How do policymakers make the climate transition just?

Many different organisations, including the European Commission, the United Nations and the International Labour Organization (ILO), have expressed a desire to ensure that decarbonisation involves a ‘just transition’.1 The organisations have often focused on the ‘workers’ rights’ element of the transition, without giving other aspects of a just transition the same level of consideration. In this article, we identify these other aspects and, in particular, we explain why current methods of funding decarbonisation are often ‘regressive’ rather than ‘progressive’.

Intuitively, it would seem that a just transition aims to ensure that fundamental changes, such as decarbonisation, occur in a way that is ‘fair’ to all stakeholders (workers, consumers, businesses, investors, and the like). However, in the context of the climate transition, the term ‘just transition’ is often used in relation to the aim of ensuring that workers in sectors that will be significantly and adversely affected by decarbonisation (hereafter ‘affected sectors’), such as coal, gas and oil, are not ‘left behind’.2

While it is important for a just transition to mitigate the adjustment costs to workers and communities in the affected sectors, it is also important that the term becomes associated with a number of other ‘fairness’ challenges relating to decarbonisation. These include, for example:

- implications for gender equality in developing countries;

- the extent to which wealthier countries should subsidise the transition for poorer countries;

- concerns over the treatment of workers in upstream mineral-extracting processes needed to produce renewable technologies;

- how to ensure that the costs of technologies, such as electric vehicles and heat pumps, remain affordable.

As it is not possible to cover all of these issues in this article, we focus on explaining the traditional, worker-oriented, definition of a just transition (given that this is the context in which the term is most commonly applied), before discussing why current approaches to funding the climate transition (i.e. surcharges to consumer bills) are often regressive.3

Workers and communities in affected sectors

Decarbonising the economy is widely considered to be necessary and justified due to the significant costs and harm that climate change will impose on future generations, and because the countries likely to be most affected by the effects of climate change tend to be poorer. The challenges of achieving a just transition do not provide good reasons not to decarbonise, but rather emphasise why some transition pathways and policy tools should be preferred over others.

Decarbonising the economy requires moving away from high-polluting sectors such as coal, gas and oil towards low-polluting sectors such as renewable energy and hydrogen. The structural change in employment associated with this shift has occurred previously many times, whenever technological progress or policy has resulted in the obsolescence of one technology in favour of another. In the present case, decarbonisation will tend to lead to workers in high-polluting sectors, over time, losing their current jobs.

In many cases, jobs in the affected sectors tend to be concentrated in particular regions (for instance, there are many coal and lignite mining and generation jobs in the Ruhr region of Germany). The purpose of a just transition, in the context in which the term is commonly applied, is to ensure that both the individuals and the communities that are dependent on these sectors are retrained in order to obtain work in the new decarbonised industries that will replace the affected sectors.

