Please leave a message: has telecoms become too complex for consumers?

With an ever-increasing array of products, services and bundles available in the telecommunications market, and in a world in which consumers have limited computational power, it is not a straightforward task to discern the best option. Does this complexity cause consumer harm, and should regulators do anything about it?

Consumers in telecoms markets face increasingly complex decisions as technology advances and the number of choices expands. Such complexity is a by-product of technological progress, convergence, and product bundling—all of which can have procompetitive and welfare-enhancing attributes and effects.

However, it is not always easy for consumers to figure out the best option for them.1 This article asks whether there is a role for regulation, and if so, what it should look like.

Consumers’ ability to compare products is a key part of the European Commission’s regulation of telecoms markets:2

End-users and consumers of electronic communications services should be able to easily compare the prices of various services offered on the market based on information published in an easily accessible form.

In 2015, the Commission consulted on the effectiveness of current switching regulations, and the ability of consumers to understand and compare products was an important factor in this debate.3

Retail complexity is also firmly on the radar of the UK communications regulator, Ofcom. In its Strategic Review of Digital Communications, Ofcom stated that ‘[G]reater product, pricing and bundle complexity may reduce consumers’ ability to assess the choices and make informed choices,’4 and in November 2015, the regulator acted with the Advertising Standards Authority (ASA) to reduce the complexity of fixed broadband pricing.5 Ofcom also touched on the issue of complexity in its mobile switching consultation in February 2016,6 and in July 2016 it issued a consultation on simplifying switching between bundles.7 Questions remain, however, over whether consumer harm can be demonstrated and, if so, what remedies would be effective.

Behavioural economics provides a framework through which consumer behaviour and decision-making in telecoms can be assessed. This article examines why complexity might lead to sub-optimal decisions for consumers; assesses firms’ incentives and actions in light of such consumer behaviour; considers whether this leads to consumer harm; and discusses what remedies might be appropriate and effective.

Why are purchasing decisions in telecoms markets difficult for consumers?

Behavioural economics offers an alternative perspective on consumers: it tells us that consumers do not have limitless computational abilities—instead, they use rules of thumb (‘heuristics’) to simplify decisions. These heuristics are often highly efficient (as they save mental effort), but can cause systematic mistakes or biases. Due to ‘choice overload’, consumers are also prone to inertia in the face of complexity, even when they could gain from making a decision.8 Price comparison websites have a role to play here (discussed in the box ‘The impact of price comparison websites’ below).

Decisions in telecoms markets can be particularly complex for consumers, for the following reasons.

- Telecoms products have numerous dimensions. For example, when choosing a mobile contract the consumer needs to consider factors such as price; choice of handset; quantity of minutes, text messages and data; quality of service; data speed; coverage; and duration of contract. When faced with such decisions, consumers tend to focus on one salient dimension that they consider to be representative of the product, and to ignore others (which is known as ‘representativeness bias’). Furthermore, some dimensions of telecoms products are difficult to assess pre-purchase (e.g. quality of service), and even if consumers were able to focus on all dimensions, it would be difficult to aggregate them (e.g. weigh up coverage versus price). This can cause consumers to focus on only one salient dimension or to be overloaded by choice and opt for inertia (e.g. continue with their current product).

- Preferences over telecoms products may depend on the availability of complements, which can complicate decisions between bundles. For example, a consumer’s willingness to pay for fixed broadband may vary depending on whether it is provided in a bundle with mobile broadband or pay-TV.

- Actual payments for telecoms services often depend on future behaviour, which consumers may find difficult to either predict or control. Many contracts require consumers to estimate their usage over a two-year period.

- Telecoms prices often vary over time, and may include teaser rates and other pricing strategies. This requires additional comprehension, so consumers may use heuristics that do not maximise their long-term benefit.

- Telecoms products are often bought on an irregular basis, which limits the opportunity for consumers to learn in this rapidly developing industry.

Much of the complexity in telecoms is inherent—i.e. not in the hands of operators—but we can make some predictions about how firms might be incentivised to behave as a result of it.

How might firms behave in this environment?

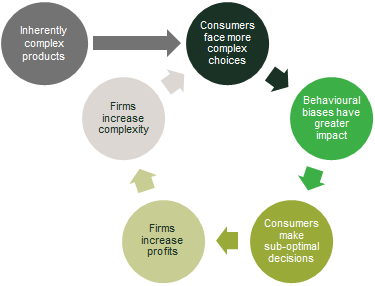

Complexity makes it more difficult for consumers to compare products and prices, which may reduce price elasticity of demand, switching rates and churn rates. Greater complexity may therefore be profitable for firms. There is evidence that firms in some sectors deliberately complicate their products,9 which could lead to increasing complexity in the market (see Figure 1).

