Improving consumer engagement with financial services (and why banning commissions might be a bad idea)

The remuneration of financial intermediaries has been the subject of debate across Europe for several years. In its recently published Retail Investment Strategy (RIS), the European Commission has proposed to impose a (partial) ban for insurance intermediaries to receive inducements when independent advice is provided, or products are sold ‘execution-only’. We discuss the remuneration of intermediaries from an economics and policy perspective, drawing on insights from behavioural economics and an analysis of the experience in the Netherlands and the UK.

In the current debate about how financial intermediaries should be remunerated, attention has been drawn to the perceived conflicts of interest arising from models of remuneration that involve paying commissions (or inducements more generally) to financial intermediaries, with some arguing that such commissions should be banned.1

Various stakeholders have referred to the experiences of consumers in countries which have (to varying extents) banned commissions to financial intermediaries—most notably, the Netherlands and the UK. Some have cited these two countries as proof of the positive consequences of a ban on commissions, claiming that the ban removes conflicts of interest for intermediaries. Others have noted the negative consequences such as an advice gap, where customers with low willingness/ability to pay have not received advice at all.

Either way, this is a simplification. The reality of the regulatory interventions in the Netherlands and the UK is more complex, and the consequences far more nuanced. And importantly, there are policy trade-offs to consider.

Below, we discuss insights from behavioural economics about consumer behaviour and decision-making in relation to financial services, the positive and negative effects of the commission ban in the Netherlands and the implications for the debate on commissions.

Why ban commissions?

Banning commissions is a tool that may look attractive, as it gives the impression that the perceived problem is being addressed head on. No beating around the bush—you simply remove what you believe causes the problems in the market: commission payments!

At first sight, the logic of the arguments in favour of banning commissions looks intuitive, and raises the question of why other countries have not followed the Netherlands and the UK. The core of the argument is that if advisers are paid by providers in the form of commissions, then they will be incentivised to recommend products with higher commissions that benefit themselves rather than their customers. Imposing a ban on commissions will remove this conflict of interest and will then, according to the argument, result in a market where advisers deliver unbiased quality advice, and are no longer disincentivised from recommending lower-cost products (such as tracker funds) that benefit consumers.

Closer inspection shows that this line of argument is based on assumptions which are not supported by evidence. To inform policy-making and regulation at the EU-level, one should be careful to identify what has been proven and what remains unproven in the cases of the Netherlands and the UK, and not to extrapolate from these case studies alone. Financial markets vary significantly across member states, and were a ban to be introduced, its impact would differ depending on the conditions in the individual markets.

The impact of the commission ban in the Netherlands

The Dutch authorities introduced a package of regulatory measures (including a ban on commissions for certain products) and have been successful in removing problematic ‘complex products’ from the market, as well as related customer steering behaviour on the part of advisers.2 More generally, various elements of the markets for mortgages, insurance, and investments seem to be working well in the Netherlands and, traditionally, retail-investor participation in capital markets in the Netherlands has been relatively high compared with some other European countries.

That said, as recognised by the Dutch Minister of Finance in a report to Parliament, it is not possible to disentangle the impact of the ban on commissions from the broader series of regulatory interventions that accompanied and preceded it (such as commission disclosure, prohibition of certain types of inducement such as volume-based bonuses, and limits to the share of commissions that could be paid upfront).3 The changing trends in the main outcomes of interest across the primary products of concern were observed prior to the ban on commissions, and in large part due to market-specific regulations and developments unrelated to the ban.

Other positive trends in the Netherlands, such as the increase in the use of index tracking, are reflecting a more general trend. This is also observed in other countries, including in countries where there is no commission ban (such as the USA).4

There has been a meaningful decrease in the extent to which Dutch consumers seek financial advice, but importantly this has not resulted in a reduction in, for example, the use of pension products.5 The Netherlands has a multi-pillar pension system with significant mandatory public and semi-mandatory occupational group coverage.6 In other European countries that rely to a larger extent on voluntary pension systems, the role of advice is more important and the potential negative impact of a commission ban on the use of pension products would be of much greater concern.

