RIIO-2 Draft Determinations: what next?

On 9 July 2020, Ofgem published its Draft Determinations for the RIIO-2 price controls for the GB electricity transmission (ET), gas transmission (GT), and gas distribution (GD) sectors, and the electricity system operator (ESO).1 The price controls are due to start on 1 April 2021 and run for five years, until 31 March 2026.2

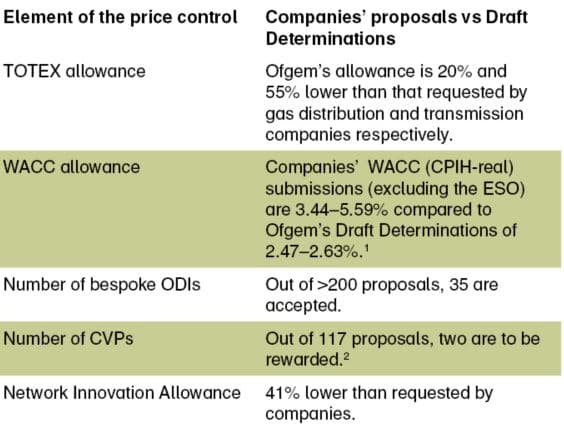

The outcome of the Draft Determinations is substantially different from companies’ business plan proposals across many elements of the price control. Table 1 shows selected elements of the price control, comparing companies’ proposals with Ofgem’s Draft Determinations.

Table 1 Comparison of companies’ proposals and the Draft Determinations across selected elements of the RIIO-2 price control

Source: Ofgem (2020), ‘RIIO-2 Draft Determinations for Transmission, Gas Distribution and Electricity System Operator’, 9 July.

The companies now have the opportunity to respond to the allowances and other proposals in Ofgem’s Draft Determinations. The deadline for responses to the Draft Determination consultation is 4 September 2020.

Below, we provide an overview of the main movements in Ofgem’s methodologies and assessment outcomes (section 1) across three key areas of RIIO-2—outputs, expenditure allowances and uncertainty mechanisms—and then discuss implications for the overall balance of the price control package (section 2).

Three key areas of the RIIO-2 price control

Outputs

The outputs framework for RIIO-2, as previously determined,3 consists of: (i) Licence Obligations (LO) setting minimum standards; (ii) Price Control Deliverables (PCDs) specifying deliverables for the allocated funding and mechanisms for refunding consumers in the event of outputs not being delivered; and (iii) Outcome Delivery Incentives (ODIs) that drive service improvements through reputational and financial incentives.

Ofgem proposes several common outputs (i.e. outputs that apply to multiple networks and sectors) in the areas of ‘meeting the needs of consumers and network users’, ‘maintaining a safe and resilient network’, and ‘delivering an environmentally sustainable network’. Additionally, Ofgem invited companies to put forward bespoke outputs in their Business Plans. Out of the more than 200 bespoke outputs that companies proposed, only 35 were accepted in the Draft Determinations, with Ofgem considering that a large proportion of the bespoke output proposals lacked sufficient evidence of value to consumers over and above business as usual. Examples of bespoke output categories that have been accepted relate to participation in international TSO benchmarking studies, an environmental scorecard, and timely job-completion and repairs targets.

It remains to be seen whether further evidence provided by companies will convince the regulator to accept more of the proposed bespoke outputs.

Expenditure allowances and incentives

Cost allowances

Ofgem proposes to disallow a significant proportion of companies’ submitted costs, in many cases because it did not see sufficient justification for the planned expenditure. Additionally, approximately 50% of baseline total expenditure (TOTEX) across all sectors is linked to uncertainty mechanisms and PCDs, where companies are only to be paid for what they deliver over the price control period.

Gas distribution

In the gas distribution sector, Ofgem proposes to disallow around 20% of proposed expenditure across the companies. This expenditure comprises:

- costs being moved to uncertainty mechanisms;

- volume of work adjustments where engineering justification was considered insufficient (this especially affected the replacement expenditure (REPEX) programme, where benefits are being taken into account only until 2037 because of uncertainty around the future of gas);

- efficiency adjustments.

