High time for hydrogen: establishing a hydrogen value chain in Europe (part 1)

Across Europe and around the world, hydrogen is gaining traction as a low-carbon solution to our energy and transport needs. This is the first of two articles investigating the key strategic developments for hydrogen in the EU and the UK, and identifying the potential regulatory challenges that accommodating a hydrogen transition might entail. In this article, we introduce the hydrogen value chain and examine some upstream production issues. The second article will focus on the midstream (storage and transportation) and downstream (usage) elements of the value chain.

Hydrogen is emerging as a low-carbon resource in Europe and worldwide, especially for the transport and heating sectors. At the EU level, the European Commission published its EU hydrogen strategy1 and EU Energy System Integration Strategy in July 2020,2 which provides a direction of travel for policy and the regulatory support of hydrogen. Shortly afterwards, in August 2021, the government published a comprehensive UK Hydrogen Strategy,3 in which it set out the main objectives and financial commitments for the development of renewable and low-carbon hydrogen in the UK.

For the EU hydrogen strategies, we focus in this article on the EU-level policies and the member state-level implementations in Germany and Italy, as both countries have already introduced their national hydrogen strategies.

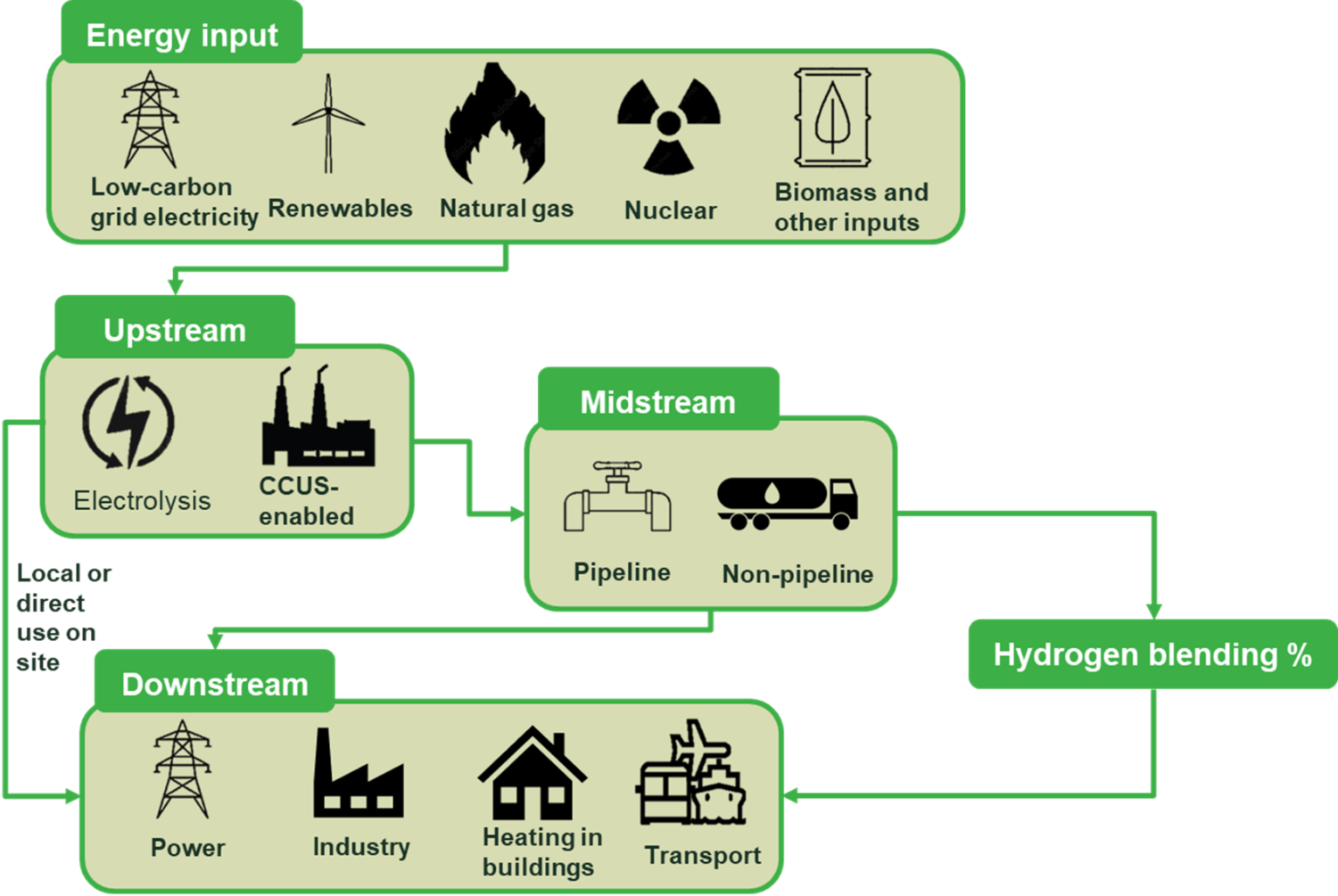

The hydrogen value chain

The hydrogen value chain can be broadly categorised into three parts.

