Home advantage? Who wins in multi-sided platform competition?

What do Google, Mastercard and Amazon have in common with early auction houses or the traditional village matchmaker? One answer is that they are all multi-sided platforms (MSPs). Much has been done in the last decade to try to understand the economics of such platforms. Yet current research is still uncovering new findings about pricing, multi-homing and the competitive dynamics of platforms—some of which can seem counterintuitive.

‘Multi-sided platforms’ is a term that has been applied to some of the biggest and most influential businesses in the modern economy. What exactly are they, and how should they be viewed in terms of competition considerations?

This article explains the economics behind MSPs and explores some of the latest literature that focuses on competitive dynamics. Among other topics, such papers discuss the (at times surprising) effects of multi-homing.

What is a multi-sided platform?

The term ‘multi-sided platform’ has been around since the start of the 21st century,1 yet there is still no single widely accepted definition. However, most definitions include the notions that MSPs:

- enable distinct groups of agents to interact with each other;

- face indirect network effects, meaning that a price change on one side of the platform affects demand on other sides.

A multi-sided platform facilitates interaction between different types of user. For example, payment card companies enable interactions between cardholders and merchants. Similarly, newspapers enable interactions between readers and advertisers; and marketplaces between buyers and sellers.

The second element of an MSP is the existence of network externalities (see the box below). This feature leads to pricing strategies that can be very different to those in one-sided markets.

Network externalities

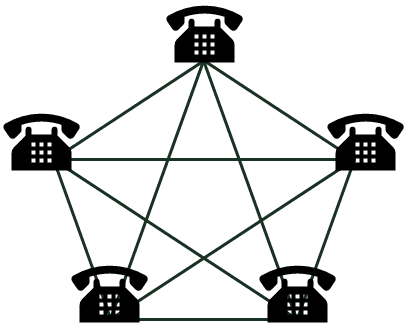

Network externalities occur when the participation of other users on a platform affects the utility that a user gets from using that platform. For example, landline phones are of value only if others use them as well; the more people one can ring, the more one benefits from owning a phone. This is an example of a direct network externality because the increased benefit comes from having more users on the same side of the platform.

Direct network externality

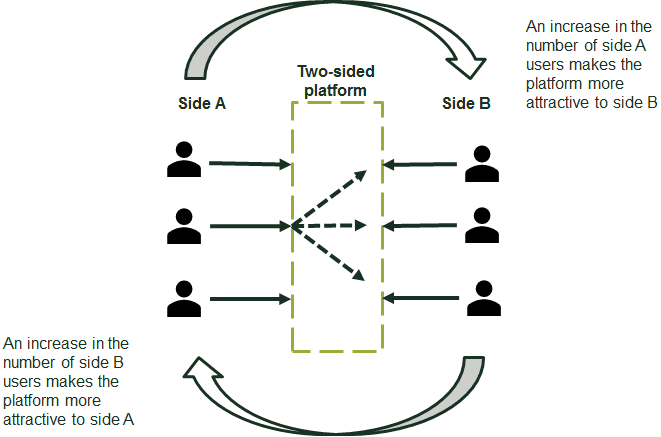

MSPs are characterised by indirect network externalities. Here, the demand for a platform on one side is affected by the demand for the platform on another side. The more customers hold a brand of payment card, for example, the more retailers are willing to accept that card. Likewise, the more retailers that accept that brand, the more customers are willing to carry around such a card. These indirect network externalities are a key driving force behind the economics of multi-sided platforms.

Indirect network externality

For a platform to succeed, it must get all sides on board. In order to do so, it must consider how prices on one side will affect demand on the other side(s). Profit maximisation may be achieved by deviating from single-sided optimal prices, and may even imply setting prices below marginal cost to specific sides of the platform. It is not just the level of total price that matters, but also the structure of prices between sides.

