Intel and the AEC test: ‘Do. Or do not. There is no try.’

After more than two decades, the Intel saga may have finally ended with the General Court’s judgment of 26 January 2022. The judgment—which had at its core the use of the ‘as-efficient competitor’ test in the context of loyalty rebates―confirms the critical role of robust economic analysis in abuse of dominance cases. We reflect on the implications going forward.

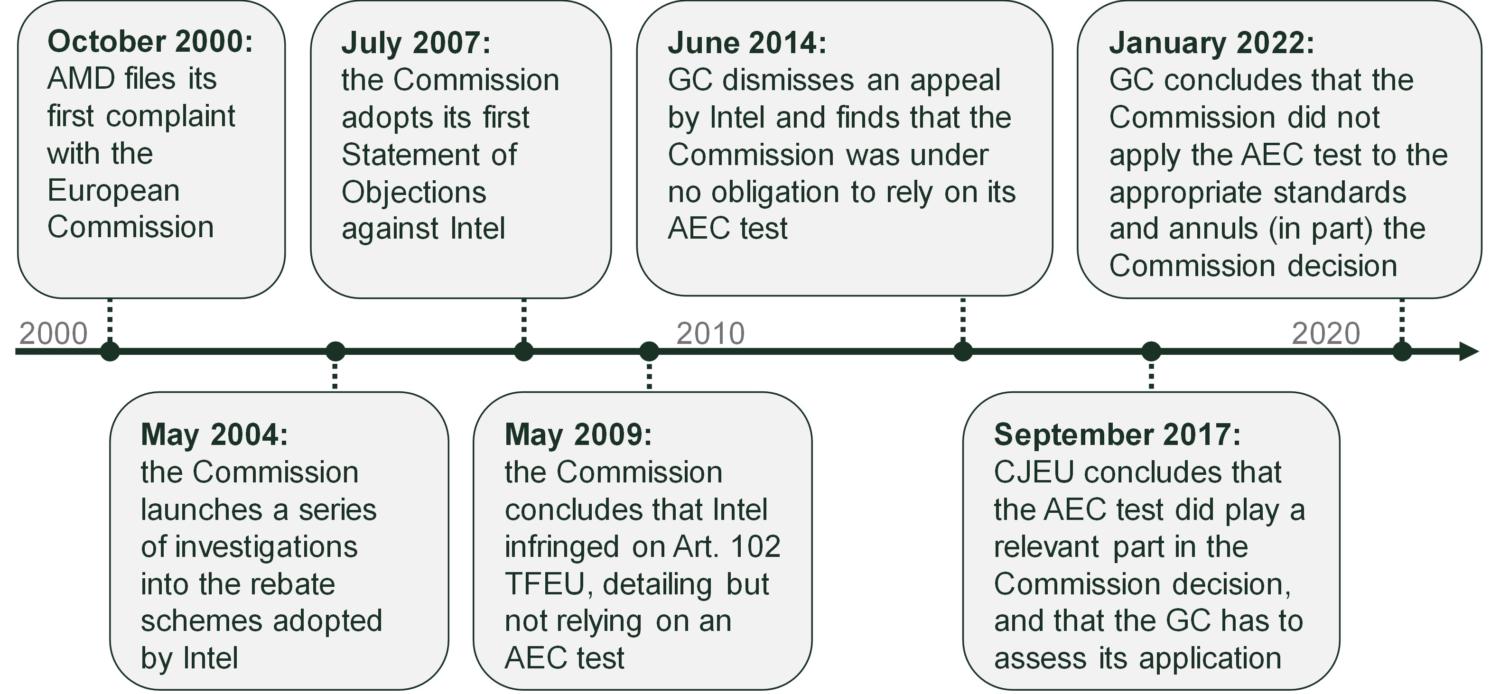

First, what is the saga? The Intel case started back in 2000 with a complaint from rival chip manufacturer AMD regarding Intel’s rebates to computer manufacturers. Through one decision, two appeals and three judgments, the case has put economic analysis at the centre of the debate around assessment of price-based abuses (see Figure 1).

