The Cloud, or a silver lining? Differentiated pricing in online markets

The overarching aim of the DSM strategy is to harness the European digital economy to deliver jobs, growth and welfare benefits to consumers and businesses throughout the EU.1 The strategy is built around three key pillars:

- better access for consumers and businesses to digital goods and services across Europe;

- creating the right conditions and a level playing field for digital networks and innovative services to flourish;

- maximising the growth potential of the digital economy.

All three pillars have implications for the ways in which online businesses make use of the data they hold, and how they price their offerings and distribute their products and services. They have also inspired debate. The first pillar raises the question of what ‘better’ means: should all consumers be offered the same price, or should they be offered access to the goods at prices that reflect their differences in purchasing power? Similarly, the second pillar raises questions around how online businesses (e.g. platforms) should be able to use consumer data to develop and monetise new services; while the third pillar suggests that online businesses should be given the opportunity to use their competitive advantage to grow and prosper.

Alongside the DSM strategy, the Commission has launched a full-scale competition inquiry into the e-commerce sector, following an initial investigation into the online sales of consumer electronics.2 It is also continuing to investigate geo-blocking and territorial pricing in the online supply of video games.3

Concerns about online markets have been on the rise in recent years. For example, in Karen Murphy v Media Protection Services, the European Court of Justice found that territorial copyrights could not prevent a Greek satellite TV decoder from being used to watch Premier League football games in the UK.4 Following this, the Commission launched an investigation into the cross-border provision of pay-TV films, and the terms of licensing between major US movie studios and European pay-TV operators.5 Differential pricing has also been investigated in the context of online sales of physical goods (for example, website bookings of car hire companies).6

While the DSM strategy and e-commerce inquiry appear to focus on price discrimination along national borders, firms can also price-discriminate along other dimensions. One example is companies’ use of ‘big data’—such as information on browsing or purchase history—to tailor prices to certain consumer groups. Many of these practices are also likely to be included within the broad scope of the Commission’s DSM and e-commerce initiatives.

What are the potential effects of price discrimination in online markets? Are they likely to be different from those in traditional bricks-and-mortar settings, and can price discrimination actually be beneficial for consumers?

What is so special about online markets?

It is widely accepted that online markets offer firms an increased opportunity for efficient growth across Europe. This benefits businesses, which can access new markets more easily, and consumers, who can expect to enjoy more choice and competition. Indeed, the rise of online markets has not only offered consumers easier access to many products that are already sold offline, but has also introduced new products and formats—such as search functions, maps and ebooks, as well as price-comparison and user-recommendation platforms.

Overall, online markets provide increased scope for competition between suppliers, as consumer search costs are lowered. They may also raise new concerns. Some of the key characteristics of online markets—and the opportunities and problems they create—are discussed below.

- Transparency: online markets are generally more transparent than their offline counterparts, as information on the latest prices/offerings is available in real time through search engines and comparison sites. This reduces consumers’ search costs and thereby increases the scope for shopping around and, consequently, competition between suppliers.

- Use of personal data: online suppliers are better able to gather and use personal data on consumers—including data on actual purchases and searching/browsing patterns—to tailor their offerings and prices (for example, to differentiate prices and introduce new products). The opportunity to differentiate between consumers is therefore higher than it is for bricks-and-mortar suppliers. The use of personal data can benefit or harm consumers, depending on the specifics of the market. In any event, it raises issues of consumer trust and privacy.

- Geographic location: one aspect that is of particular interest to the Commission is the reduced importance of geographic location and physical presence for making a trade. This allows consumers to shop around more widely and for firms to expand more easily into new markets. In addition, from a supplier’s perspective, online markets may offer further (potentially superior) technical means of using geographic location as a proxy for consumers’ spending power, such as charging different prices in different countries.

- Marginal costs: as well as giving firms the opportunity to price-discriminate, the nature of online business can increase the incentive to do so. Many online firms have high fixed costs (e.g. in building a platform), but very low marginal costs from supplying each additional customer—particularly in the case of digital goods (for example, the cost of creating each additional digital copy of a music track is virtually zero). With low marginal costs, a price-discrimination strategy allows firms to maximise their reach among consumers while still making enough profit to recover their high upfront investment costs (as discussed further below).

