Sharing is caring: supporting the roll-out of 5G networks

Early 5G services are being launched in major towns and cities around the world, providing enhanced mobile broadband services to users. However, further investment in new network infrastructure will be required to support widespread deployment of 5G and take full advantage of the technology’s transformational capabilities. Given the significant costs involved, network sharing agreements may be increasingly important. Will this greater industry collaboration have an impact on head-to-head competition? If so, how should this tension be assessed?

Commercial 5G services are starting to be launched across Europe, including by EE and Vodafone in the UK, Italy and Spain, and Swisscom and Sunrise in Switzerland, with more providers also planning to launch their own services. This follows the first round of auctions to award radio spectrum designated for 5G use and is in line with the European 5G Action Plan, which specified that every member state should have at least one major city ‘5G-enabled’ by the end of 2020.1

These early 5G propositions will have limited coverage—typically in just a small number of cities—and will initially be focused on providing improved mobile broadband services for those who are able and willing to upgrade their handsets and commit to a 5G subscription.

However, 5G is expected to offer much more than simply enhancing mobile broadband as we know it. In addition to improved mobile broadband to support entertainment services, 5G promises advanced capabilities designed to support a wider range of services, including the expected boom of the ‘Internet of things’ and wireless real-time control of devices. The box below details some of the changes.

Policymakers and operators may want to roll out 5G networks as quickly as possible—to meet additional capacity demands and (from the perspective of individual operators) to stay ahead of the competition.

Nevertheless, it may still be some time before there is widespread availability of 5G and consumers and businesses can truly take advantage of its capabilities. In particular, at the time of writing, the exact technical standards for 5G have not yet been specified.2 In addition, more spectrum needs to be released—particularly at the higher frequencies needed to support the significantly higher speeds (and increased data requirements) of 5G.

Furthermore, the costs of widespread 5G network deployment will be significant. Industry collaboration, supported by central and local government, may be necessary to lower the costs to individual operators to help speed up network deployment.

There is a tension here: on the one hand, such agreements may unlock investment and facilitate quicker network deployment. On the other hand, there may be concerns around ensuring effective and sustainable competition between service providers. However, such agreements should not be blocked by potentially misplaced concerns over competition. Below, we explore the particular challenges of 5G deployment and how this tension between collaboration and competition could be balanced.

What is 5G?

5G is the term used to describe the next (and fifth) generation of wireless networks. It is expected to bring improved technical capabilities relative to previous generations of mobile technology, including the following.1

- Enhanced mobile broadband to support data-hungry applications and services thanks to improvements in peak data rates, user-experienced data rates, and spectral efficiency.

- Improvements in connection densities—i.e. the number of devices that can connect and maintain a good quality of service within a given area. This would support the expected boom of ‘Internet of things’ devices and smart city infrastructure. Such usage scenarios are referred to as massive machine type communications.

- Resilient, instantaneous connectivity. This will enable ultra-reliable and low-latency communications such as wireless real-time control of devices and industrial robotics, thanks to significant reductions in the round-trip time for data packets.

