Gender on the agenda: improving inclusivity in competition analysis

The Organisation for Economic Co-operation and Development (OECD) has launched an initiative to explore whether applying a gender ‘lens’ can help deliver more effective competition policy. As surveys are often used to help define markets and assess the impact of mergers, the OECD asked Oxera to assess gender differences in surveys carried out in past competition cases. What differences does our study find, and does gender matter in competition policy?

There is increasing awareness of a ‘gender data gap’ in a range of academic, business and policy areas. The problem arises where policy or business decisions are based on data that has been collected only for men,1 or on analyses of data in the aggregate that do not account for differences between men and women. Competition policy is one such area.

Oxera has contributed one of the seven studies covered by the OECD’s initiative, focusing on the assessment of gender differences in surveys carried out for the purposes of market definition and merger analysis. The full Oxera study is due to be published in summer 2021.

In competition policy, surveys and other analyses that help to define a market or assess a merger are typically analysed in aggregate across genders, thereby overlooking potentially significant differences. If there are differences in these surveys according to gender,2 this may provide valuable insights for competition authorities and practitioners, and would suggest the need for a change in approach.

Oxera’s analysis is carried out on consumer surveys previously undertaken by Oxera and by a number of national competition authorities (NCAs). These surveys covered a diverse set of sectors, products and industries, including sports channels, supermarkets, health insurance, beach holidays, the Internet, retail banking and energy.

Analytical framework

Oxera’s study contributes to the debate around gender-inclusive competition policy by addressing two questions.

- Are there significant differences by gender in consumer behaviour?

- If there are differences, what are their implications for market outcomes and competition policy, and in particular for market definition and merger analysis?

To answer the first question, we assess whether there are significant differences by gender in the key metrics of interest by comparing the proportions of male and female respondents who chose a particular answer. Typically, the key metrics of interest are consumer responses to price changes and consumer diversion to substitutes. If there are significant differences in the responses of male and female respondents, it is important to understand what is driving these differences. In particular, we must determine the extent to which gender, as opposed to other variables (such as age, employment status, income, preferences, and familiarity with the product), influences the responses. Differences in male and female respondents’ preferred retail bank, for instance, might be better explained by age if the women in the sample are on average older than the men.

To isolate the effect of gender, we undertake a logistic regression analysis to understand whether the gender of the respondent significantly affects the likelihood of their giving a particular response,3 while controlling for the effects of other variables.

If the analysis shows that there are significant differences between men and women in terms of consumer behaviour, we need to consider the second question: what are the implications of this for competition cases? This is because the existence of differences in consumer behaviour alone is not a sufficient condition for defining separate markets or concluding that there are different merger effects for men and women.

In this context, it is relevant to test for the ‘toothless fallacy’ highlighted in the United Brands case of 1978.4 In this case, bananas were deemed to constitute a separate market from other fruit because babies and elderly people could not switch to other fruit. However, because it is not possible to differentiate between the ‘toothless’ group and the other group, the real question is whether enough people can and do switch to exert a sufficient constraint on banana prices.

