Energy market investigation: what next for the GB retail energy market?

In late June 2016, the CMA is due to publish the final report on its energy market investigation. The report will be the culmination of a two-year root-and-branch review of the GB electricity and gas sectors. Over the two years, the focus of the investigation has increasingly been on consumer engagement and the competitive pressure that consumers are able to exert on energy retailers.

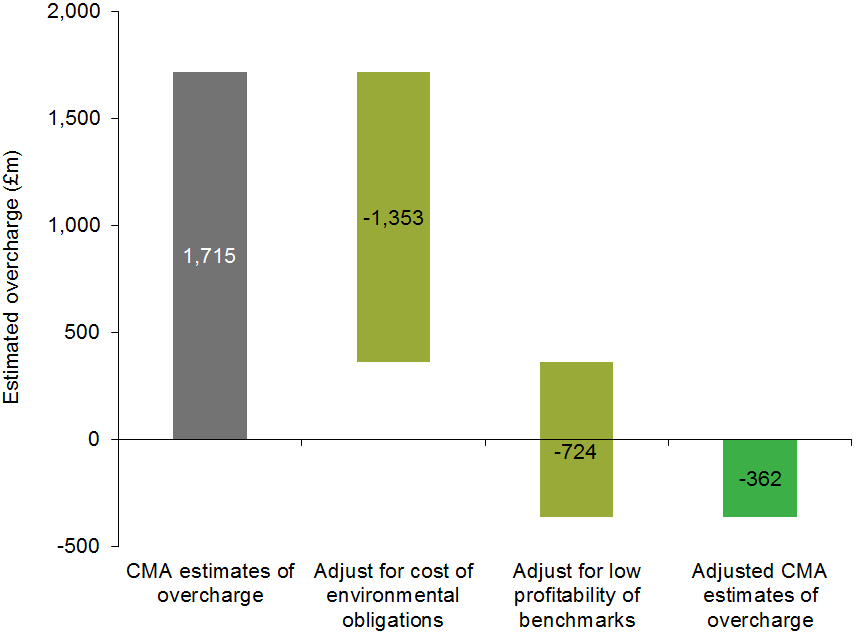

The CMA has proposed that consumers pay too much relative to what would be the case in a well-functioning market.1 A direct benchmarking analysis of prices charged by the six large energy firms, which is set out in the CMA’s Provisional Decision on Remedies, suggests that these firms may have been charging domestic energy consumers around £1.7bn per year more than a competitive pricing level.2 The CMA has proposed a competitive retail price benchmark based on a volume-weighted average of the energy prices charged by two smaller suppliers.3

Oxera’s analysis in the context of the energy market investigation suggests that exemptions from certain social and environmental obligations granted to these smaller suppliers, in combination with the smaller suppliers sacrificing short-term profitability for growth in customer numbers, could more than account for the ostensible excess in charges by the six large energy firms.4 After adjusting for these factors, the benchmarking analysis provides no evidence of excess charges by the six large energy firms in the period 2012–15.

The CMA also concludes that the fact that many consumers do not take advantage of the gains available from switching provider is a sign that consumers are disengaged from the market and do not see the full benefits of competition.5 To test this hypothesis, Oxera built a model of consumer switching, based on rational and ‘behavioural’ features of consumer decision-making, to understand the factors that drive consumer switching or may act as a barrier to it. This model quantifies the costs of searching for offers and switching tariffs, allowing hypothetical consumers to weigh these against the potential gains from switching. The net gains from switching are a key driver of consumer activity and engagement. There is therefore a stark trade-off between encouraging consumer engagement and competition on the one hand, and protecting consumers by controlling outcomes (e.g. with a price cap) on the other.

The CMA has proposed a transitional price cap on prepayment tariffs—meaning that energy customers who have prepayment meters would have their tariffs capped at a level based on the competitive pricing level suggested by the CMA. This price cap would be in place for four years, or until smart meters have been rolled out to ‘substantially’ all prepayment customers, and would then be lifted to allow full price competition in prepayment tariffs. This remedy is designed to control outcomes for consumers directly, and in this segment of the market could counteract the CMA’s other proposed remedies that are designed to enhance competition. While the price cap is in place, gains from switching would be expected to decrease, as prices would be bounded by the price cap, and the switching rate among prepayment customers would consequently be expected to decrease. When the price cap is removed, a significant amount of resolve would be required on the part of the CMA, Ofgem (the energy regulator for Great Britain) and the government to allow gains from switching to rise and give time for competition to take full effect in this segment of the market.

