REPowerEU: managing energy supply and prices in the EU

The current spikes in electricity and gas prices are raising concerns at the EU and national level. To mitigate their impact, while also increasing security of supply, the European Commission has introduced a variety of measures, which have been (and are being) applied at a national level. We ask how these measures should best be implemented to ensure their success, looking in particular at the case of Italy.

In the second half of 2020, when some COVID-19 restrictions were lifted and the post-pandemic recovery began, demand for electricity and gas rebounded, driving up wholesale prices. This upward trend was even more pronounced over the course of 2021, when wholesale prices reached a record high—and prices continued to rise into 2022.

This article summarises the main drivers of the current price spikes, and the remedial measures proposed by the European Commission, looking at examples from Italy and highlighting the main challenges for these measures to be effective. The article was drafted before the Commission’s REPowerEU plan of 18 May 2022,1 and therefore does not provide a full assessment of the latest changes.

The current gas and electricity price spikes

The increase in energy prices has been driven by a number of factors on both the demand and supply side of a market that, over the years, has become increasingly interconnected and global.2 One such factor is changes in demand due to the recovery from the COVID-19 pandemic and the rapid growth of gas consumption in Asia-Pacific. Furthermore, weather-related events, such as ‘wind droughts’ over 2021 (which resulted in reduced wind output) and water shortages (limiting hydroelectric production), have contributed to higher gas demand. On the production side, domestic production of gas in the EU has been declining over time, increasing dependence on third countries. Moreover, storage levels were lower than usual at the beginning of the season,3 influencing gas prices and their volatility.

