Contemporary infrastructure business cases: assessing impact in the round

Recent developments in infrastructure business cases reflect a complex and volatile environment. Writing infrastructure business cases now comes with new challenges—but how can we tackle these challenges in such a rapidly evolving environment? We explore the key points that factor into this, including the Five Case Model, value-based decision-making, uncertainty, nonstationary ‘business as usual’, and monitoring and evaluation.

Some may consider infrastructure business cases to be as grey and solid as the concrete being appraised, but this is not the case. Infrastructure business cases and impact assessments are rapidly evolving to cater for changing circumstances, providing a more complete view of the impacts being assessed.1

International Five Case Model

First, there is the further development of the Five Case Model2 by the UK government, into an international business case method focused on infrastructure that explicitly considers the UN Sustainable Development Goals (SDGs) and inclusive social programs.3 This is an advance on the well-tested version of the Five Case Model that has been used in countries such as the UK, New Zealand and Saudi Arabia—the revised version is now being applied in Indonesia and Colombia.4

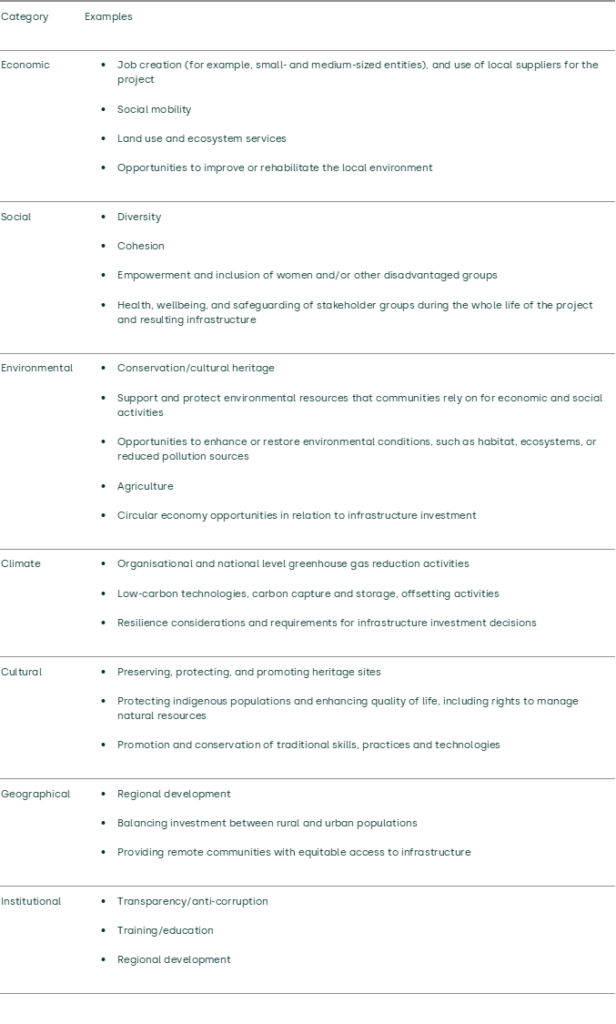

The revised version explicitly considers the wider issues around infrastructure development, including those of sustainable development that include gender, inclusion, decarbonisation, climate mitigation and resilience, and alignment with the SDGs. The full scope of the issues is reproduced in Table 1 below.

Table 1 Wider issues in infrastructure development

Quite apart from this dramatic widening of strategic scope from a purely economic focus, the revised version of the Five Case Model also provides a more granular implementation process, with clear guidelines for the use of workshops and the transition process from one stage to another.

Value-based decision-making

A second development in the standards arena has focused on taking a wider view of the value that infrastructure provides, or sometimes harms. Building on the work by the Construction Innovation Hub in creating the Value Toolkit,5 a new standard has been issued on value-based decision-making in the built environment: BSI Flex 390 v.1.0:2022-06 Built environment – Value-based decision making – Specification. This standard sets out how to create a value-based decision framework, based on the ‘four-capitals approach’,6 (i.e. natural, human, social and produced). The standard defines a process for moving from strategic objectives (given a weighting), to the value framework based on the four capitals. This mapping is then supported by the identification of outcome drivers—i.e. actions that support the strategic objectives by influencing the four capitals.