For the efficiency adjustments, Ofgem is proposing to set a significantly challenging benchmark at the 85th percentile. This compares to a less challenging benchmark at the 75th percentile at RIIO-GD1 (which was moderated by the Information Quality Incentive (IQI) interpolation) and even at the 67th percentile in previous price reviews. The proposed regression analysis consists of a single TOTEX model. This is in contrast to RIIO-GD1, when Ofgem combined the results from models developed at different levels of aggregation (top-down, middle-up and bottom-up). As with RIIO-GD1, Ofgem proposes to adjust costs for regional factors (e.g. regional wages, urbanity and sparsity).

The efficiency assessment in the Draft Determinations raises a number of questions and areas for further analysis, especially where the evidentiary basis underpinning Ofgem’s position is not yet fully developed. In particular, Ofgem’s business plan assessment framework, choice of benchmark and reliance on a single TOTEX model will be key areas of contention.

Electricity and gas transmission

In the electricity and gas transmission sectors, Ofgem is planning to allow only 45% of the submitted costs across the companies. The vast majority of this reduction is due to more than half of NGET’s £7.1bn of submitted costs being disallowed by the regulator. In particular, this is the case for non-load related expenditure (i.e. investment to maintain the health of the existing asset base), as Ofgem has explained that the proposed volume of asset replacement work has not been sufficiently justified.

Real price effects (RPEs) and frontier shift

As previously indicated,4 Ofgem proposes to index costs for labour and materials using the same input price indices as for RIIO-1. The upfront allowance will be based on forecasts and then ‘trued-up’ annually.

Ofgem proposes to set the ongoing efficiency targets at 1.2% p.a. for capital expenditure (CAPEX) and REPEX and 1.4% p.a. for operating expenditure (OPEX). This represents the upper end of the range calculated by Ofgem’s consultants based on EU KLEMS data and includes an upward adjustment of 0.2% for ongoing efficiency benefits from innovation.5

An important area for careful examination will be how the different parts of the efficiency challenge (relative efficiency and ongoing efficiency including the innovation uplift) fit together with the proposed outperformance overlay on the cost of equity, and how the overall targets compare to historical outperformance.

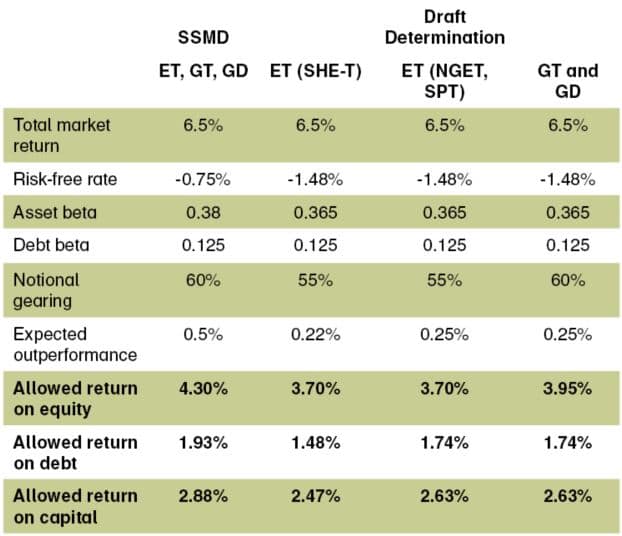

Allowed return on capital

Ofgem has set the allowed return on capital at 2.47% CPIH-real for SHE-T and at 2.63% CPIH-real for GD, GT and other ET companies. This is a decline of 41bps and 25bps respectively, relative to the sector-specific methodology decision (SSMD). In the SSMD, the allowed return was set at 2.88% CPIH-real. The decline has been largely driven by movements in relation to the risk-free rate (see table below).6

The lower allowed return on capital for SHE-T reflects a change in SHE-T’s allowed return on debt methodology. Ofgem has reverted to a regulatory asset value (RAV)-weighted index for SHE-T (similar to RIIO-1) instead of an 11–15-year trailing average allowance in the SSMD.7

The allowed WACC for SHE-T and other transmission and GD companies will change during RIIO-2 to reflect the combined effect of the debt indexation and equity indexation mechanisms.

Table 2 below shows the changes in the allowed return on capital parameters since the SSMD.

