Tipping: should regulators intervene before or after? A policy dilemma

In digital markets, platforms often reach a tipping point. When network effects are sufficiently strong, users are drawn towards the network with the highest number of other users, making it more attractive, until the market eventually tips in its favour. While there are benefits to market tipping, concerns regarding abuse of dominance may also arise, which, as discussed in this article, can present a dilemma for policymakers.

On 10 March 2021, Dr Helen Jenkins, Managing Partner at Oxera, took part in a roundtable organised by Concurrences on the topic of ‘Tipping: should regulators intervene before or after?’.1 ‘Tipping’ refers to the ‘tendency of one system to pull away from its rivals in popularity once it has gained an initial edge’ generally driven by strong network effects.2 When this happens, the market in which the system operates is a ‘tipping market’.

Tipping has been used to describe how certain markets converge towards specific standards. For instance, the market for digital optical disc storage tipped to Blu-ray rather than HD DVD. In 2008, when both standards were supported by distinct hardware firms and content producers, Toshiba (the main proponent of HD DVD) announced that it would stop producing HD DVD players and recorders, following decisions by a number of film studios to release movies only in Blu-ray format.3 The HD DVD technology has now virtually disappeared.

The existence of one standard or one firm in tipping markets benefits consumers because more value is created in the market than if there were many firms operating. In the Blu-ray and HD DVD example, before the market tipped in favour of Blu-ray, consumers had access only to a limited number of movies and TV shows in either format. However, the ‘winner-takes-all’ nature of tipping markets can give rise to concerns of abuse of dominance.

Today, concerns around tipping are being highlighted in digital markets. The concern is that network effects are so strong that only a small number of large firms can be successful. Tipping in digital markets is one of the main rationales for the introduction of the Digital Markets Act (DMA) by the European Commission;4 in the UK, a ‘digital markets unit’ (‘DMU’) has been launched in April 2021.5

As the effects of tipping can be irreversible, and assuming that a regulatory intervention is needed,6 the debate regarding tipping has turned to the optimal timing of such an intervention—namely, whether competition authorities and regulators should intervene before or after tipping has occurred. It is with the objective of avoiding market tipping that the German Federal Ministry for Economic Affairs and Energy has proposed an amendment to the Competition Act. This new regulation is designed to intervene in markets that may tip before dominance—as defined in Article 102 TFEU—can be attained.7

In this Agenda article, we present the economics of tipping markets and discuss the optimal timing of regulatory intervention. In particular, we consider the following questions.

- What makes digital markets tip?

- Is it possible to intervene before a market tips?

- What are the current policy proposals for a market that has tipped?

Why does tipping occur?

The tendency of a market to tip is most commonly the consequence of positive network effects. Network effects arise when the value of a product or service to a user increases with the number of other users, as illustrated in Figure 1.8

Figure 1 One-sided (direct) network effects

When network effects are sufficiently strong, users are drawn towards the network with the highest number of other users. This in turn makes the largest network even more attractive, until eventually the market tips in its favour and everyone has joined it—this is often referred to as a ‘winner-takes-all’ outcome.

Users benefit from positive network effects because the value of the good increases with the total number of users—from this perspective, it is desirable that markets tip. For instance, most people would certainly prefer being able to contact all their professional contacts on the same network, as opposed to these contacts being spread out over multiple networks. These are positive network effects in action.

However, once a market has tipped, it can be difficult for rival networks to attract users, since no individual user has an incentive to switch when all other users remain on the largest network. This convergence towards one network gives rise to concerns from competition authorities that an anticompetitive market outcome may be reached.

Network effects can also arise between two (or more) groups of users. The classic example is shopping centres—the developers of a centre have to attract shoppers and retailers alike.9 The more shoppers there are, the higher the value of the centre to retailers, and vice versa. The example alluded to earlier regarding digital optical disc storage is essentially a three-sided platform including hardware firms, content producers, and viewers. In this example, tipping to an agreed common standard (Blu-ray) allows each side of the platform to invest in producing or buying coordinated content and hardware, facilitating a beneficial outcome for consumers.

For these multisided network effects, the ‘chicken and egg’ problem must be overcome: the platform needs users to attract businesses, but it needs businesses (that provide services) in order to attract users.10 Once a critical mass of either side has been achieved by one platform, it can be hard for others to enter.

