Ofgem’s RIIO-3 Sector Specific Methodology Decision

On 18 July 2024, Ofgem published its Sector Specific Methodology Decision (SSMD) for the forthcoming RIIO-3 price control period for electricity transmission (ET), gas transmission (GT) and gas distribution (GD) networks.1 This follows Ofgem’s consultation on the matter in December 2023.2 RIIO-3 will last for five years from April 2026 to March 2031 for the ET, GT and GD sectors. The price control for electricity distribution (ED) companies is not being set as part of the present round, as RIIO-ED3 starts two years after the regulatory period for the other sectors, i.e. in 2028. Nonetheless, the SSMD is likely to influence the regime that Ofgem will determine for ED. In this article we summarise the key decisions that Ofgem has revealed for RIIO-3.

In the SSMD, Ofgem highlights the significant push for investment in the electricity system that will be required to reach net zero, including the build-out of generation, storage and network infrastructure, as well as revamping the ET network to accommodate increasing shares of renewables.3 This has led to a revised approach for incentivising the delivery of important ET network investments. At the same time, gas networks are facing uncertainty over the timing and scale of the gas phase-out and possible re-purposing of infrastructure. Ofgem’s SSMD has clarified the source of funding for the transition or re-purposing of gas infrastructure in the medium term, and set out its expectation that the RIIO-3 period will not yet entail significant changes in usage of the gas sector.

The SSMD sets out four key outcomes for consumers and network users that Ofgem’s regulatory approach aims for:4

- infrastructure fit for a low-cost transition to net zero;

- secure and resilient supplies;

- high quality of service from regulated firms;

- system efficiency and long-term value for money.

In addition, Ofgem explains that it is seeking to streamline and simplify the process for RIIO-3 where possible, in order to reduce the regulatory burden.5

These aims are potentially difficult to reconcile with the fact that Ofgem has to assess challenging trade-offs between incentivising sufficient investment and ensuring value for money—all under significant uncertainty over the exact requirements of the energy system.

It also remains to be seen how Ofgem’s new statutory duties of net zero (since June 2023) and growth (since May 2024) will affect its regulatory approach. Ofgem interprets its net zero duty as a requirement to include consumers’ interests in meeting the statutory 2050 net zero target and other associated targets.6 The new growth duty requires Ofgem to have regard to ‘the promotion of sustainable economic growth through our regulated activities’.7 However, the exact effect of this very recent growth duty is something that Ofgem plans to clarify further. Ofgem expects that ‘this will include developing metrics to assess our contribution to growth across our regulatory decision making, reviewing our regulatory practices for pace, and doing more to understand the needs of business consumers.’8

Electricity transmission

Currently, the transmission system is operated by the Electricity System Operator (ESO). There is work ongoing in advance of RIIO-ET3 to transition the ESO to the National Energy System Operator (NESO), which will act as an expert, impartial body with a duty to facilitate net zero while maintaining a resilient and affordable system.9

RIIO-ET2 initially featured the Large Onshore Transmission Investment (LOTI) re-opener to approve and fund large projects. In December 2022, Ofgem published its decision on the Accelerated Strategic Transmission Investment (ASTI) framework, in response to the UK government’s target of 50GW of offshore wind by 2030.10 Ofgem introduced ASTI with the aim to accelerate the funding for these projects and ensure timely delivery. This would be achieved through (i) a financial delivery incentive; (ii) early development funding; and (iii) a streamlined cost assessment process.

In the SSMD, Ofgem has stated that ‘RIIO-ET3 will progressively build upon the principles of ASTI by incorporating an evolution of this mechanism into the enduring price control framework’.11 Due to the vast level of new investment required in ET infrastructure, Ofgem is keen to ensure a strategic approach to planning. As part of this, the NESO will be required to develop a Strategic Spatial Energy Plan (SSEP) in coordination with the government, which will then feed into a Centralised Strategic Network Plan (CSNP) that identifies the strategic investment required across the transmission network.12

The first CSNP, due to be published in 2026 and updated annually, will identify a delivery pipeline of load-related work for the ET network for the following 12 years.13 It will also include a 25-year view, which will be updated every three years. The CSNP will be designed to help Ofgem to make quicker investment funding decisions, minimise investor uncertainty and keep costs down.14

Crucially, the RIIO-ET3 mechanism will have to permit approval of investments as per future CSNP updates, which can occur outside of the typical five-year business plan cycles. As the first CSNP will be published after the start of RIIO-ET3, related costs will not be reflected in the RIIO-ET3 baseline allowances. Funding for load-related expenditure announced in the first CSNP will therefore be provided through an uncertainty mechanism (UM).15

CSNP Funding Mechanism

The CSNP Funding Mechanism (CSNP-F), which will be used to fund projects that are set out in the CSNP as necessary for addressing system needs, incorporates the three key elements of ASTI mentioned above, although with some differences.16 These are discussed in turn below.