Figure 1 Cycle of complexity

Comparison between products could be made more difficult in various ways:

- by increasing the number of products and options available;

- by using different pricing strategies—for example, offering introductory deals that involve the price changing over time, or splitting prices into smaller parts. Splitting prices has been shown to increase consumer demand;10

- by offering add-ons such as free gift vouchers, free access to music streaming services, or priority access to event tickets;

- by offering a wider range of bundles, which requires greater computation.

However, these factors may also act to increase consumer welfare. A greater range allows consumers to choose a product that better meets their needs, and the fact that consumers often choose add-ons demonstrates their value. Bundles may simplify decision-making, as there is one decision to make rather than many, and pricing strategies such as teaser rates act to increase switching and consumer demand (and therefore total welfare).

At the heart of the consumer harm debate is the distributional aspect—savvy consumers may benefit while naive consumers may not. The net effect on consumer welfare will depend on the relative proportions of savvy/naive consumers and the extent to which they gain/lose.

One innovation that has developed in response to the expanding choices faced by consumers is price comparison websites, as discussed in the box below.

The impact of price comparison websites

Price comparison websites have become increasingly important in retail markets across a range of industries, including telecoms. The comparisons often go well beyond price, and compare products across many dimensions. Such websites have a role in making comparison quicker and easier for consumers.

In telecoms, purchase decisions on price comparison websites can still be complex, although this may be a by-product of the expanding choices offered to consumers. For example, many products now come with prominently advertised ‘free gifts’ in the form of online shopping vouchers. Such strategies may complicate consumer decision-making, and thereby counteract the positive impact of price comparison websites on competition.

The design of price comparison websites also influences the way in which consumers compare products.1 For example, when products are arranged in vertical columns (with dimensions in horizontal rows) consumers are more likely to compare a single dimension, such as price.2

Price comparison websites provide fertile territory for regulators to gather information on the dynamics of complexity in telecoms, as they provide a neat summary of the product offering facing consumers.

Source: 1 Benartzi, S. and Lehrer, J. (2015), The Smarter Screen, Piatkus. 2 Shi, S.W., Wedel, M. and Pieters, F.G.M. (2013), ‘Information Acquisition During Online Decision Making: A Model-Based Exploration Using Eye-Tracking Data’, Management Science, 59:5, pp. 1009–26.

Firms may also respond to representativeness bias by offering attractive terms on the product dimension that consumers focus on, with poor terms on other dimensions. Similarly, firms may influence the relative salience of product dimensions.11

Is consumer harm likely?

Complexity in telecoms is an issue worthy of regulation only if it can be demonstrated that there is likely to be consumer harm. Complexity may give rise to consumer harm if it causes consumers to make sub-optimal decisions. This might occur where consumers:

- do not fully understand the choices they face. It was on this basis that Ofcom required providers to simplify fixed broadband prices (see the box ‘Fixed broadband pricing in the UK’ below);

- focus on one salient product dimension. The UK consumer advocacy group, Which?, has previously highlighted this tendency, and urges consumers to consider quality as well as price;12

- are overloaded by choice and opt for inertia;

- choose ‘satisficing’ products rather than optimal products—i.e. to save effort, they opt for choices that are good enough but not the best for them;

- compare products less, or their comparisons are less effective.

However, in a competitive market where consumers value being able to understand a product, and choose products that they understand, competitive pressure could result in simplification.13 Competition therefore has the potential to eliminate some of the complexity in telecoms markets.

What remedies might be appropriate?

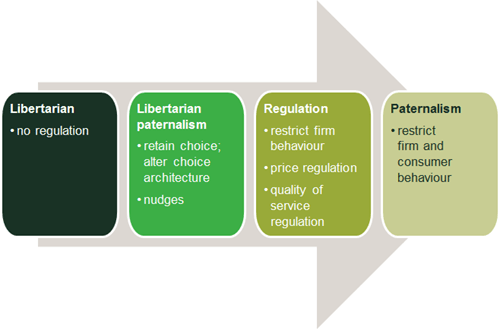

Consumer harm might justify the introduction of regulation; if this is the case, there remains a question over the appropriate extent of this regulation. In general, regulators have a continuum of approaches open to them, ranging from light-touch nudges to interventionist restrictions on firm and consumer behaviour (see Figure 2).