- New business models: the market features above have triggered a wave of new business models to better attract and serve customers. For example, ‘freemium’ pricing (a form of price discrimination based on minor quality differentials) is designed to make a service available as widely as possible. Under the freemium model, consumers do not pay for the basic version of the product, but there is a chargeable ‘premium’ version that can be adopted at a later stage (for example, this is the model used by music streaming service, Spotify).

Overall, there are clear benefits to consumers from the rise of online businesses, which can lead to better products at lower prices. However, there are also potential concerns about whether other business practices—such as price discrimination—can offset these gains.

Fundamentals of price discrimination

Price discrimination comes in many flavours and is often observed in offline as well as online sales. Common examples include student discounts, season sales, first/second class services, and peak/off-peak pricing. Prices for the same good can also vary by geography—between countries or even regionally within a country.

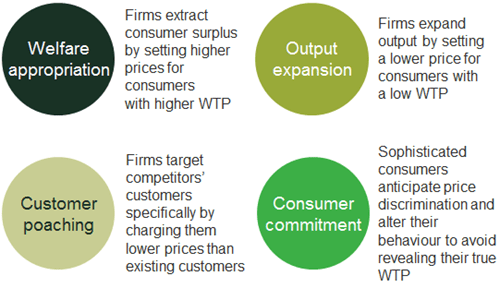

Economic theory indicates that the effect of price discrimination on consumers and total welfare depends on the characteristics of the market. The four main effects of price discrimination are shown in Figure 1.

Figure 1 Four main effects of price discrimination

Source: Oxera, based in Office of Fair Trading (2013), ‘The economics of online personalised pricing’, May.

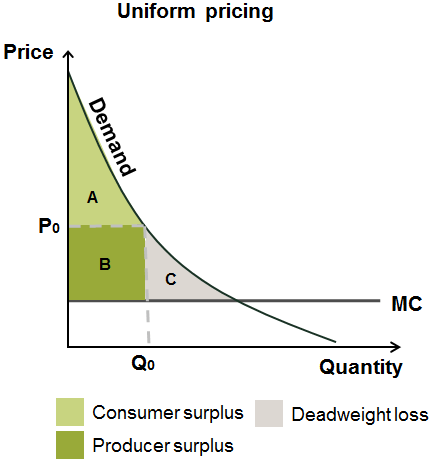

The simple model of monopoly pricing in Figure 2 below illustrates the welfare appropriation and output expansion effects. With no price discrimination, a monopolist charges a uniform price (P0), at the profit-maximising quantity (Q0). The total available welfare gains from trade are split between consumer surplus (region A), producer surplus (region B) and deadweight loss (region C). The box below defines the different welfare concepts.

Definitions of welfare concepts

Consumer surplus is the total sum across consumers of the difference between each consumer’s maximum willingness to pay and the price actually paid. Conceptually, this reflects the amount of ‘enjoyment’ consumers get net of the price they have paid. In the figure, it is the region between the demand curve and the price level (region A).

Producer surplus is essentially the total of the suppliers’ profits above cost and a reasonable return on capital invested. In the figure it is the difference between price and cost across all sales made at the chosen price (region B).

Deadweight loss represents welfare that is forgone as a result of a potentially beneficial trade not taking place. This occurs when firms set a price above the cost level, thereby implying that output is lower than the perfectly competitive level, and hence some trades are not taking place. Since this potential welfare is not achieved by consumers or producers, it is referred to as deadweight loss (region C). One way in which price discrimination can benefit society is by reducing deadweight loss—as discussed below.

Total welfare is defined as the total benefit to society—i.e. the sum of consumer surplus and producer surplus.

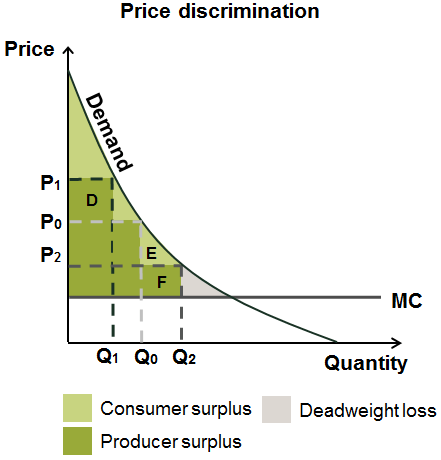

If the monopolist is able to discriminate between consumers according to their willingness to pay, the appropriation effect means that part of the consumer surplus is turned into producer surplus. In this setting, a monopolist will charge consumers with a high willingness to pay a higher price (P1), thereby appropriating some of the consumer surplus (region D).