Early development funding

In the SSMC, Ofgem proposed to provide early development funding in the form of Pre-Construction Funding (PCF) and Early Construction Funding (ECF).17 Both mechanisms are already included in ASTI. However, in the SSMD, Ofgem confirmed only the PCF, while introducing a stand-alone mechanism for the advanced procurement of equipment (this is part of ECF under ASTI).18 In addition, Ofgem is considering including early enabling works, which are also part of ECF in ASTI, within PCF in RIIO-ET3. This decision will be informed by data on spending in this area under ASTI. TOs will be automatically eligible to receive PCF for all CSNP-F projects, as Ofgem recognises the value that early development funding provides to the delivery of transmission projects, particularly within the current challenging supply chain environment.19

On the scope of PCF, Ofgem retained the same position as in the SSMC, considering the selection of activities to be broad enough to enable effective network development. Moreover, it confirmed that PCF will be set out on a portfolio basis, as is done under ASTI.20 The level of PCF will be published as part of the Draft Determinations, and there is a possibility of a re-opener to request changes to PCF allowances.

Furthermore, in recognition of challenges in the supply chain, Ofgem is working to introduce an equipment procurement mechanism, starting from the remaining years of RIIO-T2.21 The aim is to provide funding for TOs for booking factory slots years in advance for equipment with long lead times or very high demand. This mechanism is set to be implemented around early 2025, and it will operate on an enduring basis across regulatory periods.22

Ofgem’s intention is that the equipment procurement mechanism will not be limited to CSNP-driven projects, but will apply to all price control areas that are relevant to the equipment procured.23 Funding will be provided in the form of an allowance when TOs are required to make financial commitment(s). This will determine an ex ante increase in the RAV, with the actual spend used to true up the RAV.

Independent Technical Adviser (ITA)

The ITA is intended to provide assurance on design decisions, procurement processes and overall project delivery for CSNP projects. It will be an independent organisation providing assurance to Ofgem, which will to speed up decision-making and reduce the knowledge asymmetry between Ofgem and the ET networks.24

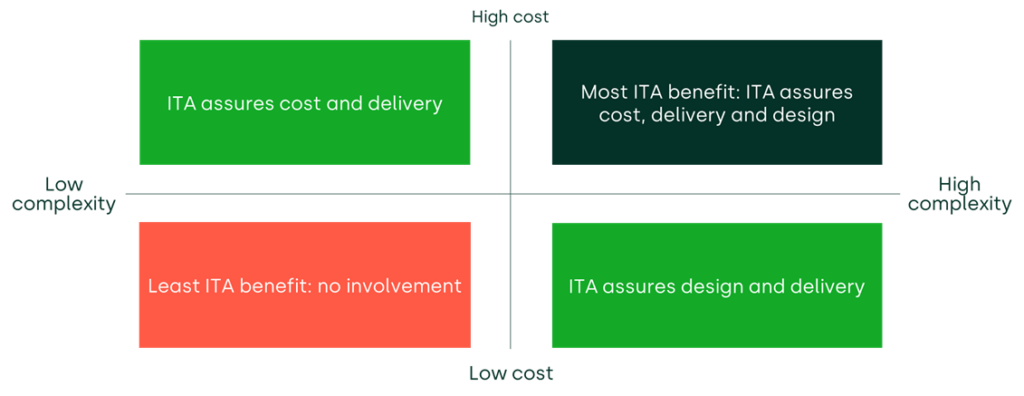

Ofgem’s criteria for determining when, and to what degree, an ITA will be involved in a project depend on both the project’s cost and its complexity, as shown in Figure 1 below.

Figure 1 Decision on determining ITA involvement in CSNP projects

Source: Ofgem (2024), ‘RIIO-3 Sector Specific Methodology Decision – ET Annex’, 18 July, p. 39.

