The impact of state aid on competition: an economic framework for the European Commission

In December 2017 the European Commission published Oxera’s ex post assessment of the impact of state aid on competition, a study that could have significant implications for future state aid control. We first developed an economic framework that the Commission can use in state aid assessments to evaluate the competitive effects of the aid. We then applied the framework in four case studies, providing insights into the main drivers of the impact of aid on competition.

State aid control has been a top priority on Margrethe Vestager’s agenda as the European Commissioner for Competition. This has led to a number of high-profile state aid investigations that have made the headlines around the world and have involved multinationals such as Apple and Starbucks.1

State aid control has also evolved as a result of the Commission’s state aid modernisation initiative.2 This has led to a significant increase in the scope of the General Block Exemption Regulation, which gives member states the authority to approve aid, under certain conditions, without notifying the Commission.3 In 2016, nearly 80% of all aid measures were block exempted, which represented an increase of around 20% relative to 2013.4

The greater role for member states comes, however, with greater obligations. Going forward, the Commission will increasingly require member states to carry out ex post assessments. It remains to be seen what the consequences will be in the event that an assessment identifies significant detrimental effects as a result of a particular state aid measure. While a reversal of the measure seems unlikely, it is possible that the measure would need to be revised going forward, or remedies introduced.

In light of these significant developments, the Commission asked Oxera to create a framework that can be used to assess the competitive effects of aid, and to gain further insights into the actual impact of aid measures on competition.5

How to assess the impact of aid on competition?

Although state aid control is designed to ensure fair competition across the EU, an extensive competitive assessment of the impact of the aid is not always undertaken. However, this is expected to change going forward, as state aid control is brought more in line with other areas of competition policy such as merger control, anticompetitive agreements, or abuse of dominance, where competitive assessments are at the heart of the practice.

While assessments in these areas vary, they essentially explore the impact of a particular event, such as a merger or acquisition. We therefore developed our framework from approaches that are already established in other areas of competition law and economics, with adjustments to reflect the specifics of state aid control.

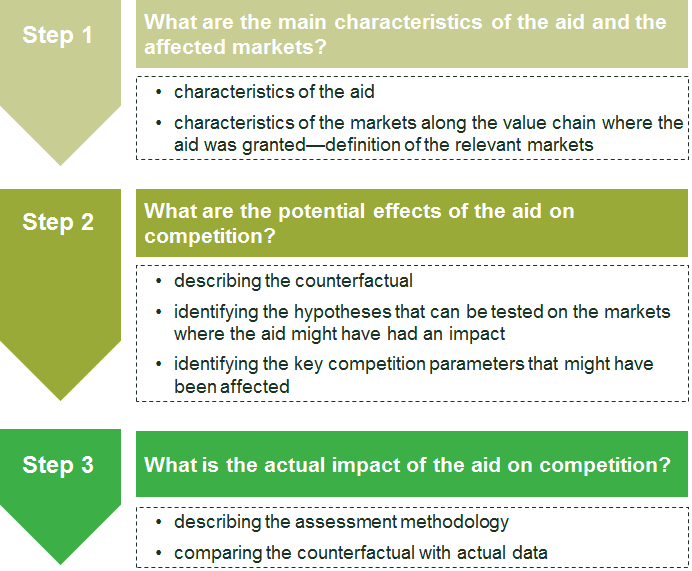

Our framework consists of three key steps, as summarised in Figure 1 and described below. Although it is designed for ex post evaluations of aid measures, the same principles can be applied in ex ante assessments.

Figure 1 Oxera’s analytical framework to assess the impact of aid on competition

Step 1: what are the main characteristics of the aid and the affected markets?

As the impact of the aid is likely to vary according to its characteristics, the first step is to identify the objectives of the aid, the aid instrument, the form of the aid, the number of firms receiving the aid, and the amount of aid granted. To understand why this matters, consider the form of aid. If aid reduces marginal costs, it is more likely to distort competition in the short run than aid that affects fixed costs. This is because changes to marginal costs influence firms’ short-run pricing decisions.

The impact of the aid also depends on the characteristics of the market in which it is granted. To identify the markets that may have been affected by the aid, the tools developed in antitrust and merger control can be used. However, the emphasis of the market definition exercise in state aid assessments may differ from the standard exercise in two main areas.

- Market definition may need to focus more on the supply side—in merger control and antitrust, the theories of harm may relate to both the supply side and the demand side. On the demand side, a certain conduct may affect prices directly—for example, if competition is reduced between firms at the same level of the value chain (e.g. two producers of the same good or service). On the supply side, interaction between buyers and sellers might affect competition—for example, if a seller forecloses access to inputs or a buyer forecloses access to customers. In state aid, in contrast, demand-side effects are often the purpose of the government intervention to ensure that a certain product or service is offered at a desired price or quality that differs from the level that would exist in an environment without the aid. Therefore, the state aid assessment may need to focus more on identifying possible competitive distortions on the supply side.

