Loyal, lazy or time poor?

Today Citizens Advice issued a super-complaint to the Competition and Markets Authority about the ‘loyalty penalty’.

According to Citizens Advice, firms are ‘routinely punishing their customers simply for being loyal’, which disproportionately affects vulnerable customers such as older people.

Who is affected?

The super-complaint focuses on five retail markets in two sectors: financial services (home insurance, mortgages, and savings) and telecoms (mobile and broadband). However, the issues raised reach far wider than this, to other sectors, such as energy, transport and water.

Regulatory context

Regulators and policymakers are already investigating similar issues in a number of contexts.

The government’s energy market price cap is targeted at helping customers who do not switch their provider. The Financial Conduct Authority is considering what forms of price discrimination are acceptable, and is applying this in the mortgages market study, the proposal for a basic savings rate, and a forthcoming insurance market study. Ofcom is consulting on how to ensure that mobile customers get ‘fairer tariffs’ after their minimum contract period expires.

Why do existing customers sometimes pay higher prices?

New customers can get lower prices than existing customers for three reasons:

- competitive dynamics—fierce competition for new customers, some of whom will then stay loyal;

- technological advances—cost reductions mean that better products can be offered over time;

- firms compete to attract more profitable customers, via customer data and algorithms.

Each of these can be positive for customers, and price discrimination may be good for society overall.

Switching is necessary for competition and switching is unlikely without an incentive. Further, it is not clear that charging higher prices to those who are time-poor is a market failure, and the unwinding of price discrimination is likely to benefit some customers and hurt others. Thus regulators will need to be cautious not to cause unintended consequences.

What should firms be doing?

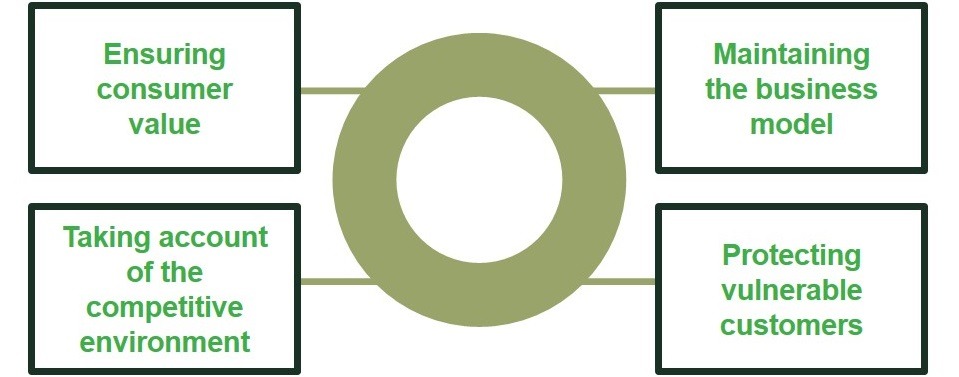

Fairness is a subjective matter and, in our experience, to inform a sensible discussion at board level it is useful to look at product design and pricing from four perspectives, shown below. Each perspective adds insight using a new toolkit of behavioural economics, competition economics, business model analysis and quantitative techniques. There will inevitably be tension between the different perspectives and it is useful to make this transparent—trade-offs will have to be made. An agreed product purpose informs these trade-offs.

Figure 1 Considerations for firms

The CMA has 90 days to publish its response to the super-complaint, and therefore has around three months to consider the complex issues surrounding market functioning and fairness across the five identified retail markets. The Authority’s conclusions could influence many other markets, affecting firms and customers across the wider economy.

Oxera advises firms on how to tackle these issues, and our fairness framework has delivered results for clients across industries.

Download

Related

The 2023 annual law on the market and competition: new developments for motorway concessions in Italy

With the 2023 annual law on the market and competition (Legge annuale per il mercato e la concorrenza 2023), the Italian government introduced several innovations across various sectors, including motorway concessions. Specifically, as regards the latter, the provisions reflect the objectives of greater transparency and competition when awarding motorway concessions,… Read More

Switching tracks: the regulatory implications of Great British Railways—part 2

In this two-part series, we delve into the regulatory implications of rail reform. This reform will bring significant changes to the industry’s structure, including the nationalisation of private passenger train operations and the creation of Great British Railways (GBR)—a vertically integrated body that will manage both track and operations for… Read More