EU broadband: co-investing in a faster future

Rolling out very high-capacity networks (VHCNs) across Europe to deal with ever-increasing broadband demands is challenging. To incentivise investment, the European Commission has introduced new conditions relating to co-investment agreements, including a promise (subject to certain conditions) not to regulate operators with significant market power (SMP) that enter into an investment agreement with at least one other operator. Peter Culham, Senior Adviser, Felipe Flórez Duncan, Partner, and Michael Weekes, Senior Consultant, ask: is it enough to unlock investment in VHCNs?

The European Commission has set ambitious targets for deployment of VHCNs throughout the EU, with the aim of 100% coverage by 2025. However, large-scale investments in VHCNs—including full-fibre networks—are risky due to demand, cost and regulatory uncertainty.

To mitigate this risk, some operators have entered into co-investment programmes, in which they share the costs and risks of the investment with other operators while also sharing the returns. These co-investment agreements (see the box below) can also help to overcome the challenges of economies of scale and density.1

In addition, the Commission has identified co-investment schemes as an enabler for the participation of smaller-scale undertakings in infrastructure investments, thus promoting sustainable, long-term competition—including in areas where infrastructure-based competition may be inefficient.2

What is co-investment? Key concepts, models and examples

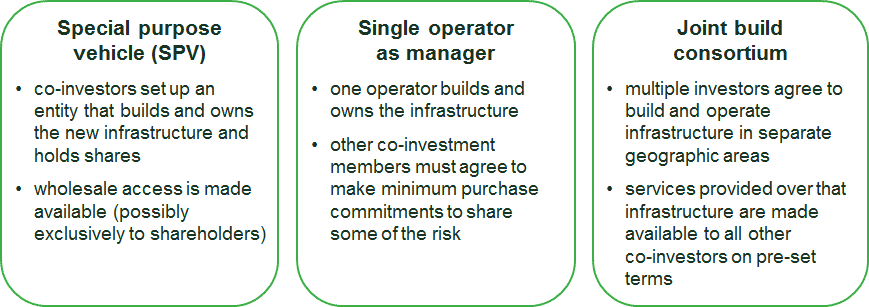

Co-investment agreements involve collaboration between two or more operators with the aim of sharing investment risks through various means, such as:

- co-ownership of network assets;

- long-term risk-sharing through co-financing;

- purchase agreements that give rise to rights of a structural nature (as opposed to commercial access agreements, which are limited to the rental of capacity and do not give rise to such rights).1

These may take the form of governance models such as the following.2

Source: Oxera.

To date, the majority of co-investment initiatives in the EU have involved operators that are not designated as having significant market power (SMP).3 As a result, while the number of co-investment schemes is growing, their overall impact on VHCN roll-out in the EU remains somewhat limited.

Will this new regulatory tool be successful in unlocking investment in VHCNs? In particular, are the costs of compliance worth it?

One BEREC to guide us all

The concept of deregulation will sound appealing to SMP operators, especially if it raises the prospect of higher returns than would be possible under a stand-alone investment subject to SMP regulation. Operators may also see appeal in the prospect of diluting competition by bringing together potential network competitors into the joint venture.

However, the extent of this appeal will depend on how national regulatory authorities (NRAs) interpret the requirements of Article 76 and Annex IV. In turn, NRAs will need to pay close attention to guidance issued by the Body of European Regulators for Electronic Communications (BEREC), due in 2020. This could include guidance on the following key issues:

- the terms on which members join the co-investment agreement and the prices they pay;

- the terms on which parties that are not part of the co-investment agreement can gain access to the new network;

- the long-term regulatory framework that applies to the co-investment agreement.

Terms of participation in the co-investment agreement

Annex IV of the EECC states:

The co-investment offer shall be open to any undertaking over the lifetime of the network build under a co-investment offer on a non-discriminatory basis.5

This requirement makes sense in order to avoid a situation where only a small number of operators participate in the co-investment scheme, with the rest being unable to access the full range of wholesale access products.

However, there is a risk that this requirement could give rise to arbitrage or ‘free-riding’ opportunities. Depending on the terms of access, the requirement could allow access-seekers to gain access to the facilities after the network has been built on terms that do not reflect the lower risk that they are bearing, relative to the risk borne by the original investors.

Therefore, an important question is about what the rules should be for co-investors who join later (i.e. once other entities have already entered into a co-investment agreement).

The EECC requires that a latecomer should join on terms that are ‘fair, reasonable and non-discriminatory’ relative to the original co-investors, in terms of pricing that fairly reflects risks faced at the time of joining.6 Therefore, the price paid by any latecomer should accurately reflect the risk profile of the project at that particular point in time and the risk that they take on. This will necessarily mean a price premium, increasing over time, to reflect the reduction in risks and avoid incentives to withhold capital in the early stages of the project.7

BEREC, NRAs and operators will therefore need to think carefully about how to price to reflect diminishing risk and what an allowable ‘premium’ might be.

The box below provides an example of how pricing could be set so as to reflect diminishing risk under different models of co-investment and avoid arbitrage opportunities.

