Different plans, common challenges: national recovery and resilience plans in the EU

Through their national recovery and resilience plans, EU member states have allocated funding to renewables, hydrogen fuel, energy networks, and innovation in the context of energy supply. While the largest countries are taking different approaches to funding, the approval and implementation phase set out by the EU’s Recovery and Resilience Facility is likely to come with some common challenges, including compatibility with EU rules, coordination with national energy policy agendas, and market design issues.

Next Generation EU (NGEU) is the EU’s recent funding mechanism to recover from the COVID-19 pandemic and build a more sustainable and inclusive economy. Within the NGEU, the Recovery and Resilience Facility is expected to allocate grants to member states amounting to €338bn, and loans amounting to €390bn by 2026.1 On 30 April, member states submitted their national recovery and resilience plans to the European Commission, which set out the reforms and investments that will be financed through the RRF. The national plans will be assessed by the European Commission over the next two months and will then require approval from the Council of the EU within a month.

The green transition

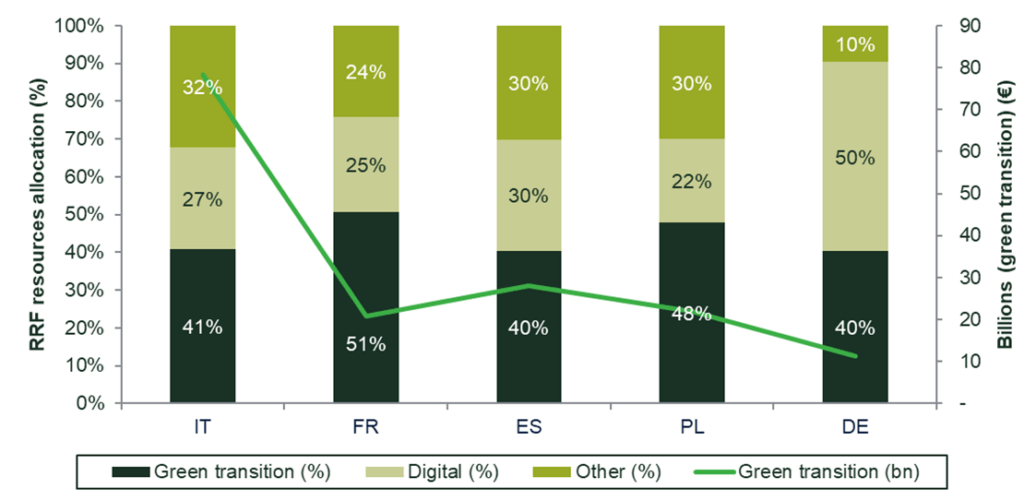

A significant share of the Recovery and Resilience Facility is dedicated to the ‘green transition’. The green transition encompasses a very broad range of measures, including those relating to energy generation capacity, green technologies, biodiversity, energy efficiency, building renovation and the circular economy. At least 37% of Recovery and Resilience Facility (RRF) funding should be dedicated to the green transition,2 and so this represents a key policy priority alongside digitalisation. The following graph shows the composition of funding requests (both loans and grants)3 from the five largest member states,4 focusing on the ‘green transition’ component therein.

Figure 1 RRF resources allocation and ‘green transition’ funding for the five largest EU member states

Within the broader theme of green transition, energy supply and networks play a key role, and represent the focus of the present article. As Oxera’s review of the National Recovery and Resilience plans of Italy, Spain, France, Poland and Germany show, member states appear to have set out different investment priorities to promote the green transition through RRF funding.

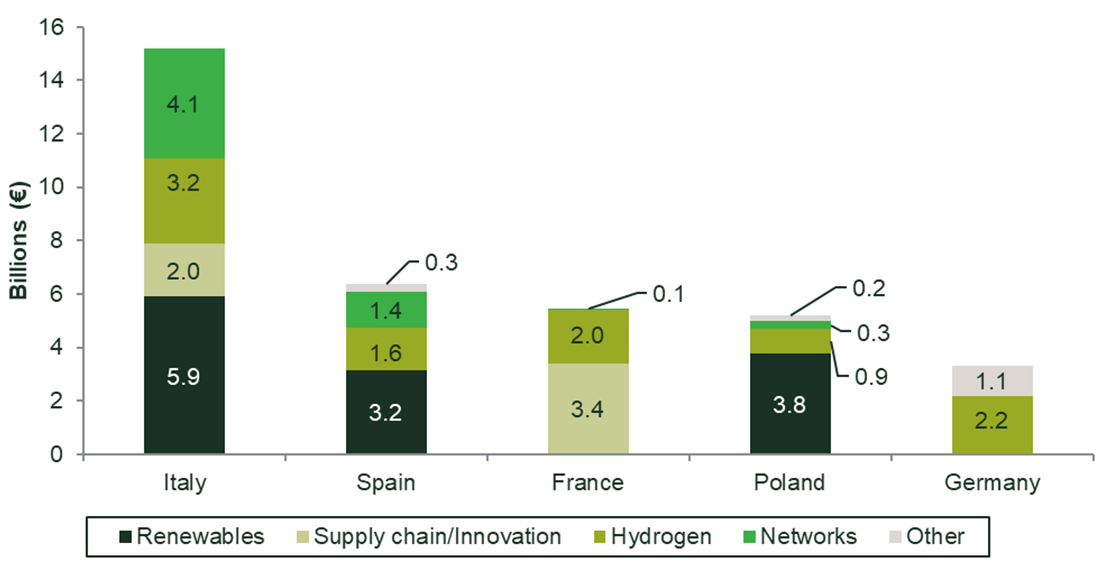

Figure 2 RRF resources (grants and loans) allocated to energy production and networks for the five largest EU member states

Source: Oxera analysis of a selection of National Plans made available by the EU: European Commission (2021), ‘The Recovery and Resilience Facility’.

