with different pricing schemes to recover this investment. Such schemes could include charging end-users and content providers for the transport of the content and applications that consume the most network resources. It appears from statements from network operators (eg, Telefónica, Vodafone, AT&T) that there are limits to how much of this cash can be directly raised from end-users, and an alternative cost-recovery path seems to be required. For example, as recently stated by Vittorio Colao, Vodafone Chief Executive:

I do not want to be forced to go to the customers only to fund my investment, … I might go to the content world if there is any interest.[ii]

On the other hand, firms providing content and applications are generally in favour of the net-neutrality principle, drawing on the core principles of an open Internet. According to the content provider community, any deviation from net neutrality would imply significant distortions to the end-to-end principle underlying the development of Internet content thus far (also known as the ‘best effort’ principle). The main concern of content providers is that, should the ISPs be able to price- (and non-price-) discriminate against certain types of content, this would effectively render an additional entry cost to content production, thereby hindering innovation and consumer choice.

While the regulators are still in the process of defining specific rules, a variety of views on practical (and legal) approaches have been put forward in relation to net-neutrality issues.

In the USA, the Federal Communications Commission (FCC) has made a number of statements and rulings promoting network neutrality. Most recently, in October 2009, it published a consultation effectively confirming its position of promoting net neutrality.[iii]

The European Commission has called for additional regulation to require transparency by providers on contract terms and ‘minimum quality of service’ as part of the reform package introduced in 2007 and approved in 2009.[iv] Similarly to many other individual Member States, Ofcom, the UK communications regulator, recently announced its plans to have a close look at net-neutrality questions in 2010.[v]

The following sets out some economic considerations of relevance to defining the appropriate regulatory stance on these issues.

Pricing in two-sided markets

Net-neutrality regulation has thus far received scant attention in economic literature.[vi] With few exceptions, the relevant [why relevant?] academic research has relied largely on a two-sided market framework. In such a two-sided setting, the aggregate volume of realised transactions depends not only on the aggregate price level charged to the two parties (content providers and end-users), but also on how this charge is divided between them, given that, due to network externalities, ‘treating the other side better’ may be beneficial for overall efficiency. [vii] (This is explained in further detail below.) The discussions among economists, including at the Oxera Economics Council meeting, boil down to a dispute over whether ISPs should be allowed to implement new pricing schemes for content providers and discriminate between different types of content and applications.

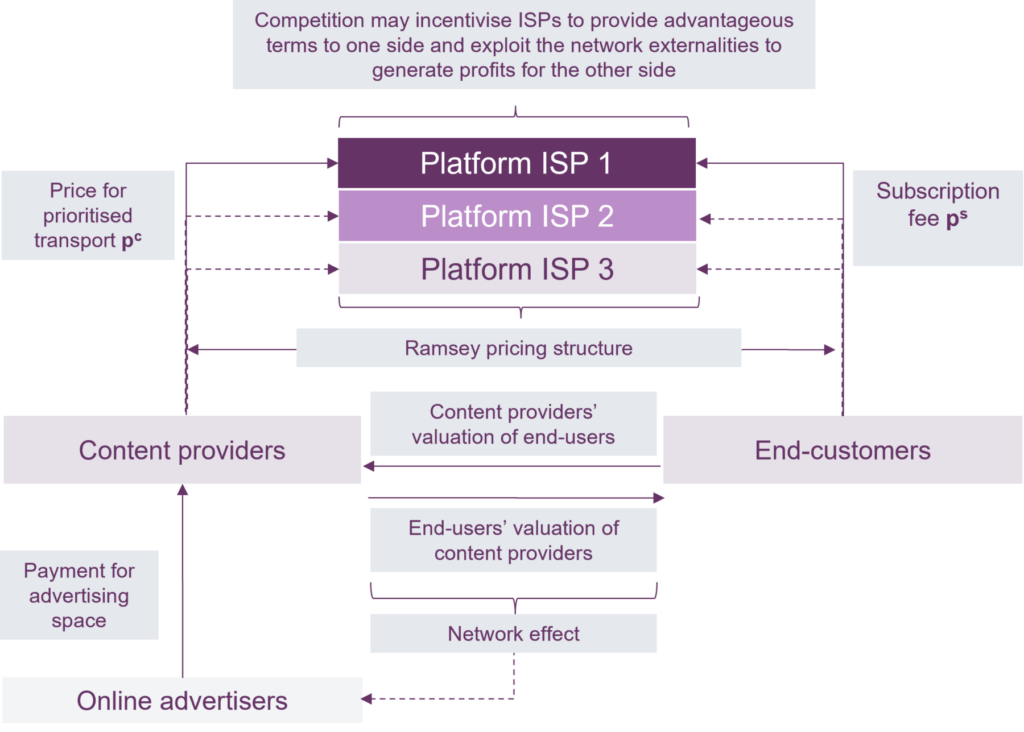

Abstracting from certain complexities inherent in the Internet value chain (eg, varying degrees of independent versus leased infrastructure), the two-sided nature of the Internet market is illustrated in Figure 1, and discussed further below.