Table 2 Allowed return on capital, CPIH-real

The methodology for determining the allowed return on equity has largely remained the same since the SSMD. It is notable that:

- there has been a large downward movement in the risk-free rate allowance, driven by movements in the market data;

- there has been a slight downward revision in the estimation of the asset beta, also driven by movements in the market data;

- the expected outperformance adjustment has been reduced from 50bps to 25bps, and is also subject to an ex post adjustment—if realised outperformance is less than expected at the close of RIIO-2 (e.g. 25bps at 60% gearing), an additional allowance, up to the original value of the expected outperformance, will be provided;

- there have also been some changes in the cross-checks to the cost of equity.8

Ofgem has changed the methodology for the allowed return on debt in the Draft Determinations. Specifically:

- the averaging period—Ofgem has indexed the return on debt to a 10–14-year trailing average, instead of an 11–15 year trombone;

- the benchmark index—Ofgem proposes to index the return based on the iBoxx 10+ years utilities index, instead of indexing the average of A/BBB 10+ iBoxx indices;

- transaction costs—Ofgem now proposes to provide a separate allowance of 17bps for additional borrowing costs.

In revising the methodology for determining the allowed cost of debt, Ofgem states that the utilities index better reflects the networks’ actual debt costs, and that a 10–14-year trailing average with a separate allowance for borrowing costs increases transparency relative to an 11–15-year trombone.

Moreover, Ofgem has decreased the notional gearing assumption for electricity transmission from 60% at the SSMD to 55% in the Draft Determinations (in line with the RIIO-1 notional gearing assumption).

Corporation tax

Ofgem has decided to retain the RIIO-1 approach to providing notional tax allowances with some added protections. This includes a tax reconciliation to be submitted to Ofgem on an annual basis; board assurance of tax reconciliations and the introduction of a tax review mechanism that would enable Ofgem to review and (if necessary) adjust the companies’ tax allowance during the course of RIIO-2.

TOTEX incentive mechanism (TIM)

As per the SSMD, companies’ TOTEX outperformance or underperformance will be shared with consumers in proportion to the incentive rate, which in turn depends on the confidence that Ofgem has in the efficiency of the costs proposed by the companies. The better the company has justified the costs, the higher the rate, and the greater the exposure to TOTEX outperformance and underperformance.

Incentive rates could not be outside the 15–50% range according to the RIIO-2 methodology, and the range as determined in the Draft Determinations is 30.9–39.2% for ET and GT and 49.4–50.0% for GD companies. Ofgem explains the difference with reference to the structure of the sectors—it is easier to benchmark the costs in the GD sector given there are four companies operating in that market.

This is a significant reduction in the incentive rates in comparison to RIIO-1. Specifically, for RIIO-1: GD incentive rates are currently 63–64%;9 NGGT and NGET have incentive rates of around 44% and 47% respectively (within a lower expected range than GD, of 40–50%);10 and SPT’s and SHE-T’s incentive rates are 50%.11 Other things equal, lower incentive rates reduce companies’ ability to outperform (or underperform), i.e. lower rates reduce companies’ risk exposure.

It remains to be seen whether incentive rates will increase at the Final Determinations stage if the companies present evidence to Ofgem that a greater proportion of their costs are in a high-confidence category.

Business Plan Incentive (BPI)

The BPI was developed to encourage ambitious, high-quality business plans. The outcomes of the BPI’s four stages of assessment are as follows.

- Stage 1: NGGT and NGET were penalised for not meeting the specific quality requirements for the business plans in Ofgem’s assessment.

- Stage 2: two customer value proposition (CVP) proposals by NGN and SPT were rewarded out of the 117 proposals put forward by network companies in total.

- Stage 3: almost all companies incurred a penalty for poorly justified cost submissions. The penalty amounted to 10% of the poorly justified costs. NGET’s and SHE-T’s penalties were the highest—5.4% and 2.9% of Ofgem’s proposed TOTEX allowance for each network, respectively.12

- Stage 4: companies could be rewarded if Ofgem found their proposed cost forecasts to be lower than its benchmark for setting the allowance; however, no companies appeared to be eligible for this reward in the Draft Determinations assessment.

As a result, under the BPI, companies earned rewards of up to £1.6m (NGN), and penalties of up to £66.6m (NGET).13

Managing uncertainty

Uncertainty mechanisms

The key areas of uncertainty that Ofgem is addressing with its uncertainty mechanisms are decarbonisation strategies and enhancing cyber resilience. In the Draft Determinations, Ofgem makes the following proposals in relation to the design of the re-openers.

- Ofgem proposes to shorten the re-opener application windows for companies from one month to one week, and to enable itself to trigger a re-opener at any time during the price control.