Ofgem will appoint the ITA as a single entity, but it can be composed of multiple firms in the form of a consortium to ensure that the various required specialisms are sufficiently well covered.25 An ITA will be appointed to act as the adviser for all projects within a set period of time—Ofgem uses five years as its hypothetical example. The ITA will be funded by the TOs at a portfolio level, with the cost being recoverable through the price control mechanism.26

Delivery incentives

In the SSMD, Ofgem set out the three key objectives of the financial delivery incentives: (i) avoiding/reducing delays, where these bring costs for consumers; (ii) ensuring that consumers are compensated for delays; (iii) ensuring that incentives do not create costs for consumers in other parts of the price control (e.g. in the allowed WACC).27 Eligibility will depend on the project costs and the importance of timely delivery for consumers, with Ofgem anticipating that the project cost threshold will be higher than the £100m threshold under ASTI.28

Ofgem has not yet made a decision on the strength of the incentive, although it intends to apply a daily late delivery penalty, as in the ASTI regime. Ofgem notes that a different approach could be implemented for the reward, as the CSNP-F portfolio is likely to be characterised by a lower level of urgency than ASTI and early delivery could bring little or no consumer benefit. As such, Ofgem is considering a lump-sum reward for delivery on or before the target date, instead of a daily reward.29

As under ASTI, a cap will apply on the level of reward/penalty applied in any 12-month period and across the duration of the project.30 The cap levels for ASTI set a precedent that will be taken into account alongside the RoRE and financeability impact. In addition, Ofgem is considering a minimum reward/penalty for projects where the standard calculation results in a number that is low relative to the project costs, in order to ensure that a sufficiently strong incentive is provided for such projects.

Cost assessment

Ofgem confirmed that, for CSNP-F projects, it will implement the same streamlined form of cost assessment as used under ASTI.31 Direct costs will be set by the market and will be regarded as efficient by Ofgem, given evidence of competitive tender processes, and given that unit rates are broadly consistent with Ofgem’s expectations.32 Indirect costs will be assessed on a project-by-project basis to ensure that there is no double counting across different projects.33 Ofgem intends to monitor the ASTI approach, and will implement modest changes if appropriate.

Gas transmission and distribution

In the GT and GD sectors, networks face different sources of uncertainty to those in the ET sector. Specifically, gas networks face uncertainty about how the pathway to decarbonisation will affect existing and new/enhanced network assets. The pace at which the GB energy system decarbonises, and the pathway that it takes, will influence whether assets are retained, repurposed or decommissioned.

Ofgem’s starting point for RIIO-3 is that it does not currently foresee large-scale, systematic changes to the gas networks during the RIIO-3 price control period.34 Consequently, it proposes a largely unchanged price control process from RIIO-2. However, several policy areas that could significantly affect the future of the gas network are awaiting government decisions,35 and will affect the future regulation of the gas sector, not least because of re-opener and other uncertainty mechanisms that are anticipated to be in place through RIIO-3.

The future of gas

Ofgem highlights the longer-term risk of gas network asset stranding if gas demand falls before assets are fully depreciated. It notes that exposing investors in gas networks to stranding risk ‘could undermine regulatory stability and predictability and is likely not in the consumer interest’.36 Ofgem is explicit about seeking to address risk ‘at source’,37 rather than through, for example, an increase in the return on capital allowance as compensation for the asset stranding risk perception.

Ofgem acknowledges significant uncertainty about how much and which parts of the gas network may be repurposed for hydrogen in the future. Noting the interactions with the government’s Hydrogen Transport Business Model (HTMB), Ofgem has decided that much of the investment and development expenditure relating to hydrogen transport infrastructure, including costs for repurposing the network, will not be funded through RIIO-3. Instead, such expenditure is envisaged to be funded in the future via the HTBM, which will be open to parties beyond the gas networks.38

Due to the uncertainty regarding the roll-out of hydrogen blending in the pre-existing network, Ofgem proposes that any related costs should be recovered through the uncertainty mechanism related to net zero in both GD and GT.39 In relation to decommissioning, Ofgem has decided not to create a decommissioning liabilities fund or to provide upfront funding for this as part of RIIO-3, due to significant uncertainty around scope, timelines and funding sources.40 While it will not fund decommissioning costs through baseline allowances, Ofgem signalled that decommissioning costs would be recoverable through the Heat Policy Re-opener and/or net zero uncertainty mechanisms.41

In relation to depreciation, Ofgem has decided to accelerate depreciation for gas network companies during RIIO-3 in order to protect current and future consumers.42 Accelerated depreciation will lead to increased charges during RIIO-3, but is considered necessary by Ofgem in order to mitigate the risk of unsustainable increases in future depreciation charges, as the consumer base decreases. With this approach, Ofgem also aims to provide confidence to network companies and investors by mitigating perceived asset stranding risks. While accelerated depreciation will apply to both the GD and GT sectors, there are differences in terms of the payback date of additional RAV spend, as follows.