First, in its 2009 decision the European Commission showed support for an effects-based approach by conducting an ‘as-efficient competitor’ test (or AEC test) to assess quantitatively whether a competitor would be able to compensate the customer for the loss in rebates and remain viable.1 While the Commission reverted to a more form-based approach in its final decision—concluding that Intel’s loyalty rebates were ‘by their very nature’ capable of foreclosing an as-efficient competitor—the inclusion of the AEC test was a key step towards the reform of Article 102 in line with the Commission’s 2009 guidance paper.2

However, the pendulum swung the other way in 2014 when the General Court, while upholding the decision, held that the AEC test was unnecessary and that the (near-)exclusivity rebates granted by a dominant undertaking are indeed ‘by their very nature’ capable of restricting competition.3

In 2017, the Court of Justice of the European Union (CJEU) set aside the General Court judgment and swung back towards an effects-based approach—concluding that ‘not every exclusionary effect is necessarily detrimental to competition’, that ‘competition on the merits may, by definition, lead to the departure from the market or the marginalisation of competitors that are less efficient’, and that if an AEC test is conducted, the Court needs to engage with all arguments from Intel concerning the test.4 Following the CJEU ruling, the General Court has now ruled that the Commission’s AEC test was indeed important evidence when assessing the ability to foreclose:5

[…] [A]lthough the Court of Justice did not hold that an AEC test necessarily had to be carried out in order to examine the foreclosure capability of all rebate systems, it follows […] that, where the Commission has carried out an AEC test, that test is one of the factors which must be taken into account by the Commission to assess whether the rebate scheme is capable of restricting competition.

Furthermore, the Court has engaged with the details of the AEC test conducted by the Commission and the evidence submitted by Intel, ultimately concluding that the Commission’s analysis ‘is vitiated by a number of errors’ and cannot ‘determine that [the rebates and payments] were capable of having or likely to have anticompetitive effects’.6

So what does this judgment mean for the use of the AEC test in abuse cases and economic analysis more generally? And what are the lessons for companies considering an assessment of competition law risks?

Figure 1 Timeline of Intel and views on the relevance of an economic approach

‘Do. Or do not. There is no try’

The General Court’s message regarding the use of the AEC test is loud and clear: if one conducts this test, one needs to ensure that the evidence and assumptions used as inputs to the test are robust.

The AEC test is an appealing tool for operationalising the principle that the pricing of a dominant firm should allow a competitor with same the costs to viably compete in the market. As explained in the box below, its implementation requires a number of parameters, including the contestable share of a customer’s demand, the structure and value of the rebates, and the relevant cost benchmark to use. Robust implementation therefore demands careful thought about the value of these parameters.

It was in this implementation by the Commission that the General Court found a number of errors. After a detailed analysis of the parameters used by the Commission, and evidence put forward by Intel, the Court found that the Commission erred in the calculation of the contestable share, the value of the conditional rebates, and the non-cash advantages customers received. The Court also found that, for some customers, the Commission relied on the results of the AEC test for only one quarter of the year—without explaining why these can be extrapolated to the entire infringement period.

While it is well established that the burden of proof is on the Commission to show infringement to the requisite legal standard, this judgment clarifies the high evidentiary threshold for the Commission, both for the use of AEC test to operationalise the AEC principle and for demonstrating foreclosure effects more generally.

Or, as the wise green master from another well-known saga would say: ‘Do. Or do not. There is no try’.7

The AEC principle and the AEC test

The AEC principle is that dominant firms cannot set rebate conditions (or other pricing strategies) that are capable of excluding an as-efficient competitor. The AEC test operationalises this principle using a number of market-specific parameters. In the context of loyalty rebates, the AEC test proceeds in two steps.

First, it seeks to calculate the ‘effective price’ that a competitor would have to offer in order to convince a customer to switch at least part of its demand (i.e. part of the ‘contestable share’) from the dominant firm to itself, by compensating the customer for any loss in rebates due to the switch.

Second, this effective price is compared to the relevant cost benchmark of the competitor, assuming that it is as efficient as the dominant firm—i.e. that it has the same cost structure as that of the dominant firm and so is proxied by the dominant firm’s cost. If this cost benchmark is above the effective price, then the test implies that an AEC cannot compete with the dominant firm, and would therefore be foreclosed.