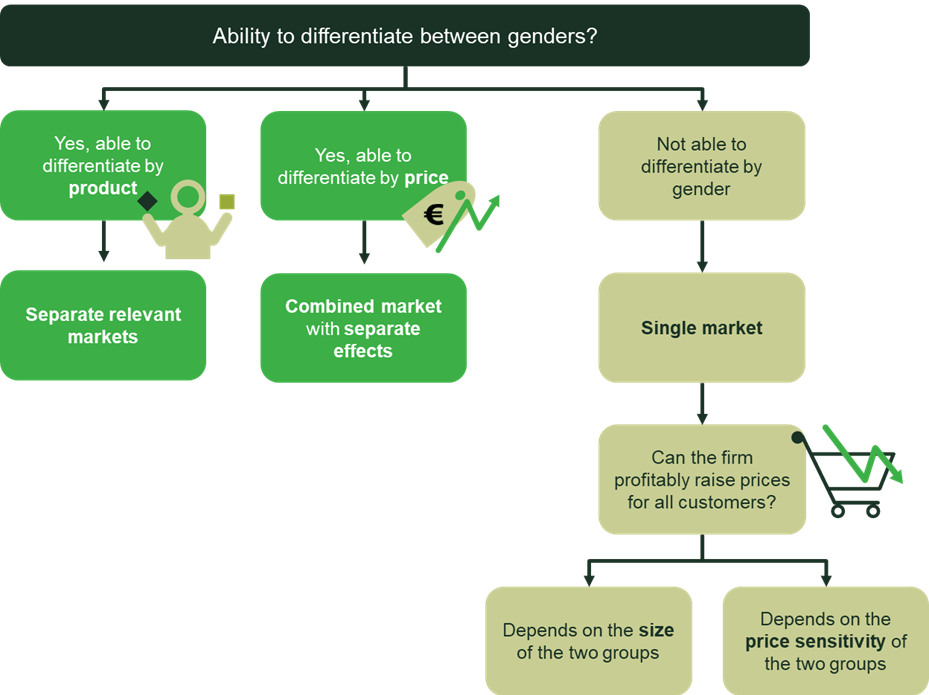

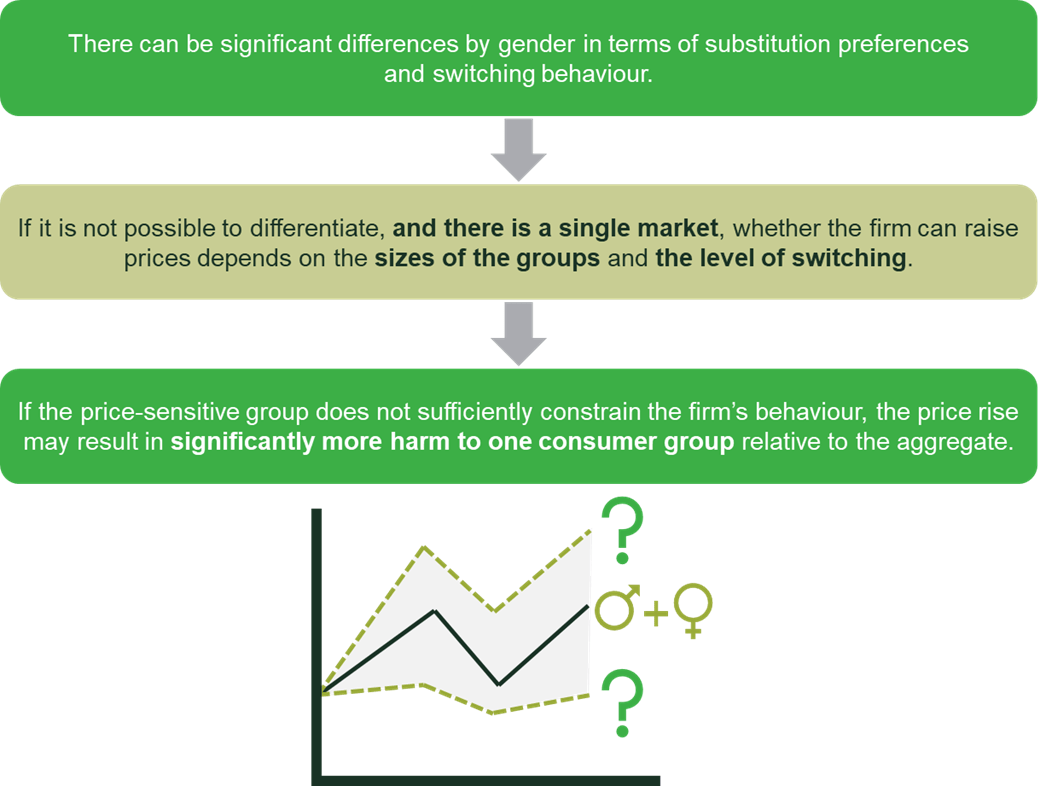

Therefore, the implications of the competition analysis depend on two main factors: the ability of firms to differentiate between consumer groups; and, if that is not possible, how profitable it is to increase prices for all customers (determined by the size of the groups and the level of switching). This is illustrated in Figure 1.

