Snowball effects: competition in markets with network externalities

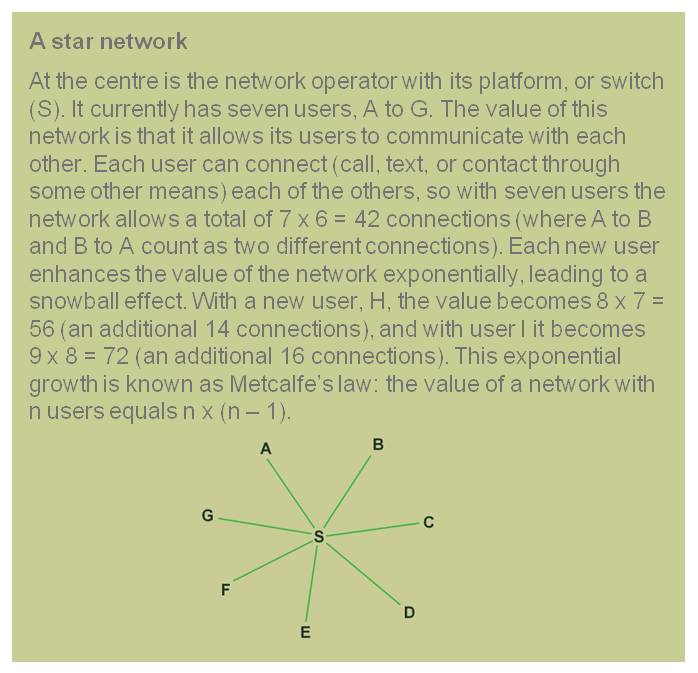

Network effects are a form of economies of scale driven by the demand characteristics of a product rather than the supply side. A network effect is where the benefit that one consumer receives from a network product is affected by how many other consumers also use it. Economists call this a positive demand-side externality—positive because users influence each other’s demand positively; externality because individual users do not take into account the positive effect on others when deciding whether to join the network. Network effects are explained in the box below.

Network effects can sometimes be exhausted quickly—for example, at a restaurant. Your demand for a restaurant (especially one you’ve never visited before) can be positively influenced by the number of people already eating there. First, it is an information signal and, second, your enjoyment is enhanced by the atmosphere of a restaurant that has a reasonable number of patrons.

However, such network effects do not lead to significant market power. The positive benefits you receive from the presence of others quickly turn to negative effects if the restaurant is too crowded. Even if that were not the case, there is a natural limit, given the capacity of a restaurant, which is well below the total market size. There is plenty of room in the market for other restaurants.

