When to give the green light to green agreements

Should companies be allowed to cooperate—or ‘collude’—on socially beneficial environmental behaviour? Do companies even have the incentive to cooperate on socially beneficial behaviour? In this article, we reconcile apparently divergent views concerning the law and economics of the value of sustainability agreements, by illustrating how the presence of sustainability spillovers between firms can generate both socially and privately beneficial cooperation.

In writing this article, we have benefitted from valuable discussions with Maurits Dolmans, Simon Holmes, Professor Maarten Pieter Schinkel, Martijn Snoep, and Leonard Treuren. Any remaining errors are our own.

Can cooperation between competing firms help them to become more environmentally responsible? And should such ‘green agreements’ therefore be exempted from competition law restrictions on coordinated behaviour?

Within the competition community, a debate has erupted on whether competing firms should be allowed to coordinate on sustainability objectives—particularly in the context of reducing greenhouse gas emissions and addressing the global climate challenge.1 On 10 September, the European Commission published a policy brief outlining is current thinking in this debate.2

On the one hand, there are practitioners and scholars who point towards the need for competing firms to coordinate on more sustainable behaviour, in order to avoid the so-called ‘first-mover disadvantage’ that exists under competition when firms want to limit their negative social impact. Competition law is seen to play an obstructive role in such coordination.3 Thus, it is said that competition law needs to adapt. Using first-best government regulation as the solution, it is maintained, is unrealistic given the political realities of achieving the necessary scale of change.4

On the other hand, there are scholars who stress that allowing for corporate coordination risks achieving the exact opposite effect.5 Recent economic research indicates that, to ensure that firms behave in a more environmentally responsible fashion, we need more competition, not less. Allowing for coordination risks taking away the incentive for firms to compete on sustainability efforts, leading to ‘friendly fire’ in our fight against climate change.6

In this Agenda article, we aim to reconcile the divergent views about the desirability and feasibility of socially beneficial environmental coordination among profit-orientated firms.

The key word: spillovers.

Law and economics: talking at cross purposes?

If you are a firm with green ambitions, competition can be an obstacle. By adopting more environmentally friendly production technology, for instance, you may reduce your greenhouse gas emissions, but you are also likely to increase your costs. If your competitors are not following you in these green ambitions, you risk ending up with a competitive disadvantage—reducing your profitability and perhaps even your long-term financial sustainability if your customers do not recognise and fully value your green solution.

This obstacle in ‘going it alone’ is called the ‘first-mover disadvantage’.

But what if you manage to coordinate with your competitors to all move to more environmentally friendly production technology together, at the same time?

Solving the first-mover disadvantage

Being environmentally responsible and providing ‘green’ products is likely to be costly, and as long as ‘grey’ products remain available in the market, consumers might not want to pay (more) for the greener products.

Moreover, the fact that consumers do not always behave rationally does not aid the introduction of unilateral green initiatives by firms either: the climate challenge is stated to be a priority for a large part of the population, but, as consumers, we are not always willing or able to make the necessary sacrifices.7 Both of these factors—the costliness of being environmentally responsible, and the unwillingness of consumers to pay—can confer a first-mover disadvantage on firms looking to reduce their negative social impact.8

