A tale of two cities: the rise and fall of listings

The decline in European public equity markets has sparked concern from policymakers about how to revive listings. Behind this overall declining trend, there is a notable variation between financial centres. The contrasting experiences of Sweden and the UK highlight how more flexibility in some aspects of the listing rules and corporate governance might encourage more listings.

This article is part of a series on primary and secondary equity markets in the EU, based on research conducted by Oxera for the European Commission. For Oxera’s final report, see Oxera (2020), ‘Primary and secondary equity markets in the EU’, report prepared for the European Commission, September.

As discussed in November’s Agenda in focus,1 recent years have seen a fall in the number of initial public offerings (IPOs) in many regions.2 At the European level, the number of listings fell from 7,392 in 2010 to 6,538 in 2019—a net loss of 854 companies from the public equity markets. This represents a 12% reduction in the total number of listed companies across Europe, while GDP rose by 24% over the same period.

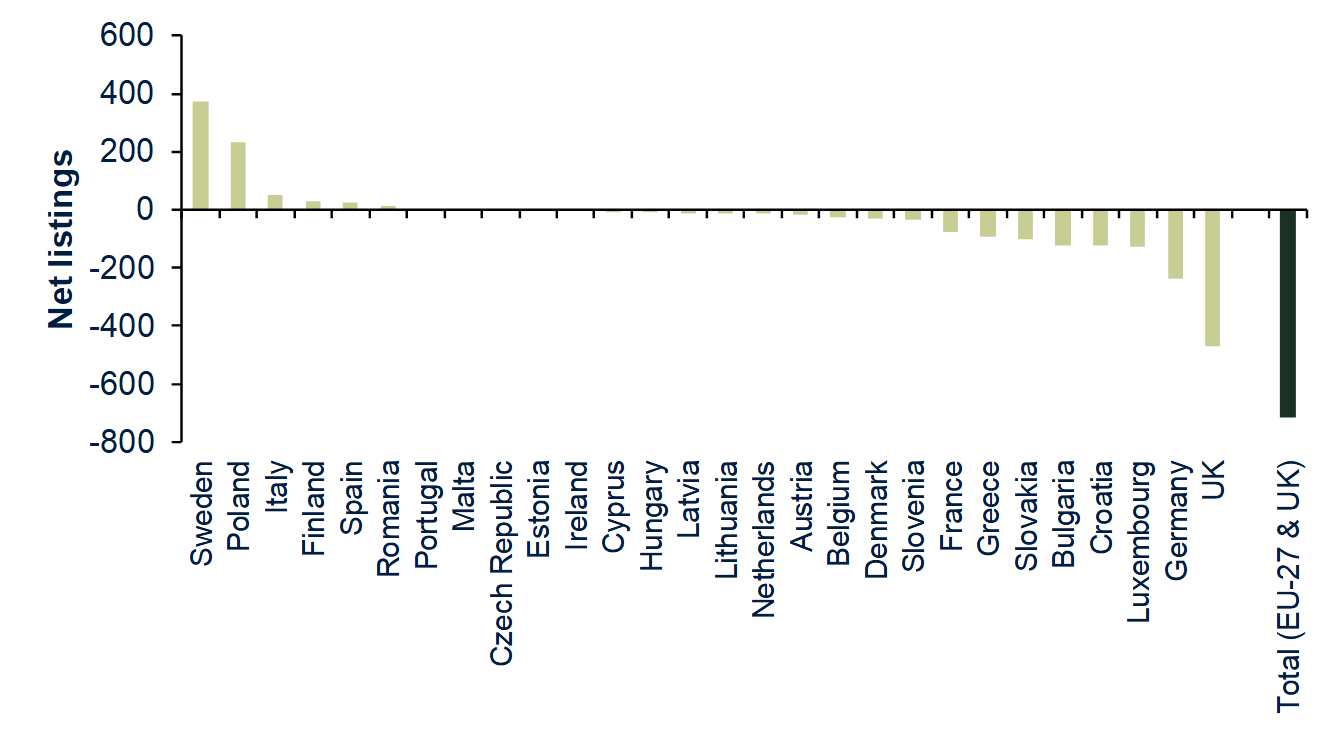

The decline in public equity markets has sparked concerns from policymakers about how to revive listings.3 While overall listings have been in decline for some time at the pan-European level, closer analysis of the data reveals variation across countries (Figure 1). Comparing these different trends and the experiences in European financial centres can help to identify best practices and areas for improvement.

