Increased market power: a global problem that needs solving?

The suggestion that there has been a widespread reduction in competition across many industries has been widely discussed in recent years by academics, policymakers and the media. But what does the empirical evidence actually say, and what are potential causes and policy options? The Oxera Economics Council met to discuss this topic in November 2018.

A growing number of studies covering various countries and sectors have identified increases in market power, as measured by profit margins and measures of concentration. This in turn has fuelled widespread concerns about a lack of competition in many markets, a shift in power towards capital at the expense of labour, and a need for stronger policy intervention. However, it is important to take a careful look at the evidence.

What does the empirical evidence say?

Evidence on trends in market competition is mixed, but a number of observers have argued that market power has increased over the past few decades.

The debate over the empirical evidence is focused on two main issues regarding the measurement of market power. The first is how informative aggregate statistics are for the purpose of understanding developments in market power. Some commentators argue that industry-specific case studies are necessary to understand the complex mechanisms at play.1 Most of the recent evidence on market power is based on cross-industry, high-level studies.

The second issue is which measure is appropriate when conducting studies covering multiple sectors. A well-established method is to measure profit margins, the logic being that higher mark-ups of prices over costs are indicative of greater market power. There are some shortcomings to this approach—for example, due to differences in accounting standards over time and geographies.

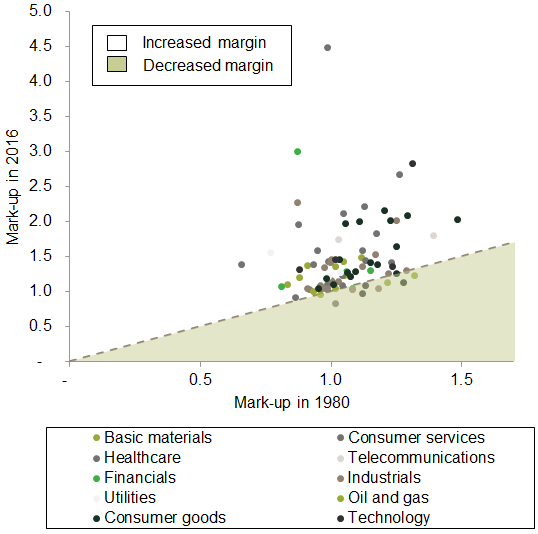

Empirical work has broadly found evidence that mark-ups have increased recently, but these results are still being debated. A prominent study by De Loecker and Eeckhout (2018) found that aggregate global mark-ups increased from just above 20% in 1980 to just above 60% in 2016.2 This result could be due to a composition effect involving higher-mark-up industries becoming more prominent. However, the authors’ industry-by-industry analysis suggests that this is not the case, as mark-ups have increased across all industries. Figure 1, based on data from an IMF study, shows a similar trend in mark-ups.

Overall, most other papers in the literature find increasing mark-ups, though to a smaller extent than in De Loecker and Eeckhout (2018). The general evidence suggests that the increase in aggregate mark-ups is mainly caused by those firms that already have high mark-ups increasing their mark-ups even further.

Figure 1 Mark-ups by sector, across many developed and emerging markets, 1980 and 2016

Source: International Monetary Fund (2018), ‘World Economic Outlook: Challenges to Steady Growth’, October.

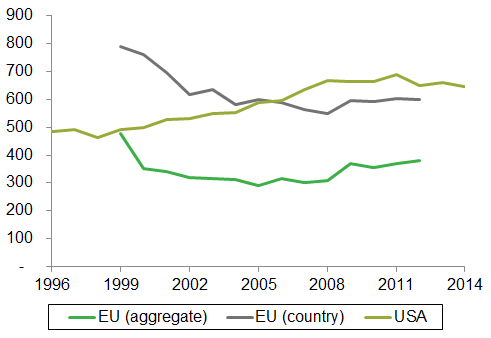

Another way of assessing the health of market competition is by using the Herfindahl–Hirschman Index (HHI). This index measures market concentration by looking at the (squared) market shares of all suppliers in the market. Gutiérrez and Philippon (2018) find that HHI is stable or declining in Europe but increasing in the USA, as can be seen in Figure 2.3 This is consistent with other evidence suggesting that there are geographical differences in market power trends, and that the USA is broadly seeing more of an increase in market power than Europe.4