In order to undertake cross-country comparisons, the process of identifying specific investment areas that are relevant to energy production and networks requires a degree of approximation. For example, some proposed investment projects are relatively broad in scope and can thus overlap between different categories (e.g. hydrogen and innovation) or may include types of expenditure that also relate to other areas within the broader category of the ‘green transition’. Notwithstanding this limitation, our review focuses on investments related to generation (including installing new renewables, promoting the industrial value chain, and hydrogen-specific support), as well as networks. The remainder of the article sheds further light on the national plans of Italy, Spain, France, Poland and Germany.

The Italian plan: a diversified range of interventions5,6

The Italian plan envisages investments of €191.5bn, of which €78.2bn is related to the ‘green transition’.7 €23.78bn is allocated to a specific component called ‘Energy Transition and Sustainable Local Mobility’.8 A portion of that (€15.2bn) focuses on energy production and infrastructure.9

With regards to renewable support, Italy is planning to support a number of clean generation technologies, including distributed generation, offshore production and agrovoltaics,10 with around €5.9bn. Moreover, the RRF will support the development of biomethane plants and the conversion of existing biogas plants into biomethane.

The promotion of hydrogen (€3.2bn) will focus primarily on hard-to-abate sectors (e.g. chemicals and oil refining), with a gradual shift from grey to green hydrogen. Other activities reveal a priority focus on green hydrogen. For example, for production on brownfield sites, the strategy is to produce hydrogen using renewables; for rail transport, electrolysers are expected to be installed near train filling stations.

€4.11bn has been allocated to electricity grids. The first aim is to increase the capacity of distribution grids in order to integrate an additional 4GW of distributed generation from RES, including through smart grids, and provide connection to approximately 1,850,000 consumers. The second aim is to improve the resilience of electricity grids in order to reduce the effects of extreme weather events on the network.

Italy is also planning to support the national supply chain in a number of strategic areas (e.g. batteries, electrolysers and fuel cells, electric buses) with €2bn overall. The objective is to support an Italian supply chain also in order to reduce dependence on imported technologies and generate an impact on GDP. The objectives are quite clear, while the financing instruments, as well as the methods for identifying the private investors involved, will have to be clarified.

The Spanish plan: short-term focus on a wide range of areas11

The Spanish plan, which unlike other member states is focused on a short-term horizon of two years, aims to support and integrate renewables in the energy system (around €3.2bn) and infrastructure (€1.4bn), as well as hydrogen (€1.6bn). In relation to renewables, the plan has committed to putting in place a regulatory framework and eliminates barriers to the deployment of renewables.

For networks, the Spanish plan envisages supporting the industrial development of large-scale storage, digitalisation of the distribution networks, and new business models through direct investments and support schemes. Hydrogen will involve support measures for SMEs and technology centres, large-scale production, and pilot projects. The plan also includes a specific component (‘Just Transition Strategy’, amounting to €300m) to cope with the economic impact of coal mining, nuclear and thermal power plants.

The French plan: hydrogen and technological innovation12

The French plan places a particular emphasis on the fight against climate change due to investments in energy efficiency, sustainable transport and green technologies.

As regards production and networks, a key objective of the plan is to support the development of carbon-free hydrogen and promote innovation in the energy generation value chain. For hydrogen, which will be allocated around €2bn, the government is expecting to finalise relevant auction schemes by 2022. The plan is to develop an annual capacity of electrolysers of 140MW and to support the development of 100,000 tonnes of renewable hydrogen by 2026. Finally, the plan allocates around €3.4bn to provide long-term support for innovation in various forms, including for the development of low-carbon energy.13

The Polish plan: focus on green energy in a challenging context14

Poland is planning to invest considerable resources in green investments, including renewable energy (mainly onshore and offshore wind),15 energy efficiency, smart mobility, and improving the quality of public transport (especially the railways) in order to reduce emissions.16 In relation to energy production, the plan focuses on investing in the hydrogen value chain, supporting the development of offshore generation (infrastructure and wind capacity), and promoting renewables from energy communities.