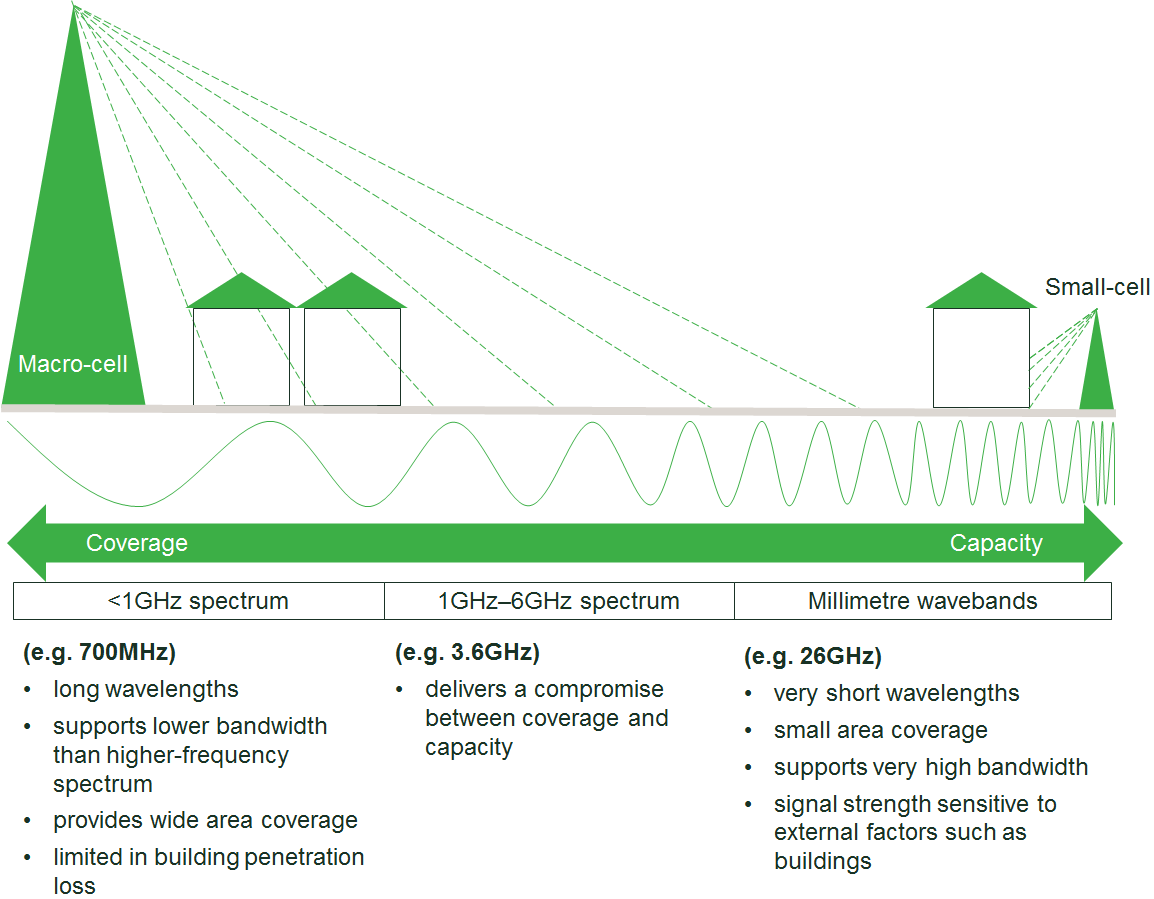

In the EU, radio spectrum identified for 5G use comprises:

- the 700MHz band (low-frequency, for providing wide area coverage);

- the 3.6GHz band (mid-frequency, delivering a compromise between coverage and capacity);

- the 26GHz band (a very high-frequency, millimetre waveband to deliver very high capacity).

Note: 1 Identified by International Telecommunication Union (2015), ‘IMT Vision – Framework and overall objectives of the future development of IMT for 2020 and beyond’, Recommendation ITU-R M.2083-0, September.

5G network deployment brings new challenges

We should not underestimate the challenging programme of investment ahead. In addition to the costs of obtaining spectrum for 5G, there are significant costs associated with upgrading existing Radio Access Network (RAN) infrastructure (e.g. masts, base stations and antennae) and upgrading IT and service platforms. While, in part, 5G will rely on similar-frequency radio spectrum to 3G or 4G (including below 1GHz) for wide area coverage, and some of the existing physical infrastructure and site locations may remain suitable for supporting initial 5G deployments, upgrades to existing networks alone will not be sufficient to support the increased traffic or the technical requirements of 5G.

For example, 5G will rely on significantly higher frequency spectrum (3.6GHz and above 26GHz), to support the provision of higher download speeds, the greater number of connected devices per cell, and increased data capacity requirements. This is particularly true in urban areas.

Due to the physical propagation characteristics of these high-frequency wavelengths, which have a short range and cannot penetrate through certain materials such as concrete, the signal cannot travel far from the transmitter before it deteriorates. As shown in Figure 1 below, the upshot is that more base stations (or cell sites) will be needed to cover any given area, including in buildings, to limit signal degradation. This problem is particularly true for the millimetre wavebands such as the 26GHz band.

This creates the following new challenges for network roll-out.

- Public 5G networks, particularly in urban areas, will require a much larger number of base stations (or cell sites) than those for 3G and 4G—which is sometimes referred to as a need for ‘network densification’. This will significantly increase the costs of network roll-out relative to previous generations, as operators will need to build new cell sites and new RAN infrastructure.