The calculation of the effective price involves a number of parameters that determine the magnitude of the incentive required for the customer to switch away from the dominant firm. These include: (i) the structure and the value of the rebates offered by the dominant firm, as this determines the compensation the competitor needs to offer to the customer; (ii) the contestable share of the market (i.e. the part of the customer’s demand that it could realistically switch away to the competitor), which determines the maximum volume the competitor can use to incentivise the switch. The greater the value of rebates (or greater the loss from switching) and the lower the contestable share, the lower the effective price required for a customer to switch.

In the case of exclusivity rebates or rebates with minimum volume commitments, the effective price is likely to be lower than the price charged by the dominant firm, because the competitor will need to compensate the customer for the loss of discount on the non-contestable part of the demand if the volume commitment to the dominant firm is no longer met.

Note: For further discussion, see Niels, G., Jenkins, H. and Kavanagh, J. (2016), Economics for Competition Lawyers, second ed., Oxford University Press, section 4.6.

Reinforcing effects-based analysis

While the General Court stresses the relevance of the AEC test and the need for robustness where it is conducted, the test is not ruled to be imperative in supporting a finding of anticompetitive rebates (or, for that matter, other pricing structures). At the same time, the judgment does uphold the AEC principle and strengthens support for an effects-based approach:8

[…] [A]lthough a system of rebates set up by an undertaking in a dominant position on the market may be characterised as a restriction of competition, since, given its nature, it may be assumed to have restrictive effects on competition, what is involved, in the present case, is a mere presumption, which cannot relieve the Commission, in any event, of the obligation to conduct an analysis of anticompetitive effects.

Additionally, the Court confirms that such an analysis of competitive effects should be based on a thorough examination of all the circumstances of the case—including the degree of dominance, the structure and duration of the rebates and its market coverage, as well as the existence or plausibility of a strategy intended to exclude competitors from the market.9

These make economic sense. For instance, the degree of market power or dominance matters. A company with a near monopoly has a greater ability to foreclose competitors than a company with a 50% market share (all else being equal), and yet both may be considered to be ‘dominant’ under competition law. In the context of rebates, a smaller market coverage may increase the likelihood that an AEC can still access the remaining part of the market and compete. The opposite is likely when the value of the rebates to the customer is significantly high.

None of these factors are necessarily conclusive alone, however, and it is the combination of factors—including the parameters going into the AEC test—that determines the likely foreclosure effect.

This in turn raises the question: how can the Commission meet the standard of proof set by the Court without conducting an AEC test? The existence of internal documents showing a strategy to foreclose or an inability of competitors to incentivise customer switching despite strong interest, might assist in avoiding such analysis.10 In the absence of sufficiently strong direct evidence, however, the Commission may be more inclined to conduct the test (and ensure robustness) in order to establish with sufficient certainty the capability of the rebates (or other pricing arrangements) to foreclose.

On the other hand, the high bar set by the Court on the robustness of an AEC test can also incentivise the Commission to adopt a general effects-based approach, but stopping short of conducting a quantitative AEC test.

Critical role of economic analysis in submissions and internal assessments

Irrespective of whether the Commission is now more or less likely to carry out an AEC test on their own accord, the judgment underlines the importance of the alleged dominant firm submitting a thorough economic analysis, including―but not exclusively―an AEC test, given that the Commission is now bound to engage with any such analysis during the investigation.11

Moreover, as evidenced by the 2018 Qualcomm decision,12 to conduct such analysis as part of an internal risk assessment may constitute a much more credible piece of evidence during any future investigation than an analysis produced ex post as a part of the defence.

Of course, it is likely that any analysis conducted by a (potentially dominant) company would not be based on the same data as that conducted by an authority, given the authority’s likely access to broader data including third-party information. However, carrying out simple analysis of the key parameter values and scenarios analyses (with conservative assumptions and sensitivity checks around the contestable share, costs benchmark, and duration and value of rebates) can produce valuable indicators, and provide a reasonable level of certainty of the overall conclusions of such assessments.