Figure 1 Two-sided market framework in the context of the Internet value chain

In this conceptual framework, the ISP’s network is the platform serving content providers on one side of the market and subscribers on the other. These two parties pay the platform owner —ie, the ISP—a content premium (currently zero) and a subscription fee, respectively . Content providers’ current revenue model is, in turn, largely driven by payments from online advertisers.[viii]

As the pricing structure imposed by the platform ISP may have consequences for the number of broadband users, as well as the applications available to them, there are implications for overall welfare. As with any multi-product firm whose services share a common cost stack, the pricing decision of the ISP could apply the Ramsey pricing principle—ie, the ISP would seek to recover a higher share of its common network costs from the more inelastic services. Thus, if the end-users are considered price-sensitive relative to content providers, charging content providers for transport services could be warranted from an economic welfare perspective (as implicit in the Vodafone statement cited above).

Furthermore, the standard result of two-sided market economics is that pricing is based on the relative size of ‘cross-group externalities’.[ix] In other words, the benefit that one side of the market obtains from access to the other side is directly related to the number of parties that are accessible on the other side:

- the benefit that end-users receive from subscribing to broadband services depends on the number of content providers and the quality and quantity of the content available;

- content providers’ valuation of the platform is contingent on the number of end-users subscribed to it, as higher customer penetration implies wider coverage for advertisers.

Consequently, if content providers exert a large positive externality on end-customers, content providers will be targeted and ‘subsidised’ aggressively by ISPs (platforms).[x]

An important result of many theoretical papers in this area is that, in terms of static consumer/producer surplus, a welfare-maximising pricing structure may well be to recover some of the platform costs from the content community, depending on the externality effect and price-responsiveness on the two sides of the platform.

Competition in two-sided Internet markets

Two-sided markets present important implications for the mechanisms that underlie competitive processes between ISPs. For context, the debate in Europe has generally focused on access regulation, and, in particular, local-loop unbundling (mandatory network sharing) as a means of promoting competition. Proponents of unbundling argue that if the incumbent ISP is only one of many retailers offering services over its infrastructure, it will have less incentive to discriminate in favour of, or against, a particular type of content.

Competition in two-sided markets follows different patterns compared with a multi-product situation in standard one-sided markets, given that the competing platforms are faced with the externality effects described above. Competition between ISPs allows both content providers and subscribers to switch between, and subscribe to, multiple platforms (a concept referred to as multi-homing). If an ISP increases subscription fees, or imposes further restrictions on the level of quality downloaded, consumers have the choice of alternative providers. Similarly, in the hypothetical scenario where an ISP charges content providers a fee (over and above the connection payment), content providers could reach end-users via alternative platforms. However, while competition might constrain the aggregate price level set by the ISP, it does not imply that the competing ISPs would not find it optimal to recover some of the costs from content producers, as confirmed in a number of academic papers exploring this area.[xi]

The reasoning above suggests that an ISP may have private incentives to deviate from net neutrality, and that there are circumstances under which such deviation may be justified from a social welfare perspective, given that the optimal pricing structure depends on a complex set of relationships including the externality constraint, and demand elasticities in the two sides of the market.

However, this framework is rather static, and does not take into account asymmetries between content providers and platform operators; nor does it fully reflect the complexities inherent in the Internet value chain.

First, even in Europe, where access regulation has enabled significant market entry, alternative operators’ ability to materially constrain incumbent telecoms companies from price-discriminating and prioritising certain types of content may be limited, given their small network size. Large incumbent operators could also exert significant bargaining power when engaging in negotiations with content providers.

Second, competition in Europe is largely intra-platform, rather than inter-platform, competition. Entrants’ business models rely to a variable extent on leased infrastructure, and some, but not all, ISPs have their own backhaul and/or transit network.[xii] The implication is that while an ISP may control the interconnection to the Internet at the core network layer, in many cases it pays the incumbent a wholesale charge (for backhaul capacity) contingent on traffic congestion.

