Discrimination or differentiation? Price discrimination as an abuse of dominance

When does price discrimination by a dominant firm amount to an abuse? Is the mere existence of a price difference sufficient? A recent ruling by the Court of Justice of the European Union (CJEU) provides some guidance on these questions, highlighting the ability to distort competition as a key criterion for a finding of abuse. Taking an economic perspective, we look at the CJEU’s approach and consider the implications for other cases of discrimination more broadly.

Allegations of anticompetitive price discrimination have often been made in the context of concerns about vertically integrated suppliers preventing downstream competitors from having access to the market (known as ‘foreclosure’). However, the competition and broader regulatory community’s recent focus on fairness has brought to the fore concerns about price discrimination amounting to exploitative abuse—i.e. a practice that is intended not to exclude a competitor, but to potentially extract higher gains from the customer. The concerns could involve consumer prices (driven, for example, by personalised pricing in the digital world) or prices to different trading partners.

In this context, the CJEU’s ruling of April 2018 provides valuable guidance on the criteria to use when deciding whether price discrimination by a dominant firm is abusive, or legitimate. The ruling also has implications for the question of the fairness of prices more broadly, including in the setting of FRAND (fair, reasonable and non-discriminatory) royalties during a commercial licensing negotiation.

What was the ruling about?

The ruling involved a dispute (referred to here as MEO) between GDA, a Portuguese copyright collecting society, and MEO (a TV broadcaster), one of GDA’s customers, regarding royalties that GDA was charging MEO. GDA is the only collecting society in Portugal managing the rights of artists and performers, and collecting royalties on their behalf. MEO’s allegations included excessive pricing and anticompetitive price discrimination. In this context, the CJEU was asked to provide guidance on when price discrimination amounts to abuse, and how to assess ‘competitive disadvantage’.1

In particular, the CJEU was asked whether:2

- there is a need to assess the ability (or lack thereof) of the downstream firm facing discriminatory prices (here, MEO) to absorb the difference in costs, in order to establish the existence of a competitive disadvantage;

- evidence of little effect on the costs, net income and profitability of the downstream firm is appropriate for concluding that there is no abuse of dominance, or if it can be used only to determine liability;

- there is a minimum threshold of impact on the downstream firm for showing capability to distort competition.

The CJEU’s ruling in MEO indicates that:

- a finding of competitive disadvantage must be based on all the relevant circumstances (e.g. costs, profits) of the case; a mere disadvantage as such (i.e. a different price) is not sufficient for such a finding;3

- there is no de minimis threshold—i.e. no minimum percentage differential is required to find abusive behaviour; nor is a quantification of the deterioration in the competitive position. Rather, the analysis should assess all relevant factors that are specific to the case.4

The CJEU ruling is consistent with previous effects-based approaches and relevant case law (such as British Airways v Commission and Intel v Commission).5 Following this judgment, the referring court will need to look at the effects of price discrimination by GDA.

The dispute between GDA and MEO

This case involved an assessment by the Portuguese competition authority and a subsequent appeal.

MEO first complained to the competition authority that GDA charged higher royalties to MEO than it did to its competitor, NOS (another broadcaster), placing MEO at a competitive disadvantage. MEO consequently alleged an abuse of dominance by GDA contrary to Article 102 TFEU, which provides that a dominant undertaking must not apply:

dissimilar conditions to equivalent transactions with other trading parties, thereby placing them at a competitive disadvantage.

Following an investigation of this allegation, the Portuguese competition authority closed the case on the basis of, among other factors, a small differential in the royalty rates, and analysis of the impact on MEO’s costs and profitability. The authority ultimately concluded that the difference in royalty rates did not restrict MEO’s competitive position in the market.

MEO appealed the authority’s decision to the Portuguese court, which referred the questions to the CJEU.

How does this align with the economics of price discrimination?

In its assessment of the case, the CJEU took account of three factors.6

- It accounted for the commercial relationship between GDA and MEO, noting in particular that MEO was one of GDA’s key clients and had some negotiating power vis-à-vis GDA, given that the existence of an arbitration process is a legal requirement in case the negotiation fails.

- It took into account the small differential in the royalty rates charged to MEO and NOS, and the fact that the difference was a low percentage of MEO’s costs.

- It considered the lack of incentives on GDA’s part to distort competition between MEO and NOS, given that GDA did not operate as a broadcaster and was active only in the upstream market of licensing the relevant works.

This approach, for the large part, is aligned with the economics of price discrimination, as explained below.