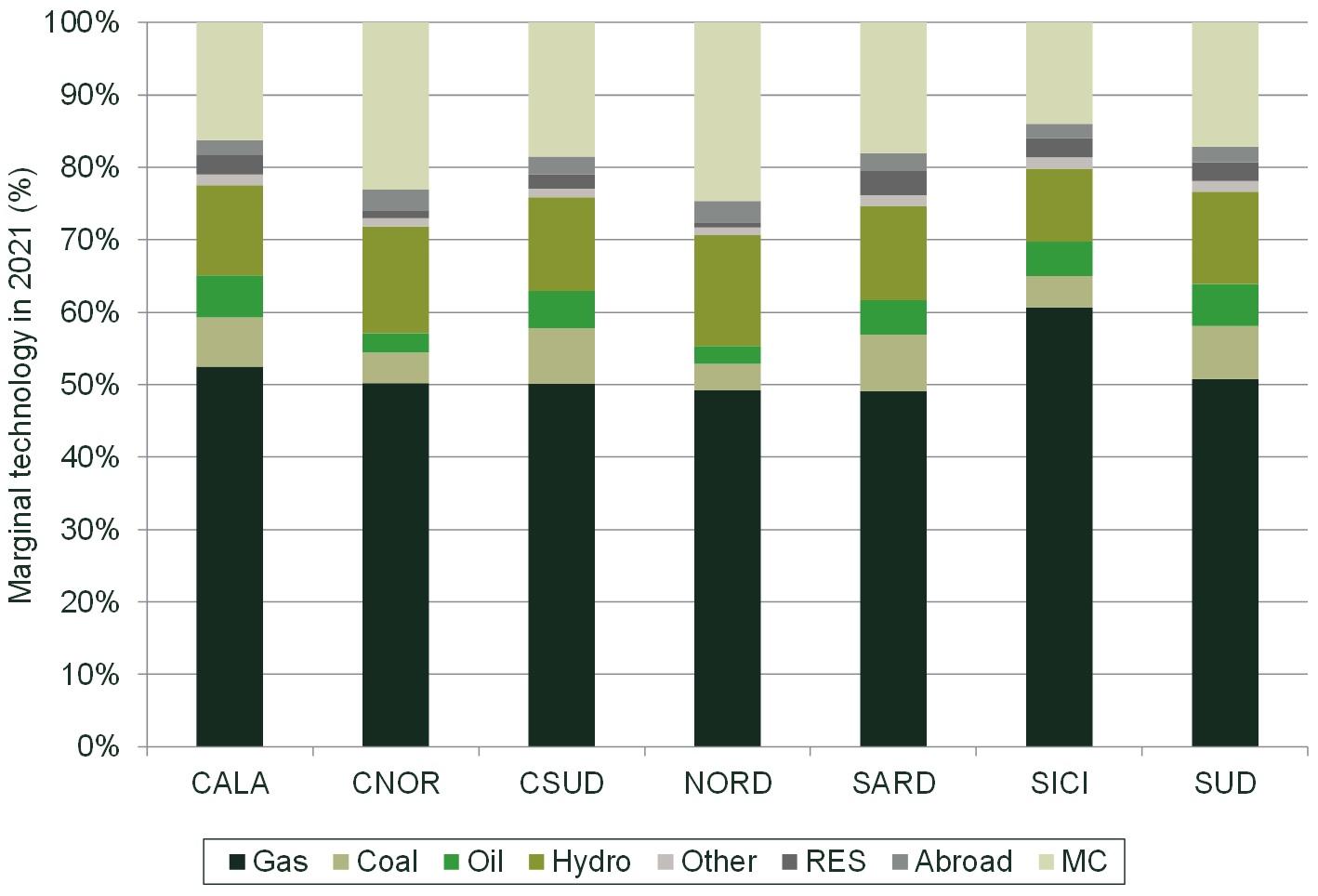

High wholesale gas prices have also translated into high wholesale electricity prices. The first and most direct link between the two markets is the pricing system of the wholesale electricity market—the ‘system marginal price’—at which all accepted bids in a given hour are remunerated at the clearing price. This is represented by the variable cost of the latest generator needed to cover demand. Gas units are usually the marginal technology in Europe, thereby setting the wholesale electricity price in the majority of hours. For example, this has been the case in Italy, where in 2021 gas represented the marginal technology in approximately 49–61% of hours (depending on the bidding zone—see Figure 1 below).

Figure 1 Marginal technology in Italy in 2021

Source: Oxera analysis of Gestore dei Mercati Elettrici data.

Higher CO2 prices have also contributed to higher electricity prices, although to a lesser extent.4 High prices, sometimes close to or above historical maximums, have been recorded in the majority of European electricity markets (bidding zones) over the course of 2021 and the beginning of 2022. Day-ahead prices between June and December 2021 increased by around 420% in Italy, 408% in Germany, 467% in France and 393% in the Netherlands.5

This situation, resulting in higher retail prices for both electricity and gas, has inevitably raised concerns about the impact on households—especially vulnerable consumers—as well as industrial producers. Over recent months, national governments have introduced a number of measures to mitigate the impact of spikes in energy prices, including reduced VAT/taxes, support to vulnerable consumers, or taxes on windfall profits (e.g. in Italy, Spain and Romania). The Commission also published a toolbox in October 2021 to provide guidelines for member states,6 and issued a communication in March 2022 with more extensive guidance and assessment of specific measures.7 Additional temporary measures have been outlined in the latest communication published on 18 May 2022.8

Security of supply and diversification of supply routes

The situation has become even more challenging in the wake of the Russian invasion of Ukraine. Given the threat of a possible interruption of Russian gas supplies, in retaliation for European (and Western) sanctions or as part of future sanctions, security of supply and diversification of supply roots have received renewed emphasis and are playing a central role in the EU policy agenda.

In light of the changed situation, on 8 March 2022 the European Commission published its REPowerEU Communication, setting out an action plan to reduce dependence in Europe on Russian gas by diversifying gas supply routes and reducing dependence on fossil fuels.9 According to the Commission’s estimates, this plan could reduce EU demand for Russian gas by two-thirds by the end of 2022 and end EU dependence on Russian gas (and fossil fuels more generally) ‘well before 2030’.10

The Commission put forward several measures to increase security of supply and mitigate high energy prices, including:

- reducing dependence on fossil fuels by increasing RES installed capacity and boosting energy efficiency;

- ensuring adequate levels of gas storage;

- diversifying gas supplies;

- increasing EU gas, biomethane and hydrogen production.

