Labour markets: a blind spot for merger control?

Recent months have seen increased discussion of merger control in Europe. One central question is whether the impact on labour markets should be examined directly, or indirectly in terms of product market concentration. We shed light on the main arguments in this debate, and discuss some of the challenges that would be faced by competition authorities if they were to consider labour markets concentration in their merger assessments.

The role of competition policy in society has recently come under scrutiny. The standard merger control framework focuses on consumer welfare and product markets. However, a range of proposals have been made about expanding the scope of competition policy to cover broader policy objectives, including labour market outcomes. Some national merger decisions have seen politicians deviate from decisions by national competition authorities due to concerns about labour market outcomes.1

In May 2019, the Oxera Economics Council met to discuss competition in labour markets. This article is the second of two that present insights from these discussions, and focuses on the analysis of labour market competition in the context of merger control.2

There are two main proposed approaches to expanding the scope of competition policy to cover the labour market—the ‘industrial policy’ approach and the ‘competition policy’ approach. This article looks at some of the cases and proposals that have been debated in this context. It then looks at recent academic proposals for how to extend standard merger control tools to the competition assessment of labour markets in addition to product markets. The discussion focuses on challenges in defining relevant labour markets, but also exemplifies some of the broader challenges encountered in expanding competition tools to cover labour markets.

Industrial policy vs competition policy

The role of merger control in shaping labour market outcomes has raised political interest at both national and wider levels. In the EU, the critical reception of recent highly publicised merger decisions such as Siemens/Alstom may have contributed to the European Commission’s increased tendency to communicate on wider policy considerations. While EU merger control relies on decisions made purely on competition grounds, recent communications from the Commission seek to highlight how other EU legal tools contribute to protecting European jobs. For instance, following a decision to block the Tata Steel and ThyssenKrupp merger in June 2019, the Commission highlighted in its press release:3

The EU takes action and is using the full potential of its trade defence toolbox to ensure a level playing-field for the EU steel industry and its ability to maintain jobs in the sector.

In addition, the European Commissioner for Competition, Margrethe Vestager, has encouraged the participation of wider stakeholders in the merger control process, with trade unions being invited to contact the Directorate-General for Competition during mergers. She has also recommended that companies involved in mergers ‘respect their national and European obligations for worker information and consultation’.4

This is part of a broader discussion on the role of competition policy and whether other societal goals (such as protection of the environment or of national sovereignty) should be taken into account. This tension between the traditional approach to merger assessment and broader considerations gives rise to what can be summarised as two conflicting proposals to change the role of merger control in shaping labour market outcomes post-merger.5

The competition policy proposal argues that labour markets should be covered by competition policy rules as if they were relevant markets of their own. It claims that competition in these markets should therefore be preserved in the same way as competition in product markets. If we consider labour as an input to firms and workers as suppliers of labour, the established competition assessment framework can be applied to assess product and labour market outcomes of a merger at the same time. In merger control, to our knowledge, this approach has not been applied in any jurisdiction. To implement it, the toolbox used by competition authorities would first need to be expanded to apply to labour markets.

The industrial policy proposal argues that competition authorities should take into account the impact of their decisions on the product market for job creation and destruction. Proponents of this view argue that when competition authorities are making their decisions, they should assess the impact of remedies and efficiency gains on workers, not only as inputs to firms, but also as citizens and consumers. This type of analysis is undertaken in some jurisdictions—for instance, in South Africa the effect of a merger on lay-offs of the workers of the merging firms is considered.6 In contrast to the competition policy approach, the proposed industrial policy approach does not necessarily require the use of economic tools, and may be seen as more relevant to politics than to economics.

In an EU context, recent discourse has focused on potentially implementing the proposed industrial policy approach more thoroughly. Currently, the only tools available to enact the industrial policy approach are ‘Phase III’ merger procedures, such as those that exist in France and Germany. These are exceptional national competition procedures that allow the relevant Minister to have the last word in blocking or clearing a merger, and can potentially be used to take into account labour market outcomes in the final merger assessment.

In the past, some Phase III national procedures were motivated by employment concerns relating to the transaction. In France, the Minister of Finance used his right to intervene in a merger decision for the first time in June 2018 when he decided to allow (subject to commitments to preserve employment) the merger between Cofigeo and Agripole, two manufacturers of tinned food. The French Competition Authority had previously authorised the transaction, but only if the parties agreed to extensive divestitures. The Minister was concerned that these divestitures would negatively affect employment, and therefore decided to replace them with commitments to preserve employment.7 The two manufacturers are major employers in rural areas, which was a key factor in the final decision.