One potential criticism of this evidence is that the HHI analysis has been conducted using aggregate data. Werden and Froeb (2018) argue that such studies looking at aggregate (industry-level) HHI data cannot demonstrate change in concentration because one needs to examine the relevant markets in the context of competition law.5

Figure 2 Average HHI in Europe and the USA

Source: Oxera elaboration of Gutiérrez, G. and Philippon, T. (2018), ‘How EU Markets Became More Competitive than US Markets: A Study of Institutional Drift’, National Bureau of Economic Research, No. w24700.

Various alternative measures are important to complement the statistics described above, such as mark-ups and the HHI. One measure that has received particular attention is the labour share of income—i.e. how much of a country’s GDP accrues to labour (wages) as opposed to capital (profits). The labour share of income has remained relatively constant throughout history; however, it has been falling in recent decades, whereas that of capital has been rising.6 The labour share of GDP has been falling at a faster rate since the early 2000s, dropping from 64% in 2000 to less than 58% in 2016.7

One potential explanation for falling labour shares is the increased market power of firms. The reasoning is as follows: increased market power might lead to increased monopsony power in labour markets. This mechanism makes more sense in product markets that are closely aligned with their respective labour markets.

The evidence overall points to increased concentration at the industry level. This trend appears to be particularly strong in the USA. However, the debate is ongoing as to whether the evidence is strong enough to suggest that market power has also increased, and as to whether competition in a broader sense has decreased.

Why might market power have increased?

Although it is debatable whether market power has increased, it is useful to investigate why this might have happened. Developing specific theories for the purported trend of increased market power will allow researchers to test for this phenomenon more rigorously. Moreover, if a consensus emerges that there is indeed a problem, a causal mechanism will inform policy prescriptions.

There is a strand of academic literature that takes as a starting point the view that market power has indeed increased and focuses on potential explanations, several of which are offered. Many of them invoke a combination of globalisation, economics of scale and new technologies.

The traditional view of economics is that in some markets, supply-side economies of scale are so large that only a few firms can coexist. In the current debate, attention has shifted to demand-side network externalities—i.e. large tech companies such as Facebook and Google—controlling digital platforms that keep growing as the number of users grows.8 Theories supporting this hypothesis build on the notion that there have been deep structural changes in the economy in the past few years, driven mostly by technological change and digitalisation. Technology could theoretically have three effects on market power.

- First, the type of competition may have changed due to technological shifts, but the overall impact on market power is neutral.

- In several markets—including new digital markets—there is a notion that competition is ‘for the market’ rather than ‘within the market’. The two kinds of competition can both be effective. The mechanism is that a small number of efficient firms will win almost all of the market, knocking out competitors and thus leading to increased concentration. However, the winning firm(s) are kept on their toes by the threat of entry by disruptive start-ups, and they may ultimately be displaced by a new ‘superstar’ firm.

- Winner-takes-most markets can raise concerns for competition authorities, as there is a significant chance of lock-in once the winning firm has become established. This potentially results in inefficiency. However, these concerns may be diminished if the same forces that led to the emergence of competition ‘for the market’ also lead to increased ease of entry into markets. If barriers to entry have fallen then one may not be concerned about the risk of lock-in, as start-ups will have the potential to disrupt markets if the superstar firms do not stay on their toes.

- Second, technological changes may have led to a reduction of market power. Indeed, there are obvious ways in which technology and globalisation have strengthened competition: in the last 50 years there has been a fall in the cost of trading internationally, shipping goods, communicating, and comparing prices.9 It is not difficult to think of many markets in which consumers have benefited from new or better products in large part thanks to technological changes.

- Third, market power may have increased because technology may reinforce network effects and may facilitate coordination in the market.

