Reducing or removing CO2 emissions: Can offsets make the difference?

As countries and corporates focus on reducing emissions in line with European net zero targets up to 2050, in this article, Oxera Partner Sir Philip Lowe examines the use of offsets, particularly in hard-to-abate segments of the economy. Oxera’s research on Growth Zero shows how the use of targeted levers including regulation and carbon pricing can unlock net zero in Europe before 2050, while also supporting economic growth. Indeed, Oxera’s study shows that carbon pricing is one of the most powerful policy instruments available to tackle the climate crisis—it shifts the burden of paying for carbon onto the producers of greenhouse gas emissions, and incentivises corporates to invest in cleaner technology and consumers to choose greener options. By providing a means to support the pricing of carbon, offset instruments can be part of this toolkit; Philip argues in this article that addressing weaknesses in the market for offsets, including rigorous monitoring, reporting and verification will be critical to deliver net zero without greenwashing.

The EU must insist on more rigorous carbon offsets for these to become a credible tool to achieve net zero emissions

It is almost 18 years since the release of Lord Stern’s review on ‘The Economics of Climate Change’ in October 2006, which warned that all countries would need to act to cut their greenhouse gas emissions. Since then, more than 140 countries, along with many regions, local authorities and public institutions, have already set emission reduction targets. Private firms—under pressure from auditing and control agencies as well as NGOs—are also fixing their own decarbonisation targets. Net Zero Tracker, an independent group that follows corporate pledges, estimates that in 2023 at least half the world’s 2000 publicly listed companies had a net zero target.

But achieving many of these targets requires ‘offsets’—that is, rather than reducing their own emissions, firms take steps to either permanently remove existing emissions from the atmosphere or reduce future emissions. It is still not clear whether all the figures behind corporate pledges are verifiable, and in the European Parliament many MEPs are trying to limit the use of offsets. The European Commission is right to take a more balanced approach: offsetting will be an essential element of achieving net zero emissions, and the EU must insist on more rigorous offsetting if it is to be credible.

Carbon credits, or offsets, are used to compensate for emissions which are, in the jargon of climate politics, ‘hard to abate’. Broadly speaking, this covers emissions which are difficult to eliminate because it is currently uneconomic or technically infeasible to do so. Prime examples of sectors where emissions are hard to abate are aviation, shipping and some agricultural activities.

Corporate emissions are not born equal, according to the 1998 Greenhouse Gas Protocol:

- Scope 1 emissions are caused directly by a company’s activity;

- Scope 2 emissions are caused indirectly by a company due to its energy consumption, for example for heating and cooling buildings;

- Scope 1 emissions are caused directly by a company’s activity;

- Scope 2 emissions are caused indirectly by a company due to its energy consumption, for example for heating and cooling buildings;

- Scope 3 emissions are not produced by or attributable to the company itself, but are related to activities up and down its supply chain—this includes, for example, emissions from the purchase, use and disposal of products from a firm’s suppliers.

In general, companies are now developing effective systems to measure and validate Scope 1 and Scope 2 emissions. But measuring Scope 3 emissions, and setting targets for them is problematic, as it requires co-ordination between every company and its partners along the value chain.

Many jurisdictions require parent companies, or subsidiaries of foreign firms based in their territories, to implement a carbon neutrality strategy. These obligations are frequently part of wider requirements on companies to adopt environmental, social and governance (ESG) standards. In the EU, the Corporate Sustainability Reporting Directive (CSRD), adopted in 2023, requires all companies to adopt sector-specific European Sustainability Reporting Standards (ESRS). The Green Claims Directive, adopted in March 2024, aims to regulate and standardise the environmental claims made by businesses across the European Union.

Vetting the integrity of carbon emission reduction commitments is essential both to avoid greenwashing and to achieve carbon neutrality objectives. However, this requires rigorous carbon accounting standards and credible independent institutions tasked with verifying offsetting claims.

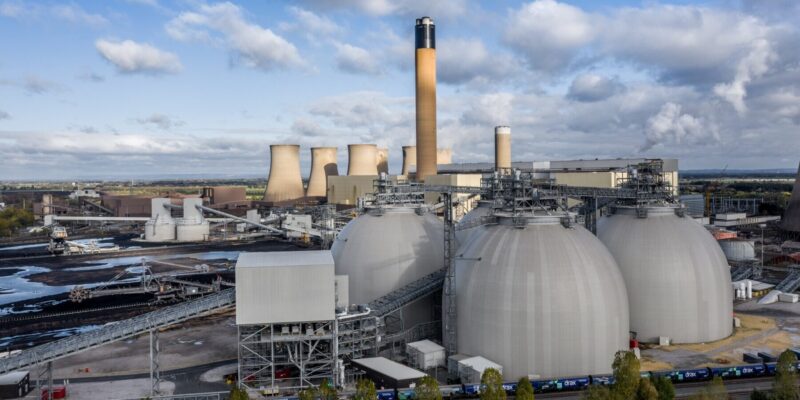

The EU is currently trying to develop an effectively functioning market for carbon offsets (often referred to as the ‘Voluntary Carbon Market’). The essential issue is whether companies seeking to offset their unavoidable emissions can obtain genuine offsets. There are two types of genuine offsets. The first comprises initiatives which will reduce future emissions, such as new renewable energy installations, waste management, energy efficiency or nature-based projects. The second type involves initiatives that would remove existing emissions from the atmosphere on a permanent basis. Examples of these are carbon capture and storage, or soil improvement such as restoration of peatlands where nature absorbs the emissions over time.