How to reflect diminishing risk over time for new co-investors

Take the case of a model in which the co-investors hold shares in an SPV, and the SPV builds and owns the new infrastructure and offers wholesale access services on an exclusive basis to co-investors on the same terms as each other (i.e. a set access price per line).

Assume the following.

- The investment project costs €1bn, which is financed by the original co-investors.

- At the outset, the projected NPV of positive cash flows is €2bn if successful and zero in the case of failure. The risk of the project success or failure is 50%; hence, the expected NPV of positive cashflows is €1bn, covering investment costs.

- If the project were certain to be successful, an access price per line of €100 would be needed to generate an NPV of positive cash flows of €1bn; however, due to the risk of failure, the access price must be €200 over the lifetime of the project.1

- By the time a new co-investor wishes to participate in the project, the risk of the project failing has reduced from 50% to 25%, and they wish to access 10% of the project’s capacity.

How should the price of participation be set for this new co-investor?

In principle, if shares in the project were traded, the fair price to be paid by future co-investors would be the market price of the shares. This would capture the changes in risk over time, in a similar way to how the prices of traded equities move to reflect changes in risks. The market price of a share is equal to the (discounted) expected values of future cash flows, and is therefore affected by changes in the probabilities of future outcomes, as these affect the expected value of the cash flows.

At the outset of the project, a 10% share in the SPV would be worth €100m (10% of the expected NPV of cashflows of €1bn). As assumed above, by the time the new co-investor wishes to join the risk of project failure has reduced from 50% to 25%, meaning that future expected cash flows are now €1.5bn. A 10% share would now be worth €150m, and this would be the contribution that the new co-investor would need to make in order to join the SPV.

An access price of €200 per line must then be paid by the new co-investor for each broadband line that it sells in the downstream market. This is the same price paid by the original co-investors. In other words, in this example, the risk premium is entirely reflected in the price of the 10% share, rather than in the access price.

Note: 1 This is to ensure that the project generates an NVP of €2bn if successful, which equates to an expected NPV of €1bn, given the 50% chance of success.

Source: Oxera.

A separate question is whether late co-investors have an automatic right to participate in the co-investment scheme provided that they pay the risk-adjusted price. If so, this exposes the original co-investors to the risk of having their shares diluted at a later date without having much say in the matter, while also encouraging more risk-averse investors to wait until some of the risk has been resolved. This would run counter to the objective of bringing forward investment. BEREC must be clear on the extent to which the original co-investors can charge above the minimum (risk-adjusted) price, or impose additional conditions such as the need for co-investors to agree to expanding the coverage of the SPV into new areas.

Rights of access by non-co-investing access seekers

While co-investors would be able to refuse access to non-co-investors for the higher-speed access products, there will remain a requirement to provide some form of access to access-seekers that are not participating in the co-investment. Specifically, Article 76 of the EECC states that:

access seekers not participating in the co-investment can benefit from the outset from the same quality, speed, conditions and end-user reach as were available before the deployment, accompanied by a mechanism of adaptation over time confirmed by the national regulatory authority in light of developments on the related retail markets, that maintains the incentives to participate in the co-investment8 [Emphasis added]

The intention of this condition is to ensure that the ‘new’ network can be used to provide services that emulate those provided over the old network. This could be regarded as an application of the Pareto principle, by which no consumer is made worse off as a result of the introduction of the new network and services.

The implication of this requirement is to introduce a form of ‘anchor’ product regulation on the new network for an entry-level access service. As with all forms of anchor product regulation, the exact terms (including price) will act as a constraint on the degree of pricing freedom for services provided over the new network (and therefore have an effect on investment incentives).

A particularly important issue in this regard is the interpretation of the need for the emulated service to adapt over time through the ‘mechanism of adaptation’ outlined in the EECC.

If the emulated service evolves such that it becomes a better service for the same or similar price, the constraint on margins to be made from the higher-value services on the new network can be significant. However, if the price of the emulated service is allowed to rise while the functionality falls behind that of the higher-value services, the constraint will be weaker.

Clarity on the extent to which the price of the anchor product will be constrained, and the degree of ‘adaptation’, are therefore critical in determining the attractiveness of the investment opportunity. At the very least, the terms and conditions of any anchor product regulation need to be consistent with allowing investors to earn a fair return on their investment.

Furthermore, if a regulator wished to encourage co-investment models, it would need to specify up front the conditions under which anchor product regulation could be applied in a more relaxed way to a co-investment project than to a stand-alone investment. For example, this could be linked to demonstrating that there would be superior outcomes for consumers under a co-investment model, if that model were effective in accelerating or expanding the reach of a VHCN investment. This would be similar to an efficiency argument to support the case for cooperative agreements under Article 101 TFEU.9

Long-term regulatory commitments

The EECC provides for a co-investment commitment to be in place for a minimum of seven years.10 However, there is no clarity on the maximum duration of the exemption from regulatory obligations. For example, if regulatory exemptions automatically expire after seven years, this can have a significantly negative effect on the returns of the investment.