However, the monopolist will also have an incentive to target consumers with a low willingness to pay (as long as the willingness to pay is greater than the marginal cost, MC). Charging a lower price (P2) to these customers leads to a total output expansion (from Q0 to Q2), which reduces deadweight loss and so unambiguously increases total welfare. This is why economists on balance usually regard price discrimination as positive. This welfare gain will be divided between producer surplus (region F) and consumer surplus (region E). Critically, the consumer benefit (region E) comes as a direct result of the ‘market opening’ facilitated by price discrimination—that is, incentivising the monopolist to supply consumers who would otherwise not have been served.

Figure 2 A stylised model of price discrimination by a monopolist

Source: Oxera.

The net effect on total consumer welfare depends on the relative magnitudes of the appropriation and output expansion effects. Overall consumer welfare increases if region E is larger than region D. However, this raises distributional concerns, as some consumers will be paying a higher price under price discrimination than they would under a uniform price.

Where consumers can be expected to make frequent, repeated purchases, the additional considerations of customer poaching and commitment effects come into play. An increased propensity towards customer poaching as a result of price discrimination could be shown to contribute to increased competition between firms. If firms can distinguish between their customers and those of their competitors (e.g. using information from customer online accounts or browsing history), they may want to offer lower prices to their competitors’ customers in order to poach them. However, as online markets mature, the ability of different firms to engage in poaching is likely to differ. For example, smaller firms with limited access to the necessary consumer data may find it harder to poach customers than larger, data-rich firms.

Finally, the commitment effect captures the strategic behaviour of sophisticated consumers that allows them to exploit firms’ inability to commit to a uniform pricing strategy.7

In summary, whether consumers lose or gain as a result of differential pricing depends on the specifics of the market, such as the intensity of competition and consumers’ sensitivity to price. However, consumers unambiguously benefit where the output expansion, customer poaching and commitment effects outweigh the appropriation effect. Furthermore, differential pricing often has a distributional effect and can allow firms to open markets and supply consumers who would otherwise be excluded due to price. Restricting price discrimination without detailed, market-specific analysis runs the risk of forgoing these potential benefits.

What does this mean for the European Commission’s DSM strategy?

Between the various goals of the DSM strategy and those of the e-commerce inquiry, the Commission is set to confront significant tension between its different priorities. Economics is well equipped to provide guidance through difficult trade-offs—drawing on principles such as welfare and efficiency. But, in order to do so effectively, it must provide clear, market-specific, data-driven contributions to the questions being asked.

At the highest level, the Commission’s DSM objectives appear to include an element of fairness and equity for EU citizens. Issues around geo-blocking by online retailers and national copyrights for media content have focused on the different prices offered to residents of different member states and restrictions on access across borders.

This immediately raises the question about what ‘fairness’ should mean for the EU. On the one hand, a fully integrated internal market might imply that one-price-for-all should be the guiding principle. However, if firms are forced to set a single price for the entire EU market, prices in regions that traditionally offered lower rates are likely to rise, thereby excluding from the market those consumers with the lowest willingness to pay.

While many might have an instinctive reaction against differentiated pricing on grounds of fairness, tools such as geo-blocking and national copyright enforcement offer firms the option of making their products affordable to the widest possible audience. At the same time, these tools might also be used to increase profits at the expense of consumers with a higher willingness to pay. For consumers as a whole, the balance between benefit and harm depends on the relative magnitudes of the output expansion, customer poaching and commitment effects, and the appropriation effect. Either way, appropriation at the expense of those with the highest willingness to pay necessarily introduces a welfare distribution dimension to the debate.

At a practical level, even if the wider questions such as that of fairness are resolved, tensions remain between the Commission’s own conflicting policy objectives. For example, at the same time as promoting increased competition and better access for consumers, the Commission is looking to the DSM to promote jobs and growth throughout the EU. This may require allowing online businesses scope for effective monetisation and growth, which could require elements of differential pricing.