- For GD, Ofgem is targeting the payback of additions to the RAV in line with the statutory net zero target date of 2050. Ofgem is still considering whether this target should apply to the entire RAV or only to new RAV additions from RIIO-3.43

- For GT, Ofgem is still considering whether to target the payback of the GT RAV by the statutory net zero target date of 2050, noting potential opportunities to retain or repurpose sections of the transmission network for hydrogen or CCUS transportation networks to support industrial decarbonisation.44

Building blocks of the proposed RIIO-3 regime

Building on the framework decision in October 2023,45 Ofgem started to consider the practical tools that it will use in RIIO-3 as part of the SSMC, and has confirmed its intended approach in relation to many parameters of the allowed revenues building blocks, as part of the SSMD. The key building blocks of the price control design are the same as in RIIO-2 and are discussed in turn below.

The output framework

The general output framework consisting of licence obligations (LOs), output delivery incentives (ODIs) and price control deliverables (PCDs) will stay in place for RIIO-3. Ofgem has decided on some changes to the implementation of the incentives to streamline and simplify the process. For PCDs, a materiality threshold of £15m is being introduced and, where PCDs result in (efficient) overspend due to changes in scope with benefits for consumers, the allowance can be adjusted upwards. As a change relative to RIIO-2, Ofgem intends that financial ODIs will be calculated based on a RoRE basis in RIIO-3 (as opposed to being based on base revenue). Finally, Ofgem intends that the approval of new bespoke outputs for networks will be considered only in exceptional circumstances for RIIO-3.46

Information and efficiency incentives

In RIIO-2, Ofgem introduced the Business Plan Incentive (BPI) to incentivise companies to submit ambitious business plans. For RIIO-3, Ofgem is retaining this incentive with some adjustments. The BPI will now consist of the following three stages, and there will no longer be a distinction based on high-/low-confidence cost categories.47

- Stage A can result in a penalty of up to 20bps of RoRE if business plans lack the minimum amount of information required.

- Stage B consists of an assessment of whether submitted costs are efficient and well justified. This will result in a maximum reward of 40bps and a maximum penalty of 20bps of RoRE—although the exact distribution will depend on the proportion of bespoke costs vs comparatively assessed costs.

- Stage C can result in a maximum reward or penalty of 20bps of RoRE depending on the quality and ambition of the business plan, which will be assessed in the round.

The overall value of the BPI will therefore be capped at ±60bps of RoRE, which Ofgem expects to be a strengthening of the incentive relative to the 2% TOTEX BPI incentive in RIIO-2.48 While the maximum reward/penalty is symmetric, it differs across the three stages and depends on the share of comparatively assessed costs.49

Ofgem is also planning to retain the TOTEX incentive mechanism (TIM), advising companies that ‘using a sharing factor in the range of 20–50% is plausible for the purpose of business planning and financeability analysis’.50 This compares with a 33–50% range in RIIO-2.51 The sharing rate for the TIM will not be mechanically derived from a cost confidence assessment, but instead determined using a qualitative and quantitative assessment of relevant factors.52

Incentivising innovation

Innovation funding will continue to be provided via the network innovation allowance (NIA) and strategic innovation fund (SIF). The former ensures that companies are able to undertake important early-stage research and development, and the latter focuses on the continued development of large-scale demonstrators to address net zero challenges.53 Ofgem will also continue to develop regulatory sandboxes that will inform changes to the rules for energy network activities.54

Efficiency assessment

Relative efficiency

In addressing uncertainties around the future of gas and broader economic challenges, Ofgem has outlined its cost assessment approach for RIIO-3 across the three sectors as follows.