Figure 1 Net changes in the number of listed companies between 2010 and 2018

Source: Oxera analysis of stock exchange data; WFE.

Some of the observed variation between countries can be readily explained. For example, if a country has relatively immature capital markets, the rate of growth might naturally be expected to be higher.

Furthermore, higher economic growth and stock market expansion are related. It has long been documented that IPOs often occur in waves (Ibbotson and Jaffe, 1975).4 Various reasons for this have been suggested in the academic literature, including fluctuations in investor sentiment, fluctuations in demand for capital driven by macroeconomic conditions, fluctuations in information asymmetry, and product market conditions. Two key papers are Lowry (2003), and Gao, Ritter and Zhu (2013), which both find that the number of IPOs is positively related to futures sales growth of publicly traded companies and future GDP growth.5

Some of the economies that have grown (e.g. that of Poland) have also recorded strong stock market growth over the same period. On the other hand, some stock markets (e.g. in Spain) experienced sustained and significant expansion in listed stocks before the financial crisis in 2008, but this trend has tailed off as macroeconomic conditions have worsened.

With respect to larger financial centres in Europe, Sweden and Italy have been the exceptions in terms of growth in the number of listed companies. In both cases (and particularly in Italy), the increase in the number of listed companies has been driven by the successful performance of SME-focused markets (such as AIM Italia and First North).6

The other larger financial centres have been either fairly flat or in a long-term decline for a sustained period. This is the case for France, Germany, the Netherlands, and, notably, the UK—as we discuss below.

The decline of UK plc

The number of companies listed on the London Stock Exchange (LSE) fell by 378 between 2010 and 2018, the largest numerical fall among European markets. The decline represents a 21% fall in listed companies in just eight years. This has occurred as new listings have failed to keep pace with delistings.

While the number of listed companies in the UK has fallen since 2010, market capitalisation has increased over the same period, implying that UK listed companies have also (on average) become larger. Table 1 shows how the average size of a company listed on the LSE markets increased by the equivalent of 5–8% per year between 2008 and 2018.

Table 1 Increasing size of UK companies, 2008–18

Source: Oxera analysis of London Stock Exchange statistics; CMA (2020), ‘The state of UK competition’, November.