Unintended negative consequences

Good consumer decisions on investments, insurance and pensions are vital for people’s financial wellbeing. But making good financial decisions is hard.

The behavioural economics literature shows that consumers are subject to inertia, and that many are loss- and risk-averse and may consider what happens in the far future to be of low importance. Many consumers do not engage sufficiently with financial planning and products, and are not willing to pay for financial advice. Furthermore, investment decisions are often highly influenced by emotional and social drivers such as gut instinct, irrational exuberance, and perception of other people’s investment success.7 Recent research also indicates that consumers tend to overestimate the riskiness of, for example, investing in stocks and shares.8

One of the benefits of a commission-based system is that it helps to overcome consumer inertia, and the engagement makes it more likely that consumers will plan for their retirement and take financial products. A ban is therefore likely to affect the use of advice and engagement with financial planning.9 This could result in the insufficient use of, in particular, insurance and pension products.

As explained above, this is of particular concern in some European countries that rely to a larger extent on voluntary pension systems. This would affect people’s financial well-being in the longer term. The costs of not taking certain insurance and pension products can be substantial in the long term, particularly for lower-income consumers who risk having their savings eroded—especially in high-inflationary environments.

It is also worth noting that just because a consumer chooses not to receive regulated financial advice, it does not mean that they do not look for similar types of guidance and information from unregulated sources such as on social media, where the information is of variable quality and accuracy.

Conflict of interest and consumer outcomes

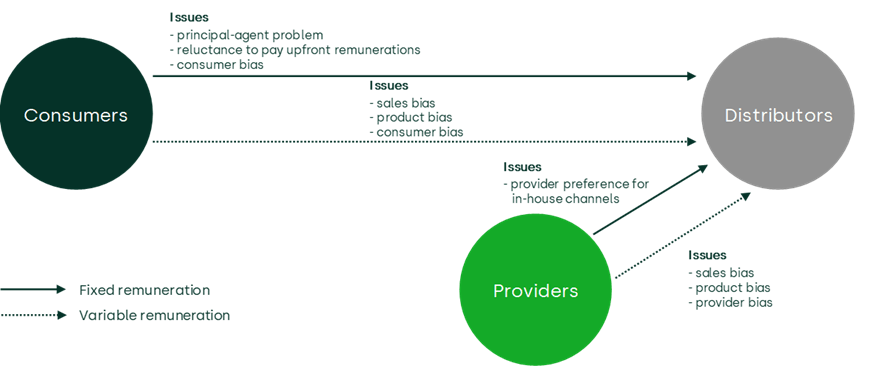

The relationship between a consumer and a financial intermediary can be described as a principal–agent relationship. This similarly describes the relationship between providers and intermediaries.

Economic theory tells us that any principal–agent relationship can result in conflicts of interest. This is because the principal and the agent have differing incentives and interests. Whether the distributor is paid by the provider or directly by a consumer with imperfect knowledge, these incentives may not be aligned and the conflict of interest may lead to (high) costs for the consumer. The principal concern with commission payments is generally that they could be used to incentivise certain kinds of products, providers, or the volume of products sold. But this only considers one side of the principal–agent relationships.

Figure 1 Potential impacts of different types of payments

Source: Oxera.

There is no simple remedy that can remove all material conflicts of interest. Economic theory tells us that any financial intermediary will ultimately act in their own interest. This also applies to financial advisers who receive fees from customers. Advisers have an incentive to recommend a needless transaction when there is a fee to be justified. To make their work less time consuming, advisers may consider a smaller range of products than perhaps is optimal for their customers. Also, an adviser under pressure to justify a fee might direct customers to sub-optimal products just because they were not easily accessible to the public.