Figure 1 Analytical framework

For instance, firms may be able to sufficiently differentiate their product offering such that switching behaviour between male- and female-targeted products is limited (represented on the left-hand side of Figure 1). In such cases, competition between the two different products is limited or non-existent, resulting in separate product markets. This was found to be the case in the merger between Sara Lee and Unilever (2010), where deodorants for men and deodorants for women were considered to form separate relevant product markets.5

The middle branch of Figure 1 reflects a market in which firms offer identical products to men and women but with differentiated pricing. A firm’s ability to price-differentiate by gender can result in separate effects of a merger for men and women. For instance, imagine that women use only licensed taxi drivers for late-night travel, while men also use other modes of transport. If licensed taxi drivers are able to price-differentiate, they may be able to charge a higher price to women than to men—a hypothetical monopolist licensed taxi driver might increase the price for women who could not use an alternative mode of transport, while the price for men might remain competitive as they could switch away to other modes of transport. In this example, the market may be more narrowly defined, as was the case in the Federal Trade Commission decision in the matter of McWane.6 In any case, in both a single and a separate market, the ability to price-differentiate will result in separate effects for men and women.

If firms cannot product- or price-differentiate between male and female consumers then there is a single market. As shown in the United Brands case,7 the implications of differences in male and female consumer behaviour depend on whether there are enough people to exert a sufficient constraint. For example, women may be protecting men from price increases if the group that would not switch following a price increase (e.g. men) is outweighed (in terms of total sales) by the group that does switch (e.g. women). The extent to which this protection exists depends on two factors: (i) the relative size of each group; and (ii) the level of switching away to other products by the price-sensitive group after a price increase. If the price-sensitive group does not exert a sufficient constraint, the firm can raise prices for all customers. However, there will still be separate effects by gender due to the difference in the level of switching: following the price increase, the price-sensitive group will switch away while the price-insensitive group will pay the higher price.

Below we set out two case studies from our report exploring the differences in consumer behaviour of men and women and the potential effects on market definition and competition.

Case study: supermarkets

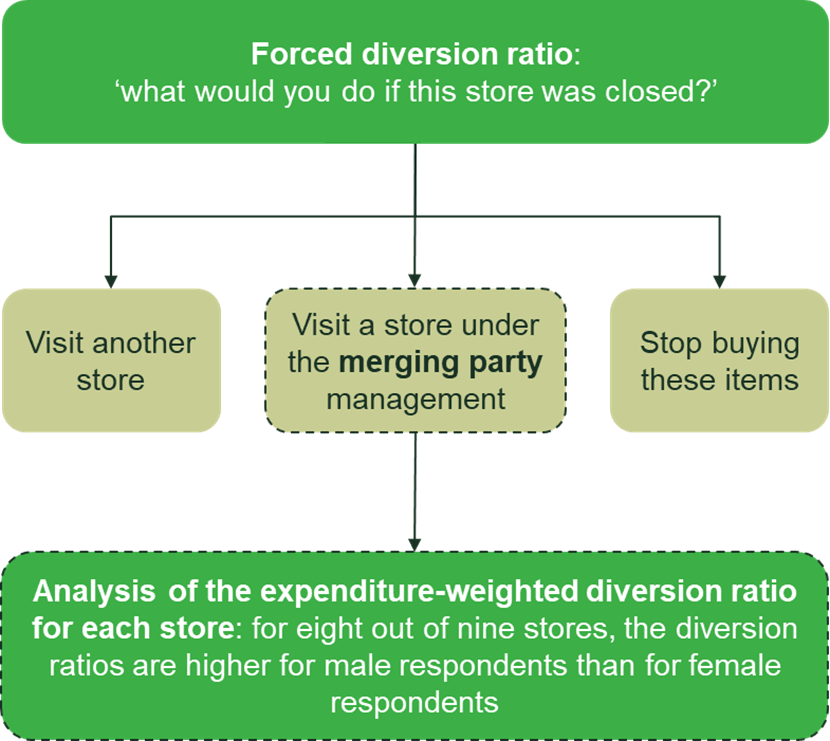

Oxera advised parties involved in the acquisition of a number of stores by a supermarket chain. To inform the merger review proceedings, we designed a consumer survey to assess the closeness of competition of the merging parties’ stores. Based on the results of the survey, diversion ratios were calculated to reveal the extent to which the customers of each merging party saw the other party as a suitable alternative. In this case, the survey assessed ‘forced’ diversion—i.e. diversion following a hypothetical store closure.8

For the current study, we revisited the survey analysis, assessing whether there is a difference in willingness to switch to a store of the other merging party based on gender, and consequently whether there would have been a different conclusion regarding the merger effects had these gender differences been taken into account.