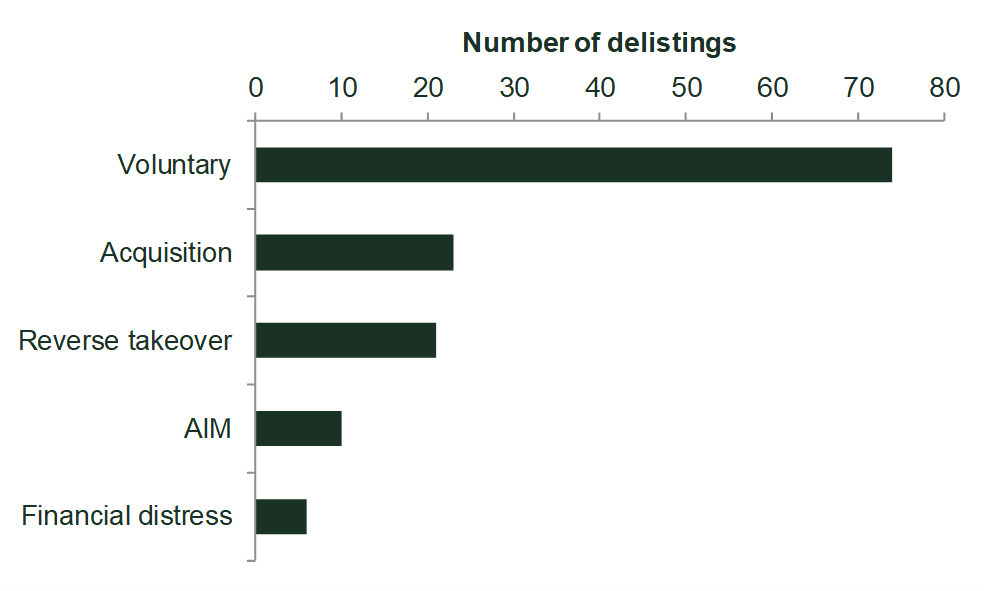

At the same time, a significant number of companies have exited public markets. In many cases, this has been a strategic decision on the part of the company, although mergers and acquisitions (M&A) have been another important driver (see Figure 2).

Figure 2 Departures from LSE main market, 2017–19

Source: Oxera analysis.

Of the 23 acquisition-driven delistings from the LSE main market shown in Figure 2, around 60% were due to M&A activity with another listed company (e.g. the acquisition of food wholesale operator Booker Group by the supermarket chain Tesco in March 2018). Around 35% were due to acquisition by an unlisted company or investment vehicle (i.e. the assets left public markets completely).

Although the UK remains the largest financial centre in Europe in terms of number of listings, our analysis also shows that the UK has more than 3,500 large unlisted companies that would be eligible to list but have not listed. The UK has Europe’s largest listing gap, followed by Italy (2,911) and Germany (2,833).7

Why are some firms choosing not to list? The results of our issuer survey and stakeholder interviews show that control is a key influencing factor in the listing decision—and loss of control is widely cited by unlisted companies as the most important reason for remaining private.