- Ofgem also sets materiality thresholds. For individual re-openers, the threshold remains at 1% of the annual average base revenues after the application of the incentive rate. For aggregated re-opener applications, the threshold is set to be 0.5% on an individual basis, and 3% when applications are considered together.

However, the materiality thresholds do not apply to such cross-sectoral re-openers as the Coordinated Adjustment Mechanism, which allows regulated companies to transfer activities and the associated revenue allowances from one company to another, nor to operational technology, IT and telecoms CAPEX re-openers, which focus on improving cyber resilience and robustness of business systems.

Ofgem is also open to the possibility of designing uncertainty mechanisms to manage the potential impacts of COVID-19, Brexit or legislative changes, such as in relation to climate change. Nevertheless, at this stage, Ofgem does not consider that it has sufficient information on the additional costs that these events may trigger.

Net zero and innovation

In line with the Decarbonisation Action Plan published in February,14 Ofgem intends to pursue its objective of facilitating the delivery of the UK’s net zero emissions agenda and making the price control framework as adaptive and flexible as possible. Central to Ofgem’s decarbonisation strategy are the net zero re-opener (available to the GD and transmission sectors) and the Strategic Innovation Fund (SIF, also available to the ESO), as well as the Network Innovation Allowance (NIA), which has been in place since RIIO-1.

- The net zero re-opener will allow for changes related to the achievement of net zero and not otherwise captured by any other price control mechanism to be reflected in the operators’ cost allowances. The mechanism can be triggered only by Ofgem at any time during the price control. The materiality threshold will be assessed on a case-by-case basis.

- The Strategic Innovation Fund (SIF) focuses on high-value innovation projects of over £5m that would not otherwise be pursued by operators as business-as-usual activities or via the NIA funding. The proposed overall funding is £450m, which can be expanded if necessary.

- The Network Innovation Allowance (NIA) focuses on innovative projects related to the energy system transition and provision of support to vulnerable consumers. The proposed overall funding of £180m, covering 59% of the £303m requested by companies, is conditional on the implementation of an improved, industry-led reporting framework to be submitted by companies before the Final Determination.

Competition

In the SSMD, Ofgem confirmed its intention to seek greater reliance on competition in the delivery of network activities, for the benefit of consumers. It identified three types of competition, as follows.

- Native competition—competition run by network companies within the price control framework operating under the TOTEX incentive mechanism, such as the use of flexibility tenders in electricity distribution.15

- Early competition—competition run prior to the project design process to reveal the best idea to meet a system need.16

- Late competition—application of a separate regime to new, separable and high-value projects. The three models of late competition proposed by Ofgem are:

- Competitively Appointed Transmission Owner (CATO);

- Special Purpose Vehicle (SPV);

- Competition Proxy Model (CPM).

With regard to native competition, Ofgem deemed that companies have not demonstrated sufficiently ambitious measures to be eligible for a reward under the BPI.17

Early competition is still being developed, as the ESO is expected to deliver the final draft of the Early Competition Plan at the end of February 2021.18

Finally, with regard to late competition, none of the potentially suitable projects were included in the baseline funding, due to the uncertainty of need, design and timing.19 However, Ofgem identified two projects that had not been identified by TOs that could meet the criteria for late competition—Dinorwig-Pentir (NGET) and Skye (SHE-Transmission).20 If these projects are brought forward during the price control, Ofgem will assess their suitability for the late competition models.

How do the key areas of RIIO-2 correspond to each other?

Transmission and gas distribution

Financeability

The purpose of Ofgem’s financeability assessment is to ensure that all components of the determination taken together allow a notionally efficient operator to generate cash flows sufficient to meet its financing needs.

Ofgem has assessed notional company financeability at a Baa1 rating. Ofgem states that all companies are financeable on the basis of the notional capital structure, taking account of the allowed costs, cost recovery and allowed returns in the Draft Determinations.

According to Ofgem’s review, all companies can attain a comfortable investment grade (Baa1) rating with adjusted interest cover ratio (AICR) at or above 1.4x, which is Moody’s minimum threshold for a Baa1 credit rating. For actual company financeability, Ofgem has left the onus on companies to show that they are financeable. Therefore, those companies that have issues with actual company financeability (rather than on a notional company financeability basis) will need to either demonstrate that their notional company modelling has been inadequate, or that relevant features of the actual company need to be considered within the assessment.

