The policy of truth? Deception in markets and in public policy

Today we live in a world of ‘alternative facts’, ‘fake news’ and ‘echo chambers’. While dishonesty in politics is not new, the methods that have been applied to influence public opinion in recent years are. ‘Post-truth’ is Oxford Dictionaries’ 2016 ‘word of the year’, and is defined as ‘relating to or denoting circumstances in which objective facts are less influential in shaping public opinion than appeals to emotion and personal belief’.1 There is perhaps a simpler terminology for post-truth—‘deception’.

Notwithstanding grammatical nuances, from a public policy perspective, post-truth raises some concerns. One is that independent, objective evidence may in future play less of a role in shaping important policy decisions—if proven facts are less appealing to the public, they will also be less appealing to political decision-makers. Another is that, by tapping into and reinforcing psychological biases in the public, politicians can manipulate people into acting against their own long-term interests. Lastly, challenging post-truth is not easy, in that the obvious solution of ‘fact-checking’ may not be sufficient.

These issues are explored below. But what does post-truth have to do with economics? The answer: substitute voters with consumers, and politicians with firms. Standard economic theory predicts that consumers cannot be systematically exploited by firms through deception. Assuming that there are several competing firms in the marketplace, and that consumers are rational and have full information, consumers see through any attempts at deception (e.g. mis-selling of add-on products). In this world, any firm that tries to exploit consumers will lose custom to those treating people fairly. Over time, firms will also be minded to protect their hard-earned reputation. The prediction is that no firm engages in deception in equilibrium.

Evidently, this is not an accurate description of the real world. There are numerous examples of deception in markets, even when several firms exist in the marketplace. Examples include mis-selling in financial services, energy and telecommunications, as well as the diesel emissions defeat-device scandal in car manufacturing. Therefore, competition does not always protect consumers—but why? The latest discipline to explore this issue brings together insights from behavioural economics and industrial organisation. Behavioural industrial organisation (BIO) explores consumers’ psychological biases, how these can be manipulated by firms, and why markets do not always self-correct.

What are the overlaps with voter deception in post-truth public policy? Interestingly, BIO and post-truth share the same underpinnings—both appeal to the role of emotion in how people make decisions; both rely on the existence of behavioural biases in explaining how people subsequently behave; and both involve adopting policies that work with or against these biases (also known as ‘nudges’). BIO and post-truth can be thought of as two sides of the same coin. To challenge post-truth it is helpful to understand how we as individuals can be deceived and coerced in equilibrium.

Heads: deception in markets

Behavioural economics adopts lessons from psychology to explain how people behave in the real world.2 It was developed as a reaction to the simplifying assumptions of the standard economic model, which assumes that people are fully rational (or, at least, act ‘as if’ they are). The traditional model assumes, in effect, that we rely on decision-making that is conscious, rules-based and slow—otherwise known as system 2.

However, if we used system 2 for every decision, we wouldn’t get much done. Instead, we strive for cognitive ease. Many of our decisions are made based on how we feel (intuition, instinct, reflex and habit) rather than how we consciously think in the true sense of the word. This in turn uses our faster, more instinctive system 1.

Biases and market outcomes

While this is an efficient compromise, system 1 is prone to behavioural biases. For example, we use shortcuts, or heuristics, to help us solve problems quickly. These are often useful, but not always. For example, take Steve. He’s a quiet person living in London who is helpful but keeps himself to himself. What is his occupation most likely to be—an airline pilot, librarian, or salesman? No doubt a mental image of Steve formed quickly in your head (system 1), which is likely to have trumped any consideration of statistics (system 2).