- ET: Ofgem plans to retain the RIIO-ET2 toolkit approach for both load- and non-load-related CAPEX, which includes needs case reviews, unit cost benchmarking and engineering reviews. Market-tested data will be incorporated to enhance unit cost assessments, and the same methodology will be applied to shared driver projects.55

- GT: Ofgem’s GT3 cost assessment toolkit will retain unit cost analysis, historical trend analysis, expert review, project assessment and benchmarking—similar to the methodology utilised during GT2.56

- GD: econometric analysis will remain the primary tool for Ofgem’s RIIO-GD3 cost assessment.57 Different aggregation levels and cost drivers will be tested, with preliminary findings indicating that the GD2 TOTEX model is a strong starting point. Alternative/additional models and cost drivers will be further explored.58 Regional factors leading to cost differences will be refined, which will involve updating wage indices and exploring the use of density variables.59

Real Price Effects (RPEs) and ongoing efficiency

Ofgem has decided to broadly retain the RIIO-2 approach to RPEs for the RIIO-3 price control period. This approach involves making annual adjustments to allowances based on the differences between the CPI (and CPIH) and input price indices. This indexed methodology aims to accurately reflect market conditions and mitigate the risks associated with forecasting errors and volatile input costs. However, Ofgem has acknowledged network and stakeholder concerns about the details of how the RPE indexation mechanism is calibrated, and has committed to assessing this further in order to ‘improve and/or simplify any underlying methodological aspects, including indices selection and their weighting’.60

For ongoing efficiency, Ofgem again plans to continue to use the methodology used during RIIO-2. This involves setting an ongoing efficiency challenge informed by a wide range of evidence including the EU KLEMS database, historical performance of network companies, and forward-looking productivity forecasts for the UK economy. Ofgem intends that the ongoing efficiency assumption of 1% per annum at the TOTEX level, used in RIIO-2, will serve as a starting point for RIIO-3.61

Return on capital allowance

In the SSMD, Ofgem has reiterated its decision to maintain its approach to setting the regulatory allowed cost of equity using the CAPM methodology, which is broadly in line with the RIIO-2 controls and UKRN guidance. There have been some changes to specific CAPM parameter methodological approaches and estimates, namely:

- on the risk-free rate, Ofgem has updated its estimates of the RPI–CPIH wedge, to reflect the RPI–CPI convergence in 2030;62

- on TMR, Ofgem has broadly maintained its estimation methodology and arrived at a slightly higher range with a midpoint of 6.75% (CPIH-real) relative to the RIIO-2 precedent of 6.5% (CPIH-real);63

- on beta, Ofgem has updated the beta sample to include European energy comparators.64

For setting the cost of debt allowance, Ofgem has retained broadly the same methodology, with two key modifications:

- for TOs, Ofgem has introduced a RAV weighting for the cost of debt to better reflect the high expected RAV growth in the ET sector in RIIO-3. This is similar to the weighting methodology applied to the cost of debt for SHET since RIIO-1, modified to account for refinancing of the historical RAV additions. A similar change has not been proposed for GDNs;65

- Ofgem has changed the inflation treatment in the cost of debt calculation to address the ‘leverage effect’.66 This is discussed further in the next sub-section.