In Germany, Phase III proceedings have thus far been granted only on an exceptional basis.8 In 2014, the German competition authority initially blocked the acquisition of the grocery chain Kaiser by Edeka, a supermarket group, over competition concerns about inner-city grocery shopping. The parties applied for Phase III proceedings, which were granted under the condition that jobs would be preserved. The merger was later cleared subject to divestments.9

The French and German governments are currently exploring the possibility of implementing a Phase III-type process in European Commission merger procedures as a potential long-term reform that, if enacted, would require a change in EU treaties.10 While the industrial policy approach would require an overhaul of the merger control process as concerns the treaties, the competition policy approach would require a widening of scope of the current competition remit. However, the competition policy approach, unlike the industrial policy approach, would require the development of new economic tools, which presents challenges of its own. Below, we give an overview of standard merger assessments, which clarifies how merger control could have an impact on competition in labour markets.

The key steps in merger control

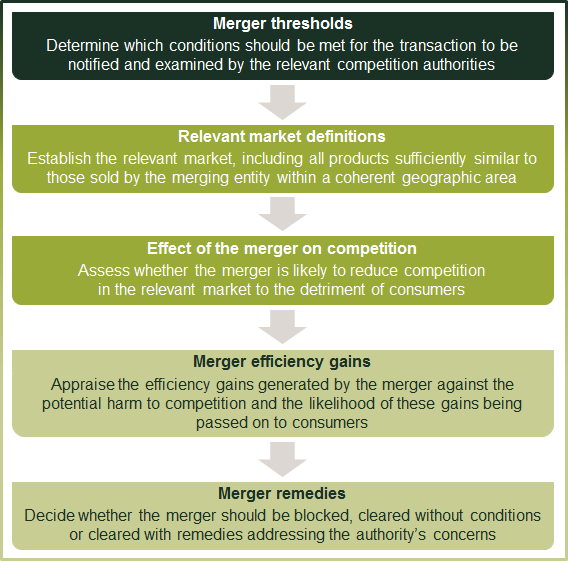

The standard EU merger assessment framework considers the effect of a given transaction on concentration in the product (or service) market, and ultimately on consumer welfare. Figure 1 below sets out the key steps involved in the assessment. Where relevant, vertical relationships are also considered in order to evaluate their impact on downstream and upstream product market outcomes. Both immediate, short-term effects (such as efficiency gains from synergies) and longer-term effects (such as innovation) are analysed and examined in the assessment.

Figure 1 Steps in a standard merger assessment

For each step in the merger control framework, the assessment tools would need to be adapted to the specifics of the labour market to allow for the application of the competition policy approach outlined above. This point is discussed further below in the context of the labour market definition.

A worked example: labour market definition

Academics have adapted established tools from merger control in product markets to assess labour markets. However, the nature of labour markets means that it is challenging to put these into practice.11

What are the difficulties involved in defining the relevant market for the purpose of assessing the effect of a merger on labour markets? We provide an example focusing on market definition which, as shown in Figure 1, is one of the key steps involved in merger control.

The European Commission defines the relevant product market as:12

[…] all those products and/or services which are regarded as interchangeable or substitutable by the consumer, by reason of the products’ characteristics, their prices and their intended use.

The relevant geographic market is defined as:13

the area in which the undertakings concerned are involved in the supply and demand of products or services, in which the conditions of competition are sufficiently homogeneous […].

When determining which definition of the product market is relevant to a merger assessment, the key question is which products, sold by which firms, are substitutable with the products produced by the two merging firms. When thinking about the labour market, it must be remembered that the switch is from supply concentration to demand concentration,14 as well as from the product to the labour market. The question is therefore about which jobs are sufficiently substitutable that the workers of the merging entities might be willing and able to switch between them.

For instance, one question might be about which alternative employers a particular nurse could switch to. This question raises its own challenges relative to the standard question of which products are substitutable from the point of view of the customer. The key factors that need to be considered are as follows.

- Skills: if two jobs require very different skills, an individual is unlikely to be able to successfully apply for both. Defining skills is not straightforward, but at a minimum the job title, description, and sector should be taken into account. Someone who has worked only as an economics teacher is unlikely to be qualified to teach physics, and is also unlikely to have acquired the relevant skills to be an academic economist.

- The overall price paid for labour: this is not limited to wages, but also includes benefits such as pensions and parental leave. Jobs may also differ along other dimensions, such as job security, working hours, and broader working conditions. Assessing the overall effective price paid by an employer to a worker is a complex task, and an assessment based purely on wages risks ignoring important aspects of the market.

