A consolidated tape in the EU? How fixed income and equity trading markets perform

The European Council and Parliament have been discussing the European Commission’s proposal to create a consolidated tape with prices and volume data on fixed income securities and equities traded in the EU. We take stock of the debate around the Commission’s proposal, review key empirical evidence, and explore the potential differences between fixed income and equity markets.

An important desired aim of the consolidated tape is to give investors and market participants an accurate and complete view of trading in equity markets in order to reduce liquidity and execution risk and therefore (implicit) trading costs.1 The Commission’s proposal also states that a lack of access to data by some market participants is a significant barrier to cross-border investments.2 This article reviews the evidence on equity and fixed income markets.

In the debate in the EU, reference has been made to the impact of the introduction of a consolidated tape for corporate bonds in the USA in 2002, when the Securities and Exchange Commission (SEC) instituted the trade reporting and compliance engine (TRACE). We first review the academic literature on the impact of TRACE, discuss the findings from empirical studies and, taking into account the specific characteristics of the US market, assess what lessons can be learned for a consolidated tape in the EU.

Second, we look at the evidence on the performance of the equity markets in the EU over time and compared with the equity markets in the USA (which have a consolidated tape) based on the economics literature. We also discuss evidence presented in the European Commission’s proposal.

What was the impact of a consolidated tape for fixed income in the USA?

The introduction of a consolidated tape for fixed income securities in the USA, in 2002, created a clear-cut event with relevant data that was suitable for academic research into the impact of introducing transparency.

The analysis showed that the introduction of trade reporting (through a consolidated tape) for fixed income securities resulted in substantial reductions in implicit transaction costs for investors. For example, Bessembinder, Maxwell and Venkataraman (2006) found average reductions in (implicit) trading costs for corporate bonds subject to TRACE transaction reporting of 5bp to 8bp, equivalent to a reduction of 40−60% in pre-TRACE trading costs.3

These benefits can be better understood if we look at the design of the fixed income trading markets. Fixed income securities are typically traded in over-the-counter (OTC) or dealer-intermediated OTC markets4 rather than on an exchange or trading platform (which is where a large part of trading in equities takes place). By design, exchange-traded markets are more transparent than OTC markets.

The academic papers that have analysed the impact of TRACE explain that the substantial reduction in trading costs was due to the very opaque nature of this market pre-TRACE. In the absence of a consolidated view, investors or brokers found it difficult to know whether their trade price reflected market conditions. The introduction of transparency (through TRACE) reduced dealers’ information advantage relative to investors/brokers, and reduced cross-sectional variation in the degree to which customers were well informed regarding bond values. With TRACE, investors/brokers were then able to assess the competitiveness of their own trade price by comparing it with recent and subsequent transactions in the same and similar issues.5

In sum, this experience in the USA shows that introducing a consolidated tape can deliver substantial benefits in some trading markets, in particular those that lack transparency.

Equity trading

The situation in relation to the equity trading markets is different. A large proportion of equities are traded on transparent trading platforms that report detailed transaction data. This data is used by brokers, fund managers and investors to inform their trading decisions. Although the data from trading platforms may not cover the entire market, there is a much higher degree of transparency than, for example, in fixed income markets.

When MiFID I was being implemented there was a concern that trading fragmentation could result in liquidity fragmentation, thereby increasing the implicit costs of trading, as it could become more difficult for market participants to search for liquidity across multiple venues. In other words, the concern was that investors, fund managers and brokers would not have connectivity with all trading venues and would therefore not always trade in the venue that offered them the best liquidity and lowest implicit costs.

The concern about liquidity fragmentation is valid in theory, but whether it has materialised is ultimately an empirical question.

The Commission’s proposal refers to an annual cost of up to €10.61bn to end-investors that is due to them not having an accurate view of equities markets (i.e. the cost of not having a consolidated tape).

However, we note that this estimate is based on opinions from trading desks at asset management firms rather than an empirical analysis from a market and welfare perspective. It is difficult to provide a view on the cost to annual trading strategies ‘of not having complete and accurate consolidated tape data’, and one of the respondents in the proposal did not provide a view for exactly that reason: ‘impossible to estimate’.