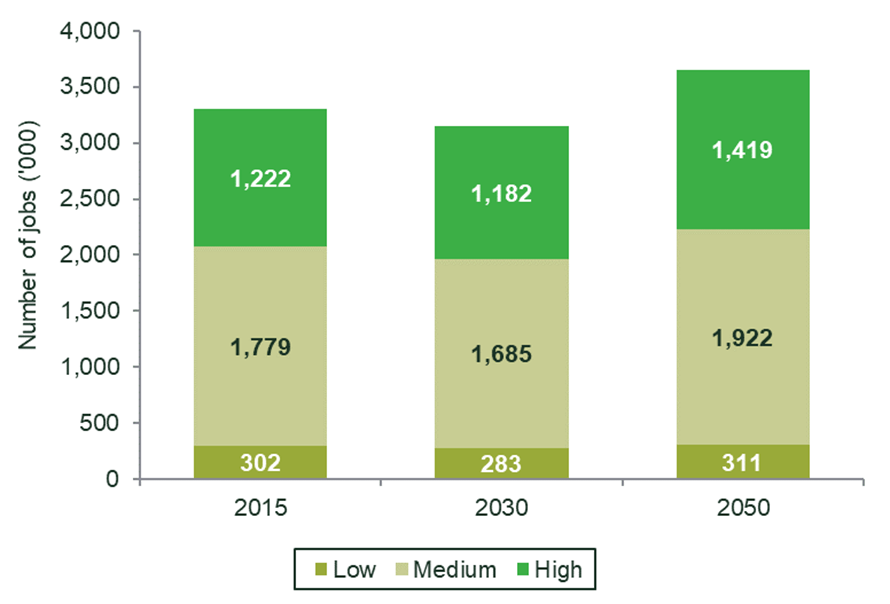

According to analysis undertaken by the European Commission, the climate transition should not result in net job losses because, on average, renewables activities are more labour-intensive than their fossil-fuel counterparts.4 Figure 1 below shows that the total number of energy-related jobs is projected to increase in the future, primarily as a result of an increase in the number of highly skilled jobs, when low-carbon technologies are more prevalent. Importantly, it also shows that there is no significant reduction in low-skilled jobs, meaning that the least well off (who are likely to be employed in these jobs) should still be able to find employment suited to their skills in a decarbonised world. In other words, while the transition for workers will require them to learn new skills, these are unlikely to be considerably more difficult than those that they have had to acquire for their current jobs, which should enable a smoother retraining process.

Figure 1 Projected evolution of the number of low-, medium- and high-skilled energy jobs in the EU

Source: European Commission (2018), ‘A technical analysis on decarbonisation scenarios – constraints, economic implications and policies’, p. 24.

It is likely that countries that promote a climate transition earlier rather than later will benefit more than those that wait.5 This is because the countries that act early are more likely to create climate-related industries within their countries. Such thinking is implicit in, for example, the UK government’s requirements for renewable developers seeking government support to ensure that 60% of their supply chain is UK-based.6

The literature on creating a just transition for workers outlines three elements that policymakers should consider when designing their decarbonisation policy.

- Collaboration between national and regional stakeholders.7 In order to engage in a location-specific approach and spend money effectively, as outlined below, national organisations such as governments and large corporations need to collaborate with local stakeholders such as local governments and smaller companies. It may be the case that countries with more decentralised government structures can perform this more effectively than those with more centralised government structures.

- A location-specific approach.8 Affected sectors are likely to be located in specific regions, and the industries located in one area may not be the same as those in another. For example, the Ruhr region in Germany is highly dependent on heavy industry, while Stavanger in Norway has many oil and gas jobs. The workers in one location may not have the same skills as those in another, and may therefore be better suited to retraining for roles in different sectors.

- A willingness for governments to spend money and collaborate with workers.9 Retraining workers will cost money, and the workers themselves may be unwilling or unable to spend it themselves. Governments can retrain workers by funding training programmes, but the nature of these programmes could be discussed with workers’ organisations before being implemented. An example of such a programme is in Schweinfurt Bavaria, where the Bavarian Metalworkers Union (IG Metall) and Friends of the Earth in Bavaria (BUND) collaborated in order to identify how local workers could best-transition to roles in the low-carbon economy.10

Impacts on consumers

Despite the focus on workers’ rights, there are also other aspects of decarbonisation that have implications for a just transition. In this section, we focus on one of these: the impact of a regressively funded climate transition on consumers.

Why is the funding of the climate transition often regressive?

The climate transition will be expensive, with the European Commission estimating that between now and 2030, an additional €480bn will need to be invested each year to meet its climate targets.11 This expenditure might need to cover not just the installation of renewable generation, but also research into new technologies, electrification of heat, and switching road transport from petrol and diesel to a mixture of electricity, biogas and hydrogen.12

While governments can and do provide support for vulnerable customers, such as subsidies for poor or elderly consumers, the fundamental nature of the three main (but not all)13 mechanisms that are currently used to pay for the costs of the climate transition are regressive. These are as follows.

- Carbon taxes and emissions permits. Both carbon taxes and emissions credits increase the amount that businesses have to pay for the production of carbon-intensive products. They are charged per tonne of CO2 equivalent,14 meaning that producers will pay higher carbon costs the more they pollute.