At the same time, the presence of a potential conflict of interest does not necessarily result in actual consumer harm compared with the counterfactual. This depends on whether the conflict of interest is material enough to change the behaviour of the economic agents. This is an empirical question. For example, if there are sufficient clawback mechanisms for commissions, this will disincentivise intermediaries from selling products that the customer later cancels. This reduces the impact of potential conflicts of interest associated with commissions.

Further, due to regulation, a financial intermediary may incentivise customer-facing staff to prioritise consumer’s interests over the firm’s interests. In this context, the incremental benefit of banning commissions is likely to be small. Indeed, in the case of a compliant firm, there might be no effect, while, if a firm has a weak compliance culture, we should not expect a ban on commissions to result in the delivery of high-quality and unbiased advice. As consumers are generally not in a position to evaluate the quality of advice, such firms may get away with offering low-quality advice.

Therefore, it is important to consider the extent to which a possible conflict of interest (as a result of commission payments) actually results in harm relative to the harm that would arise under other forms of remuneration. This depends on the regulatory framework, the extent to which regulation is enforced and compliance is supervised by the relevant authorities and the quality of conduct risk management by the intermediaries themselves.

The four As and policy trade-offs

From a public policy perspective, the extent of possible harm caused by a potential conflict of interest (due to commission payments) would also have to be weighed up against the potential harm of banning commissions that would be caused if the client does not take advice, would not take insurance or pension products, and would therefore lose out on the return that investments can deliver.

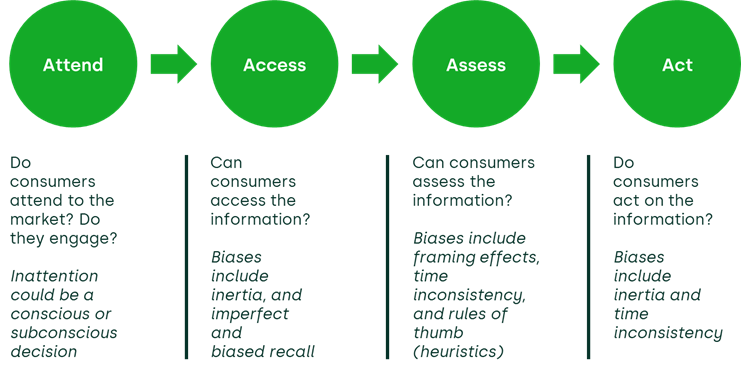

To assess consumer decision-making, regulatory authorities have used the framework of the ‘four As’: for consumers to make good decisions, they need to (i) attend to (or engage with) the market and financial products in the first place; (ii) access information about the products available in the market; (iii) assess that information and determine those that best suit them; (iv) act on that information by purchasing their preferred product.

Figure 2 The four ‘As’

Source: Oxera (2020), ‘Engaging the disengaged: why does it matter, and why is it hard?’, Agenda, June; based on Fletcher, A. (2019), ‘Disclosure as a tool for enhancing consumer engagement and competition’, Behavioural Public Policy.

A commission ban attempts to improve the assessment of the best product for a consumer (by removing the potential conflict of interest caused by commissions). In public policy terms, there are three issues with such an approach. First, it assumes that by banning commissions, the adviser will be free of any conflict and will deliver unbiased advice (which, as explained above, is not the case). Second, it overlooks the fact that a commission ban can have a negative effect on consumers’ engagement (‘attend’) with financial products and on the use of financial advice and products (‘access’), which would affect consumers’ actions. Third, it overlooks other regulatory approaches to improve the conduct of advisers which do not come with a negative impact on consumers’ engagement and use of financial products.

In the UK, where a commission ban was introduced in 2013 for certain complex products, a general Consumer Duty is being introduced. This Duty requires firms to act to deliver good outcomes for retail customers and, importantly, applies to situations with and without commission payments.10 This is happening because of serious concerns that, irrespective of how they are paid, distributors and providers were not sufficiently focused on delivering good outcomes for consumers. The Financial Conduct Authority (FCA) did not see extending the commission ban to a wider range of products as the solution. Furthermore, the introduction of the Consumer Duty shows that the FCA believes that the prohibition on commission payments did not resolve the potential for conflicts of interest—many of these still exist.