The difference between market tipping and entrenchment

Since tipping in itself is not necessarily undesirable, a question that policymakers ought to answer is whether the tipping of a market would also lead to an entrenched market position—i.e. a market outcome that is very unlikely to change even if market conditions do. Where tipping does not lead to an entrenched market position, the market remains contestable. In contestable markets, the existence of potential entrants can ensure that the market is competitive, despite only a small number of firms being active in the market.11

There are three factors that can keep markets contestable by facilitating the entry of a competitor, even if the market has tipped.

- If the total number of users in the market is increasing, this facilitates the entry of a competitor because the entrant can focus its efforts on the new users entering the market. It is easier to compete for new users because they are not yet locked into an existing network.

- If changes in user preferences are related between users—for instance, if many users grow to want the same thing from a new platform—competitors can gain a foothold by adapting to the changing preferences of users more quickly than the incumbent. If these changes are related to each other (i.e. if they are correlated), users can together switch to a competing service within a short time frame. This implies that they will not have to forego the benefits of network effects when they make the switch.

- If network effects are primarily derived from a small group of users to which one is close—i.e. if they are local network effects—tipping is less likely to be prolonged, because less coordination is required to switch. A standard example of platforms where network effects are predominantly local is meal-delivery platforms—for users, restaurants that are outside the delivery range are basically irrelevant.12 This facilitates local entry of competing platforms.

As discussed above, network effects are the main cause of market tipping. However, there are many factors that determine how strong network effects are, and digital markets have characteristics that can amplify or reduce these effects. Each of these aspects must be considered when deciding whether and how to intervene. The next section discusses these aspects, and subsequent sections outline the pros and cons of different types of interventions.

Other factors affecting the strength of network effects

Data-enabled learning is another factor that affects market tipping. Combining the collection of data with the use of algorithms allows firms to optimise the development of new and existing products, to the benefit of consumers and firms.13 In particular, data-enabled learning allows firms to identify design flaws in existing products and the most important characteristics of products and services, and therefore to better identify and meet consumer needs.

Data-enabled learning affects tipping because having a successful product allows a firm to collect more data and improve its products, which brings in more users.14 This can amplify direct network effects in cases where the platform is suitable for data-enabled learning. For instance, Google Maps relies on learning across users to improve traffic predictions. Traffic data is collected live and is combined with historical data in order to increase prediction accuracy. This is what creates a virtuous cycle—as traffic predictions improve, more drivers use Google Maps, resulting in more data to improve traffic predictions, leading to more drivers adopting it.

Another important factor is whether consumers use multiple different platforms for the same purpose—for instance, if one has a subscription to multiple movie streaming services. This is called ‘multi-homing’, and tends to mitigate market tipping. Since users are not locked in to a particular platform, new entrants may find it easier to establish a platform without first having to induce customers to exclusively use its new and as-yet-unknown platform.15

The risks associated with intervening before tipping occurs

The main concern with a tipped market is that the platform provider may—if it has the ability and incentive—abuse its market dominance to the detriment of consumers and the competitive process.16 This had led competition authorities to consider various regulatory interventions. A particular discussion point in the design of interventions is whether they should occur before or after tipping, as there are concerns that once detrimental tipping has occurred, it may be difficult to reintroduce competition to the market.

Some policymakers have suggested that interventions in tipping markets should happen before tipping occurs in order to prevent potential harm. For instance, as discussed above, the German Federal Ministry for Economic Affairs and Energy sought to achieve this through its proposed amendment to the Competition Act.17

A prerequisite for an intervention before tipping occurs is the ability to identify which markets are going to tip. Identifying which firm or technology is going to be successful in a market is a notoriously difficult exercise, especially in the digital sector. For instance, Robert Metcalfe—the inventor of the ethernet protocol used to access the Internet—predicted in 1995 that ‘the internet will soon go spectacularly supernova and in 1996 catastrophically collapse’.18

Similarly, it is possible that a market might appear to tip in one direction, or even temporarily tip, before tipping towards another firm or standard. A common example cited in this case is Myspace, which was the largest social networking site in the world from 2005 to 2008 and benefited from strong network effects, with 115m unique users in April 2008.19 In early 2019, it attracted roughly 8m visits in total.20 At the same time, Facebook attracted over 2.3bn unique users.21

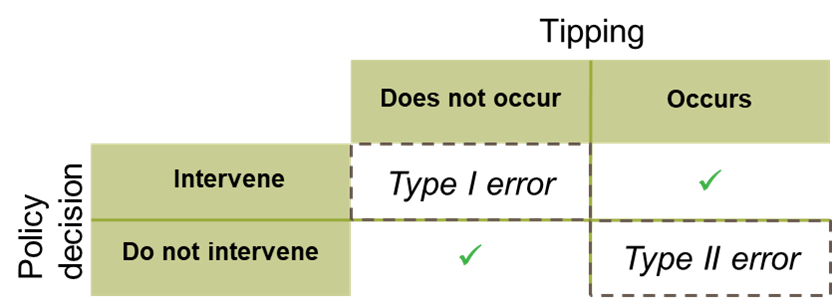

Since policymakers have imprecise knowledge of which markets are going to tip,22 any policy intervention, whether it is justified by a risk of abuse of dominance or not, involves two potential errors:

- type I errors—intervening in a market that is not going to tip;

- type II errors—not intervening in a market that is going to tip.