Further inspection of the calculations indicates that the estimated annual cost of €10.61bn is based solely on the opinions of two respondents in the survey, and that the calculation assumes that the opinions of these two respondents are representative of the entire market—i.e. their opinion is applied to the total value of trading in the EU. However, opinions varied substantially across the sample of around 40 asset managers surveyed. Most other respondents expressed the view that the costs would be much smaller—for example, less than 0.25bps of the value of trading, which would amount to less than €500m per year (rather than €10.61bn). This calculation may still overlook the fact that there are many trade orders that are relatively straightforward to execute.

Furthermore, the opinions of individual asset managers do not result in a reliable estimate of the costs to end-investors from an overall market or welfare perspective, which is what is required to inform a regulatory impact assessment.6

What does the empirical evidence tell us?

We now return to the question of whether it has become more difficult over time, in equity markets, for market participants to search for liquidity across multiple venues, and whether this has increased the implicit costs of trading.

This is ultimately an empirical question, and the empirical academic literature provides useful evidence on liquidity in EU equity markets over time and comparisons with the markets in the USA, which have a consolidated tape.

The empirical literature on equity trading in the EU shows that bid–ask spreads have decreased significantly since 2007, which suggests a reduction in implicit costs.7 However, it has been recognised that, while the bid–ask spread has narrowed, market depth—the volume of orders posted at the best prices—may also have reduced. In other words, the market may have become ‘thinner’, and this means that the implicit costs of trading in particular large orders could be much higher than suggested by the bid–ask spread.

Studies in the literature therefore also look at other metrics of liquidity such as the implementation shortfall. This is the difference between the price actually achieved for an investor’s trade and the last price obtained in that security prior to the investor starting to buy (or sell) it. The measure incorporates the impact of the prevailing spread and the impact on the price while the order is being executed, as well as any in-trade price momentum. In other words, the implementation shortfall metric reflects not only the transaction costs, but also the impact on price while the order is being executed. Price impacts quantify the ability of a market to absorb the execution of large orders without the price moving significantly, and can thus be a component of implicit costs, especially for large orders.

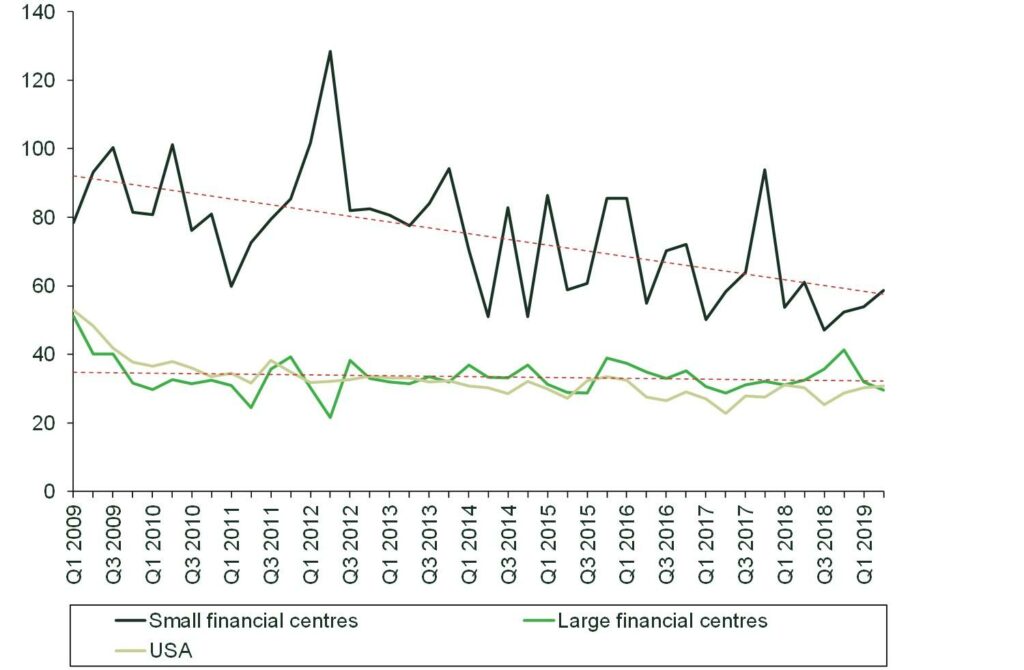

Figure 1 below shows that, as expected, the implementation shortfall has improved, albeit less significantly than the bid–ask spread. In other words, although there is evidence that markets have become ‘thinner’, implicit costs—measured by the implementation shortfall—have not increased in the EU equity markets. Interestingly, the large financial centres in the EU seem to perform on a par with the US equity markets.