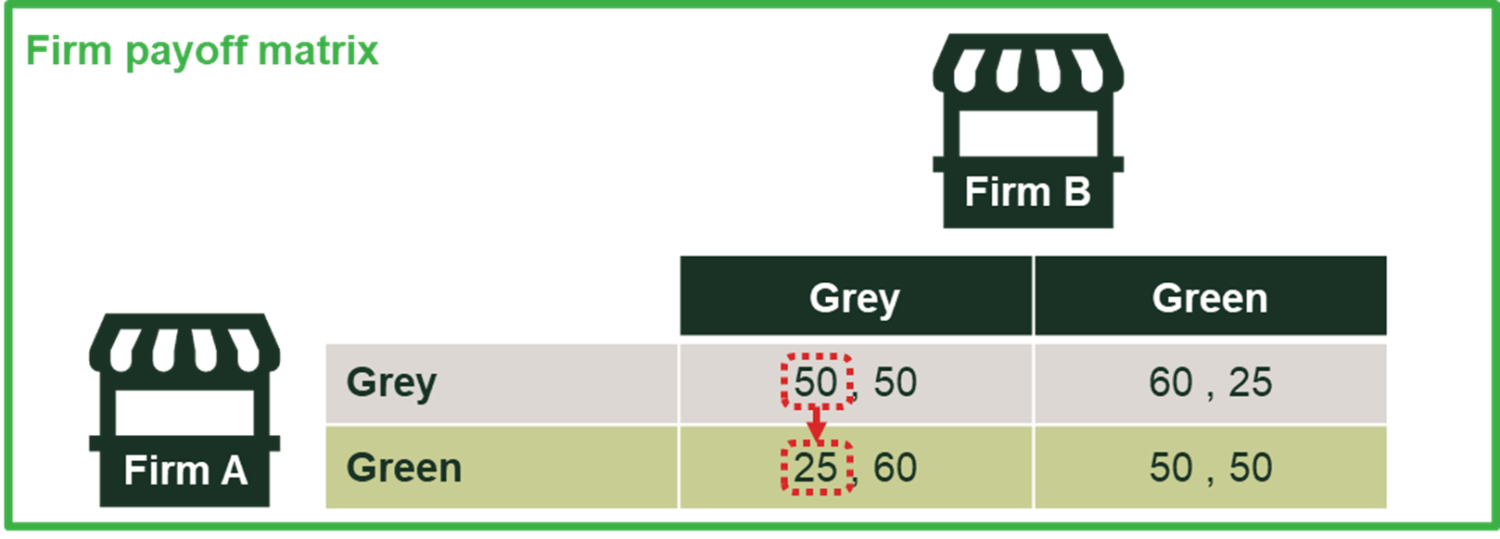

To make this argument more explicit, we can take the stylised situation of only two competing firms that can decide on whether to offer ‘grey’ or ‘green’ products. This situation is illustrated in Figure 1 using a so-called ‘payoff matrix’. Starting from a situation where both firms sell a grey (i.e. environmentally unfriendly) product and enjoy a payoff of 50 each, we can see that if one firm decides to sell a greener product, it will end up being worse off and earn a payoff of 25—with the other firm benefiting from the competitive advantage and increasing its payoff to 60.9 Coordination can then help firms reach the situation in which both sell green products and both enjoy a payoff of 50 again. Total payoff is now 100 instead of 85 (60 plus 25).

This does assume for now that consumers are willing to pay for the additional green costs when all firms do it (hence firm profits are the same when both choose grey or green outcomes). We return to this point below.

Figure 1 First-mover disadvantage in green coordination

Source: Oxera.

Note that this first-mover disadvantage is not just a theoretical possibility. In 2018, Lidl suffered from a clear first-mover disadvantage when it tried to implement and sell only Fairtrade bananas in its German and Swiss stores.10 Competitors did not follow and as consumers failed to express sufficient interest in this change, Lidl reversed its decision and reintroduced the cheaper, less sustainable bananas.

The above framework explains why firms are not always able to ‘go it alone’ and opens up the debate that coordination should be used (and should be exemptible under competition law) to achieve the green outcome.

However, from the perspective of economic theory, this framework is incomplete, and conclusive inferences on optimal competition policy cannot yet be drawn. The key component missing here is firm incentives.

What about incentives?

In the rudimentary example above, it is simply assumed that firms would want to coordinate on green, if permitted. However, it is not obvious whether this incentive does indeed exist.