Other biases are at work. Our decisions will be guided by our beliefs, which colour how we perceive the world, recall events and assess our abilities. We also tend to be loss-averse, in that we dislike losses more than we like equivalent gains (and thus will react differently according to how information is framed). We may be over-confident in our abilities, showing optimism bias. We may also have self-control problems, showing present bias. In this last respect, while system 2 tries to plan the correct path for the long haul (such as going on a diet), system 1 may give in to temptation (such as eating a chocolate bar).3

Firms may then seek to exploit these kinds of consumer bias—through product design, marketing, distribution and/or pricing. BIO predicts that the market may get stuck in an equilibrium in which there is a ‘race to the bottom’, and all firms seek to exploit consumers (e.g. all firms mis-sell payment protection insurance, PPI, rather than none). Three notable contributions to the study of this field are Gabaix and Laibson (2006), who focus on consumers’ inattention to ‘shrouded’ add-ons;4 Heidhues, Kőszegi and Murooka (2012), who focus on consumers with self-control problems;5 and Akerlof and Shiller (2015), who characterise the problem as being more general and widespread.6

Gabaix and Laibson present a model where consumers are offered a base good and an add-on (such as a loan with an optional add-on insurance product). In this market there are sophisticated consumers and naive consumers. The former always take into consideration the full price of a product including add-ons, whereas naive consumers do so only if they observe the add-on information clearly. Sophisticated consumers buy the (keenly priced) base good and not the add-on, and are cross-subsidised by naive customers who purchase the (expensive) add-on.

If the proportion of naive customers is high enough, all firms will choose to shroud the add-on price information, and the market will not resolve the problem. Why is this? Naive consumers are attracted to the keenly priced base good but are oblivious to the true combined cost. Any firm that educates naive consumers about the add-ons will lose these highly profitable customers. Sophisticated consumers are unprofitable to the firm, and prefer to buy from firms offering the base good at loss-leader prices. Serving sophisticated consumers is feasible only if there are enough naive consumers to cross-subsidise them. This is the ‘curse of de-biasing’: all firms exploit the biases of naive consumers, and no single firm has an incentive to adjust its behaviour. This price discrimination means the sophisticated do not protect the naive.

Naive consumers may get a raw deal not just because they are inattentive but also because of self-control problems. Heidhues et al. discuss retail loans in a model where all borrowers are present-biased. Whereas sophisticated consumers appreciate their self-control problems, naive consumers do not. Naive consumers under-predict the likelihood that they will miss future repayments, and so under-predict future charges. Firms can make additional profits from these consumers through future ‘hidden’ fees, but fierce initial competition for new customers means that these are ‘handed back’ through lower upfront charges on the principal product.

What, then, is the problem? Essentially the handing back stops short when sophisticated ‘arbitrage’ consumers seek to benefit from cheap upfront payment terms while avoiding future ex post penalties. Firms do not want too many of these ‘arbitrage’ consumers on their books, so they create a minimum price floor for the upfront charges. In equilibrium, all firms end up exploiting consumer naivety: they make high profits from naive consumers (who incur penalty charges), without completely handing back these profits to sophisticated consumers (through lower upfront charges).7 Far from protecting the naive consumers, sophisticated consumers exacerbate their problems.

This is a problem in theory, but do these kinds of behaviour happen in the real world? In the UK, the PPI mis-selling scandal has echoes of the shrouding framework. Here a keenly priced base good (a loan) was sold with an add-on product (PPI) at the point of sale. Consumers were not in a position to assess whether PPI suited their needs, or whether the charges for PPI were competitive.8 This also led to a significant number of mis-selling court cases.9

The case of UK payday lending seems to fit the Heidhues et al. present bias framework more closely. Here, the industry business model relied on the additional charges levied on people who repeatedly rolled over their payments. These customers were overly optimistic about their ability to exert self-control. A profitability analysis showed that this group of customers cross-subsidised those who paid off their loan on time (and were potentially unprofitable).10

Is consumer deception widespread? Akerlof and Shiller (2015) argue not only that ‘phishing’11 is widespread but that it is an inevitable consequence of a free market; we are all vulnerable at some juncture. They give the example of the positioning of bakery kiosks at airports, where the smells deliberately entice us when we are particularly susceptible. If one firm did not exploit this opportunity, another one would—just as with any other product.

Remedies for 2 + 2 = 5?