It is worth noting that any trends covering the 2009−19 period are likely to capture some impacts from the global financial crisis. However, we find a similar pattern in implementation shortfall over a longer time period from 2004 to 2019, though the reduction in the implementation shortfall across the EU is of a smaller scale.8

Figure 1 Implementation shortfall in small and large financial centres in the EU and the USA, 2009–19 (bp)

Source: Virtu, and Oxera (2020), ‘Primary and secondary equity markets in the EU’, report prepared for the European Commission, September, section 12.2.1.

These findings have been confirmed in various studies in the literature,9 and suggest that market participants have adapted their ways of working and their business models to the new reality of a more fragmented trading landscape where different execution venues such as stock exchanges, multilateral trading facilities, dark pools and systematic internalisers compete. Although trading is fragmented across different venues, various players have access to multiple venues and can therefore find the liquidity that they need.

Insights from interviews with market participants indicate that traders navigate a somewhat reduced market depth in different ways. The fact that market participants operate across multiple venues in itself means that their trading activities and the search for liquidity contribute to the alignment in prices of securities traded across different venues; the different venues are connected by the overlap in their user bases.

In sum, despite the challenges and higher implementation and IT infrastructure costs as a result of having multiple trading venues, both the EU (without a consolidated tape) and US markets (with a consolidated tape) have demonstrated how a competitive model can work, not only delivering benefits from lower explicit trade execution costs driven by strong competition among trading venues, but also maintaining sufficient liquidity.

Smaller players

Although it has generally been recognised that the market is indeed working well for larger brokerage and fund management firms, there is a perception that smaller players are likely to lose out as they ‘do not have the same possibilities to check the accuracy of market data across multiple venues’10 and because these players base their trading decisions on incomplete market data, which ‘drives the costs up for investors’.11

Different traders and investors may form different views on the value of the same financial asset, depending on the sources of information and analysis that they rely on. Importantly, it is not only the amount and type of information that varies across market participants but also their capability to process and analyse the information, and to quickly turn such an analysis into trading decisions and then access the relevant venues quickly enough to be able to execute those trades successfully. Larger players have invested heavily in access to multiple venues, and in their capability to process and analyse large amounts of data very quickly.

A market structure with different types and sizes of player can be optimal. Smaller players do not have the economies of scale to make such investments worthwhile, and will typically have access to a more limited number of venues. However, they can still use larger brokerage firms for more difficult trades in order to benefit from those brokers’ access to multiple venues, and their expertise and scale.

Although giving smaller players a consolidated tape with real-time data may be useful, it is unlikely to significantly change their outcomes. They will be able to fully benefit from a consolidated tape if they become large players themselves by investing in their capability to process and analyse large amounts of data very quickly and by obtaining high-speed connectivity with multiple venues. Without undertaking such investments, they will not be able to analyse data sufficiently quickly and react to the data in the consolidated tape, and may not have fast-enough connectivity with the particular venues where the opportunities to transact arise.

Does this mean that smaller players get a poor deal? No. Improving trade execution outcomes would come at a cost; in theory, they could achieve better outcomes if they invested in their capability to process and analyse data quickly and access multiple venues. However, from a market design perspective, there is no need for smaller players to become like larger players; there is already a wide range of large and sophisticated players. Although the outcomes for smaller players will not be the same as those for larger players, the difference is likely to reflect the difference in economies of scale and the costs incurred in relation to developing and maintaining the capability to process and analyse data, and the costs of accessing multiple venues for trade execution.

Importantly, this does not mean that smaller firms are unable to assess and monitor the quality of trade execution. There are various third-party service providers that undertake transaction cost analysis for asset managers to help them to monitor the performance of their brokers. These third-party providers typically have access to data from many venues as well as asset management firms and brokerage firms, and can therefore also offer benchmarking services. Only larger asset management firms typically conduct such transaction cost analysis in house.