Efficient pricing

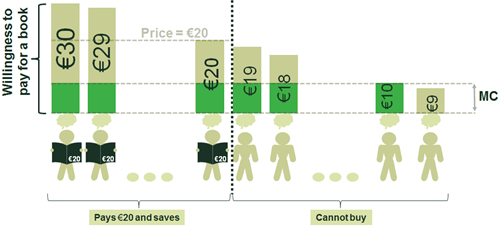

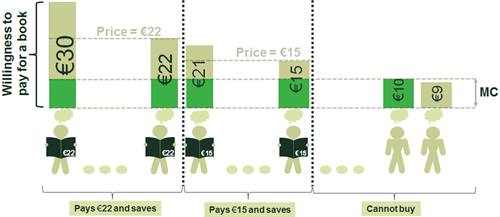

In essence, the economic literature highlights that price discrimination by itself is not necessarily harmful for competition and for consumers, because it can improve welfare if it leads to an increase in output. For example, as illustrated in the figures below, the potential for price discrimination across consumers for the same product (a book in this case) allows the supplier to charge a higher price (€22 in Figure 2 below) to customers whose willingness to pay is higher and who accord more value to the product. At the same time, the supplier can charge a lower price (€15 in Figure 2) to a customer with lower willingness to pay. In contrast, if the supplier has to charge one price, it may maximise profits by setting a price of €20 (see Figure 1), which will prevent certain consumers from buying the book because they believe it to be too expensive. In this example, therefore, price discrimination results in more customers being able/willing to buy the product.

The same can hold for intermediary firms purchasing inputs from upstream suppliers, as was the case for GDA’s works. If different intermediary firms use the same product but have different cost bases and profits (and thereby may derive different values from the use of the product), it may be more efficient and welfare-enhancing to charge different prices. The CJEU’s view, that a price difference alone is not sufficient to conclude on abuse, aligns with this economic approach.

Figure 1 Uniform pricing

Source: Oxera.

Figure 2 Price discrimination

Source: Oxera.

Incentives

The CJEU’s view on the lack of incentive for GDA to distort competition is also consistent with the underlying economics. In the case of a vertically integrated supplier, there may be incentives to discriminate in order to boost the sales of the supplier’s own downstream arm. Such incentives are not present in this case. While a non-vertically integrated supplier may have an incentive to charge excessive prices and thereby distort competition, it does not have a direct incentive to disadvantage specific customers and thereby distort competition.

In fact, the economic literature highlights that the supplier may have an incentive to maintain competition among more downstream firms because this may give the supplier more bargaining power when negotiating with one single downstream firm.7

Additional consideration: allocative efficiency

In addition to the above, the economic literature highlights an analysis of efficiency of downstream firms as relevant to the assessment of the impact of price discrimination. This suggests that price discrimination can be harmful if the more efficient downstream firm is paying the higher price.

This is because if the efficient firm is charged a higher price relative to the less efficient firm, the output of the former will decrease while the output of the latter will increase. This would mean a more inefficient supply structure in the downstream market—which economists refer to as ‘allocative inefficiency’.8 However, this potential inefficiency can be addressed by designing the tariff structure as a two-part tariff with a fixed and variable fee, where the more efficient downstream firm is charged a lower variable fee, in line with its lower costs.9

Therefore, in following the CJEU’s guidance on the analysis of costs and profits of downstream firms, it is important to consider the implications for allocative efficiency in the downstream market.

Overall assessment

Consistent with an economic approach, the CJEU notes that a finding of abuse ‘must be based on an analysis of all the relevant circumstances of the case’,10 and that there is no de minimis rule (i.e. a minimum threshold) for such a finding. In addition to the above factors noted by the CJEU in MEO, in order to assess the competitive disadvantage (or lack thereof), the relevant court or authority would need to assess a range of factors, including the number of downstream firms, their cost structure and profitability, the competitive dynamics between them, and the price-sensitivity of their customers. This analysis would be similar to other contexts, such as damages claims, where the ability to pass on a cost shock is assessed, and in ascertaining the consumer impact of potential merger efficiencies.

However, given the CJEU’s view that a rigorous quantification of the impact is not required, this still leaves open the question of how much discrimination is problematic from a competition law perspective.

Implications for the ‘non-discrimination’ (ND) part of FRAND royalty assessments?

The CJEU ruling may also have implications for the assessment of the ND part of FRAND licensing of standard essential patents (SEPs).1 While the European Commission and courts across jurisdictions have provided some preliminary guidance on this, it is still not clear whether different licensees can be charged different royalty rates.

Of particular relevance is the landmark judgment of the UK High Court in Unwired Planet v Huawei, which involved allegations by information and communications technology provider, Huawei, of abuse of dominance, as well as non-FRAND royalties by the SEP owner, Unwired Planet.2 This is a seminal judgment in many respects, including in terms of the High Court’s views on abuse of dominance under Article 102 in SEP disputes, the determination of FRAND royalties, and non-discrimination. Here, the High Court dismissed all the allegations of abuse—which involved excessive pricing, bundling, discrimination and seeking an injunction—against Unwired Planet, while also finding that the rates were higher than FRAND rates. Interestingly, when considering ND, the High Court took the view that distortion of competition among ‘similarly situated’ licensees was relevant not only for Article 102 but also for the analysis of whether differential royalty rates breach FRAND. While this aspect of the judgment is currently on appeal, this view is consistent with the CJEU’s opinion in MEO. Therefore, if the Unwired Planet approach is upheld on appeal, the CJEU opinion may be relevant to FRAND disputes.