- Upstream—the production of hydrogen. The large majority of hydrogen produced today (about 95%)4 comes from fossil fuels, which, without mitigative measures such as carbon capture, will not meet the carbon-neutral requirements set out in the EU and UK strategies. According to estimates by the International Renewable Energy Agency (IRENA), only around 5% of hydrogen produced today is green hydrogen (i.e. generated as a by-product of chlorine production through electrolysis).5 The International Energy Agency (IEA) estimates that only 0.1% of total hydrogen production today derives from water electrolysis, which is the most common method for green hydrogen production using renewable power sources.6

- Midstream—the storage and transportation of hydrogen. Since hydrogen is highly flammable, it takes up a lot of space and often requires blending with natural gas to safely distribute using existing gas pipelines (e.g. for heating purposes, as one potential use case that is being developed). Currently, hydrogen is distributed through pipelines (for large volumes and long distances), liquefied hydrogen tankers (for smaller volumes and long distances), or high-pressure tube trailers (for shorter distances). Ongoing trials and experiments in Europe and the UK are testing the commercial viability of blending hydrogen with natural gas and distributing using the existing gas networks.7

- Downstream—the usage of hydrogen. While most of the ‘grey hydrogen’ (where excess carbon dioxide created during the production of hydrogen is not captured) produced today is used as a feedstock or as a by-product of other industrial processes, both the EU and the UK strategies envisage other use scenarios for carbon-neutral hydrogen. These uses include electricity generation, heating, and fuelling different modes of transportation (e.g. heavy-goods vehicles, buses, trucks, maritime shipping and aviation).

Figure 1 The hydrogen value chain

Source: Adapted by Oxera from Figure 2 of HM Government (2021), ‘UK Hydrogen Strategy’, August.

Across Europe, governments and regulators have identified carbon-neutral hydrogen as a critical source of energy for meeting net zero targets. For example, in the UK, hydrogen is considered to be an attractive solution for the ‘hard to electrify’ industrial sectors.8 At the EU level, hydrogen is seen as a priority to achieve the European Green Deal and Europe’s clean energy transition.9

However, the production, distribution and downstream appliances that enable the use of hydrogen in heating and transport are largely immature today. Across all parts of the supply chain, hydrogen still needs to be developed for commercial use at large scale.