Concluding remarks

Our review of the evidence base shows that the benefits of introducing a consolidated tape in less transparent markets, such as fixed income securities—which are traded mainly in OTC or dealer-intermediated OTC markets—can be significant.

The situation in relation to the equity trading markets in the EU is different and more nuanced: there is a significantly higher degree of transparency already, meaning that the benefits of introducing a consolidated tape are more limited. Our review of the empirical analysis shows that the concern about liquidity fragmentation (and thereby higher implicit costs of trading) has not materialised.

1 European Commission (2021), ‘Proposal for a Regulation of the European Parliament and of the Council’, 25 November. Oxera was commissioned by Deutsche Börse, Euronext and Nasdaq to conduct the review discussed in this article.

2 The Commission’s proposal states that ‘a lack of access to data by all market participants is … one of the main reasons why national markets remain fragmented along national lines instead of integrating into a single, globally competitive CMU’. The Commission refers to its report from 2019 on capital movements, which lists the main barriers to the free movement of capital within the EU, and covers tax relief procedures and various other factors rather than the lack of consolidated tape. These findings are consistent with the general literature on this topic; a recent literature review combined with structured interviews with market participants identified similar barriers. See Oxera (2020), ‘Primary and secondary equity markets in the EU’, report prepared for the European Commission, September, sections 13.4 and 13.3.8.

3 Trading costs here are defined as the effective one-way spread, i.e. half the difference between the price at which dealers will sell a bond and the price at which they will purchase the bond. See Bessembinder, H., Maxwell, W. and Venkataraman, K. (2006), ‘Market transparency, liquidity externalities, and institutional trading costs in corporate bonds’, Journal of Financial Economics, 82:2. Other studies have estimated reductions in transaction costs of between 1bp and 4bp when additional bonds became eligible for public trade reporting. See Edwards, A.K., Harris, L.E. and Piwowar, M.S. (2007), ‘Corporate Bond Market Transaction Costs and Transparency’, Journal of Finance, 62:3, pp. 1421–1451; and Goldstein, M.A., Hotchkiss, E.S. and Sirri, E.R. (2007), ‘Transparency and Liquidity: A Controlled Experiment on Corporate Bonds’, Review of Financial Studies, 20:2, pp. 235–273.

4 In dealer-intermediated markets, there is a network of a smaller number of highly interconnected financial institutions that intermediate a large proportion of trading activity. Intermediaries can facilitate trading on either an agency basis (i.e. matching buy and sell orders from different customers) or a principal basis (i.e. acting as a counterparty to a customer order and then entering into an opposite trade with another customer or dealer).

5 Bessembinder, H. and Maxwell, W. (2008), ‘Transparency and the Corporate Bond Market’, Journal of Economic Perspectives, 22:2, pp. 217–234.

6 When an individual asset manager obtains access to the additional data, all other asset managers will also have access to that data, reducing the asymmetry of information across market participants and therefore reducing the informational advantage of an individual asset manager. This will affect its trading strategies and its ability to benefit from the data in the way envisaged.

7 See the analysis and summary of literature in Oxera (2020), ‘Primary and secondary equity markets in the EU’, report prepared for the European Commission, September.

8 See Oxera (2020), ‘Primary and secondary equity markets in the EU’, report prepared for the European Commission, September, section 12.2.1.

9 For a summary of the literature, see Oxera (2020), ‘Primary and secondary equity markets in the EU’, report prepared for the European Commission, September.

10 European Commission (2021), ‘Proposal for a Regulation of the European Parliament and of the Council’, 25 November, p. 10.

11 European Commission (2021), ‘Proposal for a Regulation of the European Parliament and of the Council’, 25 November, p. 11.

Download

Related

Investing in distribution: ED3 and beyond

The National Infrastructure Commission (NIC) has published its vision for the UK’s electricity distribution network. Below, we review this in the context of Ofgem’s consultation on RIIO-ED31 and its published responses. One of the policy priorities is to ensure that the distribution network is strategically reinforced in preparation… Read More

Leveraged buyouts: a smart strategy or a risky gamble?

The second episode in the Top of the Agenda series on private equity demystifies leveraged buyouts (LBOs); a widely used yet controversial private equity strategy. While LBOs can offer the potential for substantial returns by using debt to finance acquisitions, they also come with significant risks such as excessive debt… Read More