However, this view is not universal. In its recent communication on SEP licensing, the European Commission has also mentioned the obligation of SEP owners not to discriminate against similarly situated licensees, but without making any specific comment on distortion of competition.3 Another seminal judgment on FRAND royalties in the USA (TCL Communications v Ericsson), in finding discrimination by the SEP owner, noted that assessment of distortion to competition among licensees was not required, and that harm to the specific licensee being offered discriminatory rates was sufficient.4

Note: 1 SEPs are patents that are essential for an invention to comply with a technical standard. 2 Unwired Planet International v Huawei Technologies, [2017] EWHC 711 (Pat), judgment of 5 April 2017. Oxera acted as experts for Unwired Planet on the case. 3 European Commission (2017), ‘Setting out the EU approach to Standard Essential Patents’, 29 November. 4 TCL Communications v. Ericsson, United States District Court, SACV 14-341 JVS(DFMx) and CV 15-2370 JVS (DFM~c), 21 December 2017, p. 91.

Source: Oxera.

Is the finding of a price difference ever sufficient?

The CJEU ruling confirms the view that price discrimination by dominant undertakings does not restrict competition per se, and clarifies that a price differential alone is not sufficient to find an abuse. This means that competition authorities and courts will need to consider a range of factors specific to each case when assessing whether any price differential is likely to lead to a competitive disadvantage and distortion of competition. The application of this approach to FRAND assessment is, however, still an open question.

Approaches towards price discrimination at the consumer level are also likely to differ. While such cases have been rare in the last decade or two (with the exception of examples such as the 1998 Football World Cup case of discriminatory pricing against non-French consumers),11 the recent rise in the use of ecommerce, algorithms and personalised pricing is triggering debates about the right approach in these settings.12 The question of fairness is no doubt central to that debate, but it remains to be seen whether competition law (in contrast to other laws such as consumer protection) will be used to tackle such concerns.

1 CJEU (2018), MEO v Autoridade da Concorrência, Judgment of the Court (Second Chamber), Case C‑525/16, 19 April, paras 10–14.

2 Ibid., para. 21.

3 Ibid., paras 25–28.

4 Ibid., paras 29 and 37.

5 CJEU (2007), British Airways v Commission, Judgment of the Court (Third Chamber), Case C-95/04 P, 15 March. CJEU (2017), Intel v Commission, Judgment of the Court (Grand Chamber), Case C-413/14 P, 6 September.

6 Court of Justice of the European Union (2018), MEO v Autoridade da Concorrência, Judgment of the Court (Second Chamber), Case C‑525/16, 19 April, paras 32–36.

7 Hart, O. and Tirole, J. (1990), ‘Vertical integration and market foreclosure’, Brookings Papers: Microeconomics, pp. 205–286. See also Aghadadashli, H., Dertwinkel-Kalt, M. and Wey, C. (2016). ‘The Nash bargaining solution in vertical relations with linear input prices’, Economics Letters, 145, pp. 291–294.

8 Yoshida, Y. (2000), ‘Third-degree price discrimination in input markets: output and welfare’, The American Economic Review, 90:1, pp. 240–246; DeGraba, P. (1990), ‘Input-Market Price Discrimination and the Choice of Technology’, American Economic Review, 80, pp. 1246–1253.

9 Inderst, R. and Shaffer, G. (2009), ‘Market power, price discrimination, and allocative efficiency in intermediate-goods markets’, RAND Journal of Economics, 40:4, pp. 658–672.

10 CJEU (2018), MEO v Autoridade da Concorrência, Judgment of the Court (Second Chamber), Case C‑525/16, 19 April.

11 1998 Football World Cup (Case IV/36.888), Decision of 20 July 1999, para. 100.

12 Oxera (2017), ‘When algorithms set prices: winners and losers’, Discussion paper, 19 June.

Download

Contact

Dr Avantika Chowdhury

PartnerGuest author

Robert Lauer

Contributors

Related

Download

Related

Blending incremental costing in activity-based costing systems

Allocating cost fairly across different parts of a business is a common requirement for regulatory purposes or to comply with competition law on price-setting. One popular approach to cost allocation, used in many sectors, is activity-based costing (ABC), a method that identifies the causes of cost and allocates accordingly. However,… Read More

The European growth problem and what to do about it

European growth is insufficient to improve lives in the ways that citizens would like. We use the UK as a case study to assess the scale of the growth problem, underlying causes, official responses and what else might be done to improve the situation. We suggest that capital market… Read More