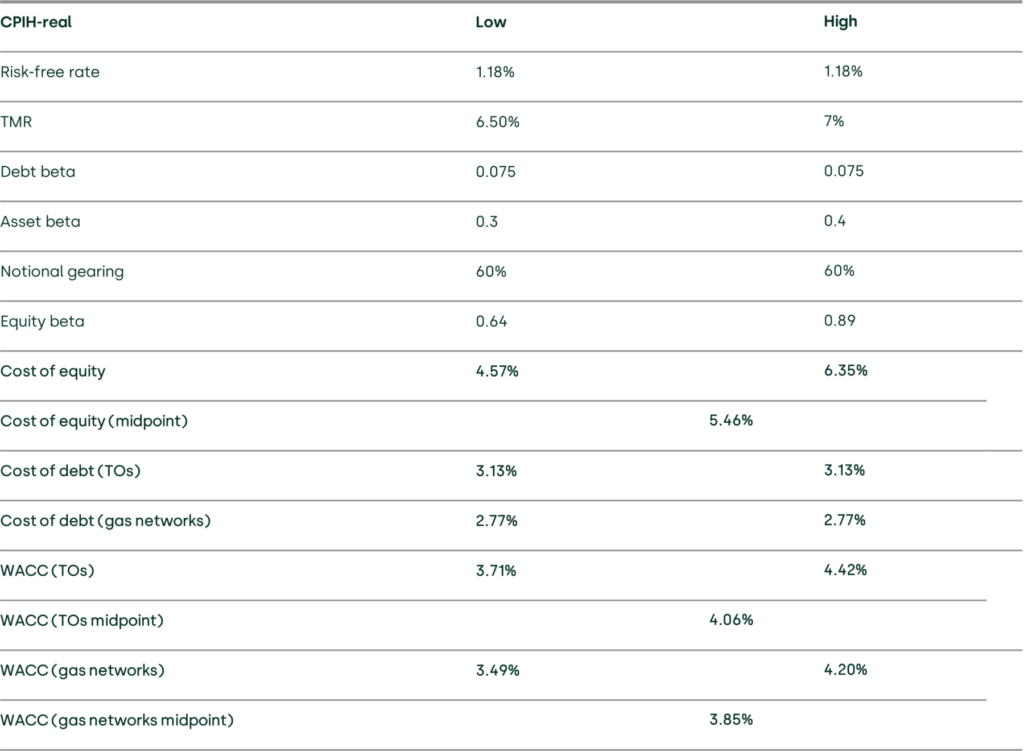

These methodological decisions result in the forecast return on capital allowance summarised in the table below.

Table 1 ’Early view’ RIIO-3 return on capital allowance

Source: Ofgem (2024), ‘RIIO-3 Sector Specific Methodology Decision – Finance Annex’, 18 July, Table 1 and Table 13.

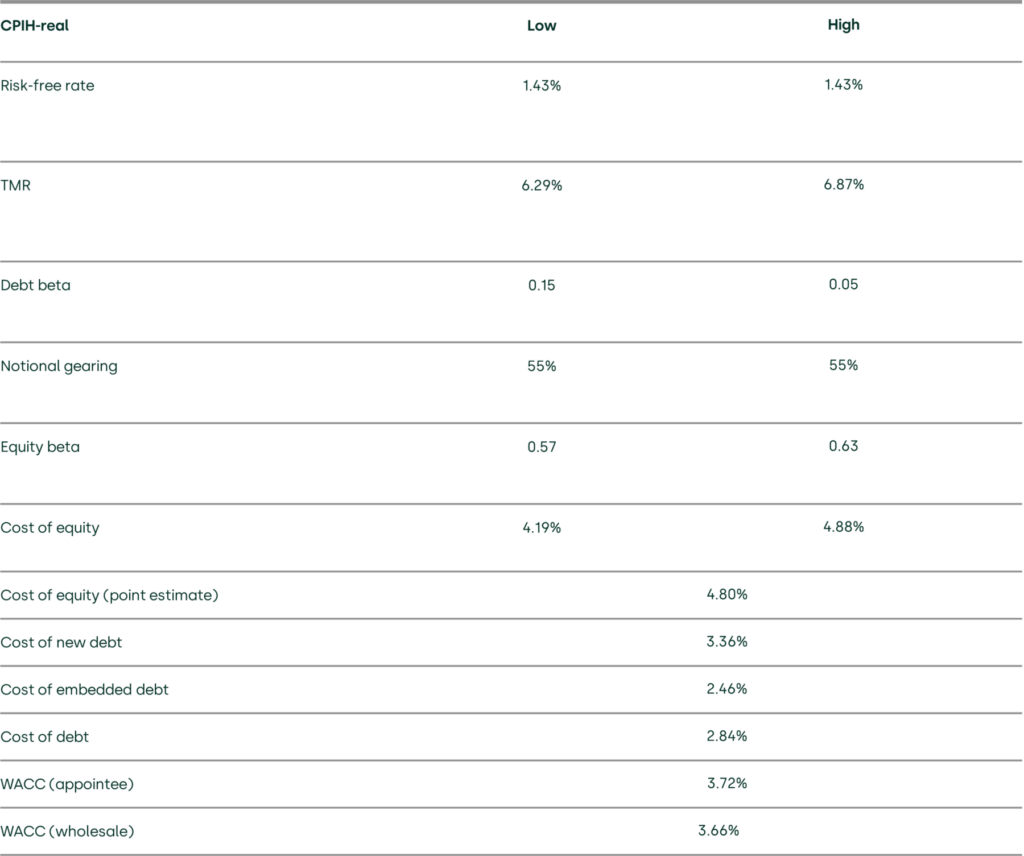

For the purposes of comparison, we also include a table below that sets out the summary WACC decision in Ofwat’s recent PR24 Draft Determination.