Similarly, objectives around privacy and data protection may conflict with the Commission’s goals of economic growth and social benefit. While an appropriate level of data protection can increase consumer trust in online markets, over-zealous application could reduce the opportunities for online operators to better serve their customers.8 For example, the wealth of data becoming available to online operators presents a greater opportunity to identify and closely target competitors’ customers. This precise targeting could encourage competition and innovation from firms (including new entrants). While there are debates to be had about access to consumer data, in principle this could benefit consumers.

Overall, differential pricing can provide firms operating online with an important tool for increasing access to their products, while still enabling them to recover fixed costs and ensure their ongoing operation and growth. Whereas, historically, this discrimination has generally been along national boundaries (as a convenient approximation of relative spending power), new technologies and access to data pave the way for improved identification of willingness to pay on a more granular, or even individualistic, basis. Could a careful exploitation of these technical opportunities allow the Commission to facilitate the opening of markets to the benefit of consumers, without contravening the overarching political goal of a truly borderless digital Europe?

The Oxera Economics Council is a group of prominent European academics, specialising in microeconomics and industrial organisation, that meets with Oxera twice a year to discuss pressing economic issues facing policymakers. In March 2015 the Council welcomed senior officials of DG Competition to debate policy issues arising from the growth in the online marketplace for goods and services, including differentiated pricing. This article does not reflect the views of the Council or its members.

1 European Commission (2015), ‘A Digital Single Market Strategy for Europe’, Communication from the Commission to the European Parliament, the Council, the European Economic and Social Committee and the Committee of the Regions, COM(2015) 192 final, Brussels, 6 May.

2 European Commission (2015), ‘Antitrust: Commission launches e-commerce sector inquiry’, press release, 6 May.

3 European Commission (2015), ‘Competition policy for the Digital Single Market: focus on e-commerce’, speech by Margrethe Vestager at the Bundeskartellamt International Conference on Competition, 26 March. Geo-blocking refers to the ability of online retailers to restrict cross-border trade through means such as IP address monitoring, website re-routing, or discrimination according to credit card billing addresses.

4 Football Association Premier League Ltd v QC Leisure and ors, Murphy v Media Protection Services Ltd [2012] 1 CMLR 29, 769.

5 European Commission (2014), ‘Statement on opening of investigation into Pay TV services’, statement by Joaquín Almunia, speech/14/13, 13 January. See also Oxera (2014), ‘Goodfellas? The European Commission investigates pay-TV film deals’, Agenda, March.

6 In August 2014, the Commission made public a letter sent to the chief executive officers of six leading car hire companies operating in Europe. The letter highlighted the practice of using the customer’s location of residence (either from their IP address or from personal data supplied by the customer) to offer differentiated prices, and urged the companies not to discriminate in this way. European Commission (2014), ‘Commission presses car rental companies to stop discriminatory practices against consumers’, press release, August.

7 For example, sophisticated consumers who anticipate firms’ strategies of pricing according to past purchasing behaviour may be able to alter their behaviour in order to signal a lower willingness to pay and benefit from a lower price—for example, by postponing a purchase so as not to signal being an ‘early adopter’, or by buying into a cheaper ‘ecosystem’ (such as Android vs iOS).

8 For example, where consumers can choose to remain anonymous at no cost, they will often do so, even when price discrimination would increase the consumer surplus. See Conitzer, V., Taylor, C.R. and Wagman, L. (2012), ‘Hide and seek: Costly consumer privacy in a market with repeat purchases’, Marketing Science, 31:2, pp. 277–92.

Download

Related

Future of rail: how to shape a resilient and responsive Great British Railways

Great Britain’s railway is at a critical juncture, facing unprecedented pressures arising from changing travel patterns, ageing infrastructure, and ongoing financial strain. These challenges, exacerbated by the impacts of the pandemic and the imperative to achieve net zero, underscore the need for comprehensive and forward-looking reform. The UK government has proposed… Read More

Investing in distribution: ED3 and beyond

In the first quarter of this year the National Infrastructure Commission (NIC)1 published its vision for the UK’s electricity distribution network. Below, we review this in the context of Ofgem’s consultation on RIIO-ED32 and its published responses. One of the policy priorities is to ensure… Read More