The question, then, is how to solve these kinds of problem. The traditional supply-side remedy of relying on competition (lowering barriers to entry to encourage new firms into the market) will not necessarily work, as the problem is not one of a lack of competitors.12

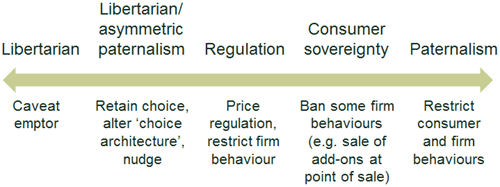

What remedies should be introduced instead? As shown in Figure 1, there are options for intervention on both the supply side (such as price regulation and bans on certain selling practices) and the demand side (such as nudging consumers), along a spectrum of interventions. The problem is that behavioural economists (and competition authorities) disagree on how interventionist we should be.

Thaler advocates libertarian paternalism.13 The idea is that, where individuals are clearly not acting in their own best interests, government (or others) should ‘nudge’ people into making better life decisions by altering the options available. Examples include sending SMS warnings to consumers who are approaching their overdraft limit, and defaulting people into tax-efficient pension schemes (while providing them with the ability to opt out).14 Policies should protect freedom of choice for the consumer, and nudge people who behave irrationally into better life decisions while leaving those who behave rationally largely unaffected.15

However, not all of behavioural economics is about nudging. Where the exploitation of consumer biases is particularly severe and the market does not adjust for this naturally, more interventionist policies may be required. In the case of the UK energy supply market, for example, the Competition and Markets Authority (CMA) concluded that competition was not working effectively enough for customers on pre-payment meters (who are also more likely to be vulnerable consumers). It recommended that temporary price regulation should be introduced for this group.16 Alternatively, interventions may seek to protect ‘consumer sovereignty’, for example by banning firms from engaging in certain behaviours such as selling add-on products at the point of sale, or levying add-on charges and hidden penalties.17 Remedies introduced by the UK Financial Conduct Authority (FCA) in the payday lending market have included a limit on the number of times a loan can be rolled over (extended), and a cap on charges.18

Figure 1 Spectrum of interventions

Source: Oxera.

Tails: deception in public policy

Behavioural economics involves examining the descriptive first (how things are) followed by the normative (how things should be). The descriptive approach explicitly acknowledges that people can be prone to biases, and uses evidence to assess the extent of these biases. Any proposed remedy then involves a normative position (a view on what the goal is), but it will be informed by evidence of the policy impact.

Where post-truth is used in politics, it can be thought of as the flip side to behavioural economics. Post-truth involves rhetoric that downplays objective evidence in the first instance, and subsequently adopts a policy tone that takes advantage of and reinforces citizens’ behavioural biases. The aim is to secure an outcome that is primarily in the policymaker’s political interests, which might not align with the long-term interests of citizens. Politicians using post-truth methods are akin to the misbehaving firms discussed above.

Biases and policy outcomes

In terms of the impact on the electorate, therefore, one way of thinking about this is that post-truth works by reversing the descriptive and the normative—as regards the order in which voters process policy arguments. If I am a rational voter I will objectively weigh up the evidence (descriptive), and then develop my position on an issue (normative). In a post-truth world, however, I first adopt my political position as to how things should be (normative), then choose facts that fit with this position and ignore those that do not (biased descriptive).19 Another perspective is that post-truth reinforces system 1 emotions and beliefs while crowding out system 2 thinking.

In terms of communicating the message to voters, recent elections have seen a number of developments:

- the growth of social media as a direct tool to link politicians directly to the voter base, thereby bypassing the mainstream media (especially in the USA);20

- rolling 24-hour TV news with live, repeated commentaries;

- frequent TV interviews and rallies by campaigners to personify a message.

The main behavioural biases that have been reinforced through this messaging then relate to ‘coherence of the narrative’. As discussed above, people are not statistical fact-checkers and we favour cognitive ease. It is easier to accept something as true when it fits our beliefs than to reject something as false when it conflicts. We can therefore be swayed by a causal story that is consistent with our beliefs. Here are some of the biases.