- Each of the large number of new cell sites will also require power and access to fibre connections to support the transfer of traffic back to a central exchange, also known as backhaul. This will add to the costs of deployment. In addition, in some areas, such as dense urban settings, there may be a limited number of physical locations that can support the physical infrastructure requirements. In some cases, site locations may be able to support only a single physical network infrastructure.

In order to address these considerable investment challenges, network sharing agreements (NSAs) may be part of the solution.

Figure 1 Characteristics of radio spectrum designated for 5G use

A shared future?

NSAs can be an effective way of delivering telecoms infrastructure, allowing operators to extend coverage at lower cost and reduce capital and operating expenditure, especially in areas where it is uneconomic to deploy several competing infrastructure networks.

NSAs are not a new phenomenon—they have been used to support the roll-out of previous generations of mobile networks. For example, in the roll-out of 3G and 4G, NSAs were able to support infrastructure roll-out in sparsely populated rural areas that might otherwise have been too costly for multiple operators to serve (i.e. where there was not enough demand to cover the costs of multiple sets of infrastructure). While this is also likely to be the case for 5G in rural areas, for the next wave of 5G investment the case for NSAs may extend to urban areas.

This is in part due to the fact that in dense urban areas the costs of network densification will also be high, and sharing could lower the burden on individual operators. In addition, given space limitations in such areas, it may simply not be feasible to have competing passive infrastructure (for example, on small sites such as urban lampposts and rooftops). For example, the Body of European Regulators for Electronic Communications (BEREC) notes:

[where] operators are confronted with such a scarcity of available sites, or limited space or other essential inputs…such that they cannot individually deploy their parallel networks in order to supply demand…infrastructure sharing could be objectively necessary for competition among MNOs [mobile network operators].3

Of course, any industry collaboration could come at the cost of reduced head-to-head competition. It is therefore important that this tension is addressed. Indeed, as NSAs are agreements between direct competitors, they must be assessed in accordance with national and EU competition law, which prohibits certain agreements that restrict competition.4 For the remainder, a balance needs to be struck: where there is a concern that agreements will restrict competition, the cost savings (and their pass-through to consumers) and benefits associated with enhancing consumer choice must be assessed against any adverse impacts on competition (such as those due to higher consumer prices, lower incentives to improve quality, and reduced innovation).5

The specific form and details of any NSA are therefore important. For example, in its Future Telecoms Infrastructure Review, the UK government acknowledged that initiatives to support the sharing of infrastructure should be backed by the government, but this should only be done ‘provided this does not restrict competition in the market’.6

Issues such as the extent to which such agreements can reduce the incentives of operators to compete, or the extent to which a greater amount of information-sharing between the operators could facilitate market coordination, remain relevant in the context of 5G deployment. For example, for previous NSAs concerns have been raised that the agreements may align the parties’ decisions on coverage, leading to a loss of one dimension of service differentiation between operators. This is something that could be particularly important in the early years of a new technology, when coverage could be an important competitive differentiator.

However, even in cases where an NSA means that some decisions about coverage in certain areas are aligned, there will remain scope for product differentiation on other characteristics. For example, price, data allowance and complementary service offerings may remain important focus points for competition, as companies that have entered into an NSA will continue to fully control their own spectrum assets and operate their core networks independently.

Furthermore, it is possible that any concerns associated with technical service differentiation as a result of NSAs will be reduced over time, as 5G technology is expected to allow for the possibility of greater virtualisation of networks, resulting in more easily programmable networks that are less dependent on the underlying hardware. Moreover, with ‘network slicing’ it may be possible for a single physical network to be separated into multiple virtual networks, allowing operators to differentiate services hosted on a common infrastructure. Therefore, NSAs could be structured in such a way as to allow for significant service-level competition between players sharing the same network infrastructure.

Consider what would happen absent the NSA—i.e. in the ‘counterfactual’ situation. If it were the case that it would be infeasible for there to be more than one operator—or if it became too costly for any single operator to deploy a 5G network—there might be no 5G coverage in these areas. It would then unambiguously be the case that an NSA would lead to a better outcome: the welfare gain associated with roll-out vs a counterfactual of no roll-out (or even a delay in roll-out) would be significantly greater than any potential welfare loss from less intense competition.7 There is nothing as costly in economics as a service that is never launched.