It is therefore important for the regulator to give a clear indication of how the project might be regulated beyond the exemption date to allow investors to assess the expected returns of their investment with confidence. This is related to the principle that all investments should be regulated in a way that provides investors with a ‘fair bet’ (see the box below).

The fair bet principle

As defined by Ofcom, the UK communications regulator, ‘An investment is a “fair bet” if, at the time of investment, expected return is equal to the cost of capital.’1 Hence, ‘ensuring that the fair bet is satisfied may entail…earning returns above the cost of capital to compensate for the additional downside risks that were faced when the investment was made.’2

This concept has also been adopted by the UK government, which defines the fair bet as ‘one that allows firms making large and risky investments to have confidence that any regulation will reflect a fair return on investment, commensurate to the level of risk incurred at the time of making the investment decision’.3

Note: 1 Ofcom (2011), ‘Proposals for WBA charge control’, 20 January, p. 181. 2 Ofcom (2017), ‘Wholesale local access market review – Volume 1’, para. 8.31. 3 Department for Digital, Culture, Media & Sport (2019), ‘Statement of Strategic Priorities for telecommunications, the management of radio spectrum and postal services’, Consultation, 15 February, para. 22.

It is important for the fair bet framework that the assessment of returns is conducted over the lifetime of a project. For very high-capacity networks, this will require time horizons of 20+ years. While it may not be possible for NRAs to make detailed regulatory decisions that last this long, it will be crucial for investor confidence that BEREC provides a framework that NRAs can adopt that explains how the fair bet principle can be honoured over this timeframe. This should include a full risk analysis of the business case, to be undertaken upfront (before the investment takes place).

It is worth noting that a ‘fair bet’ should be available to all investors of risky projects—regardless of whether the investment is made as part of a co-investment or a stand-alone investment. Therefore, if the intention of Article 76 is to make the terms for co-investment projects more favourable than for stand-alone investment, one way of achieving this would be to commit to less restrictive future price controls under a co-investment model. This might include a ‘no margin squeeze’ approach (rather than reverting to formal ex ante cost-based regulation). Since such an approach would have the potential to allow returns above those necessary to satisfy the fair bet, it would make the co-investment model more attractive relative to the stand-alone investment model.

A clear way forward?

Co-investment models can play a key role in unlocking investment in VHCNs. However, much will depend on the way NRAs, guided by BEREC, interpret the requirements of Article 76 and Annex IV of the EECC.

In order to encourage co-investment projects in VHCNs, BEREC’s guidelines will need to provide clarity on the following issues:

- the extent to which regulation of the emulated/anchor service would be ‘lighter touch’ in the case of a co-investment model, and if so, in what way;

- how to close off arbitrage opportunities by allowing original co-investors to reflect the higher risk they are bearing compared with late joiners;

- how to design a long-term regulatory framework that is committed to allowing fair returns over the lifetime of the asset, and probably higher returns relative to a stand-alone investment.

If a co-investment scheme involving an SMP operator is likely to result in clear consumer benefits that could not be achieved otherwise, it could make sense for the conditions applicable to such a project to be more favourable than under a stand-alone investment. Absent clear consumer benefits, however, it is unclear why a co-investment project should be treated any differently from a stand-alone investment.

In any case, if this new regulatory tool is to be successful in unlocking investment in VHCNs, it will be crucial that there is clarity on these points in BEREC’s forthcoming guidelines.

1 Economies of scale arise where the cost per unit of output decreases with the scale of the operation. Economies of density are cost savings relating to spatial proximity of suppliers or consumers—for example, higher population densities allow synergies in service provision that can lead to lower unit costs.

2 Recital 198 of the European Electronic Communications Code (EECC).

3 For example, Vodafone/CityFibre in the UK, Vodafone/MEO in Portugal, and Vodafone/NOS in Portugal.

4 The detailed regulatory requirements imposed on SMP operators include non-discrimination obligations, accounting separation requirements, and price controls or cost accounting.

5 Annex IV (a) of the EECC.

6 Annex IV (c) of the EECC.

7 Annex IV (c) of the EECC.

8 Article 67(1)(d) of the EECC.

9Article 101(3) of the TFEU.

10 This is specified in Article 79, which is the Commitments procedure under which a co-investment scheme compliant with Article 76 can be accepted by an NRA.

Download

Contact

Felipe Flórez Duncan

PartnerContributors

Related

Download

Related

The new electronic communications and digital infrastructure regulatory framework: what does the economic evidence say? (Part 2 of 2)

On Thursday 23 October in Brussels, Oxera hosted a roundtable discussion entitled ‘The new electronic communications and digital infrastructure regulatory framework: what does the economic evidence say?’. In the second of a two-part series, we share insights from this productive debate. The discussion took place in the context of an… Read More

The new electronic communications and digital infrastructure regulatory framework: what does the economic evidence say? (Part 1 of 2)

On Thursday 23 October in Brussels, Oxera hosted a roundtable discussion entitled ‘The new electronic communications and digital infrastructure regulatory framework: what does the economic evidence say?’. In the first of a two-part series, we share insights from this productive debate. The discussion took place in the context of an… Read More