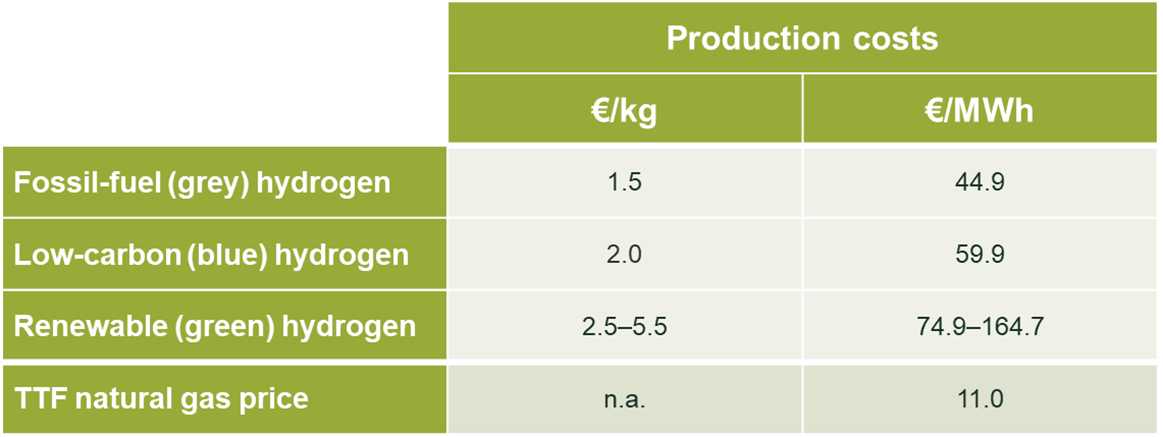

Upstream: producing low-carbon and renewable hydrogen at a low cost

The production of low-carbon and renewable hydrogen is a condition for meeting long-term emission-reduction targets. Three colours are commonly used to distinguish the production processes for hydrogen. Low-carbon (‘blue’) hydrogen can be produced by integrating CCUS technologies into the production process of traditional fossil fuel-based hydrogen. Renewable (‘green’) hydrogen is produced through the electrolysis of water in an electrolyser, powered by electricity from renewable sources. These technologies have yet to reach commercial maturity and deployment at a large scale, with costs significantly higher than the traditional fossil-fuel-based (‘grey’) hydrogen for the production of which carbon is not captured. The indicative cost difference is shown below.

Table 1 EU estimates of current hydrogen production costs

Source: Barnes, A. and Yafimava, K. (2020), ‘EU Hydrogen Vision: regulatory opportunities and challenges’ p. 5; European Commission (2020), ‘A hydrogen strategy for a climate-neutral Europe’, ‘TTF Gas Year 20’, 30 July; and ICIS (2020), ‘Gas In Focus’, 31 July.

However, the cost of renewable hydrogen is expected to drop significantly in the coming years, and to be competitive with natural gas by 2050 in most parts of the world on an energy-equivalent basis (i.e. production costs per MWh). The expected cost reduction is projected to be mostly driven by the reduced cost and increased availability of electrolysers. To put this in context, , according to a recent report on the hydrogen economy by Bloomberg New Energy Finance, between 2014 and 2019, the cost of electrolysers produced in North America and Europe had already fallen by 40%, and this trend is expected to continue.10 In fact, the EU hydrogen strategy has highlighted that in regions where renewable energy is cheaper, electrolysers are expected to be able to compete with fossil-based hydrogen as early as 2030.11

The UK hydrogen strategy diverges from the EU strategy on the technological priorities for hydrogen production. Specifically, the UK has committed to a ‘twin track’ approach, supporting both low-carbon and renewable hydrogen. In the shorter term, the deployment of CCUS-enabled hydrogen capacity is expected to deliver cost-effective low-carbon hydrogen production at scale, while driving investment across the value chain and facilitating the development of hydrogen technologies to reach the stage of commercialisation. As a strategic commitment, in May 2021, the Department for Business, Energy and Industrial Strategy (BEIS) already initiated CCUS Cluster Sequencing, a process that determines the natural sequence for locations to deploy CCUS. This aim is to identify at least two CCUS clusters12 for deployment in the mid-2020s. In the longer term (from the mid-2020s onwards), the scale of production for electrolytic hydrogen in the UK is expected to ramp up, as the costs of electrolysers decrease further.

In contrast, the immediate priority for the EU is to develop renewable hydrogen, with low-carbon hydrogen serving as a transitionary technology in the shorter term. This difference in relative priorities is reflected by the EU’s goals for hydrogen generation capacity(6GW by 2024 and 30GW by 2030), which focus exclusively on renewable hydrogen electrolysers. Indeed, the EU also highlighted the risks of stranding for low-carbon hydrogen assets, which further demonstrates that, compared to low-carbon hydrogen, renewable hydrogen is expected to play a far greater role in achieving the EU Green Deal and Europe’s transition to clean energy in the long run. This strategic focus is echoed in the national strategies published by member states. For example, the German federal government, in its National Hydrogen Strategy published in June 2020, stated that it believed that only renewable hydrogen is sustainable in the long term.13 Similarly, the Italian government has published plans to prioritise the production of renewable hydrogen in brownfield sites (defined by the Italian government as ‘hydrogen valleys’); renewable hydrogen use in hard-to-abate industries;14 and the development of industrial plants for the production of electrolysis and use in the transport sector.15

The divergence of hydrogen production strategies is most likely driven by both the projection of commercial viability timelines of green hydrogen, as well as the government and public perception of the CCUS technologies. For example, in Germany, where more than half of the total electricity supply is generated from renewable sources, there could be more surplus renewable energy for the production of green hydrogen, potentially resulting in lower costs. Negative public sentiment towards CCUS technologies also played a significant role in downplaying the prospects for blue hydrogen in Germany.16 In contrast, the UK generally has a more favourable view of CCUS.17