The CMA has also proposed a number of remedies that could help to stimulate switching—for example, removing restrictions on the number or design of tariffs offered by suppliers, and creating a database of disengaged customers that can then be targeted for switching.6 However, the CMA has not pursued a proposed remedy that would require all energy contracts to have fixed terms, and hence create a natural switching point for energy—much as in motor insurance.7 Additionally, any procompetitive remedies would be likely to be offset in the prepayment sector by the proposed price control, which would be likely to decrease price dispersion in prepayment tariffs and, in turn, decrease prepayment customers’ gains from switching and their incentives to switch.

Well-functioning markets and the benchmark chosen by the CMA

In arriving at its provisional decision on remedies, the CMA has relied on a ‘direct’ benchmarking analysis of domestic retail energy tariffs offered by the six large energy firms. In this analysis, the CMA compares the pricing of these firms to that of two selected independent challenger businesses. The idea is that an established business should be able to match the pricing of less established challengers that have sustainable business models. If it is not necessary or possible to do this, this might indicate that the established business is making excessive profits or is inefficient.

However, challengers might not always be comparable with established businesses. In an industry characterised by economies of scale, entrants focus on growing their market share as rapidly as possible in order to quickly reach an efficient scale and ensure their survival. Since offering low prices is an effective way to attract new customers, a business that is seeking to grow may price at a level that results in a loss-making position in the short term, in the expectation of being able to recoup those losses by increasing prices in the longer term.

The complex policies and regulations in the GB energy market amplify the difference between established and challenger businesses. In recent years, various obligations have been placed on energy companies to reduce household carbon emissions and improve household energy efficiency through the Energy Company Obligation (ECO) and its predecessors. There is also an obligation to provide discounts to certain vulnerable customer groups through the Warm Home Discount Scheme. These obligations all include total or partial exemptions for smaller suppliers.

Oxera’s analysis of the CMA’s findings makes various adjustments to the CMA’s direct benchmarking analysis to make the comparison between benchmark and established suppliers fairer with regard to costs and profits.8 These adjustments to the CMA’s estimated overcharge by established suppliers are shown in Figure 1. The sum of the adjustments results in the CMA’s overcharge estimates becoming negative.

Figure 1 Oxera adjustments to the CMA’s average overcharge estimates

Note: Average overcharge estimates are calculated for the period 2012–15.

Source: Oxera.

Hence, if the benchmark suppliers faced the same level of social and environmental obligations as the six large energy firms and were to make a ‘normal’ level of profit (according to the CMA’s definition), they would have had to price higher than the six large energy firms between 2012 and 2015. This is likely to be due to the benchmark companies operating below the minimum efficient scale, particularly in the early part of the benchmark period when they had a smaller customer base and their costs per customer were higher than for the six large energy firms on a like-for-like basis. Importantly, after adjusting the benchmark suppliers’ obligation costs and profitability to be on a like-for-like basis with those of the six large energy firms, the comparison provides no evidence of excess charges by the six large energy firms in the period 2012–15.

Consumer switching

In the CMA’s analytical framework, a perceived lack of consumer engagement is directly linked to the benchmarking analysis. If consumers are sufficiently reluctant to switch, this allows less competitive businesses to retain customers and charge higher prices. The CMA recognises that switching energy supplier should theoretically be responsive to the available gains. However, there are costs to switching that the CMA has not fully considered—and these include both rational factors and ‘behavioural biases’.

The rational economic agent

Traditional economics assumes that the economic agent is rational or, in other words, that they maximise utility based on personal preferences that are unambiguous and independent of context. The following rational factors can be expected to influence consumers’ switching decisions:

- discounting—future savings are worth less economically than an immediate gain;

- brand value—consumers may have a preference for, and attach a value to, a well-known brand or a brand known to have good customer service;

- trust—energy consumers place more trust in their own supplier than in other suppliers9 and hence switching involves a loss of trust, which implicitly has a monetary value;

- risks of switching—the switching process might go wrong, or the new deal might prove less favourable than the old one;

- time costs—the value of the time taken up by switching can vary significantly between consumers.

