Linking the world: economics and finance in new infrastructure projects

Modern society relies on large infrastructure projects—current examples are the Thames Tideway Tunnel in the UK and the construction of four metro lines in the Paris region. We look at the economics and financial considerations that underpin the development and delivery of such projects, with a focus on three particular aspects: how to finance them, weigh their costs and benefits, and build in effective incentive properties.

Our society is based around physical and digital infrastructure: this affects everything from the water we drink, to the energy we use, the digital communications that we rely on to manage our professional and personal lives, and the roads, railways and airports that enable us to travel.

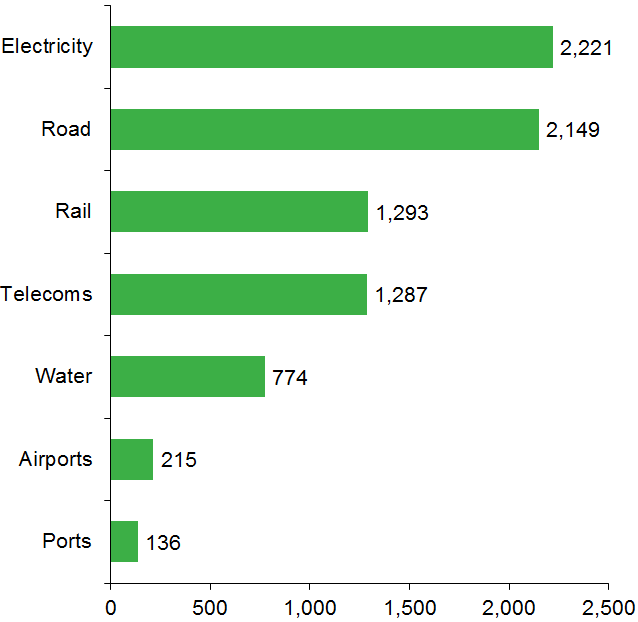

Unsurprisingly, investments in these markets can be substantial, as shown in Figure 1 below.

Figure 1 Infrastructure investments in eight EU countries ($bn)

Source: Oxera analysis, based on Oxford Economics (2017), ‘Global Infrastructure Outlook’, July.

At the current pace, investment in such infrastructure across the eight countries shown in the figure is expected to total more than $8,000bn over the 2016–40 period. This is more than $300bn of investment annually in key infrastructure—chiefly electricity and transport (especially road and rail) networks.

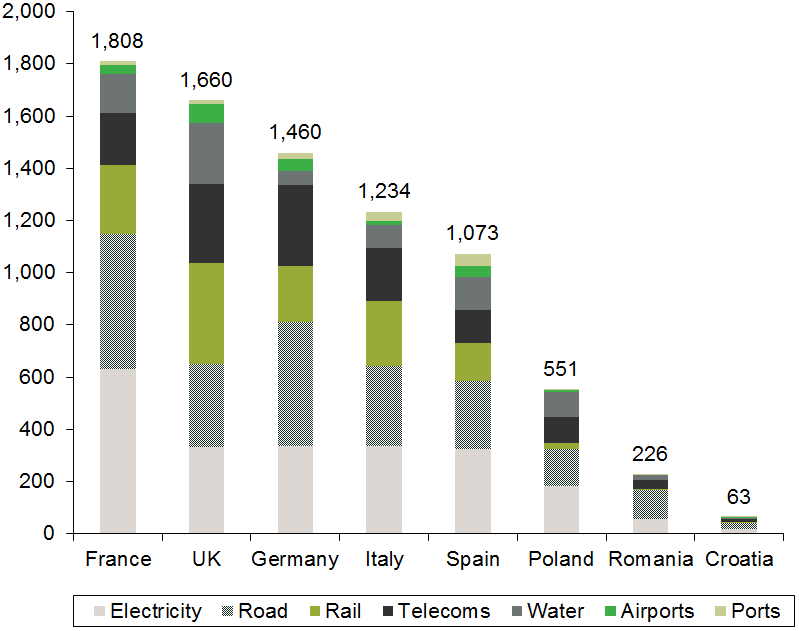

Figure 2 below shows how investment currently varies by sector in the eight countries. In the largest infrastructure markets (France, the UK, Germany, Italy and Spain), expenditure on infrastructure is expected to exceed $1,000bn over the 2016–40 period.

Figure 2 Investment needs across major EU economies ($bn)

Source: Oxera analysis, based on Oxford Economics (2017), ‘Global Infrastructure Outlook’, July.