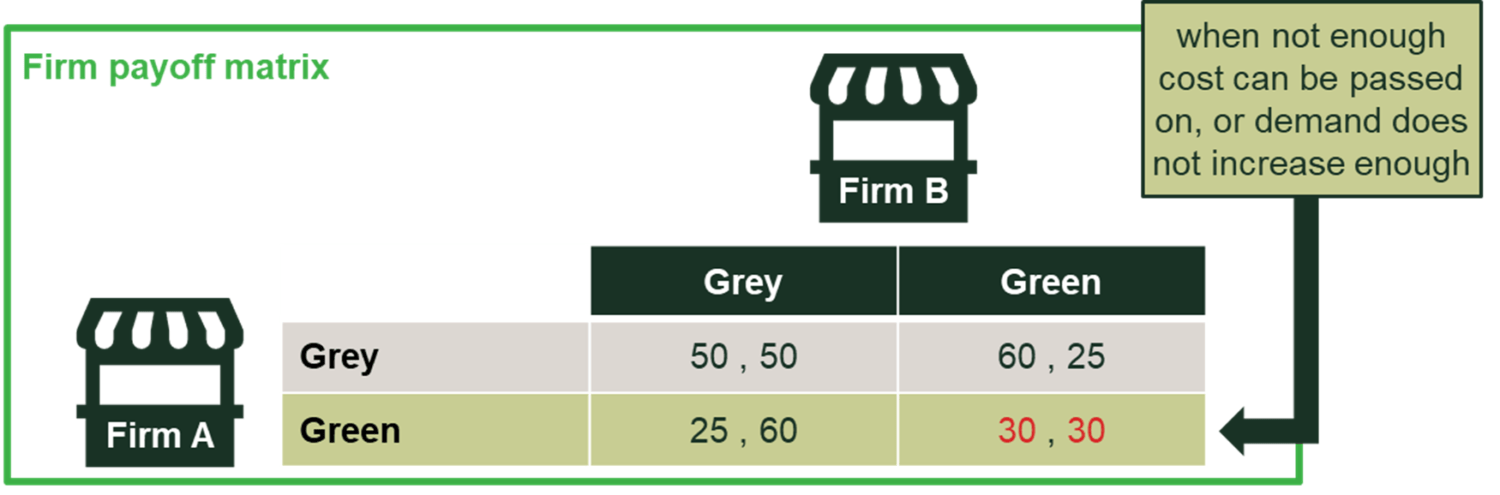

We illustrate this situation in Figure 2, where the payoffs reflect the likely situation where firms are not able to fully pass on the costs of the green products to consumers, and/or consumers do not have a sufficiently high willingness to pay for products that are ‘green’ instead of ‘grey’. Note that willingness to pay (i.e. an individual’s demand for a product) will depend on the alternatives available and budget constraints.11

Both factors (incomplete pass-on of costs and insufficient willingness to pay) mean that in the situation where both firms choose {Green}, total payoffs are likely to be lower than before—for illustrative purposes set here at 30.

This means that firms may indeed have the ability to coordinate on both choosing {Green}, but would not necessarily have an incentive to do so. While it is better for each firm to coordinate on green than go it alone, the dominant strategy here is for each firm to stick with its grey production technology. This is the ‘virtue-signalling’ outcome, where both firms may blame a first-mover disadvantage for dissuading them from implementing green technology and blame competition law for preventing them from cooperating on greener options; however, in fact, both firms’ interests are to remain with the ‘grey’ status quo.

Figure 2 Absence of incentives for green coordination

Source: Oxera.

Moreover, as flagged in the economics literature, firms may even have an incentive to coordinate on being less green.

