New game, new rules: the draft guidelines for ‘green’ state aid measures

On 7 June, the European Commission published its draft climate, energy and environmental aid guidelines (CEEAG). More comprehensive than the previous version, these guidelines cover new technologies (such as hydrogen) and state aid for the phasing out of coal. We explore the role of economic and financial analysis in assessing the compatibility of ‘green’ aid measures under the guidelines.

Given that significant public funding will be channelled to the green transition in the coming years, the CEEAG mark an important milestone in the Commission’s ongoing exercise to update the existing state aid rules (the ‘fitness check’).1

The new guidelines, which will come into force on 1 January 2022, cover a number of new areas, including aid for clean mobility, new energy sources and infrastructure such as (renewable) hydrogen, the ‘circular economy’,2 and aid for the early closure of coal, peat and oil shale activities.3 In addition, large airports will now qualify for state aid for ‘green’ investment projects.4

Overall, the approach followed by the Commission in the draft guidelines is comprehensive, setting out specific compatibility criteria for each aid category. In line with the current Environment and Energy Aid Guidelines (EEAG) published in 2014, the new draft guidelines highlight the important role for economic and financial analysis in assessing the compatibility of aid. This article discusses the role of such analysis, focusing on the need for, and proportionality of that aid. But first we look at how aid affects competition and trade.

Mind the gap: assessing the impact of aid on competition and trade

The new guidelines set out in more detail than the 2014 EEAG how the potential negative effects of the aid should be assessed, and include an explicit section on balancing the positive and negative effects.5 In particular, they highlight that the impact of aid on competition and trade needs to be examined over both the short and long term.6 The Commission highlights that, if aid is granted to projects that provide only limited short-term benefits in terms of reducing emissions, but that have the potential to impede the expansion of cleaner technologies over the longer term (such as projects that ‘lock in’ natural gas use resulting from support for investments in pipeline infrastructure), then the aid can be particularly distortive. In addition to assessing the effect of the aid on total emissions, under the CEEAG it will be important to consider the extent to which some technologies might displace other renewable generation technologies.

In line with the 2014 EEAG, the assessment should also consider whether the aid raises barriers to entry for more efficient or innovative companies, and whether it is likely to strengthen or maintain the market power of the beneficiary.7 In this context, particular focus might need to be given to the definition of the relevant geographic market, given the increasing integration of the European energy market.

The new guidelines also highlight that, for certain categories of aid (such as aid for the reduction and removal of greenhouse gas emissions), for each beneficiary or aided project, the subsidy per tonne of CO2-equivalent emissions avoided must be estimated in order to enable comparisons across different environmental protection measures.8 The assumptions and methodologies for these calculations will also have to be provided to the Commission.

As the amount of aid for future ‘green’ investments may be very large—in particular for aid measures or schemes for the reduction and removal of greenhouse gas emissions9—it is appropriate to assess in detail the impact of aid on competition and trade. The requirement to evaluate the long-term impact of aid, together with the scale of the necessary investments in energy infrastructure in the coming decade, suggests that detailed market models will be needed to assess the impact of new aid measures and schemes on competition and trade. For example, modelling will be needed to forecast the impact of the expansion of renewable generation on electricity and gas markets, the demand response, heat networks, and carbon capture and storage systems. Market dynamics can change significantly depending on the technologies adopted, and consequently the structure of the market. Cross-border flows will also affect competition. Uncertainty over the policies, technologies and prices of key inputs to such models highlights that the assessment of the impact of aid on competition and trade will also need to reflect a variety of scenarios.

Given the economic lifetime of energy plants, the analysis would need to predict over a relatively long period what will happen with or without the aid (in the counterfactual scenario). The modelling therefore requires assumptions about future new investments, the energy mix, and whether any new capacity that comes onto the system will be operated by today’s incumbents or new entrants. The results of such a counterfactual analysis will depend on the robustness of the input assumptions, such as the expected evolution of carbon prices.

Moreover, the impact of large aid measures or schemes may persist for many years, which raises a question about the timeframe that should be modelled, particularly given the long operational lives of energy infrastructure. Due to the uncertainty involved in such an analysis, in order to ensure that the simulated results are sufficiently robust, sensitivity analysis should be undertaken to consider how changes in key input parameters might affect the results.

The assessment of the impact on competition and trade will be particularly important for aid for the early closure of coal, peat and oil shale activities, given that, by the end of 2021, half of Europe’s 300 coal-fuelled power plants are due to close or announce that they will be retired before 2030.10 The box below sets out how such analysis should be carried out.

Assessing the impact on competition and trade resulting from aid for the early closure of coal, peat and oil shale activities

This is an important area given that some schemes, such as the German Coal Exit Act, will have an impact on the European energy market that will persist for several decades. The planned coal exits, which may be pursued at the same time as the phase-out of other generation capacity such as nuclear (for example, in Germany), are likely to reduce domestic generation capacity significantly over the coming years. This could lead to the electricity wholesale market becoming increasingly ‘tight’, which could strengthen the market power of the remaining operators if their plants are indispensable (or ‘pivotal’) to covering demand in a larger number of hours. The degree of electricity market ‘tightness’ should therefore be scrutinised under a variety of scenarios, together with the impact on market power arising from the proposed phase-out plans. In particular, it will be important to consider whether sufficient (renewable) generation capacity could be developed to mitigate the market power concerns.