- Affect heuristic and priming—when facing complex choices and uncertainty, we often substitute the question ‘what do I think about X?’ with ‘how do I feel about X?’—the affect heuristic. Simple emotive language can then be used to prime voters’ emotions—‘great’ and ‘bad’; ‘us’ and ‘them’; etc.21

- Base rate neglect—similarly, we construct a causal narrative based on specific information to hand rather than on the more important underlying statistics. ‘Steve the librarian’ was a case of base rate neglect—Steve looked like a librarian but, more importantly, there are many more salesmen in London than librarians.

- Availability heuristics—repetition of messages, regardless of whether they are true, means that they are more likely to be believed—as familiarity is associated with the truth.22 For example, continual tweeting of news stories makes events seem more important and frequent than they are—an availability cascade.23

In addition, information overload has a role. When there is a lot of conflicting information, engaging people with rational analysis becomes more difficult. People will instead tend to go with their instincts. In turn, instincts are open to manipulation.

Usually, present bias and loss aversion mean that, when faced with uncertainty, people prefer not to take a risk and instead stick with the status quo. This was clearly not the case in terms of the voting outcomes in the UK EU referendum or the US election. There are a couple of potential explanations.

- Present bias can be countered through targeting—for example, the UK EU referendum saw a record-breaking turnout (of 72.2%),24 suggesting that voters were engaged and that present bias was less of a factor—or at least had been countered through effective, energised campaigning.

- People who feel they have ‘nothing to lose’ will take a risk—in the case of the UK EU referendum, if a voter feels that they do not benefit from EU membership, they will feel they have little to lose by voting ‘leave’. And if a voter does feel that they benefit in the status quo to some degree, but that the future under the status quo is a ‘sure loss’, they may gamble to break even.25

Remedies for 2 + 2 = 5?

The question then is what to do about post-truth. One viewpoint is that it is simply a fact of life. However, when policy is dictated by politically driven emotions, and facts are systematically degraded, there is a real risk of harm to individuals and society in the long run.

In economic terms, a starting point is to recognise post-truth as a market failure—of misinformation. A first step would be to reassess how people access, assess and act on information. Much has been made about the tendency of Internet search algorithms to readily deliver news that conforms to previous user searches (and hence their beliefs), and the ‘click bait’ revenue model of fake news.26 In effect, the way in which voters access news is potentially an availability heuristic on a plate—what comes to mind most readily is what already fits with the voter’s beliefs. However, more research is required on the true extent of the problem and its impact.

A challenge is that the most obvious remedy may not work—at least not in isolation. Fact-checking—the process of challenging each and every statement in a systematic evidence-based way—assumes that people are rational and are responsive to re-education. US researchers have tested this by running experiments on conservative-leaning students. Subjects read fake news articles that included either a misleading claim from a politician, or a misleading claim plus a correction. The results indicated that corrections often failed to reduce misperceptions, and that there was a ‘backfire effect’ in many cases in which corrections increased misperceptions. When new information contradicted the participants’ views they simply overcompensated with counter-arguments.27

Potentially, the problem can be tackled in a preventative fashion. There may be a role for school education around the methods of post-truth coercion. However, education programmes need to be carefully designed and, on their own, may be ineffective. Returning to a markets example, teaching people financial literacy is not always effective in improving consumer outcomes.28

It also takes time to establish social norms. In the case of post-truth, the starting point rests with politicians, and the legitimacy of the methods they use to campaign and communicate to the electorate. In the UK, one option, recommended by the Committee on Standards in Public Life (CSPL) in 1998, is that the political parties agree a code of best practice on political advertising. However, the Electoral Commission has highlighted difficulties in implementing this. For its own part, the Commission does not wish to be a truthfulness ‘adjudicator’, as this could harm its (perceived) independence.29 The CSPL itself has expressed concerns about ‘fake news’ and the ‘disturbingly low’ public attitude towards politicians.30 Whether the CSPL itself will undertake a review of political standards and post-truth (coupled with recommendations) remains to be seen.