So what is contained in the detail of some of these proposals, and how are they to be implemented at a national level, especially in Italy?

Reducing dependence on fossil fuels

One of the measures proposed by the Commission to reduce dependence on fossil fuels is the boosting of RES installed capacity. This follows the path set out in the European Green Deal and the higher ambition reflected in the Commission’s ‘Fit for 55’ proposals.11

According to the Commission, the full implementation of the Fit for 55 proposals will reduce EU gas consumption by around 100bn cubic metres (bcm) by 2030, compared with the 155bcm imported from Russia in 2021.12 Policy and associated measures proposed by the Commission over the last year should therefore contribute towards reducing dependence in the EU on Russian gas. For this reason, the Commission is now suggesting a further increase in, and acceleration of, the Fit for 55 targets.

On 18 May 2022, the Commission released details of strategies and policies to support its objectives, providing a plan to save energy, accelerate clean energy production, diversify energy supplies, and combine investments and reforms.13

An important point to consider and monitor is the ‘feasibility’ of the implementation at the national level of the RES targets (both the currently foreseen targets and any upward revision). One of the challenges of the European energy and climate targets has always been the communication and transposition at the national level. The legislative process to introduce new policy, measures and targets at the EU level is usually long and complex, involving a range of stakeholders and thus the need to balance various interests.14