As reported in Figure 2, the study found that, for eight out of nine stores, a higher proportion of male respondents than female respondents indicated that they considered the store of the other merging party to be the closest substitute. For one store, the proportion of diverted value spent was 20 percentage points higher for men than for women (46% for men versus 26% for women). On average across all nine stores, male respondents were significantly more likely to switch to the store of the other merging party.

Figure 2 Willingness to switch to the merging party

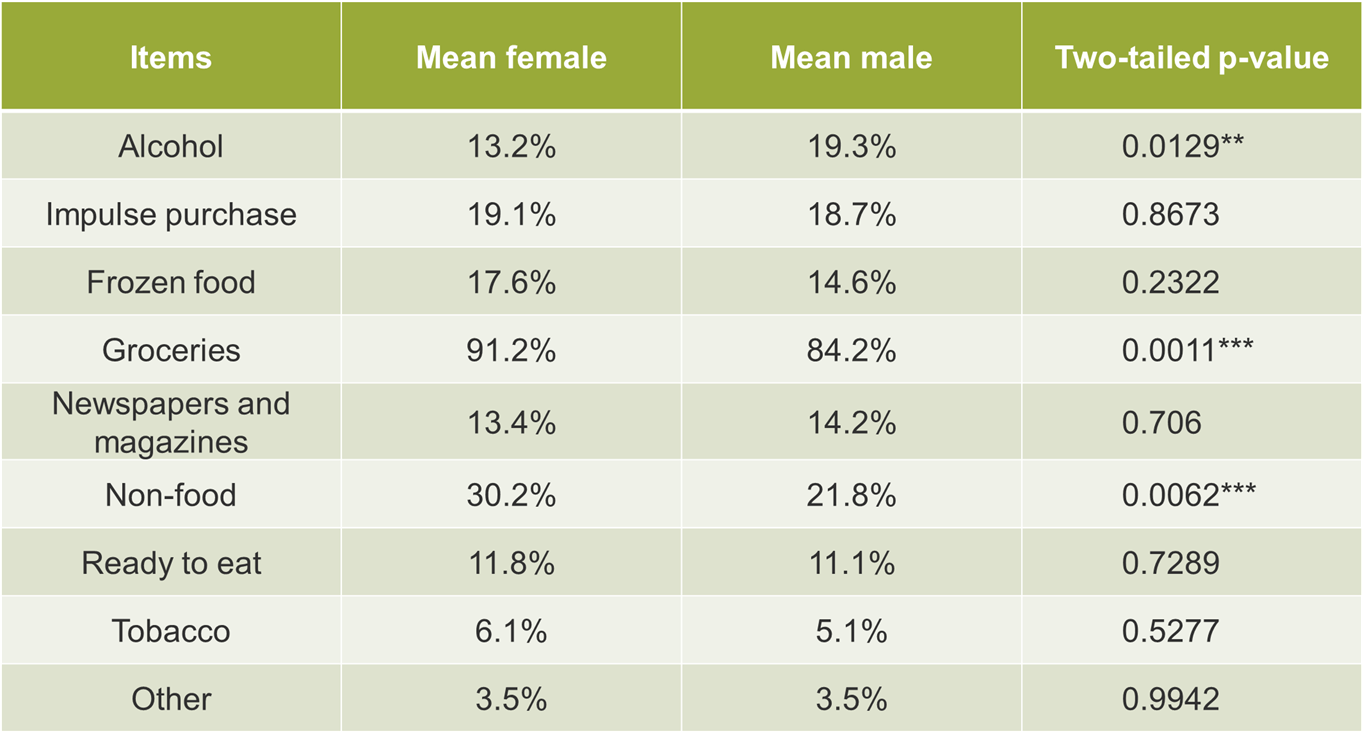

We also found significant differences in the products purchased by men and women. In particular, we found that a larger proportion of women bought groceries (e.g. vegetables, milk, eggs, bread, savoury snacks, canned food and fruits) and non-food household items (e.g. kitchen towel, cleaning sprays, and health and beauty products) than men, while a larger proportion of men bought alcohol (see Table 1 below). These gender differences could have had implications for the effects of the proposed merger.

Table 1 Items bought by the respondents

Source: Oxera analysis, based on survey data.