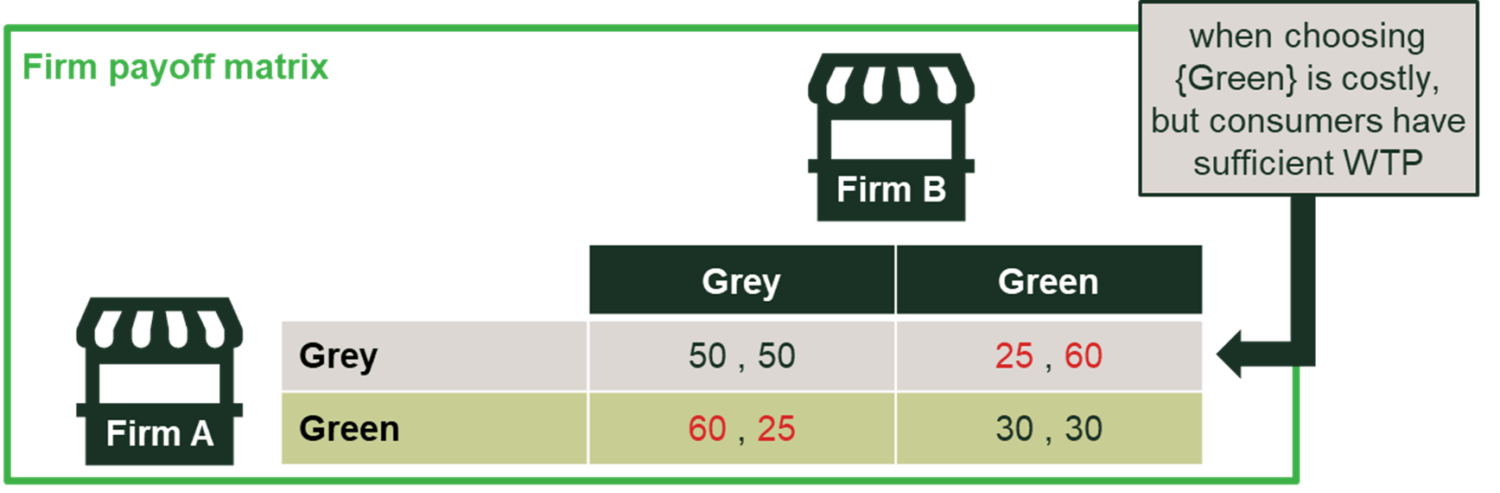

This is illustrated in Figure 3. Here, unilaterally adopting a greener product offering does deliver a clear competitive advantage to firms—say, because the costs of adopting greener offering is not too costly and consumers display strong willingness to pay for ‘green’. In such a situation, competition generates a virtuous mechanism in which firms compete on being the first to choose {Green}, and the competitive outcome would be both firms becoming greener. Overall, however, the costs to transition to the greener offering cannot be fully passed on, and so if, in this scenario, they were instead able to coordinate, they would coordinate on {Grey}—not {Green}.12

Figure 3 Incentive to coordinate on grey instead

Source: Oxera.

This stylised theoretical illustration can be generalised. Indeed, recent theoretical economic research predicts that when the costs are not too high and consumers have at least some willingness to pay for green products, allowing firms to collude on sustainability would lead to less sustainability effort—not more.13

What drives this finding in the theoretical literature? The sustainability efforts of other firms have a negative effect on a firm’s objective (where we make the standard assumption that this objective is to maximise its individual profits): if others increase their sustainability efforts, a firm will itself (all else equal) receive a lower payoff. As this holds for all firms, if they can coordinate, they are collectively better off to agree on lower sustainability efforts.

Again, this concern is not just a theoretical possibility. In July this year, five car manufacturers were fined €875m by the European Commission for agreeing to restrict their development of a costly technological innovation called AdBlue—which would have helped reduce nitrogen oxide gases of diesel cars, but which would not have been sufficiently profitable if all manufacturers adopted it.14

Contrasting perspectives?

Summing up, it is true that for firms with green ambitions, competition may be an obstacle. Unilaterally adopting greener practices can put you at a cost disadvantage, and consumers may not have the necessary willingness to pay to compensate for this.

Coordination between corporates may therefore be necessary to enable firms to reduce their negative social spillovers and realise their green ambitions. However, inferring from this that companies should be allowed to coordinate their sustainability efforts may be premature, as it is not always obvious that firms really have the required incentive to coordinate on ‘doing the right thing’. In fact, they may even have the incentive to coordinate on exactly the opposite.

These examples highlight the challenges facing competition authorities in deciding policy relating to ‘sustainability’ agreements. It is likely to be difficult for them to distinguish between situations where there is a genuine rationale for sustainability coordination to deliver good outcomes for firms and society and cases where firms take advantage of the ability to coordinate to deliver good outcomes for them and poor outcomes for society. Given the extensive history and precedent on the negative effects of cartels, this scepticism is warranted.

But does that mean that public and private incentives can never be sufficiently aligned when firms consider coordinating on ‘green’? Are there conditions under which economic analysis indicates that private sustainability coordination would actually be both socially beneficial and feasible?

As we show next, the answer to this last question is ‘yes’.

Sustainability spillovers as reconciling mechanism

The above theoretical frameworks on the incentives to coordinate on ‘green’ ignore one factor that works to reconcile the divergent views: spillovers.

More specifically, positive spillovers between firms from sustainability efforts are not captured. Where positive spillovers exist between firms, efforts by one firm also benefit other firms.15 In this case, the level of sustainability efforts by other firms would actually have a positive effect on a firm achieving its own objectives. Allowing firms to coordinate their sustainability efforts will then lead to higher overall effort levels.

The key question is then: what might drive these positive sustainability spillovers? For illustration purposes, we discuss several potential scenarios.

1. Positive social spillovers from a common cost saving

In many industries, firms face common costs. This can include a common network or infrastructure, or investments in a common upstream production industry or R&D. Setting up a more cost-efficient network or infrastructure, or investing in a more sustainable and cost-efficient common upstream production industry may require more investment than any one firm is able or willing to bear—especially when the benefits accrue to all competing firms involved.