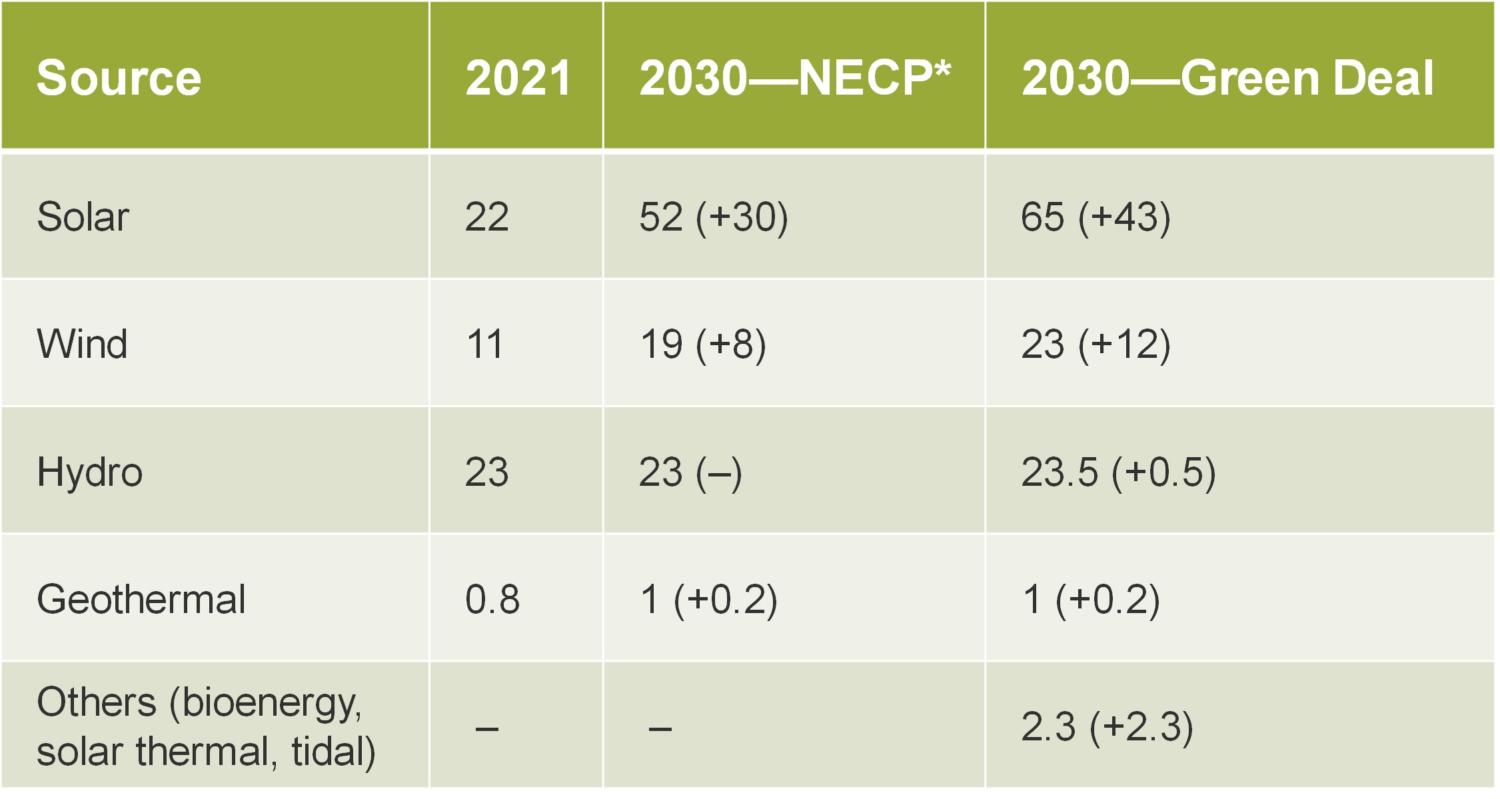

In this respect, it is useful to look at the gaps between current RES installed capacity and projected targets—for example, for 2030. Italy provides a notable example of the efforts required to meet the Green Deal targets—and this is clear from looking at both the status quo situation and RES developments in recent years.

As shown in Table 1 below, in order to meet the Green Deal targets, wind and solar capacity in Italy will need to increase by around 55GW in the current decade.15 According to the latest projections from the Ministry for the Ecological Transition (MiTE), these targets translate into annual increases that vary between +4GW and +9GW (the MiTE is assuming that more capacity will be installed in later years).16 This compares with capacity increases of around +0.8/0.9GW in recent years.

Table 1 Gaps between RES installed capacity in Italy and 2030 targets (GW)

Source: Oxera analysis on Ministero della Transizione Ecologica (2021), ‘Energia elettrica rinnovabile verso l’obiettivo UE del -55%: Strategia, caratteristiche e potenza disponibile nei nuovi meccanismi d’asta’; and Terna (2021), ‘Rapporto adeguatezza Italia 2021’, November.

These annual increases look ambitious compared with the situation in Germany, which has been a top performer in Europe in terms of RES installed capacity. From 2013, Germany’s RES capacity increased by around 6.5GW per year, reaching its historical maximum in 2012 (+10.4GW).17

These numbers show that, in order to meet the Green Deal, and any higher target, a step change in the time needed for RES projects to come online will be critical—at least in countries such as Italy. Not only will the definition of the targets and communication be key, but specific measures implementing these policies will also be needed to enable the change. An important aspect, also recognised by the Commission, consists of speeding up approval procedures for new RES projects. Italy has recently adopted a number of targeted measures to speed up the authorisation processes for certain RES projects,18 and a specific commission has been set up for some specific projects.19 It will be important to understand whether these measures will be sufficient to boost the required RES growth.

Levels of gas storage

The REPowerEU Communication anticipates the intention of the Commission to introduce a minimum filling level for European gas storage fields. The proposal, published on 23 March 2022, states that member states should ensure a 90% minimum filling level by 1 November each year for storage infrastructure in their territory. Further, some intermediate targets have been defined to monitor progress and allow for ‘corrective measures’ if needed.20 For 2022, the Commission proposed a lower minimum target of 80%, given the shorter time frame that member states will have to implement any measure to ensure that the target is met. The European Council and Parliament have recently reached a provisional agreement on the proposal, also agreeing that the minimum filling level will be limited to a volume of 35% of the annual gas consumption of member states over the past five years. This is meant to avoid an excessive burden on member states with high storage capacity.21

Setting the target may not be sufficient, and specific and additional measures might be required. One of the current challenges is the small or negative spread between summer and winter gas prices. In Italy, for example, storage capacity is made available for the system, and market operators book it through competitive auctions. During the first auctions for the upcoming heating season (2022/23), market incentives proved insufficient to ensure storage demand, with operators booking only a very small capacity, even with a price of €0.00 per scm.22 An additional challenge raised by market operators is the need for liquidity, given current gas prices and the high costs of storing large quantities of gas today.