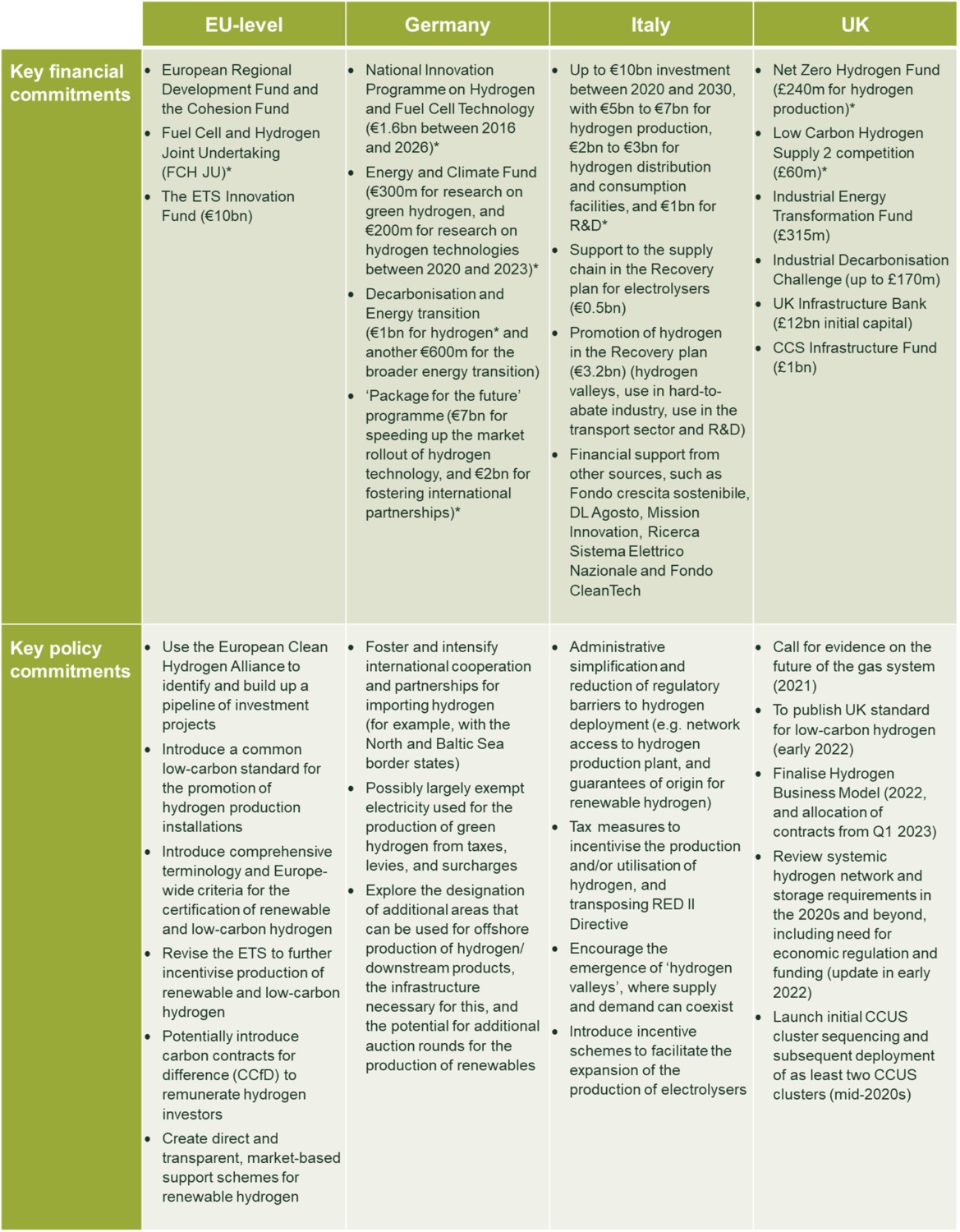

To achieve these ambitious strategies for low-carbon and renewable hydrogen, a supportive policy framework for scaling up production is required, particularly in the early stages while the technology is immature, demand is uncertain and costs are higher than for grey hydrogen. Table 2 below details the policy and financial commitments for hydrogen technologies set out by the EU (including national commitments by Germany and Italy) and the UK. While the focus and magnitude of the financial commitments vary across jurisdictions, the policy commitments are largely at the initial review and consultation stages for all jurisdictions. No detailed business cases are defined and finalised.

Table 2 Financial and policy commitments relating to the production of hydrogen

Source: European Commission (2020), ‘A hydrogen strategy for a climate-neutral Europe’, 8 July; German federal government (2020), ‘The National Hydrogen Strategy’, June; Ministero dello sviluppo economico (2020), ‘Strategia Nazionale Idrogeno Linee Guida Preliminari’; Italian government (2021), ‘Piano Nazionale di Ripresa e Resilienza. Part 2: Description of reforms and investments – Component M2C2’; and HM Government (2021), ‘UK Hydrogen Strategy’, August.