Coordination can then help prevent freeriding behaviour, allowing firms to increase overall investment and reduce their common costs or increase innovation, and in the process increasing their sustainability. This in turn benefits society as a whole.

CETIN’s shared mobile backhaul

In 2011, two mobile network operators in the Czech Republic—O2/CETIN and T-Mobile—started sharing their network on 2G, 3G and 4G mobile technologies. In addition to a fixed cost saving, this network sharing agreement led to lower CO2 emissions, as the operators were able to reduce the number of sites used from ten (five each) to only seven.

Coordinating on fewer sites meant that firms saved on energy costs and maintenance costs (including costs of travel involved in maintenance), and in the processes reduced their environmental footprint.

Source: Oxera. Oxera has been involved as adviser in this case.

2. Improved industry reputation

When an entire industry suffers from a poor reputation due to the environmental damages generated by its collective behaviour, any one firm may face insufficient incentive to try to improve the industry image by investing a significant amount in sustainability.

In such cases, coordinating on improved sustainability can help to improve the overall industry reputation. This overall industry reputation in turn can have many benefits to all firms involved, including of course increased consumer demand, but also potentially better capital market access16 or an increased ability to attract talent.17

Flygskam

Flygskam is a Swedish concept that appeared in 2017 and which has been popularised by the environmental activist Greta Thunberg. It refers to a feeling of guilt about contributing to global warming by using air transport, and literally translates as ‘shame of flying’.

This phenomenon has developed over the years and some people have already started to switch from air travel to other less polluting modes of transportation in order to reduce their footprint.

In this airline sector, demand is largely built on overall industry reputation, which means that an increase in an overall shame of flying could have a significant negative impact on the future demand of air transport and threaten the long-run viability of airlines.

In order to respond effectively to changing consumer preferences, airlines may wish to increase their sustainability efforts. However, as such efforts accrue to the industry as a whole, airlines may—individually—not have enough incentive to play their part.

Source: Financial Times (2019), ‘Year in a word: Flygskam. Swedish activist Greta Thunberg put the backlash against air travel centre stage’, December 29.

3. Firm altruism and genuine ‘corporate purpose’

Much of the theoretical economics literature builds on the assumption that firms are profit-maximising entities. However, one may also choose to assume that firms (or their executives) also care about the realisation of social objectives, such as combatting climate change.18

When a firm values not only its own efforts in achieving a social objective but also those of others, the sustainability efforts of others by definition enter the firm’s objective function as a positive term. If the same holds for other firms, coordination on sustainability efforts would indeed lead to higher overall effort levels—as it helps to prevent others from freeriding on your sustainability efforts.

USLP: Unilever Sustainable Living Plan

In 2009, Unilever, a multinational company that specialises in fast-moving consumer goods, launched the Unilever Sustainable Living Plan (USLP) in order to combat the pursuit of business growth at the expense of people or the environment, and to promote sustainable growth. More specifically, the chief objectives of this program were:

- improving health and wellbeing of more than a billion people;

- reducing by half the environmental footprint of Unilever’s products;

- improving the livelihoods of workers throughout Unilever’s whole value chain;

- sourcing the agricultural raw materials in a complete sustainable way.

With USLP, Unilever aims to signal to the outside world that it does not care only about profit for shareholders when deciding on its corporate strategy, but also about broader societal implications.

If one is willing to accept these stated objectives as sincere (and not as being expressed solely for marketing purposes or being secondary to an overall objective of increasing shareholder value), allowing Unilever to coordinate its sustainability efforts with equally ‘purpose-oriented’ competitors can speed up the achievement of these goals.

Note: In this case, Unilever should not only care about its own effort levels, but also of those of its competitors. Indeed, if Unilever (and competing forms) were only to care about its own effort levels, there would be no positive spillover. This point is discussed in more detail in Schinkel, M.P. and Treuren, L. (2021), ‘Corporate social responsibility by joint agreement’, Amsterdam Center for Law and Economics, working paper No. 2021-01.

Source: Unilever (2010), ‘Unilever Sustainable Living Plan. Small actions. Big difference.’, November.

4. Reduced existential threat

But even if one were to maintain the assumption that firms are simply profit-maximising entities, firms can still be expected to care about the existential threat that climate change poses, simply because any existential threat is bad for profit.

