The future funding of the England & Wales water sector: Ofwat’s draft determinations

On Thursday 11 July, Ofwat (the England and Wales water regulator) published its much anticipated Draft Determinations (DDs). As part of the PR24 price review, this sets out its provisional assessment of allowed revenues and performance targets for AMP8 (2025–30)—and will be of great interest to water companies, investors, and other stakeholders.

Have companies got all that they asked for in their respective business plans (BPs)? Here we provide a summary, but you can explore the issues in more depth by downloading our briefing note.

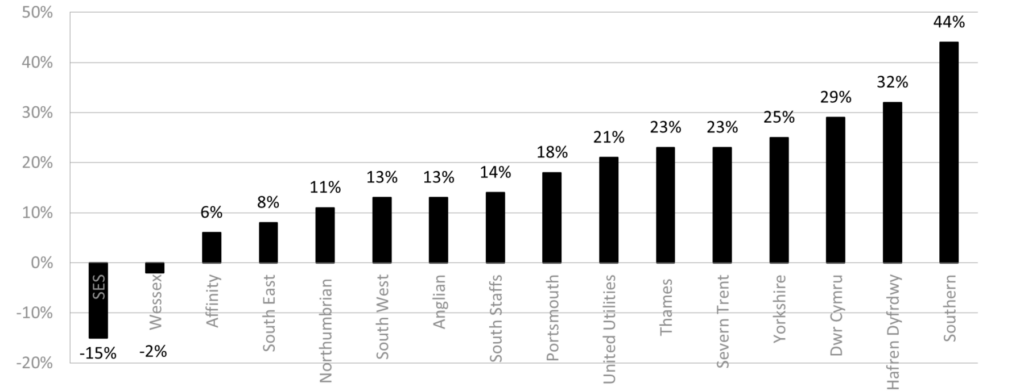

Under Ofwat’s DDs, average bills will rise by £19 per year in real terms for water and sewerage companies. Southern Water will see the biggest increase in bills (+44%), while bills for Wessex and SES customers would fall in real terms between 2024/25 and 2029/30.

Figure 1 Bill impacts, % change from 2024/25 to 2029/30

Companies put forward their own BP proposals in 2023. As part of the DD process, Ofwat has undertaken an assessment of the quality and ambition of these BPs. The results are mixed. Two companies (Severn Trent and South West Water) have been categorised as ‘outstanding’. Ten companies have been categorised as ‘standard’. South East Water’s BP has been found to lack ambition, while the BPs submitted by Thames, Southern and Wessex are all deemed inadequate. Rewards and penalties will flow through from these assessments.

Bills are increasing for a reason. The DDs allow for an increase in total industry spending (TOTEX) from £59bn over 2020–25, to £88bn in 2025–30. The increase in allowed costs reflects the large programme of enhancements that is needed to meet legal requirements, particularly in the wastewater network. Enhancement investment will increase three-fold, from £11bn to £34.5bn.

However, Ofwat has disallowed c.£16bn of TOTEX relative to company plans. This represents an overall ‘haircut’ to company BPs of 16% (versus a 11% challenge at the previous PR19 DDs). The level of challenge varies across the companies, with cuts ranging from 3% to 34% (after accounting for frontier shift and real price effects). Much of the cut is driven by Ofwat’s efficiency assessment. More detail on Ofwat’s challenge to companies’ base and enhancement cost proposals is provided in our briefing note.

Ofwat will use a suite of performance commitments (PCs) and outcome delivery incentives (ODIs) to incentivise performance. Most common PCs will have financial ODIs (i.e. rewards and penalties) attached to outturn performance. The potential rewards/penalties are mainly intended to be symmetric, and will have in-period annual settlements. Ofwat has used a ‘top-down’ return on regulated equity (RoRE) approach to set these ODI rates.

In a number of areas, the PC levels (PCLs) or targets are more stretching than set out in company BPs (per capita consumption; business demand; GHG emissions; pollution incidents; storm overflows; and biodiversity). Ofwat has set out a variety of protections within the PCL/ODI package. However, given the apparent level of stretch within the PCLs, companies are likely to remain concerned about the potential for asymmetric risk under the ODI framework.

Ofwat has also taken a number of steps to tighten delivery requirements/penalise non-delivery and deal with uncertainty. For large schemes (over £100m), where there may be concerns around uncertainty (e.g. scope, cost, deliverability), the regulator is proposing an alternative approach to providing allowances. Ofwat also has an eye on investment to tackle storm overflows—a key industry priority over AMP8. Given the unpredictability over the number of storm overflows schemes that will be required over the 2025–30 period, Ofwat is proposing potential clawback of funding in certain circumstances—plus an uncertainty mechanism. The DD also provides greater clarity on Ofwat’s approach to price control deliverables (PCDs), a mechanism intended to clawback funding where companies do not deliver on their commitments. This list of PCDs is extensive.

Of particular interest to investors, Ofwat has updated the PR24 cost of capital compared to its ‘early view’ presented in the final methodology. Overall, Ofwat’s DDs mark an increase in the allowed rate of return relative to its ‘early view’ as well as relative to PR19 determinations. Ofwat’s application of its methodology results in a wholesale CPIH-real WACC of 3.66% based on a cut-off date of 31 March 2024. This compares to its ‘early view’ of 3.23%.

Ofwat has stuck relatively closely to the methodology outlined in its final methodology. The increase in the WACC is partially driven by the increase in interest rates that have been observed since the final methodology. However, there are also some unexpected positives for companies—in particular, Ofwat has chosen to ‘aim up’ on the cost of equity, adopting a point estimate of 4.80% (which sits at the higher end of its 4.19–4.88% range) to enhance investability. This translates into a 0.27% aiming-up uplift. There has also been upward movement in the assumed cost of debt since Ofwat’s ‘early view’.

Ofwat has provided its updated view on the balance of risk and reward under the provisional determination (in RoRE terms). It considers the overall balance of risk for the notional company to be broadly symmetric at -4.85 to +4.80% around the base RoRE. However, companies are likely to take a different view on the underlying risk distribution and may question the assumptions underpinning Ofwat’s analysis.

On financeability, while Ofwat’s resulting financial ratios are relatively strong, with adjusted interest cover ratios (AICRs) generally in excess of 1.65x, this does rely on the assumption that companies inject significant amounts of equity. Given this challenge, and the benefits associated with a public listing, Ofwat is consulting on providing funding for the costs of obtaining an equity listing through a log-up of costs to the RCV at PR29. This may be indicative of Ofwat pushing towards public listing as a potential solution for some of the challenges facing the industry.

Companies have until 28 August to respond to the DDs, with Ofwat planning to set out its final decision (FDs) on 19 December.

Download

Contact

Alan Horncastle

PartnerContributors

Related

Download

Related

Future of rail: how to shape a resilient and responsive Great British Railways

Great Britain’s railway is at a critical juncture, facing unprecedented pressures arising from changing travel patterns, ageing infrastructure, and ongoing financial strain. These challenges, exacerbated by the impacts of the pandemic and the imperative to achieve net zero, underscore the need for comprehensive and forward-looking reform. The UK government has proposed… Read More

Investing in distribution: ED3 and beyond

In the first quarter of this year the National Infrastructure Commission (NIC)1 published its vision for the UK’s electricity distribution network. Below, we review this in the context of Ofgem’s consultation on RIIO-ED32 and its published responses. One of the policy priorities is to ensure… Read More