Alternative regulatory options

A ban on commissions is in many ways a blunt tool for improving outcomes for consumers. It carries with it significant risks, which include a negative impact on the take-up of insurance and pension products in some European countries (affecting households’ financial well-being in the long term), insufficient use of financial advice and reliance on social norms, and consumers seeking information from unregulated sources where information is of variable quality and accuracy.

Given the risks and limitations of a ban on commissions, it is important to consider the range of alternative policy options that have become part of the debate. These could reduce the risk of unintended consequences of a ban, while addressing some of the concerns about the commission-based remuneration model.

These not only include the greater use of measures centred around the disclosure of product and distribution fees, but also value-for-money assessments. Under such a measure, firms would bear the responsibility of ensuring that their products and services deliver value for money. This form of product oversight and governance regulation would require active supervision by the supervisory authorities. Such alternative options are highly relevant to the discussion over market reforms.

1 This article is based on Oxera (2023), ‘An economic analysis of remuneration systems: effective distribution of financial products’, a report prepared for the German Insurance Association (GDV).

2 ‘Besluit Gedragstoezicht Financiële ondernemingen Wft’, Articles 1 and 86c. See, also, a summary provided on the AFM website.

3 The other main caveat was that ‘good data is not always available’ for the purposes of making causal inferences about the impact of the ban, specifically. The research conducted used a combination of descriptive methods, and triangulated across the results from a descriptive analysis of industry trends before and after the ban, lab experiments, and industry stakeholder interviews and survey. See Dutch Minister of Finance (2018), ‘Government letter; Evaluation of commission ban – Laws and regulations financial markets’, Letter no. 74 from the Minister of Finance, 23 January.

4 See EU-level index fund and ETF investments trends in European Securities and Markets Authority (2021), ‘Performance and Costs of EU Retail Investment Products’, April, p. 20; and Refinitiv (2022), ‘Monday Morning Memo: Review of the European ETF Market 2021’.

5 Decisio (2017), ‘Zakelijker verhoudingen – de markteffecten van het provisieverbod’, pp. 6–7.

6 European Commission (2018), ‘Distribution systems of retail investment products across the European Union’, p. 14.

7 Lerner, J. S., Li, Y., Valdesolo, P. and Kassam, K. S. (2015), ‘Emotion and Decision Making’, Annual Review of Psychology, 66, pp. 799–823.

8 Haliassos, M. and Bertaut, C. C. (1995), ‘Why do so few hold stocks?’, The Economic Journal, 105:432, pp. 1110–1129.

9 See for example Elsen, M., van Giesen, R., Elshout, M. and Leenheer, J. (2017), ‘Consumenten en financieel advies’, Tilburg: CentERdata, section 3, Nationaal Instituut voor Budgetvoorlichting; Nibud (2017), ‘Keuzeproces bij financieel advies’, p. 22; and Kramer, M. (2018), ‘The impact of the commission ban on financial advice seeking’, University of Groningen.

10 Financial Conduct Authority, Consumer Duty: Final rules.

Related

Company valuation in post-M&A disputes—the Mahtani v Atlas Mara ruling

Post-merger and acquisition (‘post-M&A’) disputes can take many different forms, such as breach of representations and warranties, fraud and misrepresentation claims, and post-completion breach of contractual obligations. This article discusses the valuation issues in a post-completion breach case based on the ruling handed down by the Hon Mr Justice Butcher… Read More

Boosting growth, competitiveness and productivity in the EU and UK

Low economic growth is a current challenge for most major European economies, especially given the new fiscal burden of increased defence spending. Funding social challenges—such as climate change, the digital transition and European security—requires either some parts of society to be worse off, or that economies generate new sources of… Read More