Figure 2 Illustration of the risk of a regulatory intervention before tipping occurs

Both types of errors outlined in Figure 2 are undesirable. Type I errors come at the cost of regulating firms unduly, thereby adding to the overall regulatory burden in the economy, which may hinder economic growth and welfare.23 In the case of a type II error, consumers and firms would have benefited from a regulatory intervention that was missed.

It is worth noting that given the uncertainty around identifying markets that will tip, any policy that tries to diminish the occurrence of type II errors will necessarily increase the rate of type I errors (and vice versa). This is intuitive: because the policymaker does not know with certainty whether a market will tip, they will have to increase the overall frequency of intervention. As a result, some interventions will turn out to have been unnecessary.

While identifying markets that will tip is a challenging task, a policymaker that would be willing to intervene should consider the following questions to identify the factors that affect tipping.

- Does the growing size of a network increase the net value of the service to the economy as a whole, or are positive externalities offset by costs associated with the increasing size?

- Are there factors that facilitate switching between services?

- Do users make use of multiple services for the same purpose, i.e. do users multi-home?

- Is the total number of users increasing over time?

- Are changes in preferences correlated across users?

- Do users primarily derive value from a small group of users with particular characteristics, i.e. are network effects mostly local in nature?

We now turn to policy interventions that have been proposed once tipping has occurred.

Regulatory proposals for interventions after tipping has occurred

Assuming that tipping has occurred, there are growing concerns that the traditional antitrust tools are ill-equipped to deal with markets characterised by strong network effects, especially those in the digital sector.24 The dynamics of these markets imply that at the time an ex post antitrust case comes to its conclusion—with such a case sometimes taking over seven years to progress from opening proceedings to a decision25—the market may have long tipped and potential competitors may have disappeared. Some argue that this is unsatisfactory for consumers, competitors, and the investigated firm alike.

Furthermore, ex post competition law aims to prevent the abuse of dominance, not the elimination or reduction of dominant market positions themselves. This implies that there are inherent limitations to what can be expected from ex post competition law.

All of these factors have led to growing calls by authorities and policymakers to be given new regulatory tools to be used after tipping has occurred in order to prevent anticompetitive behaviour.

This is the approach followed in the EU, where the current proposal for the DMA lays the foundation for obligations to digital platforms in some markets that the European Commission considers as having tipped (based on certain quantitative thresholds).26

In the UK, the Competition and Markets Authority has announced the creation of the DMU, which is in charge of enforcing ‘a new code to govern the behaviour of platforms that currently dominate the market’ and will work in close collaboration with sectoral regulators.27 The DMU is being set up in April 2021. Its strategic aims are:

- the effective and efficient use of ‘existing tools to maximum effect’ in digital markets;

- building knowledge and a capability to ‘understand digital business models, and their opportunities and risks’;

- establishing the regulatory framework that will govern digital markets;

- ensuring that existing tools are adapted for the digital economy.

While the exact features of the proposed regulation advanced in the UK are still to be clarified, it appears that the CMA aims to retain a case-by-case approach while speeding up decision-making. This matches the strategic aims of the DMU by exploiting existing tools in a flexible way that would be well adapted to a dynamic digital economy.

Resolving the dilemma?

When a market tips because of positive externalities, more value is created in the market than if there were many firms operating. However, this natural tendency of tipping markets to host only a few firms has led some competition authorities to be concerned by potential abuse of dominance by the suppliers, in particular in the digital sector. As the effects of tipping can be irreversible, the debate regarding regulation in tipping markets has turned to the optimal timing of such an intervention—namely, whether competition authorities and regulators should intervene before or after tipping has occurred.

Implementing regulation before tipping has occurred, as currently suggested in Germany, appears to be a challenging task. It is difficult, if not impossible, to identify which markets are going to tip. A regulator choosing a pre-tipping regulation should carefully consider the key characteristics set out in this article, determining whether a market will tip and, if so, whether the dominant player may become entrenched.