- While many effects of technology are procompetitive, as discussed above, there are also ways in which technology can facilitate market power or collusion. One potential channel is that pricing changes have become more frequent, especially for online retailers.10 This reduces incentives to deviate from a collusive equilibrium (assuming the conditions are in place for such an equilibrium to be reached in the first place), as a deviation can be punished very quickly, meaning that there is very little gain from deviating in the first place. In this context, much attention has been paid to algorithmic pricing, which can have both pro- and anticompetitive effects.11

- Overall, the impact of technological change on competition can vary across markets and over time. However, there are many other tentative explanations for the observed trends. One theory that is particularly controversial and central to the debate is that there has been a softening in competition policy and enforcement (mergers and antitrust).12 Although evidence on the toughness of competition law enforcement is mixed, the discussions around policy solutions do often focus around strengthening competition law.13

It is possible that all three effects have been at work, perhaps with different relative importance in different markets and in different geographies.

What can competition policy do?

While the debate on increased market power is far from over, academics and practitioners have already been suggesting policy solutions. In the context of merger assessment, Steinbaum and Stucke (2018), among others, propose shifting the burden of proof to the merging parties to show that a merger will not lessen competition in the market.14 Furthermore, they suggest that the Sherman Act and the Clayton Act in the USA should be changed to give more priority to enforcement of vertically integrated companies.

Nonetheless, it is worth taking a step back and considering whether there is anything to do at all, as it is still debateable whether there is a significant problem that requires addressing. If efficient, productive and low-cost firms that set low prices are gaining market share, is it detrimental to consumers if those firms are making profits? Along these lines, Werden and Froeb (2018) state that market concentration naturally increases when the most innovative and efficient firms grow. Shedding light on the causes of the trends described above might help us to understand whether there is the need to intervene, and this may need to be done at a more granular (market-specific) level rather than in the aggregate.

A further question is whether competition policy is the appropriate tool, or whether any problems are better dealt with by other tools such as fiscal policy or regulation. The role of competition policy is traditionally to protect the process of competition and not to prevent firms from being dominant. Therefore some of the issues raised, such as large firms having too much bargaining power over their workers, might not be solved through the enforcement of competition law.

Nevertheless, the changes in market dynamics arising due to technological advances and globalisation suggest that some changes to competition policy might address the new issues and market structures that have emerged. This seems to be the case for merger control; in at least some sectors, traditional tools might not be sufficiently suited to identifying potentially harmful mergers. For example, in data-driven sectors, pure market shares or current competitive positions may not paint the whole picture. A company with access to particularly important data might still be a small player in terms of turnover, but the potential future uses of that big data could be major.

Similarly, market definition approaches that focus on existing overlaps between different firms’ activities might overlook dynamic effects on related markets—for example, if the parties are currently not competing but their products or technologies have the potential to expand in each other’s sectors in the future.

More focus on such dynamic effects might address a concern about ‘killer acquisitions’—i.e. large companies buying out promising competitors to shut down the potential threat.15 Tommaso Valletti, Chief Competition Economist for the European Commission’s Directorate General for Competition, also sees killer acquisitions as a potential issue.16 However, while there is some evidence of large tech firms buying small new entrants, this practice does not always have an anticompetitive motive or effect. Many start-up incubators finance young firms with innovative business ideas specifically with the aim to be acquired by larger companies.

Besides ex ante merger control, ex post enforcement of the rules against restrictive agreements and abuse of dominance can address the possible anticompetitive effects of increased market power of large firms and solve many (if not most) competition issues. Competition authorities could—and in some cases already do—pay close attention to sectors in which technology creates a potentially more collusive environment, for example through pricing algorithms.17 Additionally, careful analysis in abuse of dominance cases could be tailored to specific industries by considering network effects.

Conclusion

Overall, traditional methods of defining relevant markets and identifying specific harms resulting from market power may need some updating to reflect the specifics of modern digital markets. If these tweaks are made to competition policy and the enforcement toolkit, the current framework will still be suitable, by and large, to maintain competition, even in the cases of increasing market power and concentration.