- Workers’ preferences on non-price characteristics: labour markets are matching markets.15 In labour markets:

- the buyer (employer) has preferences for certain worker characteristics. This is similar to product markets, where the buyer has preferences for certain brands and product characteristics;

- the seller (worker) has preferences about job characteristics—for instance, they may prefer a large employer over a small one.

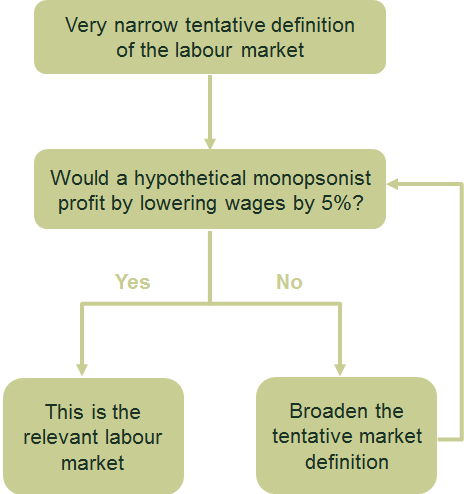

The SSNDW test

In practice, a standard way of defining the relevant product market is by using the hypothetical monopolist test, which looks at the effect of a ‘small but significant non-transitory increase in price’ (SSNIP). This test is based on the idea that the relevant market is the narrowest market for which it would be profitable for a hypothetical monopolist to increase prices by 5%. The test does not consider the effect of a change of non-price factors (quality, brand, etc.), but it does take these factors into account by capturing them in the degree of switching between products: if there is no alternative product of a similar quality, a 5% price increase is unlikely to lead to extensive consumer switching.

Naidu, Posner and Weyl (2018) propose a labour market equivalent: the ‘small but significant and non-transitory decrease in wages’ (SSNDW) test. It is effectively a hypothetical monopsonist test (i.e. one that considers a unique employer in the market), and is set out in Figure 2 below.16

Figure 2 SSNDW test

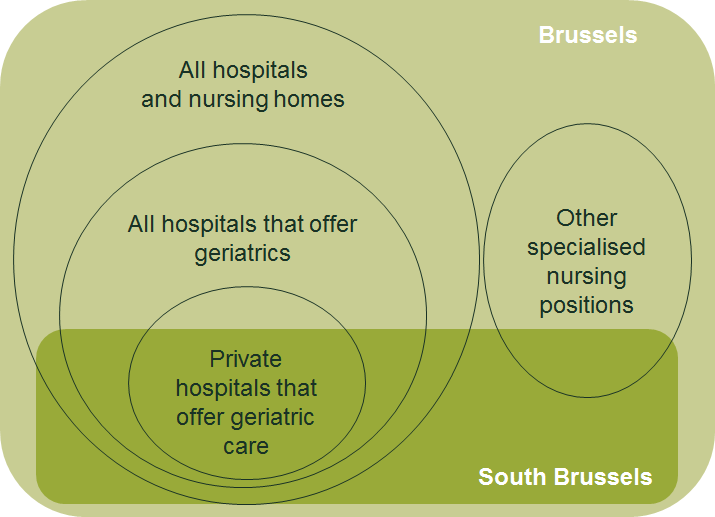

Consider the example of a nurse who practices geriatric nursing at a public hospital in the south of Brussels. It is possible that they would be willing to move to any hospital in Brussels, as long as it offers geriatric care. When conducting a hypothetical monopsonist test, we could begin by asking whether, if the nurse in our example was employed by the only private hospital in south Brussels, the hospital would have an incentive to cut their wage. The answer might be no, because the nurse might easily be able to move to a public hospital instead. We could then broaden the market to consider all hospitals in the south of Brussels, and then again to consider all hospitals in Brussels, or even all hospitals and nursing homes in Brussels. At this stage, we may find that the hypothetical monopsonist that owned all of these institutions would indeed have a profit incentive to cut wages. This is because the nurse in question may have trouble moving to another specialised nursing position (say, as a surgical nurse), and may be unwilling to move or take an alternative, less skilled, job. The example is illustrated in the figure below.

Figure 3 Examples of the labour market for geriatric nurses

However, there is a limitation in the extent to which the SSNDW is an appropriate extension of the SSNIP test. One problem is that the test is based on a 5% cut in wages, rather than broader payments such as bonuses, pension schemes, and in-kind benefits. Not factoring in the non-wage ‘price of labour’ is likely to lead to an incorrect and inconsistent market definition, as a 5% change in wages may correspond to a 5% change in the overall payment package in some contexts, and be only a small part of the payment package in other cases. However, note that similar complications are sometimes encountered in product markets—for example, in cases where an ‘implicit’ price is being paid for a ‘free’ good, such as data.