Since injections onto the grid are managed through subsequent auctions, with time, low booked capacity will make the filling target more challenging. Therefore, the Italian government has adopted a range of measures to favour storage injections—such as more frequent capacity auctions, reduced ‘logistic’ costs, and contract for difference (CfD) mechanisms to cover the summer–winter spread.23 ARERA, the Italian energy sector regulator, is in charge of defining the specific rules for this mechanism. An alternative measure to meet the minimum filling level that is not currently considered, at least in Italy, would be a storage obligation on specific operators—for example, retailers or suppliers. A similar mechanism, if well designed, could help to ensure compliance, but would add constraints on the free market.

In order to ensure both a consultation with stakeholders and a rapid application for upcoming auctions, ARERA introduced a transitory mechanism consisting of a ‘premium on stored gas’—initially quantified as €5/MWh—which is being applied in the latest auctions. It has also consulted with stakeholders on the possible design of the two-way CfD mechanism,24 selecting a mechanism covering the spread between winter and summer prices. ARERA also confirmed the ‘premium on stored gas’, with operators being able to opt for the CfD or receive the premium.25 Auctions for different storage products continued in April 2022, with additional volumes being booked by operators,26 but overall levels remain lower than in previous years, with large gaps on the seasonal products, which are deemed riskier (see Figure 2 below).

Figure 2 Allocated storage capacity at the end of April 2022 (Italy)

Source: Oxera analysis on Snam data.

Implementing measures

Other measures have been put forward by various stakeholders at the European level, including increasing electricity production from nuclear and coal units, at least in the short term.27 While these can help to reduce gas demand, they may also result in changes or delays to current phase-out plans and higher CO2 emissions (in the case of coal)—so such trade-offs must be carefully assessed.

The achievement of security of supply and diversification of supply sources will depend mostly on the actual implementation of the proposed measures. They will require clear communication, both with operators that are more directly involved with or responsible for the changes, and with the public at large. The measures and policies will also need to make sure that national specificities and evolving market conditions are properly taken into account (e.g. to achieve storage filling levels). Different countries may require slightly different implementation strategies, but overall consistency and coordination at the European level should be ensured. This should aim to minimise side effects on the common European gas market and prevent member states outbidding each other to procure additional gas volumes.

1 European Commission (2022), ‘REPowerEU: A plan to rapidly reduce dependence on Russian fossil fuels and fast forward the green transition*’, press release, 18 May, last accessed 27 May 2022.

2 See International Energy Agency (2021), ‘What is behind soaring energy prices and what happens next?’, 12 October.

3 The average EU storage filling rate on 30 September 2021 was 74.6%, compared with 94.7% in 2020 and 97% in 2019. European Commission, ‘Quarterly report on European gas markets’.

4 See Oxera (2022), ‘Carbon trading in the European Union: an economic assessment of market functioning in 2021’, prepared for ICE, 15 February, last accessed 27 May 2022.

5 Oxera analysis of GME and ENTSO-E Transparency Platform data.

6 European Commission (2021), ‘Tackling rising energy prices: a toolbox for action and support’, COM(2021) 660 final, 13 October.

7 European Commission (2022), ‘Security of supply and affordable energy prices: options for immediate measures and preparing for next winter’, COM(2022) 138 final, 23 March.

8 European Commission (2022), ‘Short-Term Energy Market Interventions and Long Term Improvements to the Electricity Market Design – a course for action’, COM(2022) 236 final, 18 May.