- Market definition may need to focus more on the medium/long run—given that state aid often enables lower prices, improved quality and/or greater innovation, it is possible that the aid could benefit consumers in the short term, but have an adverse effect in the longer term. Therefore, the market definition exercise in state aid assessments may need to focus more on the long-run effects of the aid.

However, it may not always be possible to assess the impact of aid on competition in all of the relevant markets, and it may not always be necessary to undertake a detailed assessment of the relevant geographic and product markets, particularly if the aid measure is small relative to the size of the total market.

Step 2: what are the potential effects of the aid on competition?

The second step is to understand what would have happened in the absence of the aid, in order to assess its potential effects.

The impact of the aid reflects the difference between the situation that occurred following the aid and what would have occurred in a scenario where the aid was not provided (i.e. the ‘counterfactual’).

Member states are often required to identify the likely counterfactual scenario(s) at the notification stage in their evaluation plans. The counterfactuals set out in these plans therefore represent an obvious starting point when considering what would have happened in the absence of the aid. However, for the purposes of an ex post evaluation, these counterfactual scenarios are likely to need updating to reflect subsequent developments.6

Once we have a detailed description of the competitive environment that is likely to have existed in the absence of the aid, the next step is to identify hypotheses that can be tested to assess the potential effects of the aid. Testable hypotheses could include a hypothesis that the aid has increased the beneficiary’s market power, or that the aid has distorted the competitive entry and exit process by supporting inefficient companies.

Step 3: what is the actual impact of the aid on competition?

The final step is to assess the actual impact of the aid on competition by comparing the actual outcome with the counterfactual scenario.

For an ex post analysis, this assessment should ideally be based on a series of indicators, obtained over sufficiently long timescales, both before and after the aid was granted. However, if it is not possible to obtain the necessary data, a significant part of the assessment could rely on qualitative insights and descriptive analysis.

The simplest approach to assessing the competitive impact of the aid is to examine the evolution of the key variables of interest. Any breaks in the data may indicate the impact of the aid. However, if several effects occurred at the same time, this approach would not yield conclusive results. In this case, a more sophisticated approach such as econometric analysis could help to disentangle the different effects.

Applying the framework to real world cases

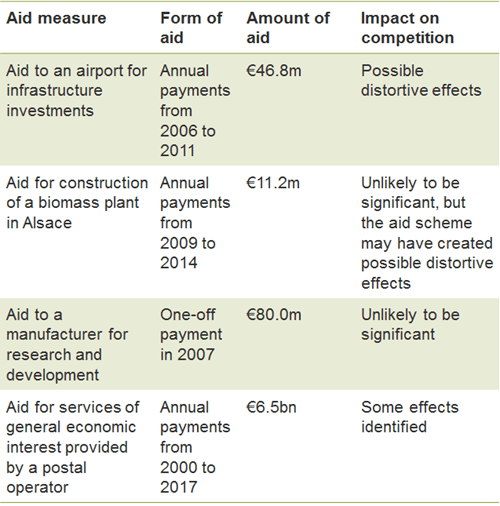

In our study for the Commission, we applied the above framework to assess the actual impact of four aid measures on competition (as shown in Table 1).

Table 1 Overview of Oxera’s findings from the case studies

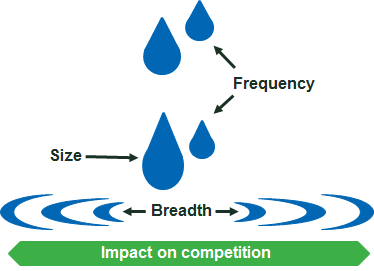

Our results from the above case studies suggest that the three factors in the box below represent the main drivers of the likely impact of aid on competition.

What are the main factors that affect the impact of aid on competition?

- The size of the aid (in monetary terms) relative to market size

- The frequency of the aid (i.e. one-off or repeated)

- The breadth of the aid (i.e. the proportion of the market that receives aid)

Source: Oxera.

- The size of the aid. In the energy and research and development case studies, the amount of aid was small relative to the market size, and we found that it was unlikely to have distorted competition. In contrast, in the airport case study, the amount of aid received by the airport in question represented a significant proportion of the total revenues of airports in the surrounding region, and we concluded that the aid might have caused distortions to competition.

- Frequency of the aid. The airport and postal case studies suggested that aid is likely to have a greater impact on competition where it is granted on a repeated basis. This is consistent with the greater potential for aid that is granted on a rolling basis to affect operating costs, while aid that is granted as a one-off is more likely to affect fixed costs. As changes in operating costs tend to have a more immediate effect on firms’ behaviour than changes in fixed costs, one-off government support is less likely to distort competition than continuous support is. In addition, granting aid on a rolling basis in markets that are characterised by a degree of entry and exit is more likely to confer a competitive advantage on companies than it is on potential entrants.

- Breadth of the aid. In the energy case study, we concluded that it was unlikely that aid granted for the construction of the individual biomass plant created any competitive distortions. However, it is possible that support by the French Environment and Energy Management Agency (ADEME) to a number of biomass plants in France could have affected competition (as discussed further in the box below).