- Government expenditure recovered through per-MWh charges. Governments spend money to subsidise renewable energy technologies because, until recently, these were considerably more expensive than their fossil-fuel equivalents. This expenditure can be recovered either through general taxation or through consumer (user) bills. Where subsidies for investments in infrastructure for delivering the energy transition are recovered through consumer bills (e.g. in per-MWh charges that are constant for each unit of energy that consumers use), the effect on consumers would be regressive.

- Regulation. Governments can require that energy suppliers spend a certain amount of money on climate transition projects, such as on energy efficiency measures in the form of home insulation for consumers. These requirements are often proportional to the amount of energy that the company supplies to consumers,15 meaning that they translate into an additional per-unit charge for the company.

The common theme across all three mechanisms is that they either result in a per-unit charge to consumers (as in the case for government expenditure recovered through per-MWh charges) or a per-unit charge to the company (as in the case of carbon taxes and emissions permits, and regulation). Per-unit charges to consumers are regressive as they involve wealthy and less wealthy consumers paying the same amount per unit of goods purchased. Per-unit charges to companies are regressive if the level of pass-on from the company to the consumer does not vary according to the consumer’s income.

These additional charges can also be quite significant. For example, in the UK, 25% of the average electricity bill comprises social and environmental obligation costs that large suppliers levy on consumers to support government decarbonisation policies.16 The costs covered by this charge reflect the mechanisms described in the latter two bullet points in the list above.

The markets through which the costs of decarbonisation are passed are generally fairly competitive or are subject to (cost-reflective) price regulation, both of which imply high rates of cost pass-on to consumers. In markets that are fairly competitive, such as electricity and heat,17 prices broadly reflect costs and so any increase in costs is likely to be passed through into the price of the product. Similarly, in heavily regulated markets (such as electricity transmission and distribution), prices are set through a regulatory process. This process consists of many elements, with the variable costs of production being directly passed through into consumer prices. Therefore, as with fairly competitive markets, per-unit cost increases directly affect consumer prices.

The fact that all consumers pay the same per-unit costs creates an obvious parallel between decarbonisation costs and indirect taxes, such as VAT, which are widely considered to be regressive.18 However, the costs of decarbonisation are even more regressive than this because many goods that are subject to VAT are consumed in greater quantities by well-off consumers. This is not the case for many goods with prices that reflect decarbonisation costs through the inclusion of surcharges, as many are necessities, such as electricity and heat, and therefore wealthier consumers spend a smaller proportion of their income on these goods than less wealthy consumers.19