To understand how gender differences related to the incentives of the merging parties to raise prices, Oxera constructed an illustrative price rise (IPR). An IPR is a price-rise test based on a model of two single-product firms that produce differentiated goods, relying on a number of restrictive assumptions.9 Based on the idea that, before a merger, two competing companies exert a ‘pricing externality’ on each other, and that the merged entity will internalise this effect, the test captures the effects of the merger on the incentive to raise prices. Because of data availability, the study assumes that the merging products/firms are symmetric, in the sense that they have reciprocal diversion ratios and identical margins of 20%.

This analysis shows that the merging parties would have an incentive to raise prices above 10% in one store when it comes to women’s diversion ratios and in three stores when it comes to men’s diversion ratios. In this case, it would have been worthwhile to investigate whether, post-merger, the parties would have an incentive to increase the price of male-targeted products by calculating the male IPRs (using each store’s own margins).

Specifically, differences in the diversion ratios mean that the incentive for the merging parties to make post-merger changes to prices and/or product offerings is likely to differ when considering their male and female customers separately.

We conclude that, if the parties are unable to price-differentiate based on a customer’s gender, male customers will be protected by the female customers’ propensity to switch to other stores, as the size of this consumer group is sufficiently large to uphold price competition.

Case study: package beach holidays

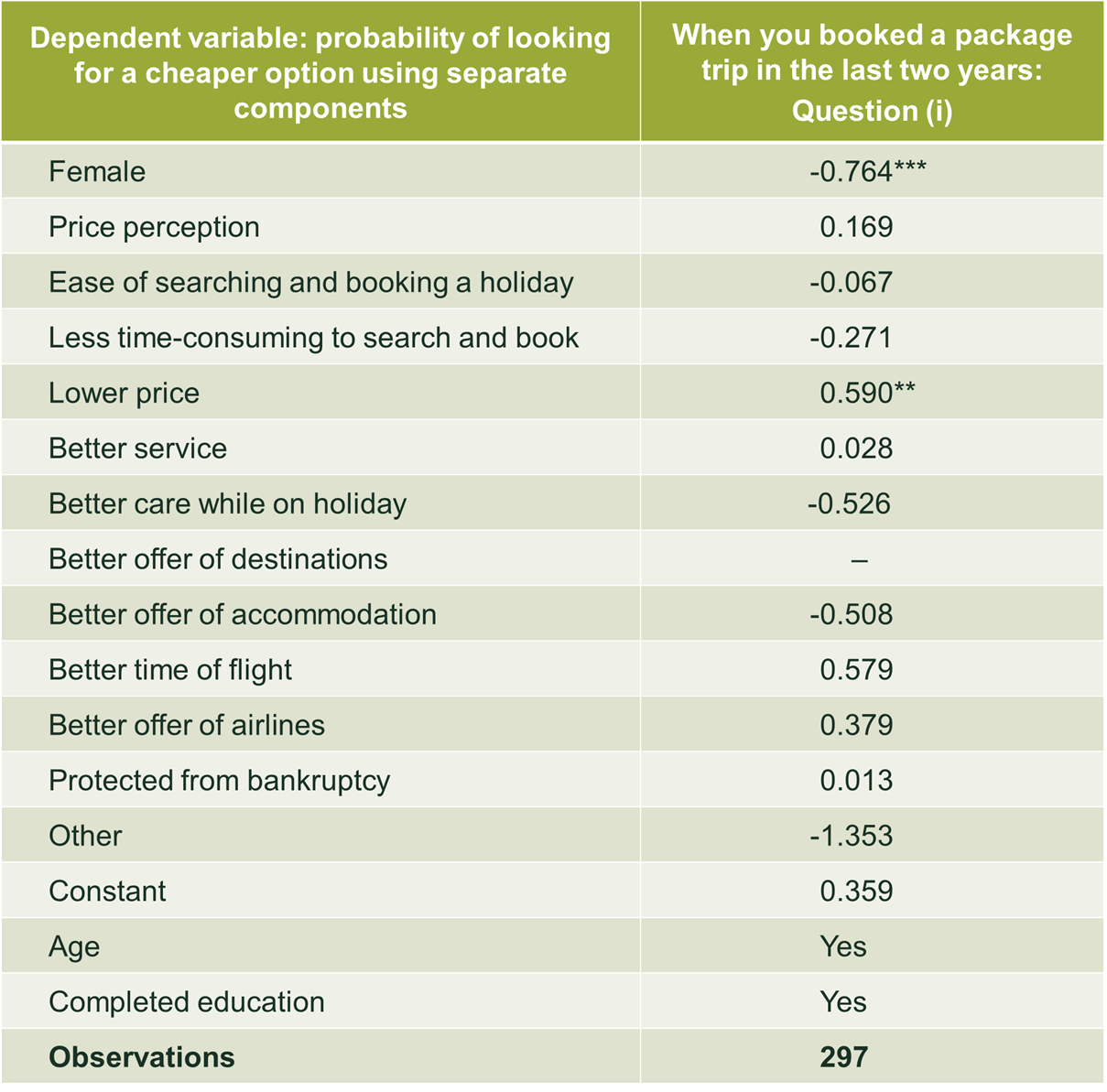

A tour operator notified a European NCA of its acquisition of another tour operator. The parties’ activities overlapped in the market for beach holidays and, in particular, package trips. The NCA conducted a market investigation in order to assess anticompetitive effects on the market for beach holidays resulting from the deal. As part of its investigation, the NCA commissioned a survey. Based on the survey results, it concluded that package trip providers experience competitive pressure from providers of separate components of the holiday package.

When assessing the survey data by gender, we find that the degree of substitutability between package holidays and separate components is significantly different for men and women. The regression results (shown in Table 2) show that, of those respondents who had booked a package trip in the past, being female decreases the probability of looking for a cheaper option, controlling for several demographic factors and individual preferences with respect to product attributes. Specifically, a marginal effects analysis of this regression shows that women are 15.6 percentage points less likely to look at separate components when booking a package trip than men.

Table 2 Package holidays: regression results

Source: Oxera analysis of data received from the NCA.