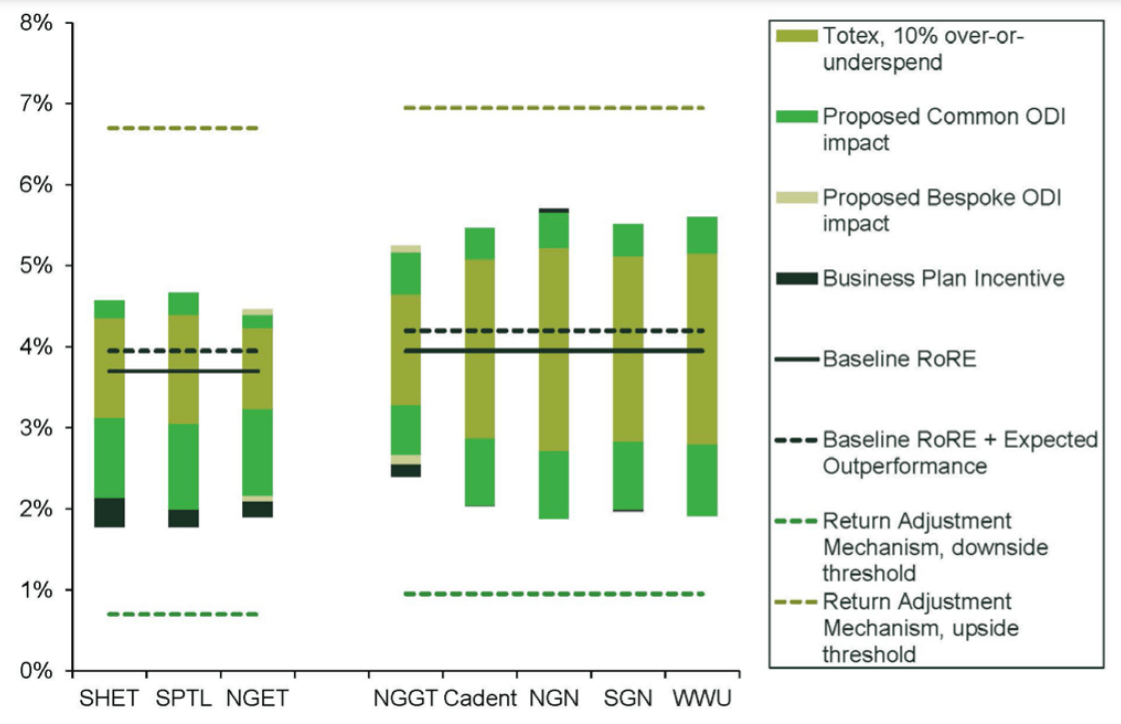

An appropriate balance of risk and return

Another tool that Ofgem uses to assess the overall balance of the regime is the expected ranges of the return on regulatory equity (RoRE). In theory, companies should have equal opportunities to outperform or underperform; otherwise, their risks are unbalanced, or asymmetric. Figure 1 reproduces Ofgem’s analysis.

Figure 1 RIIO-2 average RoRE ranges

Figure 1 shows that the downside impact of common ODIs is greater than the upside, especially for ET companies. Ofgem explains that the downside scenario shows the maximum penalties—which it considers are highly unlikely to be incurred—and that if the negative impact was weighted by its probability, the overall picture would be more balanced. However, Ofgem does not show the outcome of the probability-weighted RoRE assessment.

This assessment is highly sensitive to the assumptions that are made. For example, assumptions about the probabilities of the high and low common ODI scenarios would need to be carefully assessed.

Another example is the probabilities of the 10% TOTEX underperformance and outperformance scenarios. Reflecting the current 20% and 55% cost challenges in gas distribution and transmission respectively, the companies would tend to perceive Ofgem’s 10% TOTEX range as 12–28% (GD) 21 and 51–60% (transmission) relative to their expected costs in business plan submissions. To put this in context, to outperform allowed costs by 10%, transmission companies would effectively have to outperform TOTEX by 60% relative to their business plan modelled baselines; even an underperformance of 10% against allowed costs would represent an effective outperformance of 51% relative to business plan submissions. From the companies’ perspective, therefore, these scenarios do not confer equal symmetric probabilities of +/-10% relative to modelled baselines.