Table 2 Ofwat PR24 Draft Determinations allowed return on capital

As ‘step 2’ in its cost of equity allowance methodology, Ofgem will assess its range by considering a number of cross-checks including Market-to-Asset ratios, Offshore Transmission Operator implied cost of equity, investor managers’ implied cost of equity, infrastructure fund implied cost of equity, and cost of equity cross-checks implied by the cost of debt.67 Additionally, in its ‘step 3’ for setting the regulatory allowed cost of equity, Ofgem will consider the skew of expected returns in the overall regulatory package, to assess whether it considers that an adjustment is needed to ensure that the expected return on capital matches the allowed return.68

Treatment of inflation

As noted above in relation to the ‘leverage effect’, after reviewing the arguments outlined in the SSMC and stakeholder responses, Ofgem has decided to implement its ‘Option 1’ treatment of inflation in the cost of debt calculation. Under this option, fixed and index-linked debt (ILD) is treated differently under the notional capital structure assumptions. The fixed portion of the notional debt portfolio will now be renumerated with a nominal return on debt allowance, while the index-linked portion of the notional debt portfolio will continue to be renumerated with a CPIH-real return on debt allowance. Subsequently, the portion of notional RAV financed by fixed debt will not be indexed by inflation, while the portion of notional RAV financed by ILD will continue to be indexed. The notional assumption on the proportion of ILD in the debt portfolio will remain unchanged at 30%.69 Practically, Ofgem observes that this will have the effect of bringing cash flows forward.70 Ofgem also emphasises that it does not consider that the changes applying to pre-existing RAV are retrospective.71

Financial resilience

Ofgem has decided to introduce the additional financial resilience measures outlined in the SSMC.72 These include:

- amending the licence condition to ‘require’ licensees to maintain more than one investment grading rather than using ‘reasonable endeavours’ or taking ‘all appropriate steps’;73

- amending the dividend lock-up trigger to the earlier of reaching BBB- with a negative watch/outlook, and 80% (revised to 75% in the SSMD) regulatory gearing;74

- amending the board certification requirement to require that licensees state that they have sufficient financial resources to cover the entirety of the price control or a minimum of three years ahead;

Additionally, Ofgem has already taken forward an increase in networks’ reporting requirements of MidCo- and HoldCo-level financing structures through its recent consultations, such that it does not propose to take further action as part of the RIIO-3 process.75

Next steps

Alongside the SSMD, Ofgem has published its business plan guidance, which companies will use to submit draft business plan data over the summer. Final business plans will need to be submitted in December 2024. Draft Determinations setting out Ofgem’s proposed RIIO-3 allowances for each company are expected in summer 2025, with Final Determinations in Q4 2025. The RIIO-3 price control period for ET, GT and GD will then start in April 2026.76

1 Ofgem (2024), ‘RIIO-3 Sector Specific Methodology Decision’, 18 July.

2 See Oxera’s summary at Oxera (2023), ‘Ofgem’s RIIO-3 SSMC’, Agenda, 21 December.

3 Ofgem (2024), ‘RIIO-3 Sector Specific Methodology Decision – Overview Document’, 18 July, p. 5.

4 Ibid., para. 1.1.

5 Ibid., para. 1.5.

6 Ibid., para. 2.4.

7 Ibid., chapter 2.

8 Ibid., para. 2.5.

9 Ofgem (2024), ‘RIIO-3 Sector Specific Methodology Decision – ET Annex’, 18 July, p. 6.

10 Ofgem (2022), ‘Decision on accelerating onshore electricity transmission investment’, 15 December.

11 Ofgem (2024), op. cit., p. 8.

12 Ofgem (2024), op. cit., p. 7.

13 Ofgem (2024), op. cit., p. 14.

14 Ofgem (2024), op. cit., pp. 13–14.

15 Ofgem (2024), op. cit., p. 14.

16 Ofgem (2024), op. cit., p. 18.

17 Ofgem (2023), ‘RIIO-3 Sector Specific Methodology Consultation – ET Annex’, 13 December, p. 19.

18 Ofgem (2024), op. cit., p. 21.

19 Ofgem (2024), op. cit., p. 31.

20 Ofgem (2024), op. cit., p. 21.

21 Ofgem (2024), op. cit., p. 24.

22 Ibid.

23 Ofgem (2024), op. cit., p. 23.

24 Ofgem (2024), op. cit., p. 32.

25 Ofgem (2024), op. cit., p. 40.

26 Ibid.

27 Ibid., p. 45.

28 Ibid.

29 Ibid., p. 47.

30 Ibid.

31 Ibid., p. 48.

32 Ofgem (2024), op. cit., p. 49.

33 Ibid.

34 Consistent with Ofgem’s Open Letter on Future of Gas Price Controls. See Ofgem (2023), ‘Open Letter Decision on Future of Gas Price Controls’, 26 July, p. 8.