Table 1 Regulatory approaches to charges imposed on content providers

| Approach | Description | Likely advantages | Potential risks |

| No intervention | Regulators would not impose restrictions on the charging models | Allows full flexibility in the remuneration of investment | May impede innovation and growth of small content developers |

| Minimum quality of service requirements | ISPs would be obliged to provide certain level of QoS to all Internet content | Impedes any attempt by the incumbents to degrade QoS of rival services | Practical implementation may be difficult (ie, setting the ‘appropriate’ QoS level) |

| Strict net neutrality | ISPs not allowed to charge for prioritised content | No distortions on current Internet business models | Removes flexibility from ISPs’ cost-recovery patterns |

A further complexity arises from the interconnected nature of telecoms networks. As set out above, the ISP that connects a content provider to the backbone (and receives a payment for that) is typically distinct from the ISP that conveys the data to end-users. As a consequence, the cost-recovery structures are significantly more complicated. Indeed, this seems to be an area where further research seems warranted before informed policy conclusions can be reached.

Can prioritisation charges foreclose competition?

As discussed above, a particular pattern of pricing that has static welfare advantages does not necessarily imply dynamic efficiency in the market. As with vertical foreclosure more generally, exclusionary conduct can have negative implications for competition to the detriment of content providers and end-users. The incentives for foreclosure by the vertically integrated operator are particularly likely if:

- a content provider offers content or services similar to that of the vertically integrated operator (eg, VoIP, IPTV), thereby competing directly with the ISP for the respective market shares; and/or

- the vertically integrated provider has incentives to block certain types of traffic to allow capacity for its own (potentially different) services.[xiii]

Further to vertical foreclosure favouring incumbent ISPs’ own content over others, the ability to prioritise certain content providers may lead to ISPs providing access solely to their preferred content providers. Thus, even if the ISP does not itself provide content, it may find it profitable to engage with only one provider—the one willing to pay most to get the priority. Put another way, ‘competition in the market’ (ie, between content providers) would transform to ‘competition for the market’ (bidding competition to acquire prioritised treatment).[xiv]

Do we need net neutrality rules?

In light of the above, it appears that it is ambiguous whether net neutrality regulation yields welfare-maximising market outcomes. Given that the implications of net neutrality are driven by a complex set of relationships, policy-makers are faced with the challenge of finding the balance between providing network operators sufficient flexibility to remunerate their investments, while not distorting the innovative dynamics elsewhere in the Internet value chain. There is a spectrum of potential approaches available to regulators, each of them exhibiting advantages and risks. Table 1 summarises the main options discussed in the Oxera Economics Council meeting, and their respective pros and cons.

The risks of less intrusive approaches which allow some form of discriminatory (‘tiered’) pricing mechanisms can, in principle, be addressed by competition law—eg, under Article 102 on abuse of dominance (previously Article 82). However, when assessing the adequacy of competition law, regulators need to consider whether ex post case-by-case assessments, often taking a number of years, are sufficient to yield the desired outcomes efficiently.

Finally, when considering policy approaches, a salient factor to note is the practical complexity of net-neutrality regulation. Network management consists of a complex set of specific attributes, including priority, bandwidth consumption, link delay, latency and error characteristics.[xv] Consequently, pre-specified minimum quality standards, for example, may be challenging to implement in practice.

Abstracting from the technical considerations, the Oxera Economics Council meeting managed to establish a number of insights to aid further the policy debate, summarised in Box 1.

Views from Oxera Economics Council meeting, March 19th 2010

The Oxera Economics Council met to discuss the economics of net neutrality, and, in particular, the implications of the two-sided nature of the market. Based on these considerations the Council considered relative merits of different policy approaches.

Oxera consultants were joined by Council members Professor Mathias Dewatripont (Chairman), European Center for Advanced Research in Economics and Statistics (ECARES) at the Université Libre de Bruxelles, Natalia Fabra (Universidad Carlos III de Madrid), Jordi Gual (Caixa d’Estalvis i Pensions de Barcelona and IESE Business School, Barcelona), Estelle Cantillon (ECARES), Bruno Jullien (Toulouse School of Economics), Patrick Legros (ECARES), Abel Mateus (Universidade Nova de Lisboa), Massimo Motta (European University Institute, Florence), Eric van Damme (Tilburg University), and Carl-Christian van Weizsäcker (Max Planck Institute for Research on Collective Goods, Bonn).