Another notable area is the BPI. Is the BPI symmetric by construction? The companies could be penalised at stages 1 and 3 of the BPI for not meeting the minimum requirements in business plans, or for insufficient justification of their costs, and rewarded at stages 2 and 4 for CVPs and cost efficiency.22 Taking the outcome of the Draft Determinations as an example, to balance out stage 3 penalties alone, £600m of CVPs would need to be accepted, or the well-justified costs would need to be 4% lower than Ofgem’s benchmark.23 Indeed, the outcome of the BPI has been asymmetric, with a range of -£66.6m to +£1.6m, as referenced earlier in this note.

Finally, Ofgem retains its cost of equity outperformance adjustment, although it has been updated from 0.5% in the SSMD to 0.25% in the Draft Determinations and is now subject to an ex post adjustment if the expected outperformance does not materialise. Whether or not one agrees with Ofgem on the notion of an ex ante downward revision in the cost of equity allowance,24 Ofgem’s expected RoRE is 0.25% above the baseline allowed cost of equity by construct. This discussion is closely related to the interdependence of various elements of the price control regime. In this case, Ofgem needs to ensure that there is no double-counting of the expected outperformance—if it is assumed in the cost of equity allowance, the assumption should be appropriately reflected in the cost allowances.

Notably, Ofgem dedicates a separate section of the Draft Determinations to the interdependence between elements of the price control package. One of the conclusions from this section is procedural: as has been previously indicated, in case of a successful CMA redetermination of a specific parameter of the price control, Ofgem intends to reassess the rest of the parameters to ensure the overall balance of the regime.

The Electricity System Operator

Ofgem’s approach to the ESO price control differed from its approach for GD, ET and GT: instead of a primary focus on the delivery of cost efficiency, Ofgem has explained that it is more valuable to consumers to focus on the ESO’s deliverables. These span across the ESO’s three roles: control room operations; market development and transactions; and system insight, planning and network development. Selected elements of the ESO regime, as assessed in the Draft Determinations, are as follows.

- Unlike in other sectors, the ESO’s costs will be recovered on a pass-through basis. To control the ESO’s efficiency, Ofgem suggests that it will grant a higher incentive payment if the ESO delivers greater value for money.

- Ofgem retains an ability to disallow TOTEX expenditure in extreme cases.

- The ESO is not subject to the BPI; however, its Business Plan is required to set sufficiently ambitious aims on deliverables. Ofgem has not considered the current version to be ambitious enough and has challenged the ESO to develop it further.

- Overall, the ESO’s performance incentive scheme, including the above-mentioned value-for-money element, has an asymmetric value of +£15m/-£6m per annum.

- Within the return allowance, the ESO’s asset beta (0.45), affecting the cost of equity, is higher than that of GD, ET and GT companies (0.34–0.39), but lower than the asset beta proposed by the ESO (0.60–0.65).

- The 0.25% outperformance assumption, forming the difference between the expected and the allowed cost of equity in other sectors, does not apply to the ESO.

- The cost of debt allowance has also been calibrated for the ESO separately: Ofgem allows a positive margin to account for the ESO’s proposed floating-rate debt and uses a different maturity and trailing average window of the iBoxx GBP utilities index.

- In recognition of the ESO’s unique risks and smaller asset base, Ofgem grants it a £1.9m annual revenue allowance. This is in addition to the standard rate of return allowances in other sectors; however, this is significantly lower than £13m–£39m estimated by the ESO.

The rate of return allowance and the value of the incentive scheme in combination result in a wide expected RoRE range of 1–16% for the ESO. Together with the £1.9m additional revenue allowance, the RoRE range is 2–17%.25 The wide range implies that significant outperformance and underperformance relative to the baseline allowed revenue is possible for the ESO.

Next steps

Companies can respond to the consultation and have the opportunity to influence Ofgem’s Final Determinations until 4 September 2020. In addition, further engagement is expected between Ofgem, the main stakeholders, and third-party stakeholders ahead of the Final Determinations, which are planned to be published by the end of the year.26 To the extent that networks deem the price control to not be deliverable at the Final Determinations stage, subsequent CMA appeals would be undertaken in 2021. As noted, Ofgem has also raised the possibility that the outcome of a CMA appeal could trigger a reassessment of other price control parameters, which raises some uncertainty about the decision that will be reached by the end of the year.

1 Ofgem (2020), ‘RIIO-2 Draft Determinations for Transmission, Gas Distribution and Electricity System Operator’, 9 July. The RIIO-ED2 price control for electricity distribution begins two years after the other controls. Ofgem’s next major publication on RIIO-ED2 is the sector-specific methodology consultation, which is expected in summer or autumn 2020. See Ofgem (2020), ‘Consultations and decisions (RIIO-ED2)’.