Competition can lead to an overuse of scarce resources, particularly if firms are too focused on short-term profits and display so-called ‘myopic’ behaviour (in which they neglect the impact of current actions on future profits). However, there is no reason to assume that firms cannot be far-sighted, and indeed take the long-run environmental implications of their collective actions into account.

However, the probability of actually abating the existential threat is not just a function of one firm’s actions, but involves the behaviour of many. This again generates a spillover effect that enables positive effects from coordination: to avoid freeriding by firms that wish to benefit from the abatement efforts of others without having to incur any costs themselves, firms may want to coordinate their efforts.

Green activist shareholders at Exxon Mobil, Chevron, and Shell

In May 2021, shareholders at Exxon Mobil and Chevron pushed both companies to cut emissions generated by the use of companies’ products and voted in favour of more sustainability efforts, rather than privileging short-term profit.

In that same month, 30% of shareholders of Shell voted in favour of more ambitious emission-reduction targets—which is more than double the support for a similar vote last year. This shareholder activism is run by Follow This—a shareholder collective that lobbies the oil industry to improve its environmental efforts.

Although they are supported by environmental groups, the basic argument by these activist shareholders is that being bad for the environment is simply bad for business.

Source: Ambrose, J. (2021), ‘ExxonMobil and Chevron suffer shareholder rebellions over climate’, The Guardian, 26 May; Financial Times (2021), ‘Investors support Shell’s strategy for net-zero emission despite backlash’, 18 May; follow-this.org.

5. Avoiding costly industry-wide government intervention

Finally, firms may simply fear that if they do not step up their game, governments will make them—and possibly in ways that are a lot more inefficient and costly for all involved.

Of course, well-designed government regulation is always first-best here, as with any social challenge. However, in reality, governments may lack the knowledge or capacity to implement first-best regulation. This means that they may have to resort to less efficient or more ‘coarse’ forms of intervention that harm the firms involved, and may be less effective at reducing the environmental harm than if the industry were to act itself. In that sense, avoiding regulatory failure may also be the best social outcome.19

The threat of a short-haul flights ban in France

In 2019, the French government started to examine a measure aimed at cutting the CO2 emissions of the air transport industry in France. The draft bill aimed to ban all domestic flights between destinations that can be reached in less than two and a half hours by train, and was voted for by the National Assembly in April 2021. This measure is also mentioned in the French Citizens’ Assembly on Climate Change, during which a ban on flights of less than four hours was even suggested.1

While banning flights reduces emissions, it also takes away the opportunity from the airline industry to ‘clean up its act’. As an alternative, airline industries may seek to improve the sustainability of air travel in general—preventing more rigorous forms of government intervention.

Note: 1 Convention citoyenne pour le Climat (2020), ‘Les Propositions de la Convention Citoyenne pour le Climat’. Source: Assemblée Nationale (2019), ‘Proposition de loi N° 2005 visant à remplacer les vols intérieurs par le train (quand c’est possible…)’, 5 June.

The future of sustainability agreements

The presence of a first-mover disadvantage may prevent firms from realising their green ambitions on their own. Coordinating efforts with competitors may then provide firms with the ability to collectively increase sustainability efforts—to the benefit of society at large.

However, the incentives for firms to do so is not always obvious. Indeed, firms may even have the incentive to coordinate on less sustainability efforts—as the recent AdBlue decision by the European Commission shows.

To reconcile these two divergent views on the desirability and feasibility of socially beneficial private coordination, we point towards the role played by possible positive sustainability spillovers between firms. More specifically, we identify several scenarios in which firms coordinating their sustainability efforts could indeed lead to higher overall effort levels—advancing both private and public interests.

The list of potential scenarios considered here is not exhaustive, or conclusive. Whether positive sustainability spillovers exist and are sufficiently large in any one particular case—and hence whether an exemption from legislation prohibiting coordination between competitors may be warranted—still requires careful case-by-case consideration.

Moreover, our discussion thus far has ignored several other considerations that may be relevant when considering whether to exempt companies from cartel law.

For instance, allowing competitors to coordinate on sustainability efforts may give further opportunities for executives to talk and collude on output or prices as well.20 In that sense, socially beneficial green collusion may turn out to be a ‘gateway’ to socially harmful robust restrictions to competition.