This eventually leads to a value scorecard of metrics and targets to support the making of decisions in a way that does not only consider financial performance (the fifth capital). Management decisions can be supported throughout the asset lifecycle, namely by confirming need, selecting options, designing of the solution, construction of the asset, and its operation. The value scorecard will find particular use in choosing between options, optimising the selected option, and evaluating tender responses for implementation.

Uncertainty

A further development in business cases has been the need to accommodate uncertainty. ‘Decision-making under uncertainty’ methods have now moved from academia to practical business planning in the England and Wales water sector. As discussed in a recent Agenda article,7 adaptive planning is a cornerstone in the latest price review, PR24, ensuring that expenditure today is aligned with a long-term delivery strategy. The use of ‘real options’8 to support decision-making in adaptive planning seems a natural fit, but the application of the technique is not straightforward to infrastructure, due to the presence of path dependency and the lack of probability-related information in many cases.9

‘Business as usual’ is not static

Increased volatility and acceleration of change may also mean that the implications of the ‘do nothing’ option is unlikely to be that ‘nothing happens’. This will lead to the need to consider both the consequences of the investment (as is usual) and the impact of non-investment (which is often given less attention). It may be that the latter drives the investment decision as much as the investment itself, with a need to avoid obsolescence and falling productivity in a volatile and competitive world.

The business-as-usual state acts as a basis for the appraisal. It is often called the ‘do-nothing option’, though sometimes this is modified to ‘do minimum’, to allow for legally required work. Unsurprisingly, however, most attention is given to the counterfactual, namely the investment that might be made. Different levels of ambition are considered, as well as different delivery models.

It is unusual for so much attention to be paid to the do-minimum option, yet this option can dramatically affect the outcome of the appraisal, as illustrated in Box 1.

Box 1 Rail case study

In the example of a rail line, where its rolling stock and signaling systems are already due for replacement, there is a proposal to upgrade the line to increase capacity. However, this would require expensive new stock and systems for minor gain over the current performance. Compared with a business-as-usual option, the business case for new stock or systems may appear weaker at first sight. But once the business-as-usual option is probed in more detail, then the upgrade could appear to be more attractive.

A strict do-nothing approach could soon require the closure of the line on safety grounds—the economic cost in terms of reduced economic activity would be colossal (this is essentially the reverse of the gain in economic activity arising from opening the line). The social ramifications could, in any case, make this outcome politically infeasible. Even a do-minimum option would lead to a less-extreme version of the above, with declining service levels, leading to declining usage and possible economic contraction. All of this would have the effect of making the proposed investment in new signaling and stock relatively more attractive. Even a decision to interpret business-as-usual to mean ‘maintain current service levels’ could lead to unexpectedly high costs, as the old stock and systems become obsolete, and their supplier becomes reluctant to support them.

This example illustrates that the definition of ‘business as usual’ requires as much thought towards the examination of the counterfactual, as towards the proposed investment.

In summary, any investment appraisal is a comparison between two states, and both deserve equal attention. It is rare that ‘do nothing’ means ‘nothing happens’, even if it is feasible.

Monitoring and evaluation

In infrastructure development, it pays to start with the end in mind. Few doubt the value of monitoring and evaluation (M&E) exercises10 to confirm the validity of the initial appraisal assumptions as part of a process of continuous improvement. However, they often face the problem of limited data. The current edition of the UK Treasury’s Green Book11 on appraisal has a chapter devoted to M&E, so that the activities to support it are planned from the start. The questions to be answered by the M&E exercises are:12

HM Treasury (2022), ‘The Green Book: Central Government Guidance on Appraisal and Evaluation’, p. 72.

- to what extent were outputs delivered and when?

- to what extent were the anticipated outcomes produced and by when?

- what continuing change is expected as a result of the above?

