Most-favoured-nation clauses: falling out of favour?

Competition authorities across the globe are investigating most-favoured-nation (MFN) clauses in distribution contracts in industries as diverse as hotel bookings, books and insurance. Such clauses guarantee to a distributor that no other distributor will receive a better deal. Although there is concern that they may restrict competition and harm consumers, MFNs can also deliver benefits. How should competition authorities strike a balance?

MFN clauses, also known as most-favoured-customer (MFC) clauses, are contractual terms agreed between firms at different levels of the value chain. They usually stipulate that a seller will offer its good or service to the counterparty on terms that are as good as the best terms offered to third parties.

The concept has its roots in trade agreements between countries, ports or city-states going back as far as the Middle Ages. According to these clauses, trade privileges offered to a third party had to be extended to the counterparty of an agreement so that the counterparty remained a ‘most-favoured nation’1. In the commercial world, MFN clauses are quite common and are used in a wide range of industries from books, movies and music, to hotels, insurance and energy supply. They have come under the spotlight following a number of investigations by competition authorities.

For example, the online hotel bookings market is being investigated by at least ten national competition authorities (NCAs), including those of Austria, France, Germany, Hungary, Italy, Switzerland and the UK. While not all of these investigations are identical in scope, MFNs between hotels and online travel agencies (OTAs)—through which hotels guarantee certain OTAs the best room prices among those offered to all OTAs—have been or are being explicitly considered by most NCAs. In some cases, the clauses also restrict the hotels themselves from offering better deals through their own websites or to last-minute walk-in customers. The main concern of the authorities is that these clauses can dampen competition among OTAs and increase the prices that consumers pay. The investigation by the German NCA has culminated in a ban on MFNs by the hotel booking service provider, HRS, while the investigation in the UK is being reviewed following a successful appeal against the earlier decision of the Office of Fair Trading (OFT, now the Competition and Markets Authority, CMA) to settle with the parties2.

Another recent case concerns the pricing of e-books available through online platforms, such as Amazon. The US Department of Justice investigated six major publishers of e-books as well as Apple (which is active in e-book retailing), and found that they used MFNs as a tool to implement a collusive agreement to increase prices to consumers3.

MFN clauses have also been scrutinised in the recent investigation into the UK motor insurance market, in which the CMA found that certain types of MFN between motor insurance providers and price-comparison websites (PCWs) restricted competition between PCWs4.

How do MFNs operate under different business models?

To understand the authorities’ concerns, it is useful to first set out the two main business models under which MFNs typically operate.

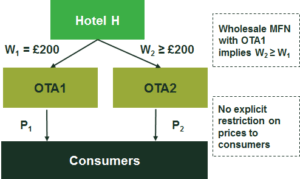

In the merchant model, the manufacturer offers the product to a retailer at wholesale terms and the retailer sets the retail price to consumers5. Figure 1 below illustrates this model with an example involving one hotel and two OTAs. Suppose hotel H offers one room to OTA1 for £200/night (denoted by W1 in the figure). OTA1 can resell it at any price (e.g. £220). A wholesale MFN agreement between hotel H and OTA1 in this case would typically stipulate that the hotel cannot provide the same room to OTA2 at a ‘wholesale’ cost of less than £200 (denoted by W2). However, OTA2 is free to set the final price to consumers at any level. Such wholesale MFNs, in isolation, therefore maintain the freedom of retailers to set prices and hence are often not considered to be problematic6.

Figure 1 Stylised example of MFNs in a merchant model

Source: Oxera.

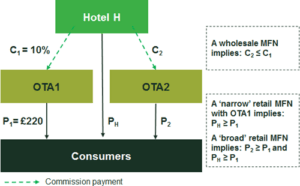

In the agency model, a ‘retailer’ is considered to be an ‘agent’ of the manufacturer and has no involvement in price-setting decisions7. So, in the hotel example, both OTA1 and OTA2 would advertise rooms of hotel H at their respective prices, P1 and P2, which are set by hotel H (see Figure 2 below). For every booking it makes, the OTA receives from hotel H a commission (denoted by C1 and C2 in the figure), which may or may not be dependent on the price of the room8.

In this case, a retail MFN clause between OTA1 and hotel H may stipulate that hotel H cannot advertise the same (or a similar) room for a lower price through any alternative OTA such as OTA2, or any other sales channel (e.g. hotel H’s own website, where the price advertised is PH). Such an MFN clause would be considered a ‘broad’ retail MFN—i.e. one that specifies conditions on the retail price advertised on all alternative channels. A ‘narrow’ retail MFN, on the other hand, might be one that stipulates only that hotel H will not advertise a lower price through its own website (i.e. PH ≥ P1), and leaves the option for hotel H to offer consumers a lower price (P2) through OTA2.

The parties could also have a ‘wholesale MFN’ that stipulates that the commission paid to OTA1—i.e. C1—will not be lower than that paid to any other OTA (e.g. C2).

Figure 2 Stylised example of MFNs in an agency model

Source: Oxera.

Synchronised shifting: the authorities’ concerns

As described above, concerns have been raised across jurisdictions and sectors. In the most recent cases, potential restriction of retail competition through the use of retail MFN clauses under agency agreements has been the primary concern9.

While the degree of concern is likely to differ depending on how broad or narrow the retail MFN is, for illustrative purposes suppose that in Figure 2 there is a retail MFN in place which covers the prices advertised through both OTAs (although similar concerns are relevant when the MFN also restricts the pricing through the hotel’s own website). In the absence of any MFN, hotel H would be able to set prices P1 and P2 freely. In particular, it has an incentive to encourage sales—by lowering the retail price—at the OTA that charges it a lower commission level, thereby providing hotel H with a higher margin while it competes more aggressively with other hotels.