Differences in substitutability may be explained by significant differences in preferences for a number of product attributes. In particular, the attribute ‘less time-consuming to search and book’ is stated significantly more often as the reason for booking a package trip by women than by men. On the other hand, ‘lower price’ is stated significantly more often by men than by women. Indeed, if the respondent considers the lower price to be one of the most important reasons for booking a package trip, it would make sense for them to compare the price of a package trip with the price of a similar trip using separate components, to make sure that they had found a lower price by booking a package trip.

These differences might provide an incentive for package holiday providers to differentiate based on gender. Using transaction-level data, tour operators may have information on which types of package trip are predominantly booked by women. While, post-merger, men will continue to be able to look for alternatives using separate components, thus constraining package holiday prices, this will typically not be the case for women. As women are less likely to look for a cheaper option consisting of separate components, the merged parties could raise prices for those packages typically booked by women, as diversion to non-package options is limited.

If it is not possible for package providers to differentiate based on gender, the sizes of the two groups should be taken into account. Indeed, the more important female customers are to the package provider’s revenue, the greater the incentive the parties would have following the merger to increase prices of package trips.

Implications for competition policy

Oxera’s analysis of past surveys shows that there can be significant differences by gender in terms of substitution preferences. This could have implications for market definition and the analysis of merger effects.

The ‘toothless fallacy’ is a useful reminder that not all differences between consumer groups necessarily give rise to separate markets. As explored in both case studies, the scope for harm will be influenced by two factors: the ability to differentiate between the two groups and, if differentiation is not possible, how profitable it is for a firm to raise prices for all customers.

In some sectors, there will be at least some scope to differentiate product offerings or prices based on gender, and this could be explored by competition authorities. If it is found that companies target male or female customers specifically, the competition authorities might consider assessing market definition and competition effects according to gender.

As explained above, if firms cannot product- or price-differentiate between male and female customers, the implications depend on the sizes of both groups and the level of switching by the price-sensitive group after a price increase.

The larger a group of potential consumers, the more weight it should receive in the overall assessment of the merger or conduct. If, for instance, the group of women that would be interested in buying the product is larger (or they buy a higher volume) than the group of men, the purchasing decision of women will have a greater impact on the sales and profit of the firm in question, and women will therefore exert a sufficient constraint on the firm to prevent it from raising its prices.