Social networks and standards

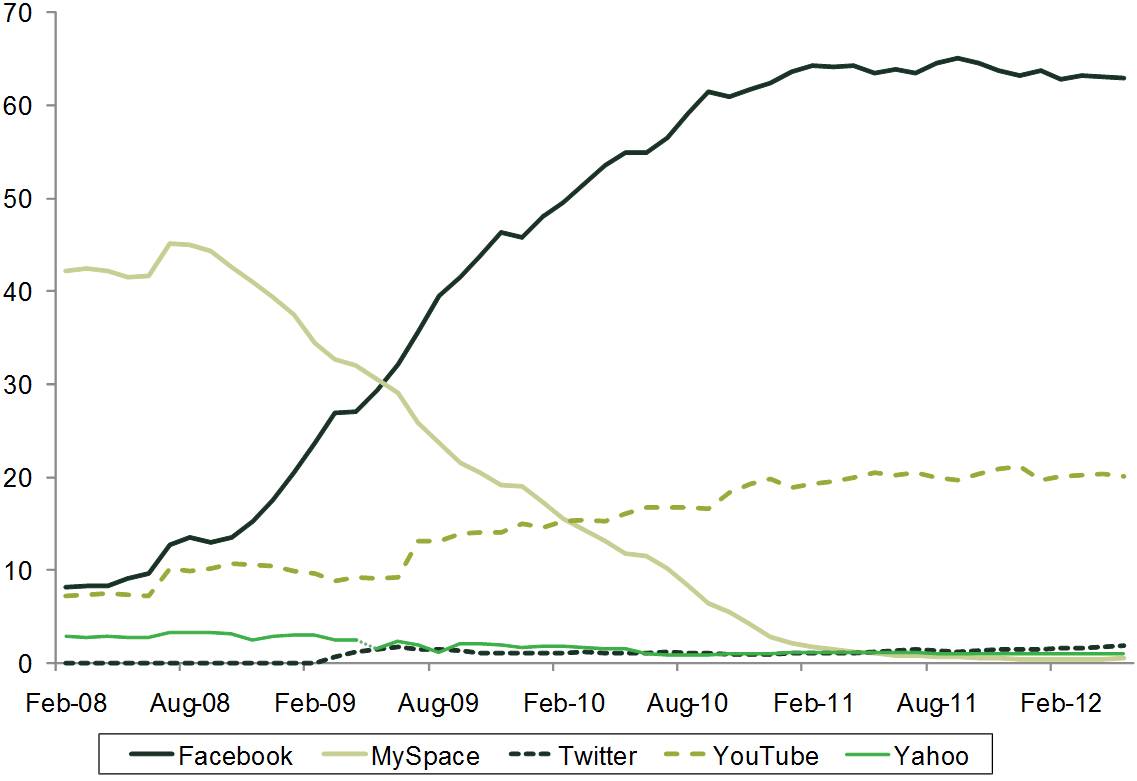

Now consider the example of social networking sites. The benefit of being a member of such a site depends on how many others are members. In general, the more members there are, the more benefits there are, as it is more likely that you will be able to link up with current friends and past acquaintances. The way this market developed between 2008 and 2012 is illustrated in Figure 1. MySpace was the first site to build a strong following, in 2008—but then came Facebook. It pulled ahead, becoming the largest of the sites and establishing a critical mass that makes it more attractive to every new potential member. By early 2010—so within a space of only two years—Facebook had more than five times as many monthly visitors as its nearest rivals.

Figure 1 Market shares of social networking sites, 2008–12 (%)

Source: Marketing Charts, www.marketingcharts.com/categories/social-networks-and-forums/, accessed 11 June 2012.

This critical mass of Facebook users became a serious barrier to entry and expansion for all other sites. A new entrant cannot simply steal a few customers from Facebook and build up slowly over time. The network effect means that an entrant must be able to establish a critical mass quickly to become a viable competitor. Indeed, most of Facebook’s direct rivals have declined in size. Twitter and LinkedIn have managed to grow because they have both differentiated themselves from Facebook to provide a different type of social networking service, rather than compete with it head-to-head.

Markets where standardisation brings benefits can also exhibit significant network effects that lead to strong and enduring barriers to entry. Microsoft is the classic example—its success in the market for PC operating systems has led to it being the global standard, and competition authorities have worried about this:

Microsoft’s dominance presents extraordinary features in that Windows (in its successive forms) is not only a dominant product on the relevant market for client PC operating systems, but it is the de facto standard operating system product for client PCs.[1]

Once a network has critical mass, rival networks face a chicken-and-egg problem: they need to persuade users to switch, and no user will switch if others do not. In terms of the star network in the box above, a user who switches by themselves finds the new network of no value if there are no others. Some coordination between users would be required.

Two-sided networks

Two-sided network effects can raise similar barriers to entry. They arise where platforms bring together two different types of customer in some form of common pursuit. Examples are dating agencies and nightclubs bringing together men and women; payment systems bringing together retailers and customers; and a newspaper bringing together advertisers and readers.

Entry barriers of this type were found in the market for printed classified directory advertising. Yell was the largest producer of such services in the UK. It issued a regionally varied publication delivered to all homes with classified advertising and had been subject to price regulation. In 2006 the UK Competition Commission concluded that this price regulation needed to continue. Although the Internet was becoming an increasingly important constraint on Yell’s business, it was still considered to be in a separate market. Within the market for classified directory advertising in the UK, Yell was found to have a market share of 75% and to benefit from strong barriers to entry and expansion in the market arising from the two-sided network effects that exist:

entry barriers are high and include the network effect referred to above and the need to establish a strong brand identity…

the incumbency position of the largest player is reinforced by the network effects present in this market. Other providers wishing to expand have to build usage in order to attract advertisers. This requires investment, particularly in usage advertising, and acts as a barrier to expansion.[2]

Only a few years later, the Dutch competition authority (NMa; now the ACM) approved a merger between the only two providers of paper-based classified directories in the Netherlands, partly because the provision of such advertising services over the Internet was considered a close substitute.[3]

Game over?

Do network effects mean the end of all competition? Not necessarily. They may be exhausted well below the total market size—as in the restaurant example above. Microsoft has been found to be virtually super-dominant as a result of the network effect in PC operating systems.

Yet even Windows never achieved a 100% share of all PCs in the world, as other operating systems, such as Apple Mac OS, continue to exist alongside it, again mainly because they have to some extent differentiated themselves.[4] In the last few years the issue of whether the advent of web-based technology would make PC operating systems obsolete has been much debated. Furthermore, in devices that increasingly compete with PCs, such as set-top boxes and mobile phones, Microsoft has faced strong competition from other operating systems.