There are several challenges with offsets. Firstly, a company which invests in an offset, and for example obtains a certificate which attests to a specific quantity of emissions reduction or removal, will generally have no direct legal relationship with the offsetting project. This means that the company cannot monitor directly whether the promised amount of carbon will be removed from the atmosphere or no longer emitted in relation to a counterfactual of continuing emissions. This problem is even more acute if the company contracts its offset with an intermediary organisation which has a commercial interest in generating a marketable certificate but is not committed to enforcing the delivery of the carbon removal or reduction, once the certificate has been issued.

Secondly, there is usually a time gap between the moment at which an offset is certified and that at which the removal or reduction of the emissions can be confirmed. In the intervening period, things can happen which invalidate the justification for the offset certificate. For example, some forests can be destroyed by fires or drought. Others could be successfully planted but their positive impact on emissions could be compromised by relocation of deforestation to other areas. Renewable projects, on the other hand, can be held up by permitting procedures or brought to a halt by changes in the framework regulating the sale of the electricity into the grid. All this affects the final impact on emissions.

Thirdly, a more rigorous accounting of past offsetting projects has highlighted the challenge of ensuring ‘additionality’, that is, demonstrating that projects are genuinely additional in their effect on emissions to what would have happened anyway. In response to these problems, several initiatives are helping to enforce high-quality standards for offsetting projects, with particular emphasis on the need for transparent measurement of likely carbon impacts, for verifiable additionality, for the permanence of the carbon impacts and for creating scope for innovative solutions for emissions reduction and removal. The Oxford Offsetting Principles set out a framework for offsetting strategies to ensure the integrity of carbon credits.

Ensuring that there is adequate third-party verification of emission reduction or removal is also essential. In general, governments are responsible for final certification but there are additional certification schemes, including Verra, the Gold Standard, the Climate Action Reserve, CORSIA and the UN’s original Clean Development Mechanism. The European Parliament approved a Carbon Removal and Carbon Farming (CRCF) Regulation which foresees EU certification of nature-based carbon removals, and which will establish an EU registry for carbon removals to ensure transparency of the certification process. The regulation is still awaiting approval by EU member states.

On the basis of these initiatives to restore the integrity of carbon certificates, there is some hope that the idea of a Voluntary Carbon Market can be revived and that it can make a significant contribution to the achievement of net carbon neutrality across the world. If companies in different sectors vie to be the most climate-friendly in relation to their rivals, the combined effect of their initiatives could be considerable.

Being rigorous about offsets is only part of the challenge, however. An equal degree of rigour should be applied to targets set by companies that cover indirect emissions as well as emissions from elsewhere in their supply chain. A key area for increased efforts is the tech sector, where for the moment AI is expected to lead to a major increase in electricity consumption. At present, the major players in the sector assert that this increase will be based solely on renewable energy but the investments needed for that will be substantial. In which case, the competition for offsets can only get more intense…

One may, of course, consider the debate over offsets as greenwashing, part and parcel of the widespread disinformation on environmental impacts which firms tolerate because it allows them to make claims which are plausible but not substantiated. However, behind the debate is a genuine challenge. Though this varies by sector, an average of 75 per cent of companies’ emissions are in their supply and value chains. If they want to be credible, companies need to enter into binding agreements with their commercial partners, upstream and downstream, in order to meet their net zero objectives. Voluntary commitments to reduce emissions may make a company look good, but they will not be credible unless they can be enforced, within and outside the company itself. The future EU registry for carbon removals will be fundamental to guaranteeing the credibility of these tools.

Sir Philip Lowe is a distinguished fellow at the Centre for European Reform and a former director-general for energy, European Commission. Read the original piece here.

Related

Blending incremental costing in activity-based costing systems

Allocating cost fairly across different parts of a business is a common requirement for regulatory purposes or to comply with competition law on price-setting. One popular approach to cost allocation, used in many sectors, is activity-based costing (ABC), a method that identifies the causes of cost and allocates accordingly. However,… Read More

The European growth problem and what to do about it

European growth is insufficient to improve lives in the ways that citizens would like. We use the UK as a case study to assess the scale of the growth problem, underlying causes, official responses and what else might be done to improve the situation. We suggest that capital market… Read More