Note: See draft CEEAG, section 4.12.1.6.

In line with the 2014 EEAG, the new guidelines also emphasise the role for ex post evaluations of aid schemes as a positive factor when weighing the positive effects of aid against its negative effects on competition and trade.11 Ex post evaluations are typically required for large aid schemes or schemes containing novel characteristics, or where significant market, technology or regulatory changes are foreseen. The aim of these evaluations is to assess whether the assumptions and conditions underlying the compatibility of the schemes have been achieved, including the impact of the schemes on competition and trade.

Is the aid needed and limited to the minimum necessary?

In line with the 2014 EEAG, the new guidelines emphasise that aid is necessary only if it targets residual market failures (i.e. after taking into account other policies that are in place, such as the EU Emissions Trading System, or ETS, and carbon taxes).12 The new guidelines, however, explicitly recognise that, in order to demonstrate the need for aid, the quantitative evidence to be provided by member states is the same as for the assessment of the proportionality of the aid.13

In terms of this assessment, the new guidelines emphasise the role of competitive bidding to a far greater extent than the 2014 EEAG. In particular, a detailed assessment of the net extra costs (i.e. the funding gap) is no longer required if the amount of aid is determined through a competitive bidding process.14

For some aid measures or schemes, such as aid for the phase-out of coal, it is possible that auctions will be used, whereby the plant operators will bid for the amount of compensation in exchange for which they would be willing to close. From an economics perspective, even if tender procedures or auctions are used, the risk of overcompensation cannot be ruled out—for example, due to strategic bidding. In addition, if the auction is not designed appropriately, there might be a risk that the auction will produce distortive incentives. For example, plants with high emission intensities that would have closed in the absence of the aid may keep operating for longer in order to receive compensation. A detailed proportionality assessment would instead detect such distortions.

Where aid is not granted through a tender, the new guidelines emphasise the role of funding-gap analysis to a greater extent than the 2014 EEAG. The draft guidelines accordingly place less weight on assessing the proportionality of the aid based on maximum amounts of the aid relative to the eligible costs of the project (i.e. aid intensities).15 The objective of the funding-gap analysis is to assess whether aid is limited to the net additional costs relative to a counterfactual scenario without the aid.

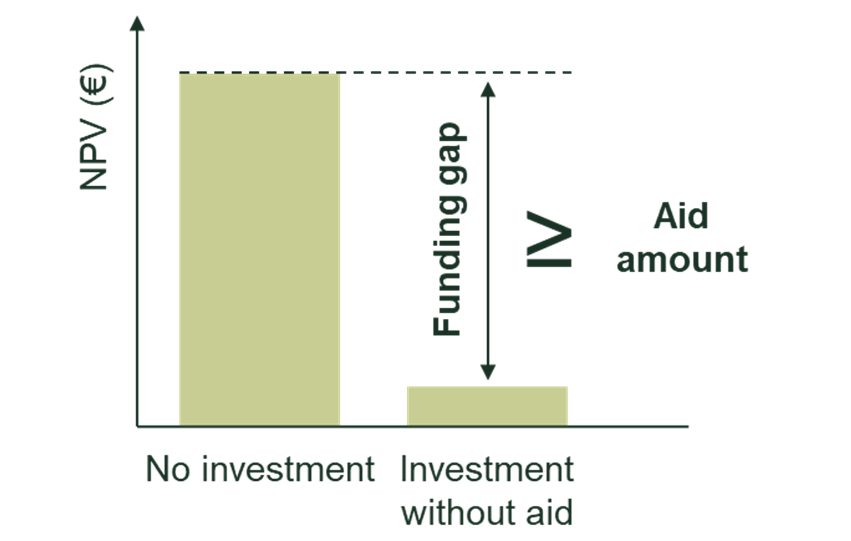

In the new guidelines, the Commission has to some extent simplified the definition of the counterfactual scenario. Instead of using a more environmentally friendly option as an alternative scenario, the Commission proposes that, for certain aid measures such as aid for energy infrastructure, the counterfactual scenario could be that the company does not introduce any changes to its current business or the investment is not undertaken at all (i.e. there is no counterfactual scenario).16 If this is the case, the aid can cover up to 100% of the funding gap.17 Figure 1 illustrates the use of the funding-gap approach to estimate the maximum amount of aid allowed. Under this approach, the amount of aid should not exceed the difference between the profitability, as measured by the net present value (NPV) of future cash flows, in the event that no investment is undertaken and the equivalent if the investment is undertaken without aid.

Figure 1 Using the funding-gap approach to estimate the maximum amount of aid

In the new guidelines, the Commission highlights that member states must explain the assumptions used for each aspect of the quantification of the funding gap, and justify the adopted methodologies, taking into account other policies such as the ETS. Similar to analysing the impact of aid on competition and trade, the assessment of the proportionality of the aid requires long-term projections of certain aspects of the energy market. Given the long investment lead times and operational lives of energy plants, to avoid the risk of overcompensation, economic modelling should assess a number of scenarios reflecting the potential for changes in fuel and carbon prices, and in the capital and operating costs of infrastructure.