2 The current ESO’s Business Plan is set for two years within the RIIO-2 period from 1 April 2021 to 31 March 2023.

3 Ofgem (2019), ‘RIIO-2 Sector Specific Methodology – Core document’, 24 May, section 4.

4 Ofgem (2018), ‘RIIO-2 Framework Decision’, 30 July, section 5.

5 Ofgem’s economic consultants (CEPA and Professor Andrew Smith) have made certain observations and recommendations in the technical annexes. Where Ofgem has taken a particular position in the Draft Determinations that does not fully take account of the technical recommendations, further examination may be required.

6 Ofgem (2019), ‘RIIO-2 Sector Specific Methodology Decision – Finance Annex’, 24 May, para. 1.12.

7 Ofgem (2020), ‘RIIO-2 draft determinations – Finance Annex’, 9 July, para. 4.1.

8 For instance, for the infrastructure funds discount rate cross-check, Ofgem has increased the number of infrastructure funds from 6 to 14 and has also estimated their internal rates of return (IRRs) based on a time-series of discount rates and net asset value (NAV) premia.

9 Ofgem (2012), ‘RIIO-GD1: Final Proposals – Finance and uncertainty supporting document’, 17 December, Table 3.2.

10 Ofgem (2012), ‘RIIO-T1: Final Proposals for National Grid Electricity Transmission and National

Grid Gas’, 17 December, Table A1.3.

11 Ofgem (2012), ‘RIIO-T1: Final Proposals for SP Transmission Ltd and Scottish Hydro Electric Transmission Ltd’, 23 April, paras 6.41 and 6.52.

12 Oxera’s calculation, based on data reported by Ofgem.

13 NGET’s penalty would have been £192m if the cap of 2% of TOTEX had not been applied.

14 Ofgem (2020), ‘Ofgem decarbonisation action plan’, February.

15 Ofgem (2019), ‘RIIO-2 Sector Specific Methodology – Core document’, 24 May, para. 10.122.

16 Ofgem (2019), ‘RIIO-2 Sector Specific Methodology – Core document’, 24 May, para. 10.104.

17 Under Stage 2 rewards for CVPs. Ofgem (2020), ‘Consultation – RIIO-2 Draft Determinations – Core Document’, 9 July, para. 9.4.

18 Ofgem (2020), ‘Consultation – RIIO-2 Draft Determinations – Core Document’, 9 July, para. 9.23.

19 Ofgem (2020), ‘Consultation – RIIO-2 Draft Determinations – Core Document’, 9 July, paras 9.12–13.

20 Ofgem (2020), ‘Consultation – RIIO-2 Draft Determinations – Core Document’, 9 July, para. 9.20.

21 E.g. 90% of the allowance, which is 20% lower than the requested costs, is 72% of the requested costs, i.e. 28% outperformance. 110% of the allowance, which is 20% lower than the requested costs, is 88% of the requested costs, i.e. 12% outperformance.

22 See section 1.2.6 for the description of the stages of the BPI assessment.

23 £600m is equivalent to the Stage 3 penalties across the companies of £243m divided by the weighted average incentive rate of 43.9%, as Stage 2 rewards are estimated as CVP multiplied by the company’s incentive rate.

24 As discussed in Oxera’s cost of equity assessment, the concept of this adjustment is questionable. Oxera (2019), ‘The cost of equity for RIIO-2’, 29 November, p. 4.

25 Oxera’s calculations, based on data reported by Ofgem.

26 Although Ofgem indicated the possibility of a delay due to the COVID-19 pandemic, it does not consider this scenario to be likely.

Download

Related

Future of rail: how to shape a resilient and responsive Great British Railways

Great Britain’s railway is at a critical juncture, facing unprecedented pressures arising from changing travel patterns, ageing infrastructure, and ongoing financial strain. These challenges, exacerbated by the impacts of the pandemic and the imperative to achieve net zero, underscore the need for comprehensive and forward-looking reform. The UK government has proposed… Read More

Investing in distribution: ED3 and beyond

In the first quarter of this year the National Infrastructure Commission (NIC)1 published its vision for the UK’s electricity distribution network. Below, we review this in the context of Ofgem’s consultation on RIIO-ED32 and its published responses. One of the policy priorities is to ensure… Read More