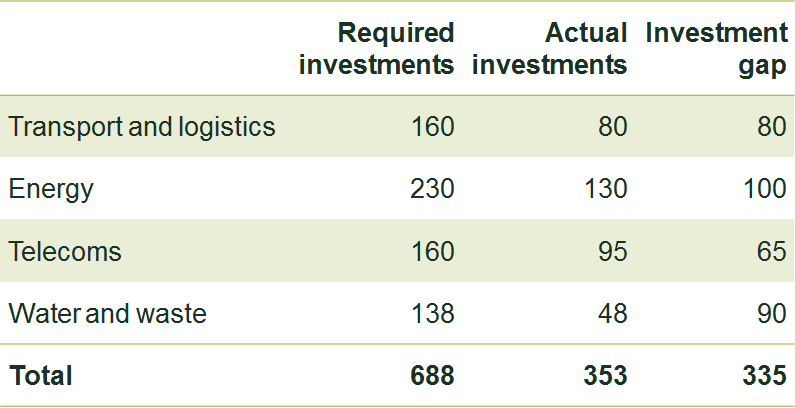

Infrastructure investment is a priority of policymakers in the EU, including the European Commission. This is because it is key to achieving the objectives of common European policy, particularly in the domains of transport and energy.1 However, after the global financial crisis that began in 2008, investment plummeted, creating a gap between the actual amounts invested in infrastructure and those required to meet EU objectives. A substantial gap remains. As shown in Table 1 below, €335bn of additional annual investment will be needed across the EU to reach the objectives in the respective policy domains—or roughly double that of current trends. These objectives include matching the USA in terms of data centre capacity in the telecoms sector, and securing the energy supply and reducing greenhouse gas emissions in the energy sector.2

Table 1 Average annual actual and required investment to meet EU objectives in key infrastructure sectors (€bn)

Source: Oxera analysis, based on European Investment Bank (2016), ‘Restoring EU competitiveness’, January.

In order to bridge this investment gap, EU institutions have promoted initiatives to help finance infrastructure projects across the EU, first under the ‘Juncker plan’,3 and more recently under the ‘InvestEU’ programme (which brings together multiple EU financing instruments to support private and public investment), of which sustainable infrastructure is a key pillar.4

The delivery of large infrastructure projects has been the subject of many books and studies, and a short article such as this cannot give a comprehensive overview. However, through Oxera’s role in helping to develop such projects in many sectors across Europe and beyond, we have identified some areas where economics and financial tools are particularly powerful, and where there are common issues.

Key economics and financial issues in developing new infrastructure

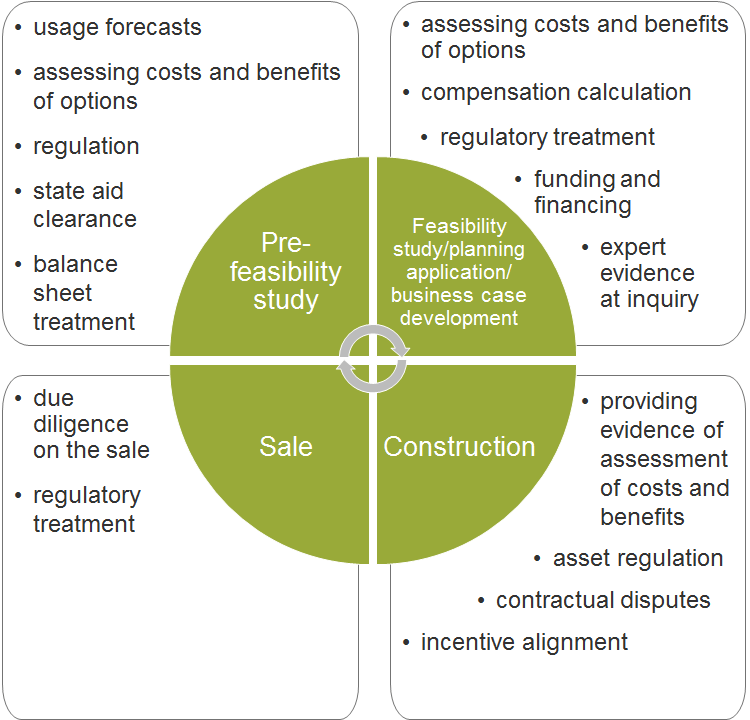

There is a clear—and widely accepted—role for economics and finance at all stages of the lifecycle of an infrastructure project, from initial idea through to the sale of the asset. This is illustrated in Figure 3 below.

Figure 3 The role of economics and finance in project development

However, four areas appear to be underdeveloped in current practice.