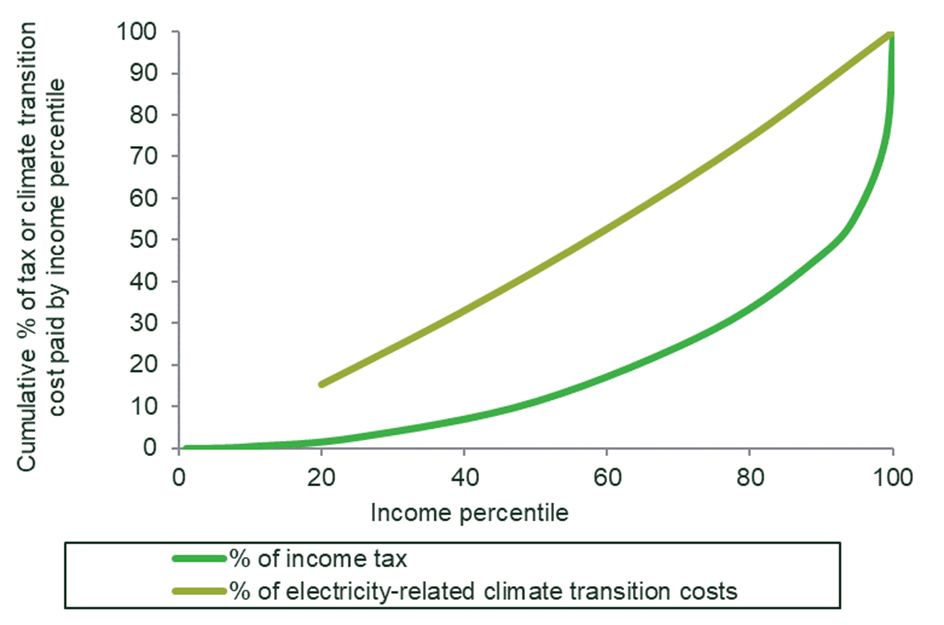

Other methods of paying for decarbonisation, such as income taxes, are less regressive. This can be demonstrated by comparing an estimate for the percentage of electricity-related climate transition costs that are faced by less wealthy consumers relative to the percentage of income tax paid by those consumers. We have chosen to consider electricity as this is a good that needs to be decarbonised and is also a necessity.

Figure 2 shows that in 2014, the bottom 20% of earners paid for approximately 15% of the climate transition costs that were passed through into electricity prices, while the top 20% paid for approximately 25%. By contrast, the bottom 20% of income taxpayers pay around 2% of income tax, while the top 20% pay around 66%. This shows that the burden of climate transition costs that are passed through into electricity prices is much more skewed towards low earners than it would be if it were funded through other means such as income taxation.

Figure 2 Lower-income households pay a greater share of electricity-related climate transition costs than income tax

Source: Ofgem (2014), ‘Beyond average consumption’; ONS (2021), ‘Table 2.4 Shares of total Income Tax liability’.

Regressive financing of the climate transition not only has distributional effects, but may also affect the feasibility of the transition. Perhaps the most famous example of this is the French government’s attempt, in 2018, to introduce a carbon tax on fuel, which resulted in the gilets jaunes protests that focused specifically on the regressive nature of the tax, and resulted in the French government reversing the policy.20

How can the climate transition be funded progressively?

There are three ways in which the climate transition could be funded more progressively.

First, as is implied by Figure 2 above, the transition could be funded more through general taxation than through consumer bills, as is already the case with some policies such as industrial carbon capture in the UK.21 General taxation, particularly income taxation, results in less wealthy consumers paying for a much smaller proportion of the climate transition (approximately seven times less)22 than they do through bills on necessities such as electricity, as income taxes are often designed to be progressive.

Second, governments could refund the amounts that they raise through carbon taxes and emissions permits to consumers, particularly the less wealthy consumers. For example, consumer electricity prices in the UK and EU are currently affected by the costs of purchasing emissions permits, the revenues of which accrue to the respective governments in the UK and the EU. These revenues could be repaid to customers as a ‘carbon dividend’. Similar policies have already been implemented in other countries, with the Canadian province of British Columbia, for example, repaying the money raised from its carbon taxes to consumers, and disproportionately to those on lower incomes.23 Such policies have the dual benefit of making the climate transition more progressive, while also creating a psychological association between decarbonisation and rebates, which may help to reduce people’s concerns about costs.

Third, there are a number of ways in which governments could target relief measures in a way that reduces the burden on poorer consumers. As an example, energy efficiency measures, such as insulation, could first be provided to the poorest households, as is already done in many countries including the UK. Modelling has shown that the cost savings from energy efficiency measures should outweigh the cost increases from climate transition costs.24 Therefore, if less wealthy households reduce their energy bills due to efficiency measures prior to facing the full costs of the climate transition, they may be able to avoid a situation where their bills increase. Alternatively, governments could introduce progressive energy measures that mitigate the regressive effects of per-MWh charges, such as the Warm Home Discount in the UK, which is only accessible to low-income consumers.25

Where next for the just transition?

This article has explained that the concept of a just transition encompasses not just workers’ rights but also ensuring that the climate transition is paid for in an equitable manner. This should be a primary consideration of policymakers, and the solutions we have outlined above highlight areas where these could be implemented in practice.

Although not covered in this article, there a number of other major issues, such as the extent to which wealthier countries should subsidise the transition for poorer countries. These are relevant both to wealthy countries and to issues of international distribution, and merit attention from decision-makers.

1 EU (2020), ‘The Just Transition Mechanism: making sure no-one is left behind’; ILO, ‘Climate Action for Jobs initiative’; UN, ‘Introduction to Gender and Climate Change’.

