Shining the light: the merits of on- vs off-exchange trading

Many financial assets trade away from exchanges in over-the-counter (OTC) markets. The academic literature has highlighted the value of both the OTC and exchange trading models but also notes some inefficiencies of the OTC model from an overall market design perspective. Getting the right balance between OTC and exchange models is critical for achieving good outcomes for end-users, and policymakers should be mindful of how regulation can affect this balance.

When one thinks about trading in financial markets, perhaps the first thought that comes to mind is the trading of shares on a traditional stock exchange. Although it is commonplace for the trading of shares to take place on an exchange, not all shares trade ‘on-exchange’. And indeed most other financial assets trade away from exchanges in over-the-counter (OTC) markets (or ‘off-exchange’).

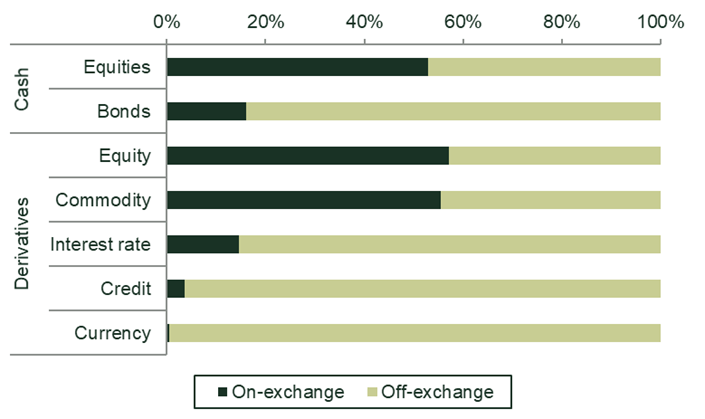

While it is difficult to measure the volume of trading taking place OTC precisely,1 it is clear that the share of trading taking place on-exchange varies considerably across markets. As shown in Figure 1, according to the European Securities and Markets Authority (ESMA), while on-exchange trading accounts for the majority of European trading in the case of equities, a much lower proportion of trading takes place on-exchange in the case of bonds. In the derivatives space, the share of trading on-exchange ranges from around 1% to 60%. Even within similar asset classes there can be significant differences in the pattern of trading activity (for instance, government vs corporate bonds, and small-cap vs large-cap equities).

Figure 1 Relative share of ‘on-exchange’ trading by instrument in Europe

Source: ESMA (2020), ‘ESMA Annual Statistical Report on EU Securities Markets’, November; ESMA (2017), ‘EU derivatives markets – a first-time overview’, ESMA Report on Trends, Risks and Vulnerabilities, No. 2.

There is a broad and evolving body of academic literature that studies the origin, development and efficiency of these market structures. Revisiting this provides a useful starting point when thinking about how to design trading markets and the balance between on- and off-exchange trading.

Different models

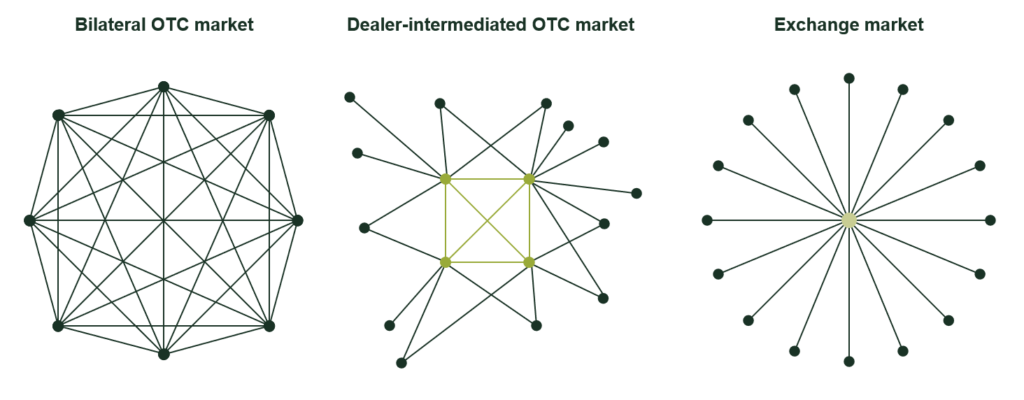

Marketplaces can be structured in a variety of ways. Figure 2 shows three stylised examples of market structures that facilitate the matching of buyers and sellers.