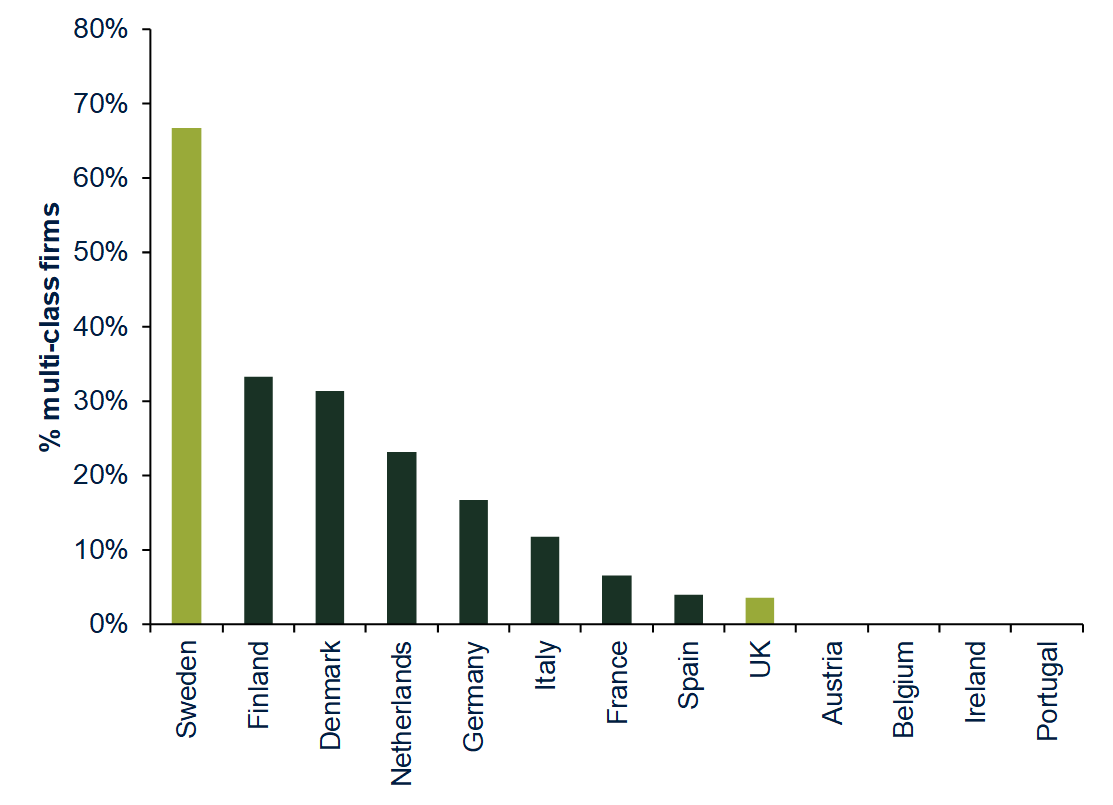

Although mechanisms (e.g. dual-class shares) exist to facilitate the listing of companies willing to sacrifice a higher valuation for more control, the UK has largely been reluctant to diverge from a principle of one-share-one-vote. Large companies with a multi-class share structure can list on the London Stock Exchange, one recent example being The Hut Group—however, such listings are excluded from the FCA’s premium listing segment and are therefore ineligible for inclusion in most major indices. As a result, such listings are generally rare (see Figure 5).

Another key concern has been around the reduction in advisers servicing SMEs (11% of delistings from AIM between 2017 and 2019 were attributed to the lack of a Nominated Adviser).8 This can compound problems of limited liquidity that listed SMEs already face.

There have been some recent market-led attempts to increase liquidity in UK SME stocks. For example, Aquis Stock Exchange has introduced an incentive scheme in which participating market makers receive the option to purchase Aquis shares, in return for fulfilling quoting obligations on high-growth stocks listed on its Apex market segment.9

Swedish success

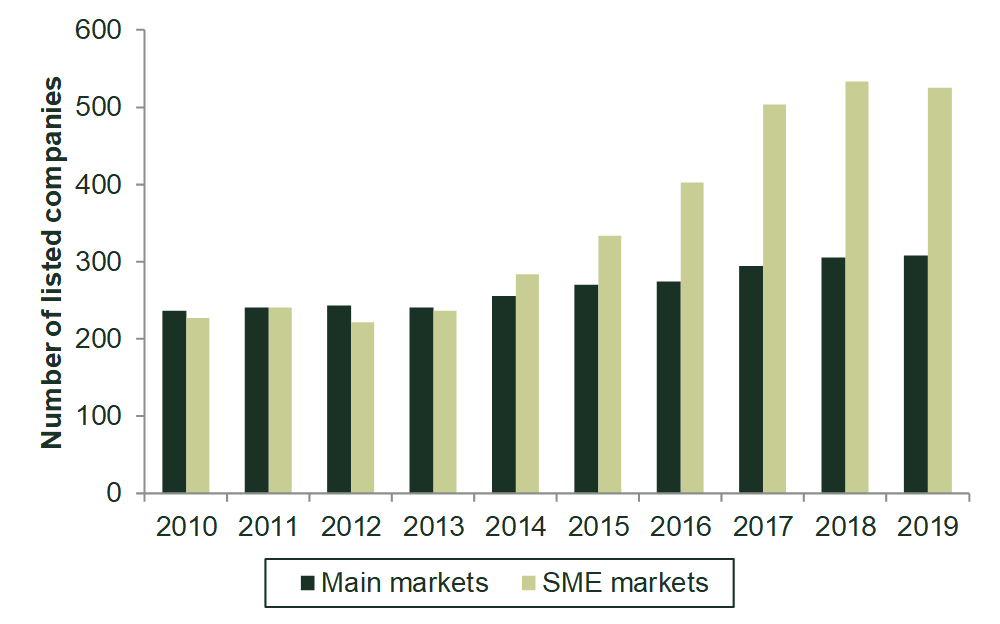

In contrast to the trends observed in many other European countries, Sweden has witnessed a large increase in the number of listings. This trend has largely been driven by developments in SME-focused markets, which more than doubled in size (in terms of listed companies) between 2010 and 2019 (as shown in Figure 3).