2 See, for example, IPPR (2020), ‘Faster, Further, Fairer: Putting People at the Heart of Tackling Climate and the Nature Emergency’, p. 34, which explains that the ILO first coined the term, which may explain why its focus has been on labour rights until now.

3 The word ‘regressive’ refers to systems of taxation or funding that rely on similar contributions from taxpayers irrespective of their income or wealth. Accordingly, regressive tax measures result in less well-off groups paying more as a proportion of their income or wealth.

4 European Commission (2018), ‘A technical analysis on decarbonisation scenarios – constraints, economic implications and policies’, p. 24.

5 IPPR (2020), ‘Faster, Further, Fairer: Putting People at the Heart of Tackling Climate and the Nature Emergency’, p. 12.

6 BEIS (2020), ‘Powering our Net Zero Future’, p. 55.

7 See, for example, Greenpeace (2021), ‘The Just Transition’.

8 Ibid.

9 See, for example, IPPR (2020), ‘Faster, Further, Fairer: Putting People at the Heart of Tackling Climate and the Nature Emergency’, p. 13.

10 OECD (2017), ‘Just Transition, a report for the OECD’, p. 10. We note that the state aid guidelines allow for compensation of the social and regional consequences of the closure of coal, peat and oil shale activities. European Commission (2021), ‘Guidelines on State aid for climate, environmental protection and energy 2022’, section 4.12.2, ‘Aid for exceptional costs’.

11 European Commission (2021), ‘Guidelines on State aid for climate, environmental protection and energy 2022’, ‘Introduction’, para. 3.

12 Biofuels frequently play a transitional role in the movement towards net zero. They are only transitional fuels because they tend to be blended with conventional fossil fuels, rather than used as pure fuels—thereby reducing but not eliminating emissions.

13 We note that there are some mechanisms which are not regressive, for example with industrial carbon capture projects being funded from general taxation in the UK. See BEIS (2021), ‘The Carbon Capture and Storage Infrastructure Fund’, p. 10.

14 CO2 equivalent includes other greenhouse gases, such as methane, after converting them into an equivalent amount of CO2.

15 See, for example, Ofgem (2018), ‘Working paper #4: Treatment of environmental and social obligation costs under the default tariff cap’, p. 5.

16 Ofgem (2021), ‘Costs in your energy bill’.

17 For example, wholesale electricity prices are set by a merit order, where the marginal cost of the most expensive power generator needed to deliver electricity sets the price of wholesale power. For further details, see Appunn, K. (2015), ‘Setting the power price: the merit order effect’, Clean Energy Wire, 23 January.

18 See, for example, Hodder Education, ‘Types of taxes’.

19 As explained by Csereklyei (2010), elasticities of demand for electricity in the residential sector in the EU are considerably below 1, meaning that as incomes double, consumers purchase less than double the quantity of electricity. See Csereklyei, Z. (2010), ‘Price and income elasticities of residential and industrial electricity demand in the European Union’.

20 See, for example, MacEwen, A. (2019), ‘French carbon tax and the Gilets Jaunes’, Encompass, February.

21 BEIS (2021), ‘The Carbon Capture and Storage Infrastructure Fund’, p. 10.

22 As explained earlier, the bottom 20% pay c. 2% of income tax, but pay 15% of electricity-related climate transition costs.

23 Grantham Institute (2019), ‘Policy brief: Global lessons for the UK in carbon taxes’, p. 5.

24 Committee on Climate Change (2017), ‘Energy prices and bills – impacts of meeting carbon budgets’, p. 11.

Contact

Please get in touch at [email protected]

Contributors

Related

Related

Blending incremental costing in activity-based costing systems

Allocating cost fairly across different parts of a business is a common requirement for regulatory purposes or to comply with competition law on price-setting. One popular approach to cost allocation, used in many sectors, is activity-based costing (ABC), a method that identifies the causes of cost and allocates accordingly. However,… Read More

The European growth problem and what to do about it

European growth is insufficient to improve lives in the ways that citizens would like. We use the UK as a case study to assess the scale of the growth problem, underlying causes, official responses and what else might be done to improve the situation. We suggest that capital market… Read More