Post-truth politics has tapped into legitimate concerns that have been left unchecked over the years. There has been declining trust in ‘the establishment’—which has presented an opportunity for campaigners to engage people in politics who were previously disengaged.31 There has also been long-standing social inequality and a feeling of segments of the population being ‘left behind’.32 However, post-truth methods—as adopted throughout the political spectrum—involve deception. This being the case, the economic approach would be to diagnose the problem, and then develop the appropriate solution. Economists need to make their case—effectively.

1 See Oxford Dictionaries, ‘Word of the Year 2016 is…’.

2 See Thaler, R. (1980), ‘Toward a Positive Theory of Consumer Choice’, Journal of Economic Behavior and Organization, 1:1, pp. 39–60; and Thaler, R. (2015), Misbehaving: The making of behavioural economics, Penguin, chapter 4.

3 Present bias is our tendency to disproportionately prefer utility today. This is a result of impatience and a failure to adequately balance current and future benefits. The difficulty of dieting is a good example of this—rationally we know we want to lose weight as a long-term objective. However, we find it hard to resist a chocolate bar when the opportunity arises. Thus although our longer-term preference is for dieting, at the relevant decision point the benefit of the chocolate bar is now, whereas the benefit of weight loss is in the future. This leads to a preference reversal.

4 Gabaix, X. and Laibson, D. (2006), ‘Shrouded Attributes, Consumer Myopia, and Information Suppression in Competitive Markets‘, Quarterly Journal of Economics, May, 121:2, pp. 505–40.

5 Heidhues, P., Kőszegi, B. and Murooka, T. (2012), ‘Deception and Consumer Protection in Competitive Markets’, in Swedish Competition Authority, ‘The Pros and Cons of Consumer Protection’, pp. 44–76.

6 Akerlof, G.A. and Shiller, R.J. (2015), Phishing for Phools: The Economics of Manipulation and Deception, Princeton University Press.

7 Interestingly, firms do not make exploitative profits when sophisticated consumers are absent from the market.

8 See Hunt, S. and Kelly, D. (2015), ‘Behavioural economics and financial mark regulation: practical policy, rigorous methods’, Agenda, July.

9 See Financial Conduct Authority (2014), ‘Redress for payment protection insurance (PPI) mis-sales: Update on progress and looking ahead’, Thematic Review TR14/14, August. For other examples of insurance add-on products, the evidence of market dysfunction has been much less clear-cut. See Oxera (2014), ‘Adding up the add-ons: the FCA’s first market investigation’, Agenda, May.

10 See Oxera (2017), ‘Should we be cross about cross-subsidies? Experience from the financial services sector?’, Agenda, March; and Office of Fair Trading (2013), ‘Payday Lending: Compliance Review Final Report’.

11 Akerlof and Shiller note that the standard definition of ‘phishing’ concerns online fraud through deceptively ‘angling’ for personal information. They extend this metaphor to any situation in which people are targeted and fooled into doing things that are not in their interests. The authors compare this to an angler (or ‘phisherman’) dropping a lure into the water and waiting as (wary) fish swim by and make an error. Here, we all get caught at some point. See Akerlof, G.A. and Shiller, R.J. (2015), Phishing for Phools: The Economics of Manipulation and Deception, Princeton University Press, p. xi.

12 However, some firms may enter the market as ‘disrupters’, with a selling point of treating customers fairly. Generally, lowering barriers to entry may be part of the solution, but by itself this will not tackle exploitation of behavioural biases where the market has dropped into an exploitative equilibrium.

13 This should not be confused with liberalism—which has various meanings. See Thaler, R. and Sunstein, C. (2003), ‘Libertarian Paternalism’, The American Economic Review, 93, pp. 175–9.

14 Not all libertarian paternalism is about improving decisions for the individual. It may also be aimed at improving the welfare of society as a whole (e.g. social nudges to encourage people to pay their taxes on time) or the environment (e.g. salience of energy efficiency labelling).

15 This is the related concept of asymmetric paternalism.

16 Competition and Markets Authority (2016), ‘Energy market investigation’, Summary of final report, June.

17 Such interventions can make some customers better off and some worse off.

18 See Oxera (2017), ‘Should we be cross about cross-subsidies? Experience from the financial services sector’, Agenda, March.