Figure 3 Number of listed companies in Sweden, 2010–19

Source: Oxera analysis of stock exchange data.

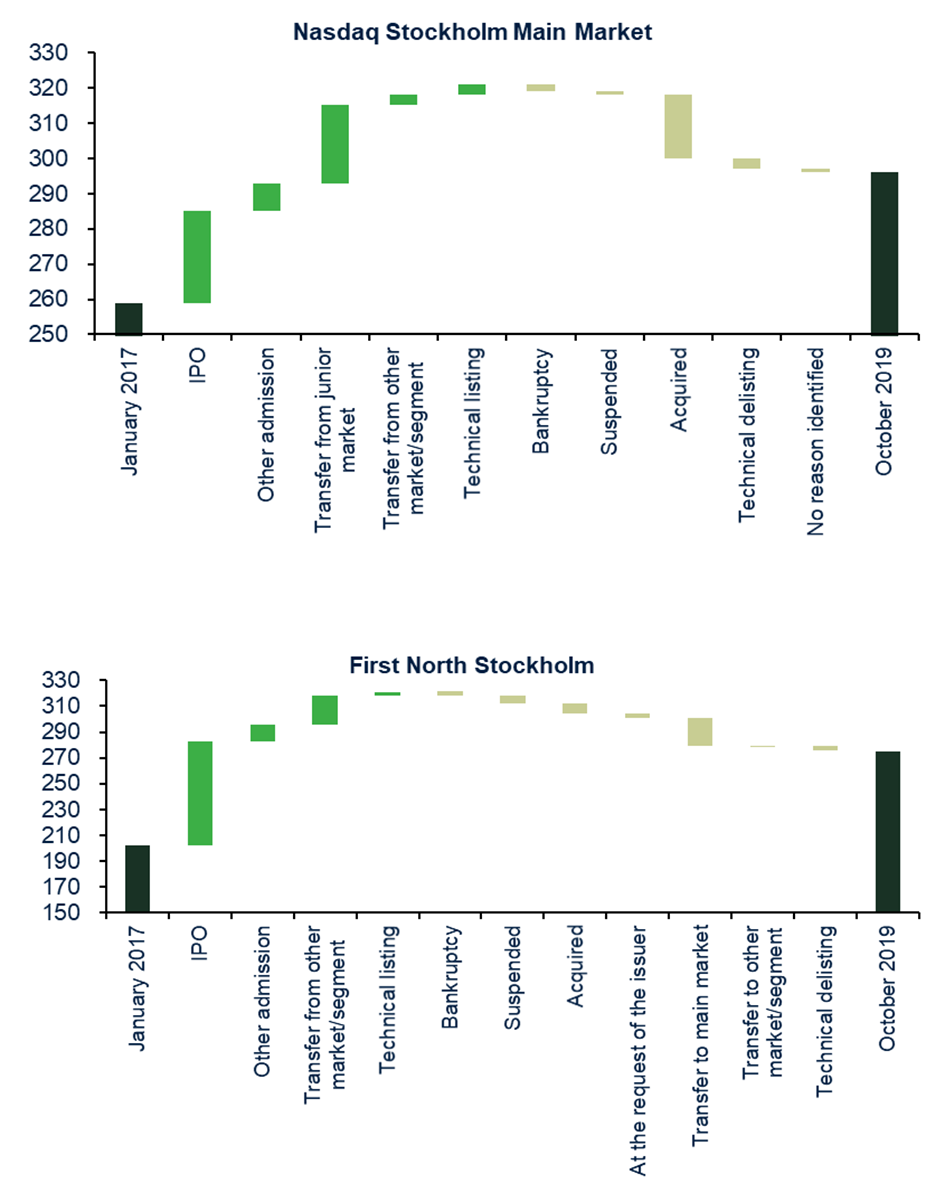

As shown in Figure 4, IPOs were the most common entry route onto the two largest Swedish markets. However, unlike most other European markets, the second most common source of listing on Nasdaq Stockholm came from companies transferring up from the largest SME-focused market (First North). In terms of flow away from public markets, Nasdaq Stockholm and First North are also notable in terms of the absence of voluntary delistings, with only three delistings occurring at the request of the issuer (see Figure 4).