Additionally, there is a risk that leaving firms to coordinate on socially beneficial behaviour may reduce the pressure on politicians to pursue forms of first-best regulation—such as carbon taxation or effective emission trading schemes. In other words, more private initiatives may crowd out more effective public measures.21

Finally, we have not considered whether a socially beneficial sustainability agreement is actually permissible under European treaties or other applicable competition laws, as a matter of law. This is a relevant question, as competition law may not always account for out-of-market benefits (such as those accruing to society as a whole, as in the case of reduced greenhouse gas emissions)—and indeed some of the above examples may involve increased prices for direct consumers. On the other hand, arguments have been made that the supposed requirement of full in-market compensation of consumers is not actually required in law, but is a policy choice made when the European Commission modernised competition law.22

But from a purely economic perspective, the possibility of firms pursuing socially beneficial green agreements is real. You just need to find the spillovers.

1 The concept of sustainability is much broader than only reducing greenhouse gas emissions and combatting the global climate crisis. Recent debate is however focusing mostly on this one particular issue—given its urgency and political mandate (in the form of the Paris-agreement).

2 European Commission (2021), ‘Competition Policy Brief 01/2021 – Policy in Support of Europe’s Green Ambitions’, 10 September 2021.

3 De Stefano, G. (2020), ‘EU Competition Law & the Green Deal: The Consistency Road’, Competition Policy International, 28 July; Dolmans, M. (2020), ‘Sustainable competition policy’, Competition Law and Policy Debate, 5:4; Dolmans, M. (2020), ‘The “polluter pays” principle as a basis for sustainable competition’, in S. Holmes, M. Snoep and D. Middelschulte (eds), Competition Law, Climate Change & Environmental Sustainability, Concurrences; Holmes, S. (2020), ‘Climate change, sustainability, and competition law’, Journal of Antitrust Enforcement, 8:2, pp. 354–405; Linklaters (2020), ‘92 percent of businesses call for changes to competition rules to boost climate change collaboration’, 30 April; Scott, I. (2016), ‘Antitrust and socially responsible collaboration: A chilling combination’, American Business Law Journal, 53:1, pp. 97–144; Unilever (2020), ‘Sustainability cooperations between competitors & Art. 101 TFEU. Unilever submission to DG COMP’, May; Ellison, J. (2020), ‘A Fair Share: Time for the Carbon Defence?’.

4 Dolmans, M. (2020), op. cit.; Holmes, S. (2020), op. cit.; Kingston, S. (2019), ‘Competition Law in an Environmental Crisis’, Journal of European Competition Law & Practice, 10:9.

5 Schinkel, M.P. and Treuren, L. (2021), ‘Green antitrust: friendly fire in the fight against climate change’, in S. Holmes, M. Snoep and D. Middelschulte (eds), Competition Law, Climate Change & Environmental Sustainability, Concurrences; Gomez-Martinez, F., Onderstal, S. and Schinkel, M.P. (2019), ‘Can collusion promote corporate social responsibility? Evidence from the lab’, Tinbergen Institute Discussion Paper TI 2019-034/VII; Peeperkorn, L. (2021), ‘Competition Policy is not a Stopgap!’, Journal of European Competition Law & Practice, June, 12:6, pp. 415–8; Veljanovski, C. (2020), ‘Collusion as environmental protection: an economic assessment’, working paper.

6 Schinkel, M.P. and Spiegel, Y. (2017), ‘Can collusion promote sustainable consumption and production?’, International Journal of Industrial Organization, 53, pp. 371–98; Schinkel, M.P. and Treuren, L. (2021), ‘Corporate social responsibility by joint agreement’, Amsterdam Center for Law and Economics, working paper No. 2021-01.

7 One important factor that may be driving this is the behavioural bias known as ‘present bias’, or ‘hyperbolic discounting’—one’s tendency to underestimate the future costs of current behaviour. See Laibson, D. (1997), ‘Golden eggs and hyperbolic discounting’, The Quarterly Journal of Economics, 112:2, pp. 443–78, and O’Donoghue, T. and Rabin, M. (2015), ‘Present bias: Lessons learned and to be learned’, American Economic Review, 105:5, pp. 273–9.

8 This definition of a first-mover disadvantage (no unilateral incentive to increase sustainability efforts) does not yet exclude the possibility that firms may, in fact, have an incentive to instead collectively decrease their sustainability efforts. We discuss this point in more detail later in this section.