It should be remembered that there may be a difference between the proportions of men and women in the total population and the proportions in the relevant product market (i.e. the pool of all potential consumers). It might be that a certain product is bought more by women than by men. Therefore, when testing and correcting for representativeness of the survey sample, or in the interpretation of the responses, it might not make sense to adhere to the distribution in the total population. Instead, it might be more appropriate to make sure that the sample is weighted to be representative of the relevant customer base.

We should also be aware that the consumers who are currently active in a market do not necessarily represent the entire potential market. If, for example, women are more price-sensitive than men for a given product, an artificially high price (due to a lack of competition) could skew the proportion of women left in the market. The current consumer base might therefore not be representative of the distribution of the population of the product market. Survey screening questions can help to identify the demographics of the relevant market.

In addition, there is the level of switching, especially by the price-sensitive group, after a price increase. The level of switching can be informed by the consumer survey. By considering the level of switching after a price increase of 5–10%10 and combining that with the size of the price-sensitive group, compared with the non-price-sensitive group, the competition authority can determine whether a price increase for all consumers would be profitable. If the price increase would be unprofitable due to the loss of price-sensitive consumers, the price-sensitive group would protect the price-insensitive group.

Figure 3 Potential effects without price or product differentiation

If the price-sensitive group cannot exert sufficient constraint to prevent the firm from raising prices, this will result in separate effects for the two groups: the price-sensitive group will switch away, while the price-insensitive group will pay a higher price.

Figure 3 below summarises these potential effects. These could influence the response by the competition authorities.

Oxera’s study demonstrates that there can be significant differences in behaviour by gender, and describes various mechanisms through which these differences can have an effect on market definition or lead to different merger effects. It would therefore be advisable for a competition authority to investigate whether the retailers in a potential merger or abuse of dominance case would be able to differentiate their offering based on gender. If it is found that they could do so, a competition authority could assess the implications for market definition and merger effects. If the firms are not able to do so, the competition authority could assess whether one group is large enough to protect the other against adverse competitive effects.

1 Criado Perez, C. (2019), Invisible Women: Exposing Data Bias in a World Designed for Men,Vintage.

2 The term ‘gender’ is generally used to describe the characteristics of women and men that are socially constructed, while ‘sex’ refers to those characteristics that are biologically determined. These two terms have often been used interchangeably and treated as concerning a male–female binary. Because we analyse past surveys, we are limited to the binary gender categories used in those surveys.

3 A logistic regression is a statistical model that is used to predict the probability of the occurrence of a certain event.

4 Case 27/76 United Brands v Commission [1978] ECR 207; [1978] 1 CMLR 429.

5 European Commission (2010), Case No COMP/M.5658 – UNILEVER/SARA LEE, 17 November.

6 The Federal Trade Commission indicates that it is proper to define a narrow relevant market that is limited to price-insensitive customers when the firm is able to identify customers with sufficiently inelastic demand and charge them higher prices. See Federal Trade Commission (2014), McWane, Inc. – WL 556261, Docket No. 9351, 30 January.

7 Case 27/76 United Brands v Commission [1978] ECR 207; [1978] 1 CMLR 429.

8 Oxera (2009), ‘Diversion ratios: why does it matter where customers go if a shop is closed?’, Agenda, February.

9 See Oxera (2013), ‘Soaps, groceries and app stores: extending merger price-rise analysis’, Agenda, May.

10 Here we take the 5–10% from the SSNIP (small but significant non-transitory increase in price) test in the context of determining the relevant market. If the case at hand is a merger, the competition authority could use the percentage of the price increase that, for instance, followed from a merger simulation model.

Download

Contact

Lola Damstra

Senior ConsultantContributors

Related

Download

Related

Future of rail: how to shape a resilient and responsive Great British Railways

Great Britain’s railway is at a critical juncture, facing unprecedented pressures arising from changing travel patterns, ageing infrastructure, and ongoing financial strain. These challenges, exacerbated by the impacts of the pandemic and the imperative to achieve net zero, underscore the need for comprehensive and forward-looking reform. The UK government has proposed… Read More

Investing in distribution: ED3 and beyond

In the first quarter of this year the National Infrastructure Commission (NIC)1 published its vision for the UK’s electricity distribution network. Below, we review this in the context of Ofgem’s consultation on RIIO-ED32 and its published responses. One of the policy priorities is to ensure… Read More