Figure 2 Three different models

In a bilateral OTC model (on the left of Figure 2), trading is completely decentralised and all counterparties have direct relationships with each other. There are a number of disadvantages to this model from a user perspective. End-users need to make contact with each individual counterparty whenever they attempt to find a buyer or seller (i.e. the search costs are high). The larger number of connections also results in higher fixed costs, and therefore higher barriers to entry for new participants, compared to the other models.

The costs associated with the bilateral market structure mean that many OTC markets are heavily dealer-intermediated (middle of Figure 2). This model involves a network with a smaller number of highly interconnected financial institutions that intermediate a large proportion of trading activity (represented by the light green dots).2 Intermediaries can facilitate trading on either an agency basis (i.e. matching buy and sell orders from different customers) or a principal basis (i.e. acting as a counterparty to a customer order and then entering into an opposite trade with another customer or dealer).

The third model is a centralised trading platform (right of Figure 2), such as that offered by an exchange central limit order book.

In practice, many complex hybrids of these models have evolved over time, with elements of each of these structures. For example, in heavily intermediated markets, trading between dealers (the inter-dealer market) may be facilitated by a Request for Quote system.3 Similarly, for some derivatives, dealers in intermediated OTC markets may hedge their outstanding market risk by trading in more liquid and standardised exchange-traded contracts.

Benefits of the OTC models

The bilateral and dealer-intermediated OTC models provide a number of benefits to users in certain situations, which may explain their attractiveness. These include:

- the high degree of flexibility with respect to the contract terms that can be negotiated between two parties. This can be particularly attractive for users in certain derivative contracts if, for example, the use case is to hedge a very specific risk.4 Standardised products, such as interest rate or commodity futures, may not be able to perfectly match the client’s requirements, leaving them exposed to residual (basis) risk that they may be reluctant to take on;

- the limited transparency in OTC trading that enables users to hide their trading intentions from others in the market. The opaqueness of OTC trading can, in some cases, make it easier for financial institutions to unwind, or open new, trading positions without revealing information to the rest of the market;

- the ability to know who is on the other side of the trade. The OTC model can allow market participants to form long-term relationships with counterparties. Some papers have found that non-anonymous trading can improve liquidity and overall efficiency by reducing concerns around adverse selection (i.e. the risk that a trader loses out by trading with a more informed party).5

The combination of the lack of anonymity and higher levels of transparency associated with exchange trading may explain why OTC models have often been preferred to the centralised exchange models for executing large orders, which involve higher inventory risk (i.e. risk associated with fluctuations in the price of the asset).6

Recognising this, many trading platforms have developed new mechanisms that replicate some of these beneficial features of OTC markets. For example, some exchanges now allow larger orders to be executed on platforms with limited pre-trade transparency and delayed trade reporting, on platforms that replicate the reputational scoring and surveillance that would normally be performed by an OTC broker in a non-anonymous trading environment, or through auction-based trading mechanisms (which may reduce the risk of orders being picked off by high-frequency traders).7

Despite the benefits of OTC trading, the academic literature also highlights that there are inefficiencies from a regulatory and market design perspective. This is due to, for example, the following phenomena.

- Search frictions—several academic papers analyse OTC trading through a search and bargaining framework.8 In these frameworks, an investor who wishes to buy an asset must approach potential sellers for quotes, incurring costs until one is found. In equilibrium, the prices negotiated will often depend on the seller’s bargaining power and the efficiency of the search process.9 From a welfare perspective, this imposes costs on end-investors and (at the margin) may prevent mutually beneficial trades from taking place.