- how well did the process of delivering the outputs and outcomes work?

- were there significant unintended effects?

- what social value was created as defined in the economic dimension?

- what level of confidence can be attributed to the estimates of impact, including social value?

- what was the cost to the public sector as defined in the financial dimension?

In addition to collecting data to answer these questions, the first act of a newly authorised project should be creating a baseline for the status quo, in terms of cost and performance. Further advice on M&E techniques can be found in the Magenta Book.13 Further guidance is published by the World Bank,14 and the United Nations.15

Steering the path

Writing an infrastructure business case now faces new challenges, but these can be tackled if there is an awareness of the new operating environment—therefore avoiding the disappointment of rejection. In regulated industries, a rejection of a business case by the regulator can impact revenue, as an application for an additional cost allowance is refused. Furthermore, in many sectors, a flawed business case could mean that a promising investment is denied funds, or that a low-return or high-risk investment is progressed.

1 For the purposes of this article, the terms ‘impact assessments’ and ‘business cases’ are treated as synonymous. All business cases consider the counterfactual, and hence the impact of investments, and any ‘impact assessment’ of an intervention will weigh its costs and the benefits for society and the environment. The term ‘business case’ tends to be used where there is a substantial financial investment involved, and there is a need to consider the economic use of resources in light of the potential alternative uses.

2 The five cases are: strategic, economic, commercial, financial, and management.

3 Infrastructure and Projects Authority (2022), ‘Infrastructure Business Case: International Guidance’, February.

4 Hill, T. (2021), ‘IPA International and the Global Infrastructure Programme: improving infrastructure project preparation worldwide’, Infrastructure and Projects Authority blog, 15 June.

5 Construction Innovation Hub, ‘Value Toolkit’.

6 A variation on the better known five capitals of natural, human, social, manufactured and financial. Some propose a sixth capital: intellectual capital.

7 Oxera (2022), ‘Adaptive planning for pathways through uncertainty: from theory to practice’, Agenda, November.

8 Real options theory applies the theory of financial options to tangible investments in the ‘real world’.

9 Haasnoot, M., van Aalst, M., Rozenberg, J., Dominique, K., Matthews, J., Bouwer, L.M., Kind, J. and Poff, N.L. (2020), ‘Investments under non-stationarity: economic evaluation of adaptation pathways’, Climatic Change, Springer, 161:3, pp. 451–463.

10 Monitoring is the collection of data, both during and after implementation, to improve current and future decision-making. Evaluation is the systematic assessment of an intervention’s design, implementation and outcomes. Both monitoring and evaluation should be considered before, during and after implementation. See HM Treasury (2022), ‘The Green Book: Central Government Guidance on Appraisal and Evaluation’.

11 HM Treasury (2022), ‘The Green Book: Central Government Guidance on Appraisal and Evaluation’.

12 HM Treasury (2022), ‘The Green Book: Central Government Guidance on Appraisal and Evaluation’, p. 72.

13 HM Treasury (2020), ‘Magenta Book: Central Government guidance on evaluation’.

14 Kusek, J.Z. and Rist, R.C. (2004), ‘Ten Steps to a Results-Based Monitoring and Evaluation System’, The World Bank.

15 Menon, S., Karl, J. and Wignaraja, K.. (2009), ‘Handbook on Planning, Monitoring and Evaluating for Development Results’, United Nations Development Programme.

Related

Investing in distribution: ED3 and beyond

The National Infrastructure Commission (NIC) has published its vision for the UK’s electricity distribution network. Below, we review this in the context of Ofgem’s consultation on RIIO-ED31 and its published responses. One of the policy priorities is to ensure that the distribution network is strategically reinforced in preparation… Read More

Leveraged buyouts: a smart strategy or a risky gamble?

The second episode in the Top of the Agenda series on private equity demystifies leveraged buyouts (LBOs); a widely used yet controversial private equity strategy. While LBOs can offer the potential for substantial returns by using debt to finance acquisitions, they also come with significant risks such as excessive debt… Read More