Behavioural bias

Other factors may also contribute to a consumer’s decision-making process. These ‘behavioural’ factors are well documented in the economics literature and are increasingly taken into account by regulators and competition authorities.10 In this case, they may include:

- present bias—there is a psychological preference for receiving a benefit in the present over receiving it in the future (i.e. over and above discounting);

- reference dependence—a consumer’s perceived gain or loss depends on where their outturn gain from switching is relative to their expectation;

- loss aversion—the marginal (negative) impact of a perceived loss is greater than the marginal (positive) impact of a perceived gain.11

Modelling consumer switching

As part of the work on the energy market investigation, Oxera built an agent-based model that was populated by data on actual consumers and their demographic characteristics,12 in order to understand the drivers of switching decisions and the potential impact of various remedies proposed by the CMA. The model reflected differences in consumers’ preferences and the degree to which they are influenced by the rational and behavioural characteristics of the decision-making process. Tariffs available to simulated consumers were the same as the actual tariffs that prevailed in Autumn 2014.

In Oxera’s model, the drivers of rational and behavioural aspects of consumers’ decision-making, and their relationship with the demographic characteristics of modelled consumers such as age, income and educational attainment, were derived from results in the economics literature. The model was also informed by the results of the consumer survey commissioned by the CMA in the context of the energy market investigation.13 Finally, any remaining model parameters were calibrated so as to achieve similar levels of consumer switching and gains available from switching as observed in recent years.

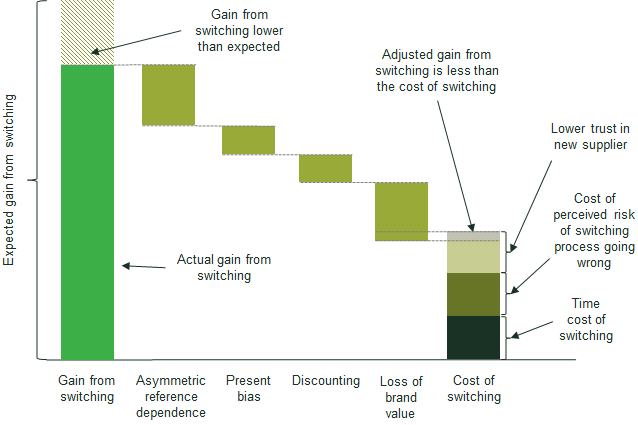

Figure 2 illustrates how a given consumer in the model, having scanned the market for alternatives, decides whether to switch supplier. This decision will look different for each consumer depending on factors such as their energy consumption profile and demographic characteristics.

Figure 2 A consumer decision on whether to switch

Source: Oxera.

In this particular example, the consumer’s actual savings are below their expected savings, and they suffer a loss of utility due to asymmetric reference dependence—i.e. disappointment due to not being able to get as good a deal as anticipated, which is a combination of reference dependence and loss aversion.

The consumer’s current value of the gains from switching is further reduced due to present bias. The consumer also values future savings less than current savings (since current savings could be put to alternative use), and therefore discounts their value.

Finally, the consumer suffers loss of brand value as a result of switching to a relatively unknown supplier.

After adjusting for these rational and behavioural factors, the consumer will switch only if the remaining benefit outweighs the remaining costs. These costs are:

- lower trust in the new supplier, as the current supplier has built up consumer trust over time;1

- perceived risk of the switching process going wrong;

- time costs associated with activities such as taking meter readings and filling in online forms.

Once all the gains and losses are adjusted and weighed up as above, the consumer in this example decides not to go through with the switch.

The model shows that consumers can decide not to switch despite the existence of significant gains—even in a market with a largely homogeneous good. It is not necessary for consumers to be uninformed for this outcome to occur (indeed, in the above example, the consumer has already undertaken a search). Rather, this consumer’s decision not to switch is due to a number of rational and behavioural costs of switching that feed into his or her decision-making process.

In addition, the model demonstrates the inherent trade-off between gains from switching and the propensity of consumers to switch. Variation across consumers due to differences in their characteristics creates a distribution of costs of switching across the population of consumers. This means that even a small increase in the gains available from switching can make it worthwhile for more consumers to switch. Equally, a small reduction in gains from switching can result in fewer consumers switching supplier.

Looking ahead—the likely impact of remedies

Since Oxera’s analysis was carried out, the CMA has put forward a number of measures aimed directly at the energy retail market. These include:

- withdrawal of the ‘simpler choices’ component of the Retail Market Review rules

- the creation of a database of ‘disengaged customers’ to be made accessible to suppliers;

- a transitional price cap for prepayment customers.

The first two of the above measures are intended to reinvigorate competition and are likely to increase customer choice and engagement, working in a procompetitive manner. However, the claim put forward by the CMA to support its remedies in the market—i.e. that each year in the period between 2012 and 2015 large suppliers’ customers faced £1.7bn per year in excess charges—is not supported by the evidence when the benchmark suppliers’ obligation costs and profitability are compared on a like-for-like basis with those of the six large energy firms. While it would be reasonable to expect a reduction in overall consumer energy costs if the proposed procompetitive remedies are successful in achieving their aims, it would be unrealistic to expect this reduction to be as much as £1.7bn per year.

