5G spectrum: the varying price of a key element of the 5G revolution

We share some reflections on the final results of the 5G UK auction following their publication by Ofcom on 27 April. The results confirm that the auction resulted in an efficient allocation of spectrum, in terms of lot sizes and contiguity/proximity of lots, and that the post-trading negotiations of the assignment stage proved helpful.

In our previous article, published soon after the completion of the initial stage of the UK 2021 5G auction, we evaluated the preliminary prices emerging from the principal stage of the latest UK auction for the 700MHz and 3.6–3.8GHz bands (published on 17 March).

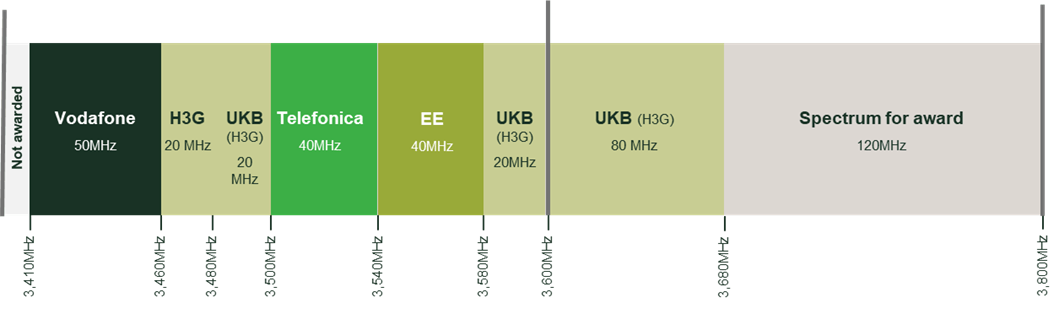

On 27 April, Ofcom announced the final results of the auction, reaching the assignment stage.1 In the auction at stake, one of the primary goals was to reduce the fragmentation of holdings for a more efficient use of the 3.x GHz band.2 Indeed, the band was already occupied by spectrum holders that secured rights in the first 5G auction in 2018 (see Figure 1). H3G also acquired relevant spectrum rights with the acquisition of UK Broadband in 2017.

Figure 1 Spectrum holdings in the 3.4–3.8GHz band ahead of the 2021 5G auction

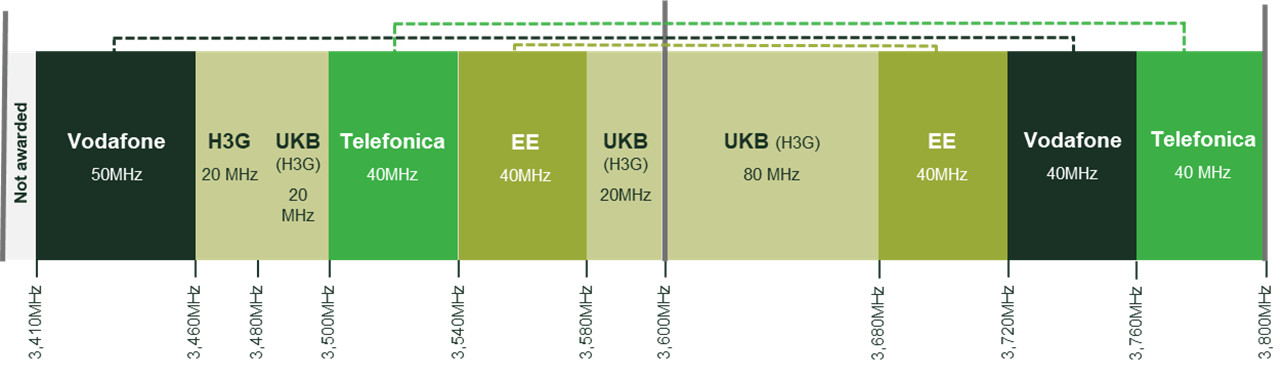

With specific reference to the 3.6–3.8GHz band, in the first (principal) stage, EE won 40MHz (at a cost of £168m), Telefónica won 40 MHz (at a cost of £168m), and Vodafone won 40MHz in the 3.6–3.8GHz band (at a cost of £176.4m).3

To allow operators to acquire spectrum rights for blocks close to the existing holdings, Ofcom allowed for post-trading negotiations within the assignment stage (allowing the negotiation period to last up to four weeks).4,5

The second stage eventually provided noteworthy improvements and additional revenues from the auction.6 In particular, EE incurred additional costs bidding on specific frequencies to reduce the distance of its split holdings, while Vodafone and Telefonica engaged in a spectrum swap.

As detailed in Figure 2, at an additional cost of £23m in the assignment stage, EE secured the rights for the lowest 3.6–3.8GHz block in order to gain sufficient proximity with its existing holding in the lower band (i.e. the highest 3.4–3.6GHz block). This enabled EE to run both blocks using the same antenna arrays at a lower cost.