Figure 2 Remedy design

Regulating to tackle complexity is not simple. The two boxes below explore case studies based on two different approaches with contrasting consequences.

Remedies should take into account the willingness and ability of consumers to access and understand information. Potential remedies for complexity include the following.

- Clearer, simpler information to consumers. The UK financial services regulator, the Financial Conduct Authority (FCA), regulates to ensure that firms do not hide information in small print or overwhelm consumers with irrelevant information.14 This is a nudge only—i.e. it does not restrict products or pricing. Oxera and the Nuffield Centre for Experimental Social Sciences recently conducted an experiment for the FCA that demonstrated that the way in which information is presented affects switching behaviour—and that some nudges were more effective than others.15

- Standardisation of pricing information. The regulator may be able to support, encourage or require the industry to come together and agree to structure their prices in a standard format in order to ease comparison.16 This might restrict innovation in price plans, and would also run the risk of violating competition policy if were is not structured carefully.

- Minimum standards on product dimensions that are important to consumers but that consumers do not focus on—for example, the European Commission’s regulation of roaming prices.17 Minimum standards may be justified even in markets where there is strong price competition. However, minimum standards restrict the products that firms are able to offer and therefore may reduce innovation and competition.

- Mandated product or pricing simplicity. Ofcom and the ASA banned the splitting of broadband and line rental prices (see the first box below), while the energy regulator for Great Britain, Ofgem, banned certain tariff structures (see the second box below).

Remedies would need to be thoroughly tested before implementation. Does the remedy alleviate the identified theory of consumer harm? Does it have unintended consequences? As shown in the second box below, remedies may not always achieve their intended end, and regulators should be mindful of how firms might respond to the regulation. Banning one type of complexity might have the unintended consequence of increasing complexity of a different form.18

Given the dynamic nature of the telecoms industry, regulators should be prepared to review the appropriateness of remedies regularly. Remedies can either be symmetric or asymmetric—do firms with significant market power cause greater complexity and thus require more regulation? However, regulating for simplicity might only be effective if all firms followed the same format.

Fixed broadband pricing in the UK

In November 2015, Ofcom and the ASA acted to simplify fixed broadband pricing. They conducted a survey to see whether there was a problem with excessive complexity, and implemented an evidence-based remedy.

In the UK, fixed broadband prices are divided into two: line rental, and broadband service. Fixed broadband cannot be purchased without the line rental fee. Ofcom and the ASA’s survey tested whether this division caused confusion among consumers.

The results confirmed the regulators’ hypothesis: 24% of consumers were unable to state correctly the total cost of broadband. Additionally, the survey found that consumers struggled to distinguish upfront costs from monthly costs, and found teaser rates confusing. Ofcom and the ASA judged that there was a case for regulation, and ruled that from November 2016 fixed broadband advertising will have to:

- show all-inclusive costs and no longer separate out line rental;

- give greater prominence to the contract length and any post-discount pricing;

- give greater prominence to upfront costs.

Source: Ofcom and Advertising Standards Authority (2015), ‘Fixed Broadband Advertising of Prices’, MCMR / 117, November.

Energy tariffs in Great Britain

In 2013, Ofgem acted to simplify energy retail markets by banning complex tariffs and mandating that no firm could offer more than four separate tariffs.1

This intervention was later judged by the Competition and Markets Authority (CMA) to ‘restrict the behaviour of suppliers and constrain the choices of consumers in a way that may have distorted competition and reduced consumer welfare’. In particular, the remedy was considered to reduce the ability of retail energy suppliers to implement innovative tariff structures that better meet consumer demand.2 The rules will be removed following the CMA’s investigation.3

This example highlights the importance of testing hypotheses before regulating. It also illustrates how behavioural economics is a complement to standard competition economics rather than a substitute.

Source: 1 Ofgem (2013), ‘The Retail Market Review – Final domestic proposals’, Consultation on policy effect and draft licence conditions, April. 2 Competition and Markets Authority (2015), ‘Energy Market Investigation: Summary of provisional findings report’, July. 3 Competition and Markets Authority (2016), ‘Energy market investigation: Final report’, June.