In contrast to the 2014 EEAG, the new guidelines also introduce an important role for clawback mechanisms, particularly where competitive bidding is not used to grant the aid, and there is significant uncertainty around the future evolution of costs and revenues.18 Such mechanisms are usually designed such that, if the actual return to the aid beneficiary exceeds a predefined level, a certain proportion of the ‘excess’ returns is clawed back by the state. Such a situation can arise if the aid is granted ex ante and key input assumptions informing the amount of aid that was originally granted (such as electricity prices) change significantly ex post. In light of the long lifetime of energy plants, the changing risk profile over the duration of a project would need to be considered in order to establish a reasonable profit benchmark.

Do the new guidelines meet the expectations?

The scale of the investment challenge means that state aid is needed, alongside changes to regulation and other areas of competition law, to achieve the EU’s ambitious climate and energy targets. The new guidelines are critical in enabling this to happen and may also have a role in delivering the policies announced by the Commission under its ‘Fit for 55’ legislative proposals.19

The new guidelines, at approximately 100 pages, are almost twice as long as the 2014 EEAG, which indicates the importance of state aid in achieving the ambitious climate targets set by the EU. However, the guidelines still leave some room for interpretation: to what extent will the Commission assess the design of auctions to determine the compatibility of aid and assess the possible risks of overcompensation; and what timeframe should be considered to assess the long-term effects of aid on competition and trade?

Although the Commission has introduced some simplifications—for example, in relation to the choice of the counterfactual scenario for the funding-gap analysis—it still sets a high bar for the quantitative evidence that should be prepared by member states to demonstrate the compatibility of the aid, in particular with regard to the assessment of the impact of the aid on competition and trade.

Given the investment challenge ahead, these requirements are important to mitigate the risk that the aid will crowd out funding from private investors (or cleaner technologies), and will help to avoid creating significant undue distortions to competition and trade.

1 European Commission (2020), ‘Fitness Check of the 2012 State aid modernisation package, railways guidelines and short-term export credit insurance’, SWD(2020) 257 final, 30 October. European Commission (2021), ‘Public consultation on the revised Climate, Energy and Environmental Aid Guidelines (CEEAG)’. The new guidelines will replace the 2014 state aid guidelines for environmental protection and energy (EEAG): European Commission (2014), ‘Guidelines on State aid for environmental protection and energy 2014-2020’, C 200, Official Journal of the European Union, 28 June.

2 A circular economy aims to maintain the value of products, materials and resources for as long as possible by returning them into the product cycle at the end of their use while minimising the generation of waste.

3 The category in the CEEAG, ‘Aid for the reduction and removal of greenhouse gas emissions including through support for renewable energy’, together with the CEEAG’s provisions for energy infrastructure, is directly relevant for investments in renewable hydrogen. For further details, see Robins, N., Puglisi, L. and Burger, A. (2021), ‘The Role of State aid in Promoting Environmental Sustainability’, in S. Holmes, D. Middelschulte and M. Snoep (eds), Competition Law & Environmental Sustainability, Concurrences, 26 March.

4 Airports with annual traffic above 5m passengers. See draft CEEAG, para. 11.

5 Ibid., section 3.3.

6 Ibid., para. 65.

7 Ibid., paras 65–66.

8 Ibid., para. 98.

9 Although the new guidelines note that, for such aid measures and schemes, the Commission presumes that the positive effects of the aid outweigh its negative effects, the draft guidelines appear to still require a thorough assessment of the impact of aid on competition and trade. See draft CEEAG, section 4.1.1.

10 Euractiv (2021), ‘Europe halfway towards closing all coal power plants by 2030’, 23 March.

11 Draft CEEAG, section 5.

12 Ibid., para. 34.

13 Ibid., para. 37.

14 Ibid., para. 48.

15 Ibid., paras 50–52.

16 Ibid., para. 51.

17 The approach for assessing the proportionality of aid for the early closure of coal, peat or shale activities differs from the funding-gap analysis. According to the draft CEEAG, if the aid is not awarded through a tender, the Commission will assess the plants’ forgone profits as a result of the early closure and any additional costs associated with the early closure. See draft CEEAG, section 4.12.5.

18 See draft CEEAG, para. 53.

19 European Commission (2021), ‘“Fit for 55”: delivering the EU’s 2030 Climate Target on the way to climate neutrality’, COM(2021) 550 final, 14 July.

Related

Blending incremental costing in activity-based costing systems

Allocating cost fairly across different parts of a business is a common requirement for regulatory purposes or to comply with competition law on price-setting. One popular approach to cost allocation, used in many sectors, is activity-based costing (ABC), a method that identifies the causes of cost and allocates accordingly. However,… Read More

The European growth problem and what to do about it

European growth is insufficient to improve lives in the ways that citizens would like. We use the UK as a case study to assess the scale of the growth problem, underlying causes, official responses and what else might be done to improve the situation. We suggest that capital market… Read More