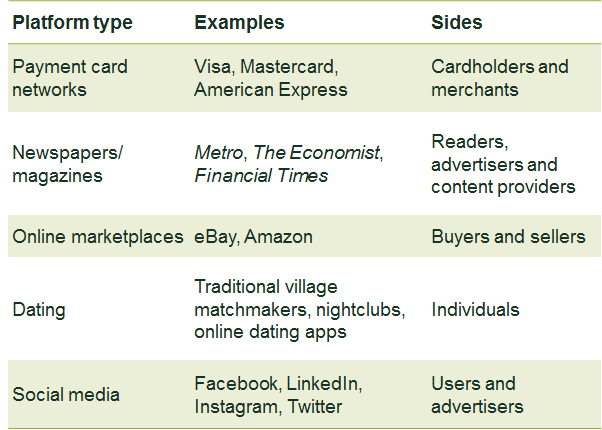

If one side derives greater benefit from the participation of the other side(s) than vice versa, the platform may find it optimal to lower the price on one side and raise it on the other. Debit card schemes do not usually charge consumers for making purchases, but merchants pay a service fee. Shopping malls charge high rents to retailers, but shoppers browse through stores for free. This is not because one side is cheaper to serve than the other. A platform that currently sets profit-maximising prices for each side individually could do better by lowering the price for one side (shoppers) and increasing the price for the other side (retailers). The reason for this is that a lower price would increase demand from shoppers, meaning that the platform becomes more valuable to retailers. Hence, a platform might choose to subsidise one side of the market (even making a loss on that side) in order to increase profits overall. Typical examples of platforms and their sides are shown in Table 1.

Table 1 Multi-sided platforms

Competitive dynamics of ‘homing’

One important factor when considering the competitive effects of MSPs is the extent to which each side can use more than one platform. If a user joins only one platform, they are said to be ‘single-homing’. A user who joins more than one platform is ‘multi-homing’.

If multi-homing is too costly, MSPs could raise prices or lower quality to current users, with a low risk of agents on either side moving to a more efficient competitor. Multi-homing can also take place if non-platform substitutes are available to users. If non-platform alternatives are close competitors, the scope for harm will be limited. For example, even if only one card scheme were available, payments could still be made using cash or bank transfers.

Alternatively, if multi-homing is a common feature on the market, platforms will be forced to compete fiercely on both price and quality. Platforms will be competitively constrained on both sides by the fact that users can easily move to a rival platform. For instance, in the case of online marketplaces, both sellers and buyers may have the option of using multiple platforms (e.g. Amazon or eBay).

In some cases, the need to multi-home is reduced because users on the other side already do this. Consumers are likely to use only one price comparison website if they think that many insurance suppliers are likely to be found on multiple platforms. Conversely, when one side chooses to single-home, the other side of the market may want to multi-home in order to access more potential matches: if readers are loyal to a specific newspaper, advertisers typically place adverts across several newspapers to reach as many readers as possible.

Multi-homing may also be limited by contractual agreements. For example, ‘radius clauses’ may be used by shopping centres to stop retail chains opening another outlet within a set distance.

The extent to which multi-homing exists may also depend on how differentiated rival platforms are. If the services that each platform offers differ, multi-homing is more likely to occur. For example, readers may wish to subscribe to both Netflix and Prime Video. Even though they are both video streaming platforms, users are likely to see them as offering different products.

The cost of joining a platform will also be relevant here. If there are high costs associated with joining a platform then single-homing is more likely. These costs could include the prices of accessing or using the platform, as well as other non-price costs, such as the time or effort needed to use the platform.

Competitive bottlenecks

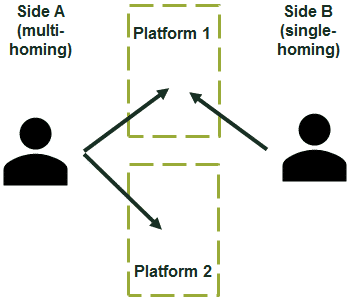

There are many cases where one side multi-homes more than another side. Consider two competing platforms, side A and side B. Whereas side A multi-homes, side B only single-homes (see Figure 1).