35 For example, in relation to (details of) blending hydrogen and methane, on hydrogen transport infrastructure and the role for hydrogen in domestic heating.

36 Ofgem (2023), ‘Consultation – RIIO-3 Sector Specific Methodology Consultation – GD Annex’, 13 December, para. 10.7.

37 Ofgem (2024), ‘RIIO-3 Sector Specific Methodology Decision – Finance Annex’, 18 July, para. 3.304.

38 Ofgem (2024), ‘Decision – RIIO-3 Sector Specific Methodology Decision – Overview Document’, 18 July, para. 4.10.

39 Ibid., para. 4.18.

40 Ibid., para. 4.34.

41 Ibid., para. 4.35.

42 Ibid., para. 4.44.

43 Ibid., para. 4.45.

44 Ibid., para. 4.46.

45 Ofgem (2023), ‘Future Systems and Network Regulation: Framework – Decision Overview’, 26 October.

46 Ibid., chapter 6.

47 Ibid., para. 7.26.

48 Ibid., paras 7.26–7.27.

49 Ibid., Table 6.

50 Ibid., para. 7.97.

51 Ibid., Table 7.

52 Ibid., para 7.96.

53 Ibid., para. 1.39.

54 Ibid., para. 12.46.

55 Ofgem (2024), ‘Decision – RIIO-3 Sector Specific Methodology Decision – ET Annex’, 18 July, para. 5.17.

56 Ofgem (2024), ‘Decision – RIIO-3 Sector Specific Methodology Decision – GT Annex’, 18 July, para. 5.21.

57 Ofgem (2024), ‘Decision – RIIO-3 Sector Specific Methodology Decision – GD Annex’, 18 July, para. 5.17.

58 Ibid., para. 5.34.

59 Ibid., paras 5.4–5.47.

60 Ofgem (2024), ‘RIIO-3 Sector Specific Methodology Decision – Overview Document’, 18 July, para. 9.20.

61 Ibid., paras 9.31–9.33.

62 Ofgem (2024), ‘RIIO-3 Sector Specific Methodology Decision – Finance Annex’, 18 July, para. 3.64.

63 Ibid., para. 3.144. Ofgem (2021), ‘RIIO-2 Final Determinations – Finance Annex (REVISED)’ 3 February, p. 24.

64 Ofgem (2024), ‘RIIO-3 Sector Specific Methodology Decision – Finance Annex’, 18 July, para. 3.197.

65 Ibid., para. 2.29.

66 Ibid., para. 2.108.

67 Ibid., paras 3.265–3.273.

68 Ibid., para. 3.349.

69 Ibid., para. 2.138.

70 Ibid., para. 2.123.

71 Ibid., para. 2.127.

72 Ibid., para. 6.17.

73 As part of this, Ofgem accedes to the request to include further credit metrics from rating agencies in its financeability test; ibid., para. 6.46.

74 Ibid., para. 6.61.

75 Ibid., para. 6.93.

76 Ofgem (2024), ‘Decision – RIIO-3 Sector Specific Methodology Decision – Overview Document’, 18 July, Table 4.

Contact

Sahar Shamsi, CFA

PartnerContributors

Related

Related

Future of rail: how to shape a resilient and responsive Great British Railways

Great Britain’s railway is at a critical juncture, facing unprecedented pressures arising from changing travel patterns, ageing infrastructure, and ongoing financial strain. These challenges, exacerbated by the impacts of the pandemic and the imperative to achieve net zero, underscore the need for comprehensive and forward-looking reform. The UK government has proposed… Read More

Investing in distribution: ED3 and beyond

In the first quarter of this year the National Infrastructure Commission (NIC)1 published its vision for the UK’s electricity distribution network. Below, we review this in the context of Ofgem’s consultation on RIIO-ED32 and its published responses. One of the policy priorities is to ensure… Read More