Other analytical frameworks show how dealers emerge naturally in the centre of OTC networks to facilitate trading in the presence of information frictions.10 Here, costs of trading depend on how central the dealer is within the network of dealers. For example, Li and Schürhoff (2019) find that dealers located within the centre of a network can provide faster execution for end-investors and therefore charge higher mark-ups than their peripheral competitors.11

- Opaqueness and price dispersion—the lack of a centralised price formation mechanism in OTC markets means that identical assets can trade at different prices at the same time.12 Intervention to increase post-trade transparency can reduce these inefficiencies; however, there is evidence of price dispersion even in relatively centralised OTC markets.13

Benefits of the exchange model

In an exchange model, all participants enter the market via a single point of access and the trading takes place on a multilateral basis (i.e. all buyers and sellers interact with each other at the same time). As well as reducing the search frictions associated with the OTC models, centralised trading platforms can also reduce the cost of trading through increased competition for liquidity provision.

From a market design perspective, the exchange model generates efficiencies to the benefit of end-users via a number of channels.

- The single point of access can reduce barriers to entry for new trading participants, and make trading more accessible. By connecting to the exchange a trader has immediate access to all counterparties, without needing to establish bilateral relationships with each one.14

- The multilateral and non-discretionary trading rules promote competition for liquidity provision. The non-discretionary nature of an exchange order book means that orders are matched automatically on a price-time basis. In order to trade, participants on an exchange must provide competitive quotes (i.e. lower ask prices or higher bid prices).

- The anonymous nature of trading (underpinned by CCP clearing) and the well-regulated trading rules mean that all traders can trust that their trading intention will be executed in a fair and consistent manner, irrespective of whether they have a relationship with the person executing the trade.

The ability of the centralised exchange trading model to attract a broader, more diverse group of market participants, in a pro-competitive manner, is ultimately likely to result in lower overall costs for end-users.

Getting the balance right

While the literature recognises the value of both the OTC and the exchange trading models, it also notes some inefficiencies of the OTC model from an overall market design perspective.

From a user perspective, it is beneficial to have a range of options and choice to help meet the specific user needs. From a market design perspective, there are advantages in terms of transparency, competition and price discovery of the exchange model.

The challenge with these market structures is path dependency. A market often starts with trading activity on a bespoke and bilateral basis and individual market participants may not have an incentive to switch from OTC to exchange-trading, even if it is socially optimal.15 This may be particularly true for intermediaries, for whom increased exchange trading may mean transacting a lower proportion of total volumes (as some trading now happens directly between end-users) and at lower bid–ask spreads. This implies that, in many markets, there is an important coordination role for the exchange in encouraging market participants and end-users to make the transition.

Shifting the market to a new equilibrium can require significant investment, especially in those markets where product innovation plays an important role (for example, derivatives). As a result, the relative costs and pay-offs faced by an exchange seeking to attract liquidity from an OTC environment will have a big impact on overall market structure.

Developments in regulation since the financial crisis have led to substantial changes in OTC markets, particularly in the area of post-trade risk management, as well as the development of electronic trading platforms. Nonetheless, there remain significant differences between OTC and exchange trading models. As a result, when designing regulation, policymakers should be mindful of any impact on the balance between OTC and exchange trading.

1 Data on OTC trading should be interpreted with care. Due to the lack of a standardised reporting format and a centralised collecting entity, the data on OTC trades may not be fully accurate. Moreover, due to reporting requirements, OTC trading volumes may include certain technical trades, such as transactions for central counterparty (CCP) collateral purposes or intra-group transfers. For a discussion of some issues around OTC data reporting in equity markets, see Appendix A8.1 in Oxera (2020), ‘Primary and secondary equity markets in the EU’, Final Report.

2 This has been documented by various empirical analyses, for example in the corporate bond market (Li and Schürhoff, 2019); and the euro area interest rate swaps market (Dalla Fontana et al., 2019). See Li, D. and Schürhoff, N. (2019), ‘Dealer networks’, Journal of Finance, 74:1, pp. 91–144; and Dalla Fontana, S., Holz auf der Heide, M., Pelizzon, L. and Scheicher, M. (2019), ‘The anatomy of the euro area interest rate swap market’, ECB Working Paper, No. 2242.

3 Request for Quote (RFQ) systems allow a participant to request bid and ask quotes from a number of dealers simultaneously.

4 Bond markets are also characterised by a large number of heterogenous securities available for trading. ESMA reports that, as at end-2019, 170,000 bonds were available for trading in the EEA, compared to 28,000 equity and equity-like instruments. See ESMA (2020), ‘ESMA Annual Statistical Report on EU Securities Markets’, November.