Figure 1 Multi-homing and single-homing

If we take just one participant from each side, we can see that an interaction can occur on only one platform—the one that the single-homing participant has chosen to use. The platform that the single-homing side B chooses will therefore be the only option for side A. Here the platforms will compete for the single-homing participant, and will then have monopoly power over the multi-homing agent. This intuition may carry through when we have many agents. In general, platforms may compete more intensely for the side of the market on which there is a higher degree of single-homing.

Competition for single-homing users and monopoly power over multi-homing users could lead to low prices on the single-homing side and high prices on the multi-homing side. Indeed, the profits from the multi-homing side may be used to subsidise the single-homing side, which could result in zero or below-zero prices. This may be part of the reason why newspapers are often sold below cost, or given away for free. Single-homing readers are subsidised by multi-homing advertisers. The idea of competition on one side and market power on another has given rise to the term ‘competitive bottleneck’.2

Who benefits from competitive bottlenecks?

This reasoning highlights a slightly counterintuitive view of two-sided platform competition: the ‘captive’ single-homing users, who are locked into using only one platform, end up better off than the multi-homing users, who are free to use more than one platform.

Imagine a scenario where there is a move from single-homing on both sides to a competitive bottleneck—i.e. where one side is allowed to multi-home. In this case we might expect that the single-homing side will benefit from lower prices, the multi-homing side will face higher prices, and the platform will earn higher profits.

Is this what we observe in the real world? In some cases, maybe not. Personal computer software platforms tend to offer access for free to multi-homing applications developers while earning profits from the (largely) single-homing user side. Some recent theoretical research has demonstrated why the standard intuition will not always necessarily hold true.

For example, Belleflamme and Peitz consider a Hotelling model of platform competition (where producers have the incentive to make their products as similar as possible).3 Here, the platform faces more elastic demand (price-sensitive users) in a monopoly case compared with a duopoly situation.4 This means that a fall in the price for one side has a larger effect in attracting more users when they can multi-home.

So there are two opposite effects on price when one side goes from single-homing to multi-homing. The competitive bottleneck effect drives prices up for multi-homing users. The price-sensitivity effect works to lower prices as demand becomes more elastic.

With no indirect network externalities, the latter dominates the former. The multi-homing side will face lower prices than under two-sided single-homing. When the indirect network externalities are large enough, they outweigh the price sensitivity effect, and multi-homing users will face a higher price.

The extent to which each side benefits or is harmed by a move from single-homing to multi-homing in this setting depends on a range of factors: the level of platform differentiation, the benefit that each side receives from the participation of the other side(s), the cost of operating the platform, and the interactions between each of these.

For example, if platforms are highly differentiated, side A may derive a greater benefit from using more than one platform. If the indirect network externality flowing from side A to side B users is weak, side A users may not face higher prices when they multi-home.

Other factors may also determine to what extent a competitive bottleneck environment harms or benefits each side. Models tend to assume that platforms charge a fee for access to the platform (e.g. music streaming platforms charging a monthly access fee to consumers). Where a platform enables transactions to occur, they can also charge a price per transaction (e.g. food delivery platforms). In some cases, both an access and a usage fee can be charged (e.g. some payment card systems). The precise effects that these different pricing structures have on the dynamics described above remain an open question.5

One implication of these findings is that it is not necessarily possible to say how multi-homing on one side only will affect the welfare of either side. Therefore, competition authorities and regulators cannot rely on a priori assumptions when it comes to multi-sided markets. Each case must be carefully analysed in order to fully understand the competitive dynamics involved.

Other competition considerations

By their very nature, MSPs often attract the attention of regulators and competition authorities. The network effects that benefit customers mean that platforms tend to be large, even to the point where only a very small number of platforms can realistically coexist. Pricing strategies such as a low price-to-cost ratio on one side can look very much like predatory pricing.