The Polish plan stresses the challenges associated with the process of coal phase-out and the transformation of key sectors of the economy to a low-emission model. As noted in the plan, dependence on carbon fuels still represents a challenge.17 Therefore, the plan indicates that energy transition is expected to be ‘evolutionary, not revolutionary’.18 A difficult task in the coming years will also be to increase renewable generation while ensuring the security of supply, given that Poland is not expected to introduce nuclear power before 2033, which will strengthen the energy system and reduce emissions.19

The German plan: priority on green hydrogen20

Germany will use the funding provided under the RRF mainly to expand hydrogen research and to facilitate the transition to the hydrogen economy for companies. Central to Germany’s plan is the promotion of integrated hydrogen projects along the entire value chain (i.e. production, infrastructure and use) through collaboration with other EU member states within the framework a so-called ‘Important Project of Common European Interest’ (IPCEI). Carbon contracts-for-differences, alongside investment incentives, are proposed to compensate companies for the higher operating costs of introducing innovative climate-neutral technologies (including renewable hydrogen) during the transition phase. Particular focus will be placed on decarbonising the production process in energy-intensive industries. In addition, the plan will promote research and development into key issues relating to the supply of green hydrogen and the development of climate-efficient and resource-saving production processes. Overall, the Plan is supporting decarbonisation projects with a total of €3.3bn.

Comment: different plans, common challenges

The various national plans show different approaches to allocating funds. While some countries, such as Italy, have diversified their RRF-related investment efforts across different areas, Germany and France appear to have concentrated their efforts on a narrower range of investments.21

The implementation phase of RRF is likely to come with some common challenges.

Indeed, there is still much work to be done to further define some aspects of the plan. For example, to ensure that the green transition is implemented in a cost efficient way and without leading to undue distortions to competition and trade, RRF-funded projects need to be in line with state aid rules. The state aid rules applicable to funding under the RRF, with a special focus on the energy projects proposed by the main beneficiaries under the RRF, is the subject of an upcoming Agenda article.

For energy policy, the RRFs are intended to accelerate the speed of decarbonisation trends across Europe. However, national energy and climate plans are expected to be reviewed to reflect the higher level of ambition set out in the recent agreement on the European Climate Law.22,23 For this reason, further policy action will be necessary to reach climate neutrality.

Finally, the ‘green’ acceleration due to the RRF will pose some broader challenges to networks and energy market players. Going forward, the role of networks will evolve and is expected to play an even more important role in ensuring security of supply and net benefit from digitalisation opportunities, as evidenced by the member states’ plans to invest in smart and resilient grids. On the generation side, it will be important to create a level playing field for new forms of energy (e.g. hydrogen) and to ensure a smooth phasing out of non-renewable energy generation.

1 At current prices.

2 Regulation (EU) 2021/241 of the European Parliament and of the Council of 12 February 2021 establishing the Recovery and Resilience Facility.

3 Within these five member states, Italy (€69bn in grants and €122.6bn in loans) and Poland (€16bn in grants, €20bn in loans) applied for loans within the RRF scheme. The Spanish Government claimed it may consider applying for loans in the future. The loan part for Germany amounts to only 8%.

4 In terms of population.

5 Italian Government (2021), ‘Piano Nazionale di Ripresa e Resilienza’, April.

6 For a review, also see Macchiati, A., Perna, P. and Vitelli, R. (2021), ‘Piano di ripresa, cosa è cambiato sulla transizione energetica’, Staffetta Quotidiana, April.

7 These amounts increase to €204.5bn and €60.78bn respectively including the React-EU facility.

8 An additional €0.18bn will be allocated in the short term for 2021–23 thanks to REACT-EU.

9 The component also focuses on the development of a local sustainable transport, which is beyond the scope of this article.

10 Agrovoltaics involves using the same land for both solar photovoltaic power and agriculture.

11 Spanish Government (2021), ‘Plan de Recuperación, Transformación y Resiliencia’, April.

12 French Government (2021), ‘Plan National de Relance et de Résilience’, April.

13 This component also includes other areas, including circular economy, sustainable transport and mobility.

14 Polish Government (2021), ‘Krajowy Plan Odbudowy i Zwiększania Odporności’, April.

15 Ibid., p. 16.

16 Ibid.

17 Ibid., p. 10.

18 Ibid., p. 175.

19 Ibid., p. 356.

20 German Government (2021), ‘Deutscher Aufbau- und Resilienzplan (DARP)’, April.

21 It should be noted, though, that the RRF funding comes on top of national funding provided to the green transition—for which some member states have more leeway than others.

22 European Commission (2021), ‘Commission welcomes provisional agreement on the European Climate Law’, 21 April.

23 As mentioned for example in the Italian Plan. Italian Government (2021), ‘Piano Nazionale di Ripresa e Resilienza’, April, p. 118.

Download

Contact

Dr Leonardo Mautino

PartnerGuest author

Rebecca Vitelli

Contributor

Related

Download

Related

Blending incremental costing in activity-based costing systems

Allocating cost fairly across different parts of a business is a common requirement for regulatory purposes or to comply with competition law on price-setting. One popular approach to cost allocation, used in many sectors, is activity-based costing (ABC), a method that identifies the causes of cost and allocates accordingly. However,… Read More

The European growth problem and what to do about it

European growth is insufficient to improve lives in the ways that citizens would like. We use the UK as a case study to assess the scale of the growth problem, underlying causes, official responses and what else might be done to improve the situation. We suggest that capital market… Read More