In other markets, several platforms can co-exist (and compete) despite the presence of network effects. An example of this is the video game console market, with Nintendo Wii, Sony Playstation 4 and Microsoft Xbox One all currently maintaining a position in the market—as can be judged by the barrage of Christmas advertising for the latest console models. This was not always so. Over 15 years ago, the UK Monopolies and Mergers Commission (MMC) believed that Nintendo and Sega had durable positions of market power because of network effects.[5]

The MMC investigated this market between January 1994 and March 1995, and found that it was dominated by Nintendo and Sega, which held a combined market share of nearly 100% for consoles (hardware) and around 40% for games (software). The MMC concluded that ‘Nintendo and Sega remain well placed to retain their dominant position in the market and derive profit from it.’[6]

However, the report was outdated almost from the time of its publication. In the same year, Sony launched its highly successful Playstation game console in Europe, which would go on to sell over 100m units worldwide—more than any console to date other than its successor, Playstation 2 (the contemporaneous rival console, Nintendo 64, sold 33m units).[7] Playstation represented a whole new ‘generation’ of consoles at the time (for example, it had CDs containing the necessary software, rather than cartridges). Several further generations of game consoles have since been developed. Microsoft also successfully entered the game console market in 2001 with Xbox, while Sega, one of the two ‘dominant’ companies in 1995, exited the market in that same year.

Playing together

Networks can also interconnect and standards can be made interoperable. In this way, different producers can compete with each other within the confines of that common network, platform or standard. Manufacturers of Blu-ray Disc players can compete with each other as Blu-ray has now become the accepted new industry standard for high-definition video, so all discs will operate on this standard. Sometimes interoperability or interconnection can be achieved through commercial negotiation, and sometimes it requires government intervention.

The main point here is that interoperability, however achieved, means that competing companies can benefit from the same network effects. Significant parts of the IT sector are now based on ‘open source’, which means that access to the source code and other proprietary information is open to others, who can modify and develop the software or hardware further. Prominent examples include the Linux operating systems and the Mozilla Firefox Internet browser. Thus, the presence of network effects does not inevitably result in insurmountable entry barriers.

Let them play?

In dynamic markets characterised by network effects and standards, the standard tools for market definition and dominance need to be applied with caution. In assessing market power, a company with a very high market share—or even 100%—today may not be in the same position in a year’s time—strong market positions can be eroded quickly. Even market positions that are supported by strong network effects may not last.

Such markets have a long history of disputes with competition authorities. The IBM case is a famous example.[8] Throughout the 1970s in both the USA and Europe, IBM was scrutinised over concerns about the interoperability of its CPUs (central processing units) and its bundling practices in the mainframe market. The case was dropped in the USA in 1982 and settled in Europe in 1984, with IBM agreeing to offer access to its interface protocols and not to bundle other products with its CPU. By that time, however, IBM’s market position had already diminished, and the company suffered a serious decline through the 1982 and 1990s, finding itself outflanked in the innovations in PCs and servers that were the source of market power for providers such as Microsoft and Intel.

Does the IBM case demonstrate that all positions of market power will one day be eroded? Will the same hold for Microsoft, which the European Commission has found to be super-dominant on the basis of a strong and enduring near-monopoly position in the market for PC operating systems? And what about Google’s current position and the competition investigations that this has triggered? Much depends on how proactively a competition authority wishes to engage with these dynamic markets characterised by standards and network effects. In any event, the lessons from the game console case are worth bearing in mind.

Contact: Dr Gunnar Niels

[1] European Commission (2004), Case COMP/C-3/37.792, Microsoft, 24 March, para. 472.

[2] Competition Commission (2006), ‘Classified Directory Advertising Services—Market investigation’, December, para. 54(a). Oxera advised the investigated party during this inquiry.

[3] Netherlands Competition Authority (2008), ‘European Directories – Truvo Nederland’, Decision in Case 6246, 28 August.

[4] Windows has had a market share of consistently over 80% since 1997, and over 90% since 2000. See Competition Commission (2004), Case COMP/C–3/37.792, Microsoft, 24 March, para. 432.

[5] Monopolies and Mergers Commission (1995), ‘Video games: A report into the supply of video games in the UK’, March.

[6] Monopolies and Mergers Commission (1995), ‘Video games: A report into the supply of video games in the UK’, March, para. 1.4.

[7] Source: http://www.scei.co.jp/corporate/data/bizdataps_e.html; and http://www.nintendo.co.jp/ir/library/historical_data/pdf/consolidated_sales_e0809.pdf.

[8] See, for example, Pugh, E. (1995), Building IBM: Shaping an Industry and Its Technology, MIT Press.

Download

Related

Blending incremental costing in activity-based costing systems

Allocating cost fairly across different parts of a business is a common requirement for regulatory purposes or to comply with competition law on price-setting. One popular approach to cost allocation, used in many sectors, is activity-based costing (ABC), a method that identifies the causes of cost and allocates accordingly. However,… Read More

The European growth problem and what to do about it

European growth is insufficient to improve lives in the ways that citizens would like. We use the UK as a case study to assess the scale of the growth problem, underlying causes, official responses and what else might be done to improve the situation. We suggest that capital market… Read More