However, we have seen that MSPs are different from one-sided platforms, and not considering this may lead to errors in antitrust analysis.6 ‘Low’ prices may appear to be predatory and anticompetitive, and ‘high’ prices may appear to be evidence of market power and harm to consumers. However, if we see these as a single price structure due to the two-sidedness of the market, we may have a different overall view. Without the ability to set ‘imbalanced’ prices, the platform may be far smaller, and in the extreme may cease to be a viable business, potentially reducing welfare for all involved. In addition, the product or service that is enabled through an MSP may never come into existence unless the platform can get ‘both sides on board’.

In a dynamic market environment, imbalanced prices may be necessary in the early stages of development. Once the platform has become established, the degree of imbalance could be reduced. This means that strategies that may appear anticompetitive from a one-sided viewpoint may actually be positive for social welfare once the multi-sidedness of the market is taken into account.

Traditional antitrust tools may therefore need to be reconsidered or adjusted. For example, defining the relevant market is a key part of many antitrust decisions, but doing so for multi-sided markets is less straightforward than in standard cases. Economists have started to develop tools such as the SSNIP (small but significant non-transitory increase in price) test, adjusting it to take indirect network effects into account.7 Similarly, the concept of upward pricing pressure has been adapted to a two-sided environment, but doing so increases the amount of data needed for analysis.8

Both Sides, Now

As MSPs continue to become more prominent in the economy, the urgency to provide practical insights into how they compete will increase. As we have seen, MSPs are different from other markets, and require additional layers of analysis. The dynamics of multi- and single-homing can sometimes lead to apparently counterintuitive results.

However, it is clear that there is no one-size-fits-all way of handling MSPs. In each case, the specific dynamics of indirect network effects, multi-homing, platform differentiation and pricing practices all interact. Exactly how this should affect competition policy and enforcement remains an open and pressing debate, but one that should be informed by careful and thorough economic analysis.

1 Rochet, J-C. and Tirole, J. (2003), ‘Platform competition in two-sided markets’, Journal of the European Economic Association, 1:4, pp. 990–1029.

2 For an early model of competitive bottlenecks, see Armstrong, M. (2006), ‘Competition in Two-Sided Markets’, RAND Journal of Economics, 37, pp. 668–691.

3 For example, see Belleflamme, P. and Peitz, M. (2019), ‘Who benefits from multi-homing?’, International Journal of Industrial Organisation, 64, pp. 1–26.

4 For a theoretical explanation of why this may be the case see, for example, Chen, Y. and Riordan, M. (2008), ‘Price-increasing competition’, RAND Journal of Economics, 39:4, pp. 1042–1058.

5 For a discussion on how the market can be defined in each case see Niels, G. (2019), ‘Transaction versus non-transaction platforms: A false dichotomy in two-sided market definition’, Journal of Competition Law and Economics, December.

6 For example, see Oxera (2018), ‘Funda-mentals of Article 102: a dominant platform, but no abuse’, Agenda, September.

7 Filistrucchi, L. (2008), ‘A SSNIP test for two-sided markets: the case of media’, Working Papers 08-34, NET Institute.

8 Affeldt, P., Filistrucchi, L. and Klein, T.H. (2013), ‘Upward pricing pressure in a two-sided market’, Economic Journal, 123, pp. 505–523.

Download

Contact

Matthew Johnson

PartnerContributor

Guest contributor

Tom Davies

Related

Download

Related

Blending incremental costing in activity-based costing systems

Allocating cost fairly across different parts of a business is a common requirement for regulatory purposes or to comply with competition law on price-setting. One popular approach to cost allocation, used in many sectors, is activity-based costing (ABC), a method that identifies the causes of cost and allocates accordingly. However,… Read More

The European growth problem and what to do about it

European growth is insufficient to improve lives in the ways that citizens would like. We use the UK as a case study to assess the scale of the growth problem, underlying causes, official responses and what else might be done to improve the situation. We suggest that capital market… Read More