Labouring for a better outcome

Recent public discourse has featured a range of proposals for reforming merger control. Most of these aim to expand the scope of competition assessment outside of consumer outcomes to include worker outcomes. However, there are challenges with trying to apply existing economic tools for merger assessment to labour markets. While this article has focused on market definition, similar issues arise when employing tools other than the hypothetical monopolist test, and in all steps of the merger assessment. This raises broader questions about whether—and how—to effectively expand the scope of competition policy in merger assessments. It is notable that the public debate so far has not taken some of these questions into account—especially the methodology required to enact some of the proposals.

1 In some jurisdictions outside the EU, such as South Africa, labour market concerns relating to merger decisions are addressed by the competition authorities.

2 See Oxera (2019), ‘How do non-poaching agreements distort competition?’, Agenda, June. The Oxera Economics Council is a group of prominent European thinkers and academics, specialising in microeconomics and industrial organisation, that meets with Oxera twice a year to discuss pressing economic issues facing policymakers. The most recent Oxera Economics Council meeting took place in Brussels on 14 May 2019, attended by Oxera consultants, the Council members, and guests from the European Commission and academia. This article is produced solely by Oxera, and does not necessarily represent the views of the Council members or the guest attendees.

3 European Commission (2019), ‘Mergers: Commission prohibits proposed merger between Tata Steel and ThyssenKrupp’, Press Release, 11 June.

4 European Commission (2018), ‘Statement by Commissioner Vestager at ITRE Committee’, Announcement, 9 July.

5 A third approach would be that competition policy should focus only on product market outcomes. In this case, if the outcome for labour markets were considered, this would be analysed by an institution other than the competition authority.

6 Global Competition Review (2015), ‘South Africa: Merger Control’, The African and Middle Eastern Antitrust Review 2016, 22 December.

7 Ministère de l’Économie et des Finances (2018), ‘Décision du 19 juillet 2018 statuant sur la prise de contrôle exclusive d’une partie du pôle plats cuisinés ambiants du groupe Agripole par Financière Cofigeo’. Autorité de la concurrence (2018), ‘Décision n° 18-DCC-95 du 14 juin 2018 relative à la prise de contrôle exclusif d’une partie du pôle plats cuisinés ambiants du groupe Agripole par la société Cofigeo’.

8 Only ten Phase III proceedings have been granted out of 23 requests since the German merger control regime was introduced in 1973. Global Competition Review (2019), ‘German minister grants rare “Phase III” deal approval’, 19 August.

9 Bundeskartellamt (2017), ‘Examination under competition law following the withdrawal of appeals against the ministerial authorisation granted to EDEKA/Tengelmann’, 29 November.

10 Inspection générale des finances (2019), ‘La politique de la concurrence et les intérêts stratégiques de l’UE’, April, section 2.2.2. Bundesministerium für Wirtschaft und Energie and Ministère de l’Économie et des Finances (2019), ‘A Franco-German Manifesto for a European industrial policy fit for the 21st Century’, 19 February.

11 Naidu, S., Posner, E.A. and Weyl, G. (2018), ‘Antitrust Remedies for Labor Market Power’, Harvard Law Review, 132.

12 European Commission (1997), ‘COMMISSION NOTICE on the definition of relevant market for the purposes of Community competition law’, Official Journal of the European Communities, 97/C 372 /03, para. 7.

13 European Commission (1997), ‘COMMISSION NOTICE on the definition of relevant market for the purposes of Community competition law’, Official Journal of the European Communities, 97/C 372 /03, para. 8.

14 In product markets, firms represent the supply side of the market and consumers the demand side. By contrast, in labour markets, firms demand labour, and labour is supplied by workers.

15 Naidu, S., Posner, E.A. and Weyl, G. (2018), ‘Antitrust Remedies for Labor Market Power’, Harvard Law Review, 132.

16 Naidu, S., Posner, E.A. and Weyl, G. (2018), ‘Antitrust Remedies for Labor Market Power’, Harvard Law Review, 132.

Download

Related

Investing in distribution: ED3 and beyond

The National Infrastructure Commission (NIC) has published its vision for the UK’s electricity distribution network. Below, we review this in the context of Ofgem’s consultation on RIIO-ED31 and its published responses. One of the policy priorities is to ensure that the distribution network is strategically reinforced in preparation… Read More

Company valuation in post-M&A disputes—the Mahtani v Atlas Mara ruling

Post-merger and acquisition (‘post-M&A’) disputes can take many different forms, such as breach of representations and warranties, fraud and misrepresentation claims, and post-completion breach of contractual obligations. This article discusses the valuation issues in a post-completion breach case based on the ruling handed down by the Hon Mr Justice Butcher… Read More