The retail MFN clause, for example with OTA1, therefore prevents the seller from ‘rewarding’ other low-commission distributors. This issue may raise the following concerns.

- If a specific agent has in place a sufficiently broad retail MFN (i.e. one covering a large proportion of the sales channels), the agent, when thinking about negotiating an increase in its commission, will not be concerned about its competitiveness relative to other agents (because the manufacturer will be bound by the MFN not to reflect the higher commission in the price advertised through this agent). Equally, agents that wish to increase their market share by lowering their commission will not be able to advertise lower prices, as these will be constrained by the MFN. Thus, there is likely to be a lower incentive for agents to reduce commission rates, although elements of non-price retail competition may remain.This, in turn, raises the likelihood of consumer harm, assuming that higher commissions paid by a supplier ultimately feed through into higher retail prices.

- MFNs may also undermine market entry. For example, a new agent that wishes to advertise lower prices to consumers will not be able to do so in the presence of MFN clauses between existing agents and sellers, thereby preventing low-cost/low-price entry.

- The incentives for agents to reduce costs may be undermined. In a well-functioning market, agents would have an incentive to cut their costs and pass some of the savings on in the form of lower commissions, in order to incentivise the seller to lower the advertised price. With MFNs, this incentive is weakened.

Other concerns might also arise, depending on the case. For example, MFNs can be used as a tool to support collusive actions (as in the Apple e-books case, where MFNs were not considered problematic as such); a pervasive network of broad MFNs across the market can also reduce inter-brand price competition between sellers; and the lack of price competition can incentivise excessive advertising by retailers (which may have caused the deluge of TV advertisements in the UK from PCWs involving robots, opera singers and ‘meerkats’). Box 1 below provides further details on how the CMA analysed MFNs in the motor insurance market.

The extent to which an MFN clause is likely to give rise to harm will depend on a combination of factors including the type and scope of the clause (retail versus wholesale, broad versus narrow); the extent of use of similar clauses by other suppliers and agents; the payment arrangements in place (e.g. the structure of the commission rates); and, importantly, the market structure and positions of respective firms.

For example, use of MFNs by smaller retailers is likely to be less of a concern, as these clauses would help such firms to become, or remain, competitive. Recent findings in the academic literature also show that MFNs can assist market entry under certain circumstances (e.g. when the payment to the retailer is based on profit-sharing rather than revenue-sharing arrangements; and when the potential entrant has a less-differentiated, higher-cost business model than the incumbent)10. The extent of retail competition on parameters not covered by MFNs (e.g. customer service and other add-on services) is also a relevant factor in the assessment11.

Are there any benefits of MFNs?

In short, yes. Indeed, although MFN clauses have been increasingly scrutinised in recent years, they are not regarded as anticompetitive per se, as they can deliver benefits. The scope of these benefits is well accepted by academics and competition authorities, although detailed assessment has so far been limited.

First, MFN clauses can assist in preventing hold-up of investments by retailers. This is because such clauses, by preventing the supplier from offering better terms to other retailers and/or undercutting via the supplier’s own sales channels, can prevent ‘free-riding’ on a specific retailer’s investment.

For example, consider an online platform such as eBay, which invests in offering a high quality of service (e.g. in terms of customer reviews and purchase advice), and also invests in advertising. Despite this, if consumers find that the product is less expensive elsewhere, they may use eBay to obtain necessary information, but purchase through the chosen seller’s own website. Indeed, without an MFN in place, the price on the seller’s website is likely to be lower in order to attract the customer (as the seller avoids paying a commission to eBay), and eBay’s investments in service quality would therefore not be protected12. This, in turn, could lead to sub-optimal investments by retailers, and potentially to market exit13.

MFN clauses can also benefit consumers directly. For example, they allow retailers to advertise ‘lowest-price offers’, which offer consumers the assurance that they will find the best available price on a single platform. This in turn can significantly reduce search costs and may even lead to a higher switching rate (for example, a consumer can switch mobile contracts more easily than they otherwise could)14. Furthermore, although broad MFNs may limit price variation in the market and lessen price competition, they might enhance competition on other aspects of the offering. For example, retailers might differentiate themselves by investing in pre-sales advice or after-sales support, which consumers may welcome.

Concluding remarks

The growth of e-commerce and the use of agency agreements by online platforms have made MFNs a hot topic in competition law. While some academics and practitioners in Europe have questioned whether certain types of retail price MFNs should be treated as equivalent to RPM and as infringements per se, others support a case-by-case assessment of their potential harm and efficiency benefits. While this debate is unlikely to be resolved in the near future, the decisions of the numerous NCAs in the hotel investigations, as well as potential investigations in the online book retailing market15 should shed some light on the future of MFNs.

Download

Related

Future of rail: how to shape a resilient and responsive Great British Railways

Great Britain’s railway is at a critical juncture, facing unprecedented pressures arising from changing travel patterns, ageing infrastructure, and ongoing financial strain. These challenges, exacerbated by the impacts of the pandemic and the imperative to achieve net zero, underscore the need for comprehensive and forward-looking reform. The UK government has proposed… Read More

Investing in distribution: ED3 and beyond

In the first quarter of this year the National Infrastructure Commission (NIC)1 published its vision for the UK’s electricity distribution network. Below, we review this in the context of Ofgem’s consultation on RIIO-ED32 and its published responses. One of the policy priorities is to ensure… Read More