While recognising that academic research is relatively immature in this field; for example the two-sided market models applied to date may not fully capture the multi-sided nature of the supply chain, the following conclusions were reached at the meeting:

- Before significant policy approaches can be implemented, it is critical to understand the extent of the congestion issue, and identify where in the network congestion issues are most likely to emerge both in fixed and mobile networks. Further evidence appears necessary to establish whether the current pricing models would not enable network operators to recover their costs, given that some European incumbents seem to be currently earning relatively healthy returns.

- The minimum QoS standards put forward by the Commission may not fully address the issue if the policy concern is that net neutrality may prevent the development of new services requiring higher quality of service.

- There are apparent economic merits in price discrimination, and the strictest form of net neutrality appears to be unjustified from an efficiency perspective. There may still be scope for further discriminatory pricing at the retail level (eg, reverting to peak-load pricing), provided that the contractual terms are well-specified.

- A model of tiered traffic prioritisation may be practically feasible, and reflect supply and demand patterns better relative to a strict form of net neutrality; however, where these tiers lie should be determined by the market, not by regulators.

- The interconnected nature of the networks requires coordination between networks over which traffic is conveyed. This would also require regulatory approaches to be consistent across countries.

- Article 102 may prove sufficient to address issues of foreclosure. Therefore ex ante constraints on operators’ pricing by reference to quality of service being conveyed may be unjustified, and lead to inefficiency and poor incentives to invest.

[i] For presentational convenience, all types of Internet access provider are referred to as ISPs in this article.

[ii] Vittorio Colao, Vodafone’s chief executive, speech at Barcelona Mobile World Congress 2010, Barcelona, February 15th–18th

[iii] Federal Communications Commission (2009), ’Notice of Proposed Rulemaking’, October 22nd.

[iv] European Commission (2009), ‘EU Telecoms Reform: 12 Reforms to Pave Way for Stronger Consumer Rights, an Open Internet, a Single European Telecoms Market and High-speed Internet Connections for all Citizens’, press release, November 20th.

[v] Statement by Ed Richards, Head of Ofcom, speech at Digital Media and Broadcasting Conference 2010, London, March 2nd–3rd.

[vi] See, for example, Economides, N. and Tåg, J. (2009), ‘Net Neutrality on the Internet: A Two-sided Market Analysis’, Working Paper, May; Musacchio, J., Schwartz, G. and Walrand, J. (2009), ‘A Two-sided Market Analysis of Provider Investment Incentives with an Application to the Net-neutrality Issue’, UCSC School of Engineering Tech.

[vii] Rochet, J.-C. and Tirole, J. (2006), ‘Two-sided Markets: A Progress Report’, RAND Journal of Economics, 37:3, pp. 645–67.

[viii] Some revenues are also generated through subscriptions from premium customers.

[ix] See, for example, Armstrong, M. (2006), ‘Competition in Two-sided Markets’, RAND Journal of Economics, 37:3, Autumn, pp. 668–91.

[x] Rochet, J.-C. and Tirole, J. (2001), ‘Platform Competition in Two-sided Markets’, working paper, November, 26, p. 3.

[xi] See, for example, Economides and Tåg (2009), op. cit., and Musacchio et al. (2006), op. cit.

[xii] Entrants’ investments in multiplexers (DSLAM) and other electronics are not relevant to the issue of traffic congestion in backhaul networks.

[xiii] Cave, M. and Crocioni, P. (2007), ‘Does Europe Need Network Neutrality Rules?’, International Journal of Communication, 1, pp. 669–79.

[xiv] Economides and Tåg (2009), op. cit.

[xv] For discussion, see, for example, Pehnelt, G. (2009), ‘Crowding out in a neutral Internet’, April 6th.

Download

Related

Switching tracks: the regulatory implications of Great British Railways—part 2

In this two-part series, we delve into the regulatory implications of rail reform. This reform will bring significant changes to the industry’s structure, including the nationalisation of private passenger train operations and the creation of Great British Railways (GBR)—a vertically integrated body that will manage both track and operations for… Read More

Cost–benefit analyses for public policy

Cost–benefit analyses (CBA) are commonly applied to public infrastructure projects where there is a degree of certainty about the physical output of the project and the consequent societal benefits. CBA can also be applied to proposed policy and regulatory changes, but there is less clarity about the outcomes and the… Read More