Area 1: who is affected matters as well as the total or average impact

New infrastructure projects are normally subject to some form of cost–benefit assessment or economic impact assessment.5 This assessment is usually subject to guiding principles laid out by a national or supra-national authority.6

However, these assessments are often carried out at a total (or average) level, even though the costs and benefits are often borne by different sections of the population. For example, consider the introduction of a new road: the environmental costs of increased traffic (noise, lower air quality, etc.) often affect a different part of the population to the one that experiences the benefits (the users of the new road, and users of other roads who may experience a reduction in congestion). Aggregating these into one assessment implicitly assumes that costs to one part of society can be offset by benefits to another part.

This raises challenging social issues, as explored in previous Agenda articles.7 It would be beneficial for policymakers to set appraisal frameworks that raise decision-makers’ awareness of the distribution of costs and benefits, as well as their average or total impacts. While there is some movement towards this (for example, the States of Jersey considers the impact of fiscal changes on seven types of household),8 it is still not widespread practice.

Area 2: adding to public debt? Or not?

The allocation of risks weighs heavily on the decision about whether a project appears on the government balance sheet—which is often a key determinant of how a project is structured from a financial and regulatory perspective, given the constraints on government finances.

The balance sheet treatment of a project does not depend simply on who is financing it, but on who ultimately funds it, and who bears the financial and operational risks. The issue is not straightforward, and the decision by the national statistics authority on whether the financial liabilities associated with a project should be included in government debt figures will be based on multiple scenarios, including what would happen if private sector funders were unable to meet their obligations.

In our experience, major infrastructure often needs government sponsorship and, in some cases, a form of financial support (e.g. direct funding or a guarantee from the government). Structuring financial arrangements that make it easier for this support to be provided, without the fear of adverse balance sheet impacts, is likely to be an important consideration in the design of any project.

In the EU, government support must often also be designed in a way that is compliant with state aid rules.9 In particular, it often needs to be shown either that the support does not constitute aid, or that it constitutes ‘good’ aid (i.e. aid that meets the European Commission’s requirements for compatible aid, where the positive effects of the aid are expected to outweigh any potential negative effects in terms of distortions to competition and trade). If the support can be deemed to represent ‘good’ aid, it must often be notified to, and approved by, the European Commission.

Area 3: does the economics align with the strategy?

There can be a wide range of strategic reasons why a project is put forward. However, the economic case is often developed to comply with a set of guidance that is—necessarily—designed to be generic and to apply to a wide range of potential situations. In our experience, aligning the economic assessment with the strategic rationale (or ‘needs case’) for a project may require creativity in the application of the economics, but it can make a material difference to the quality of the evidence being presented and the ability to convince stakeholders about the merits of the project. Clearly, any economic analysis must be robust and evidence-based to test the project rather than deliver a predefined outcome.

For example, in countries that currently have low levels of unemployment, such as the UK, Germany or the Netherlands, promoting projects on the basis of job creation is unlikely to be particularly convincing without compelling evidence that the project will reduce overall unemployment or increase labour force participation. However, stakeholders are more likely to be convinced if the project aims at increasing workers’ levels of skill through the creation of higher productivity jobs and targeted training programmes.

Area 4: my risk? Or yours?

Building new infrastructure is expensive and complex. Often the build costs alone exceed several hundred million euros—for example, the capital costs of the Thames Tideway Tunnel in the UK are estimated to amount to £4.2bn (in 2016 prices).10 Mega-projects can reach the tens of billions, such as the urban transport project involving the construction of four metro lines in the Paris region, which is forecast to cost approximately €40bn.11 Combined with the potential for cost overruns, delays, government policy changes and regulatory inconsistency, attracting private finance may be challenging and puts a premium on allocating risks appropriately.

There are two main sources of finance for new infrastructure.

- Public finance. This can come from a variety of sources—principally taxation, but also public borrowing. However, public finance for infrastructure projects will appear on the public sector balance sheet in measures of public sector net debt, and this may be undesirable for governments.

- Private finance. This is usually provided either via a project finance set-up whereby a project-specific company is launched to deliver the project, or through a regulated utility model.