Figure 2 Spectrum holdings in the 3.4–3.8GHz band after the auction (pre-trade)

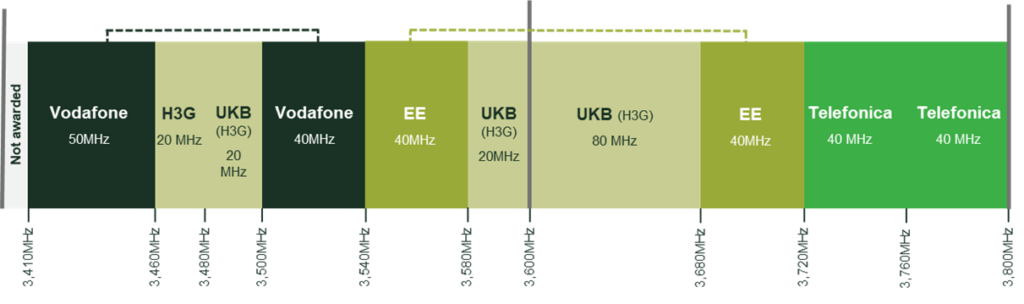

Vodafone and Telefonica took advantage of the post-trading possibility: Vodafone offered Telefonica 40MHz (in the range 3,720–3,760MHz), while Telefonica accorded Vodafone 40MHz (in the range 3,500–3,540MHz).7

As presented in Figure 3, the trade provided the sought-after proximity between Vodafone’s new blocks and its existing holding (two blocks of 50MHGz and 40MHz separated only by the 40MHz that belong to H3G) and full contiguity of Telefonica’s new 80MHz blocks running in the range 3,720–3,800MHz.

Other trades were in theory possible, but from an external perspective it appears that H3G, being the best placed for 5G spectrum (thanks to its previous holdings secured in the first 5G auction in 2018 and through the acquisition of UK Broadband in 2017), had no incentives to coordinate on a reallocation. In turn, the size of EE (and its portfolio of spectrum) might have disincentivised Vodafone and O2 from trading with EE in order to avoid benefiting their largest competitor.

Figure 3 Spectrum holdings in the 3.4–3.8GHz band after the auction (post-trade)

Overall, the auction seems to have generated an effective allocation and, from a public finance perspective, also adds revenues in the process of making the use of the band more efficient.

This is in stark contrast with the 5G spectrum auction in Italy, where the design and rules of the auction left space for only two real winners and got in the way of a more efficient allocation of spectrum.8 Since regulatory choices help shape market outcomes and can lead to win–win solutions, policy instruments such as auctions require a clear understanding of the impact of their design on social welfare, especially when they alter the structure, capacity, timing, or firm composition of the sector.9

1 This process involves a single bidding round in which the companies can bid for the frequency positions they prefer for the airwaves they have secured in the principal stage. After submitting their assignment stage bids in the 3.6–3.8GHz band, bidders will then have the opportunity to negotiate the frequency positions among themselves—if they want to join the airwaves they have secured together with spectrum they already hold in the wider 3.4–3.8GHz band. See Ofcom (2021), ‘Ofcom spectrum auction: principal stage results’, 17 March.

2 Proximity and continuity of spectrum blocks held by operators are important to achieve an efficient allocation of spectrum. A lack of proximity or contiguity could make it costlier for operators to deploy 5G. By ‘contiguous spectrum’ (or ‘contiguity’), we mean spectrum bands that are adjacent in frequency to one another and are held by a single licensee. We define ‘proximate’ spectrum as being spectrum fragments that are close enough in frequency that they could be used by a single piece of base station equipment. See Ofcom (2020), ‘Award of the 700 MHz and 3.6-3.8 GHz spectrum bands’, 13 March.

3 See Oxera (2021), ‘5G spectrum: the varying price of a key element of the 5G revolution’, Agenda, April; and Ofcom (2021), ‘Ofcom spectrum auction: principal stage results’, 17 March.

4 Post-trading of spectrum entails the possibility for auction winners to engage in potential post-auction trades of blocks, with the objective of improving the efficiency of the allocation resulting from the auction.

5 See Ofcom (2020), ‘Award of the 700 MHz and 3.6-3.8 GHz spectrum bands’, 13 March.

6 See Ofcom (2021), ‘Award of the 700 MHz and 3.6-3.8 GHz spectrum bands – Notice under regulation 121 of the Wireless Telegraphy (Licence Award) Regulations 2020 (“the Regulations”)’, 27 April.

7 See Dyer, K. (2021), ‘UK operators trade 5G midband spectrum’, The Mobile Network, 27 April.

8 As noted in our previous articles, whereas in the UK auction operators could bid for 24 symmetrical lots of 5MHz in the 3.6–3.8GHz band, in Italy the asymmetry between the two smaller lots (20MHz each) and the two larger lots (80MHz each) made the 3.7GHz band artificially scarce, leaving space for only two real winners (efficient lot size is deemed to be in the region of 40MHz). As a result, prices spiralled upwards.

9 Hazlett, T. W., Muñoz, R. E. and Avanzini, D. B. (2012), ‘What Really Matters in Spectrum Allocation Design’, Northwestern Journal of Technology and Intellectual Property, 10:3.

Download

Contact

Dr Barbara Veronese

PartnerContributors

Related

Download

Related

Spatial planning: the good, the bad and the needy

Unbalanced regional development is a common economic concern. It arises from ‘clustering’ of companies and resources, compounded by higher benefit-to-cost ratios for infrastructure projects in well developed regions. Government efforts to redress this balance have had mixed success. Dr Rupert Booth, Senior Adviser, proposes a practical programme to develop… Read More

Sustainable Divergence between the UK and the EU—the Fair Share Principle in Practice

As sustainability continues to grow in importance for businesses, regulators are starting to provide guidance on how competition law applies to ‘green agreements’. In our recent article, written alongside Linklaters, we examine how the European Commission and the UK’s Competition and Markets Authority (CMA) are shaping their frameworks to account… Read More