5 See, for example, Azarmsa, E. and Li, J. (2020), ‘The pricing and welfare implications of non-anonymous trading’, working paper.

6 See, for example, Viswanathan, S. and Wang, J. (2002), ‘Market architecture: limit-order books versus dealership markets’, Journal of Financial Markets, 5:2, pp. 127–67. Many reporting regimes also allow for the delayed reporting of block trades.

7 Examples of trading platforms that have emerged to facilitate trading of large orders sizes include Turquoise Plato Block Discovery, CBOE LIS, Euronext Block and Liquidnet.

8 Such models have been commonly employed when analysing other decentralised markets—for instance, labour markets. For a detailed summary of the literature, see: Weill, P.-O. (2020), ‘The search theory of OTC markets’, Annual Review of Economics, 12, pp. 747–73.

9 See, for example, Duffie, D., Gârleanu, N. and Pedersen, L. H. (2005), ‘Over-the-counter markets’, Econometrica, 73:6 , pp. 1815–47; Duffie, D., Gârleanu, N. and Pedersen, L. H. (2007), ‘Valuation in over-the-counter markets’, Review of Financial Studies, 20:6, pp. 1865–900; Hugonnier, J., Lester, B. and Weill, P.-O. (2018), ‘Frictional intermediation in over-the-counter markets’, NBER Working Paper No. 24956; and Uslu, S. (2019), ‘Pricing and liquidity in decentralized asset markets’, Econometrica, 87:6, pp. 2079–140.

10 See, for example, Chang, B. and Zhang, S. (2019), ‘Endogenous market making and network formation’, working paper.

11 Li, D. and Schürhoff, N. (2019), ‘Dealer networks’, Journal of Finance, 74:1, pp. 91–144.

12 In a market where trades are not CCP-cleared price dispersion may also reflect differences in bilateral creditworthiness.

13 See: Asquith, P., Covert, T. and Pathak, P. A. (2013), ‘The effects of mandatory transparency in financial market design: evidence from the corporate bond market’, NBER Working Paper, No.19417; Duffie, D., Dworczak, P. and Zhu, H. (2017), ‘Benchmarks in search markets’, Journal of Finance, 72:5, pp. 1983–2044; Dalla Fontana, S., Holz auf der Heide, M., Pelizzon, L. and Scheicher, M. (2019), ‘The anatomy of the euro area interest rate swap market’, ECB Working Paper, No. 2242.

14 In the case of commodity derivatives, exchange trading can also reduce entry barriers by centralising the cost of physical delivery of the underlying commodity. See, for example, Raman, V., Robe, M. A., Yadav, P. K. (2017), ‘The third dimension of financialization: electronification, intraday institutional trading, and commodity market quality’, CTFC Research Paper.

15 Lee and Wang (2020) present a model in which OTC dealers can price-discriminate and imperfectly cream-skim uninformed investors from the exchange. As a result, the welfare effect of the OTC market depends on adverse selection risk. Other papers have found that greater participation in a centralised market can be welfare-improving if participants are heterogenous in their ability to take large positions in the OTC market and if participation costs induce users to trade exclusively in one market. See: Lee, T. and Wang, C. (2019), ‘Why trade over-the-counter? When investors want price discrimination’, Working Paper; Dugast, J., Uslu, S. and Weill, P.-O. (2019), ‘A theory of participation in OTC and centralized markets’, NBER Working Paper No. 25887.

Download

Related

Future of rail: how to shape a resilient and responsive Great British Railways

Great Britain’s railway is at a critical juncture, facing unprecedented pressures arising from changing travel patterns, ageing infrastructure, and ongoing financial strain. These challenges, exacerbated by the impacts of the pandemic and the imperative to achieve net zero, underscore the need for comprehensive and forward-looking reform. The UK government has proposed… Read More

Investing in distribution: ED3 and beyond

In the first quarter of this year the National Infrastructure Commission (NIC)1 published its vision for the UK’s electricity distribution network. Below, we review this in the context of Ofgem’s consultation on RIIO-ED32 and its published responses. One of the policy priorities is to ensure… Read More