Concluding remarks

Consumers can be limited in their ability to tackle difficult decisions, and complexity increases the probability that they will make sub-optimal decisions. Telecoms products are inherently complex, and firms may have the incentive to further increase complexity if sub-optimal consumer decisions increase their profits. However, complexity may also be an indicator of wider consumer choice, which is itself welfare-enhancing.

Where this increasing complexity of telecoms retail markets is deemed, on balance, to cause consumer harm, behavioural economics provides a helpful framework through which such theories of harm can be identified and tested. Any regulatory response should be targeted, proportional, and mindful not to stifle innovation and limit consumer choice, especially as the increase in complexity in telecoms markets is often the result of welfare-enhancing technological progress and convergence. However, well-designed and thoroughly tested behavioural remedies can both improve consumer outcomes and increase competition.

1 Simon, H.A. (1955), ‘A Behavioural Model of Rational Choice’, The Quarterly Journal of Economics, 69:1, pp. 99–118.

2 European Commission (2009), ‘Directive 2009/136/EC Of The European Parliament And Of The Council of 25 November 2009’, Official Journal of the European Union, L 337/15.

3 European Commission (2015), ‘Public consultation on the evaluation and the review of the regulatory framework for electronic communications networks and services’, section 3.5.2.

4 Ofcom (2015), ‘Strategic Review of Digital Communications’, Discussion Document, Consultation, July, p. 138.

5 Ofcom and Advertising Standards Authority (2015), ‘Fixed Broadband Advertising of Prices’, MCMR / 117, November.

6 Ofcom and futuresight (2016), ‘Switching mobile network provider: The Consumer Experience’, Final report, February.

7 Ofcom (2016), ‘Making switching easier and more reliable for consumers: proposals to reform landline, broadband and pay TV switching between different platforms’, Consultation, 29 July.

8 Chernev, A., Böckenholt, U. and Goodman, J. (2015), ‘Choice overload: A conceptual review and meta-analysis’, Journal of Consumer Psychology, 25:2, pp. 333–58. Gourville, J.T. and Soman, D. (2005), ‘Overchoice and Assortment Type: When and Why Variety Backfires’, Marketing Science, 24:3, pp. 382–95.

9 Ellison, G. and Ellison, S.F. (2009), ‘Search, obfuscation, and price elasticities on the Internet’, Econometrica, 77:2, pp. 427–52. Grubb, M.D. (2015), ‘Failing to Choose the Best Price: Theory, Evidence, and Policy’, Review of Industrial Organisation, 47, pp. 303–40.

10 Hossain, T. and Morgan, J. (2006), ‘…Plus Shipping and Handling: Revenue (Non) Equivalence in Field Experiments on eBay’, Advances in Economic Analysis & Policy, 6:2, Article 3.

11 Spiegler, R. (forthcoming), ‘Choice Complexity and Market Competition’, Annual Review of Economics.

12 Which? (2016), ‘Top tips for using price comparison websites’, March.

13 Gaudeul, A. and Sugden, R. (2012), ‘Spurious complexity and common standards in markets for consumer goods’, Economica, 79:314, pp. 209–25.

14 Financial Conduct Authority (2011), ‘Financial promotions – guidance: Prominence’, July.

15 Oxera and the Nuffield Centre for Experimental Social Sciences (2016), ‘Increasing consumer engagement in the annuities market: can prompts raise shopping around?’, prepared for the Financial Conduct Authority, June. See also Oxera (2016), ‘How can consumers be persuaded to shop around?’, Agenda, August.

16 Garrod, L., Hviid, M., Loomes, G. and Waddams Price, C. (2009), ‘Competition remedies in consumer markets’, Loyola Consumer Law Review, 21:4, pp. 439–95.

17 European Commission website, ‘Roaming’.

18 Edwards, R. (2016), ‘Competition with Simplicity Biased Consumers’, working paper.

Download

Related

Future of rail: how to shape a resilient and responsive Great British Railways

Great Britain’s railway is at a critical juncture, facing unprecedented pressures arising from changing travel patterns, ageing infrastructure, and ongoing financial strain. These challenges, exacerbated by the impacts of the pandemic and the imperative to achieve net zero, underscore the need for comprehensive and forward-looking reform. The UK government has proposed… Read More

Investing in distribution: ED3 and beyond

In the first quarter of this year the National Infrastructure Commission (NIC)1 published its vision for the UK’s electricity distribution network. Below, we review this in the context of Ofgem’s consultation on RIIO-ED32 and its published responses. One of the policy priorities is to ensure… Read More