Other policy proposals have been advanced to mitigate the risks of tipping to competition once it has occurred. These policies have the advantage of allowing positive network effects to kick in, which benefits consumers. However, post-tipping regulations might arrive too late to appropriately remedy a competition concern.

Regulators face a complex trade-off between pre-tipping and post-tipping regulation, but what both types have in common is that they bear the risk of harming innovation in highly dynamic markets. Competition authorities around Europe are experimenting with both types of approach, and time will tell which toolset regulation will tip towards.

1 This was part of Concurrences’ broader webinar series, ‘Digital and competition: should the rules be changed?’.

2 Katz, M.L. and Shapiro, C. (1994). ‘Systems competition and network effects’, Journal of Economic Perspectives, 8:2, pp. 93–115.

3 Belleflamme, P. and Peitz, M. (2010), Industrial Organization: Markets and Strategies, Cambridge University Press, p. 583.

4 European Commission (2020), ‘Proposal for a regulation of the European Parliament and of the Council on contestable and fair markets in the digital sector (Digital Markets Act)’, paras 25–6.

5 UK Government (2021), ‘New watchdog to boost online competition launches’.

6 Aligned with the topic of the Concurrences event, we do not enter into the debate over whether tipping markets need to be regulated or not. Instead, we focus on the optimal timing of such regulation, assuming that it is needed in certain markets.

7 For further details, see Weck, T. (2020), ‘The New Abuse Rules in the German Competition Act – What’s in it for the EU?’.

8 Niels, G., Jenkins, H. and Kavanagh, J. (2011), Economics for Competition Lawyers, Oxford University Press, March.

9 Hagiu, A. (2009), ‘Two‐sided platforms: Product variety and pricing structures’, Journal of Economics & Management Strategy, 18:4, pp. 1011–43.

10 Caillaud, B. and Jullien, B. (2003), ‘Chicken & egg: Competition among intermediation service providers’, RAND journal of Economics, 34:2, pp. 309–28.

11 Baumol, W.J. (1982), ‘Contestable markets: an uprising in the theory of industry structure’, American Economic Review, 72:1, pp. 1–15.

12 Local network effects are not necessarily local in a geographical sense. For instance, if a social network consists of many small groups of friends (which may be spread around the globe), the coordination that is required to switch to another platform is minimal.

13 Oxera (2021), ‘Is knowledge power? Data-enabled learning and competitive advantage’, Agenda, January.

14 Oxera (2021), ‘Data-enabled learning: policy implications’, Agenda, February.

15 Bundeskartellamt (2016), ‘The Market Power of Platforms and Networks: Executive Summary’, Working Paper, June.

16 Tirole, J. (2015), ‘Market Failures and Public Policy’, American Economic Review, 105:6, pp. 1665–82.

17 Weck, T. (2020), ‘The New Abuse Rules in the German Competition Act – What’s in it for the EU?’, Competition Policy International, 14 April.

18 Metcalfe, B. (1995), ‘Predicting Internet’s catastrophic collapse & ghost sites galore in 1996’, Infoworld, 17:49, p. 61.

19 Lifewire (2020), ‘Is Myspace Dead?’, 16 December.

20 Statista (2021), ‘Myspace global traffic’.

21 Statista (2021), ‘Number of monthly active Facebook users worldwide’.

22 And there is also uncertainty regarding how long the market is going to tip.

23 For a discussion, see, for instance, Oxera (2021), ‘When regulators innovate, does innovation prosper?’.

24 Oxera (2021), ‘Move fast and analyse things: sensible regulation for digital markets’, Agenda, January.

25 European Commission Antitrust/Cartel case 39740 Google Search (Shopping).

26 European Commission (2020), ‘Proposal for a regulation of the European parliament and of the council on contestable and fair markets in the digital sector (Digital Markets Act)’, 15 December.

27 Competition and Markets Authority (2021), ‘The CMA’s Digital Markets Strategy: February 2021 refresh’, updated 9 February 2021.

Download

Related

Investing in distribution: ED3 and beyond

The National Infrastructure Commission (NIC) has published its vision for the UK’s electricity distribution network. Below, we review this in the context of Ofgem’s consultation on RIIO-ED31 and its published responses. One of the policy priorities is to ensure that the distribution network is strategically reinforced in preparation… Read More

Leveraged buyouts: a smart strategy or a risky gamble?

The second episode in the Top of the Agenda series on private equity demystifies leveraged buyouts (LBOs); a widely used yet controversial private equity strategy. While LBOs can offer the potential for substantial returns by using debt to finance acquisitions, they also come with significant risks such as excessive debt… Read More