19 The term biased descriptive is Oxera’s terminology.

20 See Stromer-Galley, J. (2016), ‘How Clinton, Trump are using social media to shape voters’ views (Commentary)’, Special to Syracuse.com, September. There is a debate as to how much US citizens rely on social media for their news. While this is emphasised in Gottfried, J. and Shearer, E. (2016), ‘News Use Across Social Media Platforms’, Pew Research Centre, commentary, May, the role of social media as a dominant source of news during the 2016 US election is questioned in Allcott, H. and Gentzkow, M. (2017), ‘Social Media and Fake News in the 2016 Election’, Working Paper, New York University and Stanford University (respectively), January.

21 Priming occurs when the mentioning of one word (for example EAT) means that we readily recall (using System 1) a particular word when presented with a subsequent context (e.g. SO_P). Affective priming occurs when the evaluation of a first word (e.g. GREAT) affects the processing of subsequent words.

22 Moons, W., Mackie, D. and Garcia-Marques, T. (2009), ‘The impact of repetition-induced familiarity on agreement with weak and strong arguments’, Journal of Personality and Social Psychology, 96:1, January, pp. 32–44.

23 Kuran, T. and Sunstein, C. (1999), ‘Availability Cascades and Risk Regulation’, Stanford Law Review, 51:4.

24 See The Electoral Commission, ‘EU referendum results’.

25 See, for example, Kahneman, D. (2012), Thinking, Fast and Slow, Penguin, p. 280; and Thaler, R. (2015), Misbehaving: The making of behavioural economics, Penguin, p. 84.

26 Click bait is Internet content of dubious accuracy, the main purpose of which is to attract attention and encourage visitors to click on a link, thereby generating cash for the content author.

27 Nyhan, B. and Reifler, J. (2010), ‘When Corrections Fail: The Persistence of Political Misperceptions’, Political Behavior, 32:2, June, pp. 303–30.

28 Oxera (2008), ‘Financial (il)literacy: do consumer education programmes work?’, Agenda, March.

29 The Electoral Commission (2016), ‘The 2016 EU referendum’, September.

30 Committee on Standards in Public Life (2017), ‘Culture, Media and Sport Select Committee Inquiry “Fake News”’, submission by the Committee, March.

31 On Brexit, see Hobolt, S. (2016), ‘The Brexit vote: a divided nation, a divided continent’, Journal of European Public Policy, 23:9, pp. 1259–77.

32 See Inglehart, R. and Norris, P. (2016), ‘Trump, Brexit, and the Rise of Populism: Economic Have-Nots and Cultural Backlash’, Faculty Research Working Paper Series, Harvard University, August. In the context of Brexit specifically, see Becker, S., Fetzer, T. and Novy, D. (2016), ‘Who Voted for Brexit? A Comprehensive District-Level Analysis’, Working Paper, University of Warwick, October (re-submitted November); and Goodwin, M. and Heath, O. (2016), ‘The 2016 Referendum, Brexit and the Left Behind: An Aggregate-level Analysis of the Result’, The Political Quarterly, 87:3, July–September, pp. 323–32.

Download

Contact

Leon Fields

Senior ConsultantContributor

Related

- Energy

- Financial Services

- Pharmaceuticals and Life Sciences

- Telecoms, Media and Technology

- Transport

- Water

Download

Related

The European growth problem and what to do about it

European growth is insufficient to improve lives in the ways that citizens would like. We use the UK as a case study to assess the scale of the growth problem, underlying causes, official responses and what else might be done to improve the situation. We suggest that capital market… Read More

The 2023 annual law on the market and competition: new developments for motorway concessions in Italy

With the 2023 annual law on the market and competition (Legge annuale per il mercato e la concorrenza 2023), the Italian government introduced several innovations across various sectors, including motorway concessions. Specifically, as regards the latter, the provisions reflect the objectives of greater transparency and competition when awarding motorway concessions,… Read More