As such, in the future we are likely to see more cases in which the Commission either conducts its own AEC test or engages with the results of an AEC test submitted to it during the administrative process—particularly for cases such as Qualcomm and other future cases given the legitimate expectation of firms with regard to the use of the test as set out in the 2009 guidance paper.13

Overall, a win for our collective thinking

Whether the Commission decides to appeal the judgment—and whether the case has truly come to an end—it would be too simplistic to frame the latest outcome as a loss for the Commission. Through the Intel decision, the Commission put economic analysis at the heart of the legal debate. What followed was instrumental in establishing the AEC principle as an important framework for structuring the assessment of rebates and other price-based abuses, with the AEC test as a valuable tool to further inform the analysis.

Overall, the saga has without doubt progressed our collective thinking on the relevant economic analysis in such cases and on the overall approach to abuse of dominance assessments more broadly.14

1 European Commission (2009), Decision COMP/37.990 Intel, 13 May, section 4.2.3,‘As efficient competitor analysis’.

2 European Commission (2009), ‘Guidance on the Commission’s enforcement priorities in applying Article 82 of the EC Treaty to abusive exclusionary conduct by dominant undertakings’, 24 February.

3 General Court, Case T-286/09 Intel Corp v Commission, Judgment of 12 June 2014.

4 CJEU (2017), Case C‑413/14 P, Judgment of 6 September, paras. 134 and 144. See also Oxera (2017), ‘Moore’s Law or Murphy’s Law? Intel and the reform of the EU abuse of dominance rules’, Agenda, September.

5 General Court (2022), Case T‑286/09 RENV, 26 January, para. 126.

6 General Court (2022), Case T‑286/09 RENV, 26 January, paras 521–27.

7 Yoda in Star Wars Episode V: The Empire Strikes Back (20th Century Fox, 1980).

8 General Court (2022), Case T‑286/09 RENV, 26 January, para. 124.

9 General Court of the European Union (2022), ‘The General Court annuls in part the Commission decision imposing a fine of € 1.06 billion on Intel’, press release, 26 January, p. 2, ‘Findings of the General Court’.

10 The Commission refers to such documents in its 2009 guidance paper, European Commission (2009), ‘Guidance on the Commission’s enforcement priorities in applying Article 82 of the EC Treaty to abusive exclusionary conduct by dominant undertakings’, 24 February, para. 20.

11 CJEU (2017), Case C‑413/14 P, Judgment of 6 September, paras 138–40.

12 In this decision, the Commission pointed out that Qualcomm’s AEC test was prepared specifically as part of the firm’s defence and not when agreeing its rebates scheme with clients, and that therefore Qualcomm could not argue that it believed in good faith that its conduct would be assessed on the basis of the Commission’s 2009 guidance paper. See European Commission (2018), Case AT.40220 Qualcomm, 14 January, para. 529.

13 There is also a question regarding whether the judgement and the confirmation of the AEC principle affects cases involving non-price practices. In its recent judgment on Google Shopping, for example, the General Court stated that the concept of the AEC test was suitable in the case of pricing practices such as predatory pricing or margin squeeze, further noting that ‘[t]he use of that test, which involves comparing prices and costs, did not therefore make sense in the present case, since the competition issue identified was not one of pricing’. See General Court (2021), Case T‑612/17, 10 November, paras 538–41.

14 As Commissioner Vestager noted in her response to the latest judgment: ‘We cannot be so risk averse that we will only do cases where we think there is almost a guarantee that we will win in court, because then we won’t be able to do cases with a novel interpretation of the case law that may be prone for a novel market situation’. See Gil, T. (2022), ‘EU antitrust enforcers shouldn’t be “risk averse” to prevent court losses, Vestager says’, MLex Insight, 1 February.

Contact

Dr Avantika Chowdhury

PartnerContributors

Related

Related

Blending incremental costing in activity-based costing systems

Allocating cost fairly across different parts of a business is a common requirement for regulatory purposes or to comply with competition law on price-setting. One popular approach to cost allocation, used in many sectors, is activity-based costing (ABC), a method that identifies the causes of cost and allocates accordingly. However,… Read More

The European growth problem and what to do about it

European growth is insufficient to improve lives in the ways that citizens would like. We use the UK as a case study to assess the scale of the growth problem, underlying causes, official responses and what else might be done to improve the situation. We suggest that capital market… Read More