9 This competitive advantage may come from lower (relative) costs, or increased sales because it can charge a somewhat lower price than its green rival, or both.

10 Banana Link (2019), ‘Lidl backs away from Fairtrade bananas’, 20 May.

11 This does still abstract from the possibility that willingness to pay can change over time—for instance, through increased public awareness or familiarity with greener products.

12 The perceptive reader will have noticed that this game theoretical situation reflects the well-known ‘prisoners’ dilemma’ setting, in which independent behaviour leads to outcomes that are perhaps socially beneficial, but less advantageous to the individuals involved than if these individuals were allowed to coordinate.

13 Schinkel, M.P. and Spiegel, Y. (2017), ‘Can collusion promote sustainable consumption and production?’, International Journal of Industrial Organization, 53, pp. 371–98; Schinkel, M.P. and Treuren, L. (2021), ‘Corporate social responsibility by joint agreement’, Amsterdam Center for Law and Economics, working paper No. 2021-01. The only type of agreements that would increase sustainable investments in this theoretical framework is a cartel on output or price. However, this would clearly be at the expense of consumers, who would end up paying much more.

14 European Commission (2021) ‘Antitrust: Commission fines car manufacturers €875 million for restricting competition in emission cleaning for new diesel passenger cars’, press release, 8 July.

15 Another term for ‘spillovers’ that is more commonly used in economics is ‘externalities’. Both terms can be used interchangeably and capture any situation in which an action by one ‘economic agent’ has a benefit or cost to another ‘economic agent’ without this benefit or cost being properly considered when deciding on that action.

16 Robertson, B. and Karsh, M. (2021), ‘Private Equity Follows the Money—and the Money Is Ditching Fossil Fuels’, Bloomberg, 6 July.

17 Davis-Peccoud, J. (2013), ‘Sustainability Matters in the Battle for Talent’, Harvard Business Review, 20 May.

18 Such an assumption—while not very common within economics—may be motivated by business-management practices. See, for instance, Oxera (2019), ‘What are firms for? Redefining corporate purpose’, Agenda, 29 November.

19 Whether this is indeed the case depends mostly on: (1) the costs and benefits of the regulation that would be implemented without the industry efforts; and (2) the way in which industry efforts would forestall such regulation (for instance, whether it is based on the lowest sustainability efforts of all the firms in an industry, or the average).

20 Duso, T., Röller, L.-H., and Seldeslachts, J. (2014), ‘Collusion through joint R&D: An empirical assessment’, Review of Economics and Statistics, 96:2, pp. 349–70; Veljanovski, C. (2020), ‘Collusion as environmental protection: an economic assessment’, working paper. A possible counter to this concern is that similar risks currently already exist given that competing executives already meet at trade associations, conferences, and other occasions.

21 Van Dijk, T. (2021), ‘A New Approach to Assess Certain Sustainability Agreements under Competition Law’, Competition Law, Climate Change & Environmental Sustainability, in S. Holmes, M. Snoep and D. Middelschulte (eds), Competition Law, Climate Change & Environmental Sustainability, Concurrences. Although first-best regulation is (by definition) preferred, in practice it may be second best due to suboptimal political ambitions or other political frictions, international coordination failures, or inadequate public resources or expertise.

22 See, for instance, Dolmans, M. (2020), op. cit. In its recent policy brief, the European Commission clarifies that it indeed believes that consumers within the market need to be fully compensated, and that out-of-market efficiencies should therefore not be included in the assessment—unless these benefits can be directly ascribed to the within-market consumers. See European Commission (2021), ‘Competition Policy Brief 01/2021 – Policy in Support of Europe’s Green Ambitions’, 10 September 2021.

Download

Contact

Dr Helen Jenkins

PartnerContributors

Related

Download

Related

Prevention instead of reaction: creating a robust funding structure for the NHS

1 Executive summary The NHS is at a critical juncture, facing unprecedented pressures from an ageing population, rising health inequalities, and underinvestment in infrastructure. The Darzi Report underscores the scale of these challenges, highlighting the need for systemic reforms to enhance resilience and productivity. In response to the Change… Read More

This week in economics

Delving into recent news through the lens of economics, this first episode of This week in economics tackles what’s caused the recent exodus from X and what the impacts for the social media market could be, and explores the potential impact of President-elect Donald Trump’s proposed tariffs for the global… Read More