NSAs can therefore bring benefits by enhancing consumer choice, by increasing the number of providers that can operate in certain areas (relative to a counterfactual of one or no service providers), and by preserving service-based competition. There may also be an alignment of incentives between MNOs themselves where they see NSAs as a faster way to achieve coverage and be in a better position to compete against other technologies (fixed or cable) for which 5G may become a viable substitute for some customers. Thus there is arguably a strong pro-investment (and procompetitive) case for NSAs for the next wave of investment in 5G—for example, they could facilitate faster network roll-out, earlier availability of coverage and services, and earlier fulfilment of coverage and quality commitments. Nonetheless, it is essential to assess the evidence base on these issues.

A more neutral approach?

Where physical space is limited to a single 5G infrastructure operator (such as in dense urban areas and indoor spaces), there may also be a strong case for a wholesale-only business model.

This may be particularly relevant in any locations where network deployment is critical for operators to meet coverage or service quality requirements (for example, inside a shopping centre or public events venue).

In such cases, a ‘neutral host’ model for network deployment may be favourable. This model involves a single provider supplying wholesale access services to other operators on fair and reasonable terms. The model could limit the risk of any particular mobile network operator or operators being at a competitive disadvantage in relation to access to important sites, while also controlling deployment costs and avoiding any inefficient duplication of network infrastructure. The model should, therefore, be supported by regulators where necessary.

The neutral host model is not entirely immune from potential issues associated with competing operators sharing some of the same upstream inputs. However, as discussed above, independent control of spectrum, core networks and network virtualisation tools should ensure sufficient service-level differentiation between operators for competition to remain strong. Furthermore, provided that the neutral host is used only to fill coverage in those particularly difficult or expensive areas, operators will still compete for coverage and service quality elsewhere.

Conclusion: sharing the benefits of new networks

NSAs are increasingly widespread in mobile telecoms markets, particularly given the roll-out of 5G and its significant costs. NSAs can have a pro-investment (and therefore procompetitive) potential in the next wave of investment in 5G, where the case for sharing may extend beyond rural to urban areas.

While regulators and competition authorities must guard against genuine instances of anticompetitive agreements, they should not be overzealous in assessing NSAs. Given the potential for benefits relative to the counterfactual, the downside of putting a stop on deals and arrangements that could unlock investment, as a result of misplaced concerns over competition, could be large. The welfare gain associated with roll-out vs a counterfactual of no roll-out (or even a delay in roll-out) is likely to be greater than any potential welfare loss from marginally less intense competition. Policy therefore needs to be based on the evidence rather than on any preconceived ideas about the impact of NSAs on competition.

Competition law and economics can provide the relevant tools for ensuring that the benefits of network sharing are realised in the race to roll out 5G, while ensuring that effective and sustainable competition is maintained and consumers are not adversely affected.

1 European Commission (2016), ‘Communication from the Commission to the European Parliament, the Council, the European Economic and Social Committee and the Committee of the Regions, ‘5G for Europe: An Action Plan’, – COM(2016)588 and Staff Working Document – SWD(2016)306’, 14 September.

2 3GPP Release 16 (expected to be finalised in March 2020) will bring the International Mobile Telecommunications-2020 (IMT-2020) standard submission to completion. See 3GPP (2018), ‘Release 16’.

3 Body of European Regulators for Electronic Communications (2018), ‘BEREC Common Position on Mobile Infrastructure Sharing’, draft, BoR (18) 236, 6 December.

4 Article 101 of the Treaty on the Functioning of the European Union.

5 Article 101(3) of the Treaty on the Functioning of the European Union.

6 Department for Digital, Culture, Media & Sport (2018), ‘Future Telecoms Infrastructure Review’, policy paper, 23 July.

7 A point made by Professor Jerry Hausman of MIT in 1997: Hausman, J.A. (1997), ‘Valuing the Effect of Regulation on New Services in Telecommunications’, Brookings Papers on Economic Activity, 28, pp. 1–54.

Download

Related

Blending incremental costing in activity-based costing systems

Allocating cost fairly across different parts of a business is a common requirement for regulatory purposes or to comply with competition law on price-setting. One popular approach to cost allocation, used in many sectors, is activity-based costing (ABC), a method that identifies the causes of cost and allocates accordingly. However,… Read More

The European growth problem and what to do about it

European growth is insufficient to improve lives in the ways that citizens would like. We use the UK as a case study to assess the scale of the growth problem, underlying causes, official responses and what else might be done to improve the situation. We suggest that capital market… Read More