The policy strategies set out at the UK and EU levels will be followed by a new phase that will be critical to ensure that the initial commitments and objectives will be achieved. In the UK, the government has set initial goals to establish at least one large-scale CCUS-enabled industry cluster and to scale up the electrolytic production of hydrogen by the mid-2020s. The development of the dedicated regulatory and legal framework for hydrogen is also expected during the same period.

At the EU level, EU initiatives (e.g. the ongoing revision of the renewable energy Directive, ‘RED II’) and measures by individual country governments (e.g. reform commitments following the Recovery Plan to incentivise production and innovation) will be crucial to ensure that the right investment incentives are in place. In particular, RED II extended the EU-wide certification system for renewable fuels to include hydrogen, and the newly proposed EU ETS scheme plans to include hydrogen produced with electrolysis—allowing renewable and low-carbon facilities to receive free carbon allowances. At this stage, how hydrogen is included in the EU ETS and how hydrogen production is subsidised remain to be seen. The state subsidies could be coordinated through the state aid framework for Important Projects of Common European Interest (IPCEI). For example, France, Germany, Portugal and the Netherlands have already expressed their intention to coordinate efforts on the development of renewable hydrogen under an IPCEI.18

The evolving developments for the production and use of hydrogen mean sound economic and financial analysis will need to be applied in ensuring that the new policies, such as those relating to the design of the hydrogen market and the potential CCfD schemes,19 are implemented in a cost-efficient way, promoting private investments while also ensuring that consumers and taxpayers get the best value for money.

1 European Commission (2020), ‘A hydrogen strategy for a climate-neutral Europe’.

2 European Commission (2020), ‘Power a climate-neutral economy: An EU Strategy for Energy System Integration’.

3 HM Government (2021), ‘UK Hydrogen Strategy’, August.

4 International Renewable Energy Agency (2021), ‘Hydrogen from Renewable Power’.

5 Ibid.

6 International Energy Agency (2019), ‘The Future of Hydrogen: Seizing today’s opportunities’, Report prepared by the IEA for the G20, Japan, June.

7 For example, the UK government is conducting an indicative assessment of the value-for-money case for blending up to 20% hydrogen into the existing gas network by late 2022. See HM Government (2021), ‘UK Hydrogen Strategy’, August, p. 60.

8 HM Government (2021), ‘UK Hydrogen Strategy’, August, p. 7.

9 European Commission (2020), ‘Powering a climate-neutral economy: An EU Strategy for Energy System Integration’, 8 July, p. 5.

10 Bloomberg New Energy Finance (2020), ‘Hydrogen Economy Outlook: Will Hydrogen Be the Molecule to Power a Green Economy?’, 30 March.

11 European Commission (2020), ‘Power a climate-neutral economy: An EU Strategy for Energy System Integration’, p. 5.

12 An industrial cluster is a geographic area where companies (hence industrial energy consumers) from a single or multiple industries are co-located.

13 German federal government (2020), ‘The National Hydrogen Strategy’, June, p. 2.

14 These include the cement, paper, ceramic and glass industries.

15 Italian government (2021), ‘Piano Nazionale di Ripresa e Resilienza. Part 2: Description of reforms and investments – Component M2C2’, section 3.1, ‘Production of Hydrogen in brownfield sites (Hydrogen Valleys)’.

16 For example, see Appunn, K. (2021), ‘German industry urges new debate on carbon capture, storage and utilisation’, Clean Energy Wire, 15 April.

17 For example, see HM Government (2021), ‘UK carbon capture, usage and storage’.

18 For example, see German federal government (2020), ‘The National Hydrogen Strategy’, June, p. 25.

19 For example, see Oxera (2020), ‘Making a difference: supporting investment in low-carbon electricity generation’, Agenda, October.

Related

Future of rail: how to shape a resilient and responsive Great British Railways

Great Britain’s railway is at a critical juncture, facing unprecedented pressures arising from changing travel patterns, ageing infrastructure, and ongoing financial strain. These challenges, exacerbated by the impacts of the pandemic and the imperative to achieve net zero, underscore the need for comprehensive and forward-looking reform. The UK government has proposed… Read More

Investing in distribution: ED3 and beyond

In the first quarter of this year the National Infrastructure Commission (NIC)1 published its vision for the UK’s electricity distribution network. Below, we review this in the context of Ofgem’s consultation on RIIO-ED32 and its published responses. One of the policy priorities is to ensure… Read More