Figure 4 Net admissions and delistings on Nasdaq Sweden

Source: Oxera analysis of Nasdaq data.

What can be learned from the experience of Sweden?

Our analysis, based on interviews with a range of stakeholders, highlights a range of reasons for Sweden’s success, including the following.

- A smooth IPO process—although listing rules are largely harmonised at an EU level, participants emphasised that there was a collaborative relationship between the regulator, exchanges and advisers.

- Tax incentives—Sweden introduced the ‘investeringsparkonto’ (a type of savings account) in 2012 to promote households’ savings and investments in stocks/securities and to simplify taxation.

- The role of local pension funds—the Swedish public pension reserve funds (so-called ‘AP funds’) have historically had large allocations of assets in listed equities (approximately 40–45% in 2017).10 Large institutional investors like these funds can often act as an ‘anchor’ investor in IPOs.

- Private equity exits—IPOs can provide a way for existing shareholders to diversify their own portfolios and have been a particularly common exit route for private equity firms in Sweden (a recent example is the IPO of Nordnet AB, a digital investment platform previously owned by Nordic Capital and Öhman Group). This is despite the proportion of IPO exits declining at a European level over time.11

- Listing rules—while the rules for Nasdaq Stockholm are broadly in line with other large European stock exchanges, First North differs from other SME markets in only requiring new companies to provide one audited IFRS-compliant financial report. This may have been a factor in attracting younger, rapidly growing companies to list.

- Dual-class shares—Swedish companies are permitted to issue shares with limited voting rights and/or multiple voting rights, and multi-class share structures are relatively common compared to other European financial centres.12 This last point is illustrated in Figure 5.

Figure 5 Multi-class share firms in the EU, 2016

Source: Kim, J., Matos, P. and Xu, T. (2018), ‘Multi-Class Shares Around the World: The Role of Institutional Investors’, November.

However, despite Sweden’s relative success in attracting new listings, it is notable that one of the most high-profile listings of a Swedish company in recent years (Spotify) did not take place on a Swedish stock exchange. Instead, Spotify opted for a direct listing on the New York Stock Exchange (NYSE) in 2018.

Although EU technology companies like Spotify may choose to list overseas due to the depth of capital available in financial centres such as the USA, interview feedback from market participants noted that most large US institutional investors can access EU capital markets with relative ease. Moreover, in the case of Spotify, no new capital was raised at the initial listing, suggesting that the choice of overseas listing may be more related to other factors, such as the location of peers, flexibility around listing rules, and higher valuations.

A post-COVID resurgence?

Despite the uncertainty and economic impact of COVID-19, there has been a relative increase in new listings in 2020, particularly in the UK.13 Is this a potential indicator of a resurgence in European primary markets?

The COVID-19 pandemic has re-emphasised the important role that equity markets play in the wider economy. One of the key benefits of listing is access to additional equity finance and, for those already listed, the ability to quickly tap the market for additional funding via secondary raisings.14 It is therefore perhaps unsurprising that there has been a resurgence in share issuance in recent months.

The impact of COVID-19 and the resulting lockdowns have left many corporates needing quick access to additional capital to fill funding gaps. In the UK, for example, the Bank of England recently estimated that firms could face a cash flow deficit in the 2020–21 financial year of up to £180bn.15

In many cases, follow-on equity issuances were completed relatively quickly (with over 80% occurring as pure accelerated bookbuilds or cash placings).16 The median under-pricing for UK follow-on offerings larger than $5m in size was slightly larger in 2020 compared to previous years (approximately 4.5% in 2020 compared to 3.89% for 2015–19), likely reflecting the higher information asymmetries associated with such deals.