The transitional price cap is designed to limit the ability of suppliers to charge high prices to prepayment customers. It will act directly to reduce price dispersion and hence lead to lower gains from switching for this group. It is notable that Oxera’s switching analysis shows that the switching rate and the gains available from switching go hand in hand. This highlights the tension between seeking to increase consumer engagement with some remedies, while controlling outcomes for the prepayment segment of the market in a way that is likely to reduce consumer engagement in that segment.

If Oxera’s switching model is correct in predicting that lower net gains from switching will result in a lower switching rate, and this effect is applicable to prepayment customers, then when the transitional price cap reaches its expiry date the CMA is likely to find that the switching rate among prepayment customers is significantly lower than it was when the price cap was implemented. At that point, it may be difficult for policymakers to persevere in their aim of giving time for competition to take full effect—including possible increases in gains from switching—especially if faced with calls for further protection of potentially vulnerable customers.

Oxera advised ScottishPower during the CMA market investigation.

1 Competition and Markets Authority (2016), ‘Energy market investigation – Provisional decision on remedies’, 17 March, pp. 156–77.

2 Competition and Markets Authority (2016), ‘Energy market investigation – Provisional decision on remedies’, 17 March, p. 13.

3 Competition and Markets Authority (2016), ‘Energy market investigation – Provisional decision on remedies’, 17 March, pp. 160–1.

4 Oxera (2016), ‘Critique of CMA direct benchmarking analysis’, as found in ScottishPower (2016), ‘CMA energy market investigation – ScottishPower’s response to the provisional decision on remedies’, 12 April, pp. 1–7 and 9–10.

5 Competition and Markets Authority (2015), ‘Energy market investigation – Provisional findings report’, 7 July, pp. 309–10.

6 Competition and Markets Authority (2016), ‘Energy market investigation – provisional decision on remedies’, 17 March, pp. 16–7 and 24–5.

7 Competition and Markets Authority (2015), ‘Energy market investigation – Supplemental Notice of Possible Remedies’, 26 October.

8 The results of this analysis were published as an appendix to ScottishPower’s response to the CMA’s Provisional Decision on Remedies. Oxera (2016), ‘Critique of CMA direct benchmarking analysis’, as found in ScottishPower (2016), ‘CMA energy market investigation – ScottishPower’s response to the provisional decision on remedies’, 12 April.

9 See GfK (2015), ‘Energy Market Investigation: A report for the Competition and Markets Authority by GfK NOP’, February, Figure 5.

10 Dellavigna, S. (2009), ‘Psychology and Economics: Evidence from the Field’, Journal of Economic Literature, June, 47:2, pp. 315–72; Regulatory Conduct Authority (2014), ‘Applying behavioural economics at the Regulatory Conduct Authority’, Occasional Paper No. 1, April; Erta, K., Hunt, S., Iscenko, Z. and Brambley, W. (2013), ‘Applying behavioural economics at the Financial Conduct Authority’, Occasional Paper No. 1, April; Lunn, P. (2013), ‘Regulatory Policy and Behavioural Economics’, OECD Publishing, November.

11 This article refers to reference dependence and loss aversion jointly as ‘asymmetric reference dependence’.

12 The data used to populate this model was taken from the 2014 Understanding Society panel dataset and a random sample of ScottishPower customers selected by the CMA.

13 GfK (2015), ‘Energy Market Investigation: A report for the Competition and Markets Authority by GfK NOP’, February.

14 Survey evidence suggests that consumers have higher trust in their own energy supplier than in other energy suppliers. See GfK (2015), ‘Energy Market Investigation: A report for the Competition and Markets Authority by GfK NOP’, February, Figure 5.

Download

Related

Leveraged buyouts: a smart strategy or a risky gamble?

The second episode in the Top of the Agenda series on private equity demystifies leveraged buyouts (LBOs); a widely used yet controversial private equity strategy. While LBOs can offer the potential for substantial returns by using debt to finance acquisitions, they also come with significant risks such as excessive debt… Read More

Company valuation in post-M&A disputes—the Mahtani v Atlas Mara ruling

Post-merger and acquisition (‘post-M&A’) disputes can take many different forms, such as breach of representations and warranties, fraud and misrepresentation claims, and post-completion breach of contractual obligations. This article discusses the valuation issues in a post-completion breach case based on the ruling handed down by the Hon Mr Justice Butcher… Read More