9 Following the Ukraine/Russia crisis, the Commission also introduced a new state aid Temporary Crisis Framework, allowing member states to provide aid to companies affected by high energy prices. See European Commission (2022), ‘State aid: Commission adopts Temporary Crisis Framework to support the economy in context of Russia’s invasion of Ukraine’, statement, 23 March.

10 European Commission (2022), ‘REPowerEU: Joint European action for more affordable, secure and sustainable energy’, press release, 8 March, last accessed 27 May 2022. The REPowerEU plan specifies 2027. See European Commission (2022), REPowerEU Plan, COM(2022) 230 final, 18 May.

11 See European Commission (2022), ‘Fit for 55’, last accessed 27 May 2022.

12 European Commission (2022), ‘REPowerEU: Joint European action for more affordable, secure and sustainable energy’, press release, 8 March, last accessed 27 May 2022.

13 European Commission (2022), ‘REPowerEU Plan’, COM(2022) 230 final, 18 May.

14 See Macchiati, A. and Vitelli, R. (2022), ‘Mercati del gas e transizione energetica’, Luiss School of European Political Economy, Working Paper 3/2022, 4 April, accessed 27 May 2022.

15 Moreover, 3GW of programmable RES will be needed.

16 Ministero della Transizione Ecologica (2021), ‘Energia elettrica rinnovabile verso l’obiettivo UE del -55%: Strategia, caratteristiche e potenza disponibile nei nuovi meccanismi d’asta’.

17 Oxera analysis of Bundesministerium für Wirtschaft und Klimaschutz (2022), ‘Time series for the development of renewable energy sources in Germany’, February.

18 Legge 98/2022 (‘D.L. Energia’), 1 March 2022.

19 The Commissione Tecnica PNRR-PNIEC.

20 European Commission (2022), ‘Proposal for a regulation of the European Parliament and of the Council amending Regulation (EU) 2017/1938 of the European Parliament and of the Council concerning measures to safeguard the security of gas supply and Regulation (EC) n°715/2009 of the European Parliament and of the Council on conditions for access to natural gas transmission networks’, COM(2022) 135 final, 23 March.

21 Council of the European Union, European Commission and European Parliament (2022), ‘Gas storage: Council and Parliament reach a provisional agreement’, 19 March.

22 The acronym ‘scm’ stands for ‘standard cubic metre’. See Staffetta Quotidiana (2022), ‘Stoccaggio gas: aste deserte nonostante i costi azzerati’, 22 March.

23 Ministero della Transizione Ecologica (2022), ‘Decreto Ministeriale del 1 aprile 2022 relativo alle modalità di stoccaggio per il periodo 2022-2023’, 4 April.

24 Autorità di Regolazione per Energia Reti e Ambiente (2022), ‘Delibera 08 aprile 2022: 165/2022/R/gas’, 8 April. Autorità di Regolazione per Energia Reti e Ambiente (2022), ‘Possibili schemi di attuazione del contratto per differenze a due vie’, Comunicato, 14 April.

25 Autorità di Regolazione per Energia Reti e Ambiente (2022), ‘Decisione 189/2022/R/gas’.

26 Snam (2022), ‘Capacità di stoccaggio per servizi di Punta ed Uniforme – Anno Termico 2022/2023’, last accessed 27 May 2022.

27 International Energy Agency (2022), ‘A 10-Point Plan to Reduce the European Union’s Reliance on Russian Natural Gas’, fuel report, March.

Related

Investing in distribution: ED3 and beyond

The National Infrastructure Commission (NIC) has published its vision for the UK’s electricity distribution network. Below, we review this in the context of Ofgem’s consultation on RIIO-ED31 and its published responses. One of the policy priorities is to ensure that the distribution network is strategically reinforced in preparation… Read More

Leveraged buyouts: a smart strategy or a risky gamble?

The second episode in the Top of the Agenda series on private equity demystifies leveraged buyouts (LBOs); a widely used yet controversial private equity strategy. While LBOs can offer the potential for substantial returns by using debt to finance acquisitions, they also come with significant risks such as excessive debt… Read More