Although some market participants raised concerns about the lack of retail investor involvement in the initial wave of follow-on offerings,17 there are also some encouraging signs—for instance, Compass Group’s $2.4bn equity issuance.18

Clearly there are lessons that policymakers can learn from the regulatory and market response to COVID-19, particularly around the impact of more flexible disclosure rules and retail investor involvement.

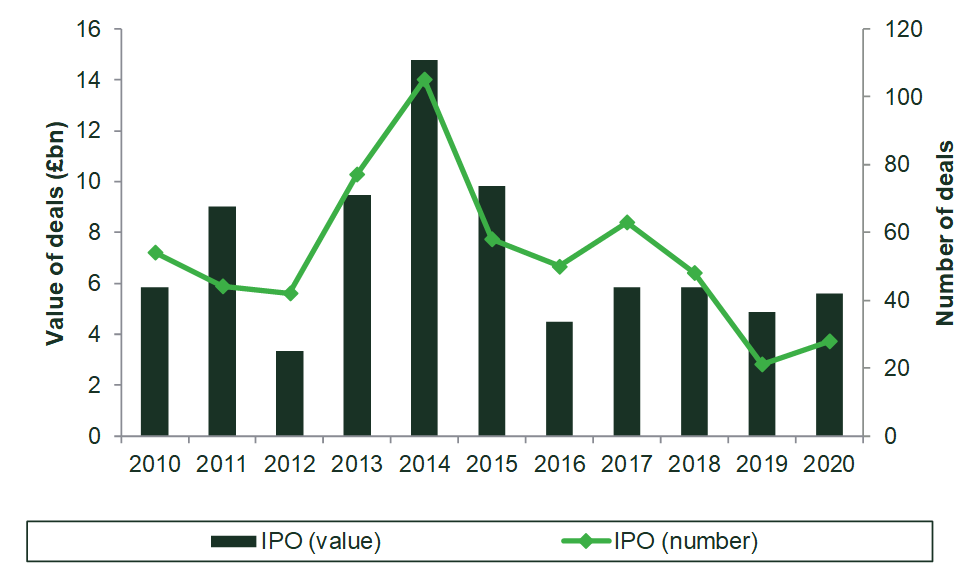

Although the data above highlights the strength of the UK equity market in enabling listed companies to efficiently access additional finance, Figure 6 also shows that UK IPO activity was virtually nonexistent during the first eight months of 2020. IPO volumes on UK exchanges did increase slightly from the end of Q3 onwards, with two large domestic IPOs in September (THG Holdings and Guild eSports).

Was 2020 an anomaly in terms of IPO activity? A certain amount of IPO activity is cyclical, and the numbers of IPOs will vary according to economic conditions. Clearly, the impact of COVID-19 will have caused some companies to postpone or rethink planned listings, and there is a pipeline of companies that have announced plans to IPO in 2021 (such as Dr. Martens and Moonpig in London). However, Figure 6 points towards the continuation of a longer-term trend of stagnating public markets. When placed in the context of the past decade, the value of UK IPOs in 2020 was broadly in line with previous years.

Figure 6 IPO equity issuance on UK exchanges, 2010–20

Source: Oxera analysis of Dealogic data.

Moreover, while there has been a relative rebound in the number of European IPOs in 2020, the increase remains very small when compared to new listing activity in the USA (although many of these are Special Purpose Acquisition Companies (SPACs)) and Asia.

Continued decline?

Despite a small increase in IPOs for some European financial centres in the last few months of 2020, it does not appear that the structural decline in public equity markets is likely to reverse without policy intervention.

Examining the variation in trends across European markets is a helpful starting place for policymakers looking to revive listings. Sweden is one example of a country that has actually increased the number of listed companies. Our interviews with market participants revealed a number of factors behind Sweden’s success relative to other European financial centres, such as the UK. Notable differences between Sweden and the UK relate to use of multi-class shares among listed companies, as well as operating history requirements. It is therefore perhaps unsurprising that these issues have arisen in the context of the UK Listings Review Call for Evidence.19

Other financial centres in the USA and Asia have also demonstrated flexibility in the use of multi-class share structures, as well as openness to innovation around alternative listing mechanisms (such as direct listings and SPACs). If European equity markets wish to remain globally competitive and attractive places to list, it may be that similar flexibility is required.