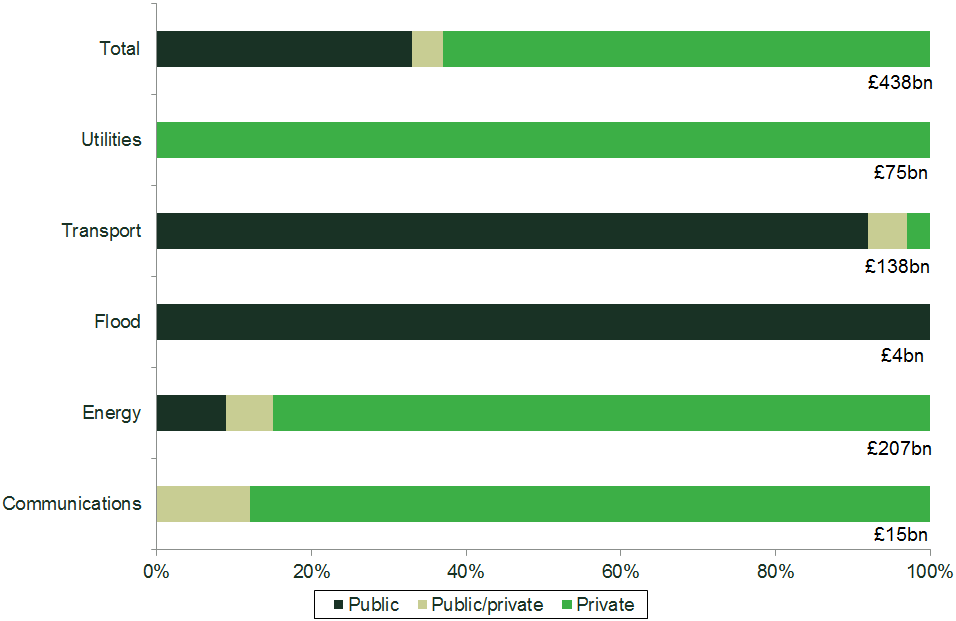

In the UK, there has been a preference to attract private participation in building new infrastructure in many sectors. Indeed, since 2016/17, private investors have financed over 60% of total infrastructure spend (see Figure 4). However, the variation across sectors is notable, with private finance providing most or all investment in utilities, energy and communications, and public finance being dominant in transport and flood defences.

Figure 4 Finance sources for UK infrastructure projects since 2016/17

Where private finance is part of the solution, the regulatory support and extent to which the regulator allows the private sector to pass risks through to users or taxpayers will be an important determinant of the overall rate of return required by private finance.

An integral part of infrastructure projects

Economics and financial considerations are at the heart of every new infrastructure project, and they sit alongside those of engineering and other disciplines in making sure that a project delivers benefits to users. The tools that economics and finance bring to testing and improving projects are powerful—but in our experience, they could be applied more effectively to improve the way in which projects are designed, regulated and ultimately operated.

1 For example, see European Commission (2015), ‘Commission identifies the infrastructure priorities and investment needs for the Trans-European Transport Network until 2030’, press release, 15 January; and European Commission (2019), ‘Energy Union: EU invests a further €800 million in priority energy infrastructure’, press release, 23 January.

2 European Investment Bank (2016), ‘Restoring EU competitiveness’, January.

3 Named after the current EU President, Jean-Claude Junker. European Commission, ‘The European Fund for Strategic Investments (EFSI)’, accessed 30 April 2019.

4 European Commission (2019), ‘EU budget for the future. What is the InvestEU programme?’, 19 March, accessed 30 April 2019.

5 An economic impact assessment is distinct from an environmental impact assessment, which may draw on the economic impact assessment, but is separate.

6 For example, see European Commission (2014), ‘Guide to cost-benefit analysis of investment projects’, December, accessed 14 May 2019; or UK Department for Transport (2013), ‘Transport analysis guidance’, 29 October, accessed 14 May 2019.

7 Oxera (2017), ‘To be fair: what does economic justice look like?’, Agenda, January, accessed 12 May 2019; Oxera (2019), ‘Fair ground: a practical framework for assessing fairness’, Agenda, March, accessed 14 May 2019.

8 States of Jersey (2017), ‘Review of Personal Tax (Stage I) – Data analysis’, 27 March, accessed 12 May 2019.

9 For further details, see Oxera (2016), ‘Brexit: Implications for state aid rules’, Agenda, June, accessed 12 May 2019; and Oxera (2018), ‘The impact of state aid on competition: an economic framework for the European Commission’, Agenda, January, accessed 12 May 2019.

10 National Audit Office (2017), ‘Review of the Thames Tideway Tunnel’, 2 March, p. 30.

11 Société du Grand Paris, ‘Grand Paris Express Investor presentation’, accessed 10 May 2019.

Download

Contact

Please get in touch at [email protected]

Contributors

Related

Download

Related

The European growth problem and what to do about it

European growth is insufficient to improve lives in the ways that citizens would like. We use the UK as a case study to assess the scale of the growth problem, underlying causes, official responses and what else might be done to improve the situation. We suggest that capital market… Read More

The 2023 annual law on the market and competition: new developments for motorway concessions in Italy

With the 2023 annual law on the market and competition (Legge annuale per il mercato e la concorrenza 2023), the Italian government introduced several innovations across various sectors, including motorway concessions. Specifically, as regards the latter, the provisions reflect the objectives of greater transparency and competition when awarding motorway concessions,… Read More