Our analysis was based on information volunteered by market participants and/or data that was publicly available. Although there were no formal requirements for parties to provide data and information, a number of meaningful conclusions about the impact of aid on competition were still drawn. However, our study highlights that, in order to ensure that a full set of hypotheses can be tested, the infrastructure must be put in place at the time when the aid is granted to ensure that aid recipients can provide the necessary data for the ex post evaluation.

What are the main insights from the energy case study?

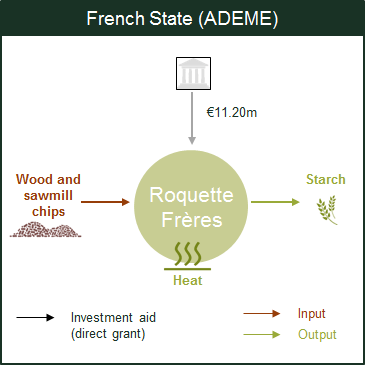

Over 2009–14, ADEME introduced a scheme that supported 17 biomass plants in the Grand Est region of France. This included a plant constructed by Roquette Frères in Alsace, which was the focus of our case study.

As the biomass plants are fuelled by low-quality wood, we assessed whether the aid led to any competitive distortions in this market.

Our analysis identified that there is a separate product market for low-quality wood, and that the geographic dimension is local. Therefore, we assessed whether the demand and price of low-quality wood increased due to the aid, and whether other purchasers of wood were affected. We found that:

- demand for low-quality wood in the local market increased significantly over the 2010–13 period;

- competition for low-quality wood in France intensified, and as a result, buyers extended the area over which they procured wood. As supply can only react slowly to changes in demand, at least initially, this led to sourcing difficulties;

- companies that were active in the local market for pellets and panels experienced a significant increase in their material costs over the period, which adversely affected their profitability. Some companies reduced their activities due to the higher wood prices, and in some cases exited the French market.

However, due to Roquette Frères’ relatively small size in the context of the local market for low-quality wood, and the relatively low level of demand from Roquette Frères’ plant alone, it is unlikely that these trends were due entirely to the aid granted to Roquette Frères. Instead, it is possible that ADEME’s scheme that supported a number of biomass plants in the local region, in addition to low winter temperatures and high fossil fuel prices, led to competitive distortions in the French market.

This suggests that aid schemes that cover a significant segment of an industry may be more likely to affect competition than aid granted to only one company, which highlights the importance of the design of aid schemes.

Source: Oxera.

Conclusions

Oxera’s framework can be used by the Commission to evaluate the impact of aid on competition. It is similar to the frameworks used for antitrust investigations and merger control, but must be tailored to take into account the specificities of state aid control.

Overall, the results from Oxera’s study show that the impact of aid varies according to the amount of aid relative to the size of the market, the breadth of the aid, and the frequency of the aid.

In light of the growing importance of ex post evaluations in state aid control, and the increasing role for sophisticated assessments of the competitive effects of aid, Oxera’s study could have significant implications for future state aid control.

1 European Commission (2017), ‘Commission Decision (EU) 2017/1283 of 30 August 2016 on State aid SA.38373 (2014/C) (ex 2014/NN) (ex 2014/CP) implemented by Ireland to Apple’, Official Journal of the European Union, 19 July. European Commission (2017), ‘Commission Decision (EU) 2017/502 of 21 October 2015 on State aid SA.38374 (2014/C ex 2014/NN) implemented by the Netherlands to Starbucks’, Official Journal of the European Union, 29 March.

2 European Commission (2012), ‘Communication from the Commission to the European Parliament, The Council, the European Economic and Social Committee and the Committee of the Regions, EU State Aid Modernisation (SAM)’, COM(2012) 209 final, 8 May. See also Oxera (2013), ‘A brave new world? Implications of state aid modernisation’, Agenda, March.

3 For further details on the General Block Exemption Regulation, see European Commission, ‘Legislation > Block Exemption Regulations’, accessed 19 January 2018.

4 See European Commission (2017), ‘State Aid Scoreboard’, accessed 20 January 2018.

5 Oxera (2017), ‘Ex post assessment of the impact of state aid on competition’, prepared for the European Commission, December, accessed 12 January 2018.

6 The Commission’s 2014 evaluation guidelines outline a number of factors that need to be taken into account when identifying the counterfactual. See European Commission (2014), ‘Common methodology for state aid evaluation’, Commission Staff Working Document, 28 May, section 3.4.

Download

Related

Switching tracks: the regulatory implications of Great British Railways—part 2

In this two-part series, we delve into the regulatory implications of rail reform. This reform will bring significant changes to the industry’s structure, including the nationalisation of private passenger train operations and the creation of Great British Railways (GBR)—a vertically integrated body that will manage both track and operations for… Read More

Cost–benefit analyses for public policy

Cost–benefit analyses (CBA) are commonly applied to public infrastructure projects where there is a degree of certainty about the physical output of the project and the consequent societal benefits. CBA can also be applied to proposed policy and regulatory changes, but there is less clarity about the outcomes and the… Read More