The topic of increasing market power was discussed at the Oxera Economics Council meeting in Brussels in November 2018, which was attended by Oxera consultants, the Council members and guests from the European Commission and academia. This article is produced solely by Oxera and does not represent the views of the Council members or the guest attendees.

1 Van Reenen, J. (2018), ‘Increasing Differences between firms: Market Power and the Macro-Economy’, Centre for Economic Performance Discussion Papers dp1576, 29 July.

2 De Loecker, J. and Eeckhout, J. (2018), ‘Global Market Power’, 18 May, National Bureau of Economic Research, No. 24768.

3 Gutiérrez, G. and Philippon, T. (2018), ‘How EU Markets Became More Competitive than US Markets: A Study of Institutional Drift’, National Bureau of Economic Research, No. w24700.

4 For example, Valletti, T. (2017), ‘Competition Trends in Europe’, European Commission.

5 Werden, G.J. and Froeb, L.M. (2018), ‘Don’t Panic: A Guide to Claims of Increasing Concentration’, 5 April, Antitrust Magazine.

6 The stability of the labour and capital shares of income is one of Kaldor’s stylised facts of economic growth observed in empirical studies. See Kaldor, N. (1961), ‘Capital accumulation and economic growth’, pp. 177–222, in D.C. Hague, The Theory of Capital, Palgrave Macmillan, London.

7 US Bureau of Labor Statistics.

8 See Oxera (2018), ‘It’s what you know about who you know: market power in digital platforms’, Agenda, December.

9 Van Reenen, J. (2018), ‘Increasing Differences between firms: Market Power and the Macro-Economy’, Centre for Economic Performance Discussion Papers dp1576, 29 July.

10 Cavallo, A. (2018), ‘Scraped data and sticky prices’, Review of Economics and Statistics, 100:1, pp. 105–19.

11 See Oxera (2018), ‘Algorithmic competition’, prepared for European Commission, 30 September.

12 Shapiro, C. (2018), ‘Antitrust in a time of populism’, International Journal of Industrial Organization, 61, November.

13 Van Reenen, J. (2018), ‘Increasing Differences between firms: Market Power and the Macro-Economy’, Centre for Economic Performance Discussion Papers dp1576, 29 July; Grullon, G., Larkin, Y. and Michaely, R. (2017), ‘Are US industries becoming more concentrated?’; Council of Economic Advisors (2016), ‘Benefits of competition and indicators of market power’, Issue Brief April; Wollman, T.G. (2018), ‘Stealth Consolidation: Evidence from an Amendment to the Hart-Scott-Rodino Act’, American Economic Review: Insights.

14 Steinbaum, M. and Stucke, M.E. (2018), ‘The effective competition standard: a new standard for Antitrust’, September.

15 Cunningham, C., Ederer, F. and Ma, S. (2018) ‘Killer Acquisitions’, 18 August.

16 GCR, Killer acquisitions are a recurring issue, says Vestager, 17 January 2019 and GCR, ‘DG Comp chief economist: Reverse burden of proof to catch killer acquisitions’, 20 November.

17 For example, see some guidance for dealing with abuse of dominance in German digital markets in Oxera (2019), ‘Dealing with digital dominance: insights from Germany’, Agenda, January.

Download

Related

Spatial planning: the good, the bad and the needy

Unbalanced regional development is a common economic concern. It arises from ‘clustering’ of companies and resources, compounded by higher benefit-to-cost ratios for infrastructure projects in well developed regions. Government efforts to redress this balance have had mixed success. Dr Rupert Booth, Senior Adviser, proposes a practical programme to develop… Read More

Sustainable Divergence between the UK and the EU—the Fair Share Principle in Practice

As sustainability continues to grow in importance for businesses, regulators are starting to provide guidance on how competition law applies to ‘green agreements’. In our recent article, written alongside Linklaters, we examine how the European Commission and the UK’s Competition and Markets Authority (CMA) are shaping their frameworks to account… Read More