1 Oxera (2020), ‘Private retreat: are we witnessing the decline of public equity markets?’, Agenda in focus, November.

2 In equity markets, investors meet to buy and sell shares in a firm. An initial public offering (IPO) is where a private company first sells shares to investors on the public market.

3 For example, the UK Listings Review, chaired by Lord Hill, was launched by the UK government on 19 November 2020, and the European Commission published its new action plan for the Capital Markets Union on 24 November 2020. See HM Treasury (2020), ‘Policy Paper: UK Listings Review’, 19 November; and European Commission (2020), ‘Capital markets union new action plan: A capital markets union for people and businesses’, 24 September.

4 Ibbotson, R. G. and Jaffe, J. F. (1975), ‘“Hot issue” markets’, Journal of Finance, 30:4, pp. 1027–42.

5 Lowry, M. (2003), ‘Why does IPO volume fluctuate so much?’, Journal of Financial Economics, 67:1, pp. 3–40; Gao, X., Ritter, J. R. and Zhu, Z. (2013), ‘Where have all the IPOs gone?’, Journal of Financial and Quantitative Analysis, 48:6, pp. 1663–92.

6 SME refers to small and medium-sized enterprises.

7 See section 7 of our report: Oxera (2020), ‘Primary and secondary equity markets in the EU’, report prepared for the European Commission, September.

8 Firms listed on AIM are required to retain an advisory firm (called a Nominated Adviser, or NOMAD) to assist with the admission process and ongoing obligations associated with being listed. See section 5.2 of our report: Oxera (2020), ‘Primary and secondary equity markets in the EU’, report prepared for the European Commission, September.

9 Aquis Exchange (2020), ‘AQSE launches market maker incentive scheme’, Press release, November.

10 OECD (2019), ‘Annual survey of large pension funds and public pension reserve funds’.

11 Pitchbook (2020), ‘European PE breakdown’.

12 Shares without voting rights are prohibited. For companies with multi-class share structures, a 10-to-1 voting rights differential is most typical. See: OECD (2019), ‘OECD Corporate Governance Factbook 2019’; Brett, A. (2019), ‘Assessing control: measuring the alignment between economic exposure and voting power and controlled companies’, MSCI Methodology Paper, April.

13 For example, see Gopinath, S. (2020), ‘Lockdown winners drive Europe’s IPO market to surpass 2019’, Bloomberg, 15 December.

14 See section 4.2 of our report: Oxera (2020), ‘Primary and secondary equity markets in the EU’, report prepared for the European Commission, September.

15 Bank of England (2020), ‘Financial Stability Report ‘, December.

16 Oxera analysis of Dealogic data.

17 All Investors (2020), ‘An urgent call for UK PLCs, industry bodies, regulators, investors, investment banks and the financial ecosystem to protect individual shareholder rights during upcoming capital raises’.

18 Thomas, D. and Mooney, A. (2020), ‘Compass seeks $2bn in biggest fundraising since pandemic began’, Financial Times, 19 May.

19 See: HM Treasury (2020) ‘Call for Evidence – UK Listings Review’, 19 November 2010; QCA (2021), ‘QCA response to the UK Listings Review’, 5 January.

Download

Related

Justice for hire? Opportunities and challenges in third-party litigation funding in competition collective actions

In many jurisdictions, collective actions in competition law have become an important route for consumers and businesses to seek redress. Yet these cases are costly and complex. Third-party litigation funding (TPLF) has emerged as a central mechanism for making them viable. Recent UK experience provides important lessons on the opportunities… Read More

Oxera AI policy map – October 2025

Drawing on Oxera’s combined expertise in digital policy and regulation, as well as in analytics, data science and AI, we have developed a database that tracks key national and supranational AI policy developments across the European Economic Area (EEA) and the UK. This curated collection brings together legal texts, strategy… Read More