Theories of benefit: platform value creation and its relevance for the regulatory debate

With the regulatory debate around platforms and competition focusing on the theories of harm to business users and consumers, there is a risk that the theories of the benefits of platforms are crowded out. Understanding how platforms generate value is crucial to ascertain the potential consequences of regulatory measures. Value generation by platforms has been studied in the IT and management literatures. Here we present findings from the literature, illuminating the debate around platform regulation.

To ensure a balanced regulatory and competition policy debate in the context of multi-sided markets and platform ecosystems, it is necessary to consider not just theories of harm but also theories of benefit. Theories of harm, concerning practices such as platforms extending their market power from the core to related services, or ‘self-preferencing’ their own affiliated services, play a prominent role in the industrial organisation literature that has influenced the current regulatory debate.1

However, the IT and platform management literature has focused more on the processes by which platform ecosystems generate value.2 This is an important perspective that needs to be given due consideration by policymakers. An understanding of platform value creation is necessary to ensure that regulators can tackle the problems they identify without simultaneously disrupting the value creation process.3

Realising economies of scale and scope and demand complementarities

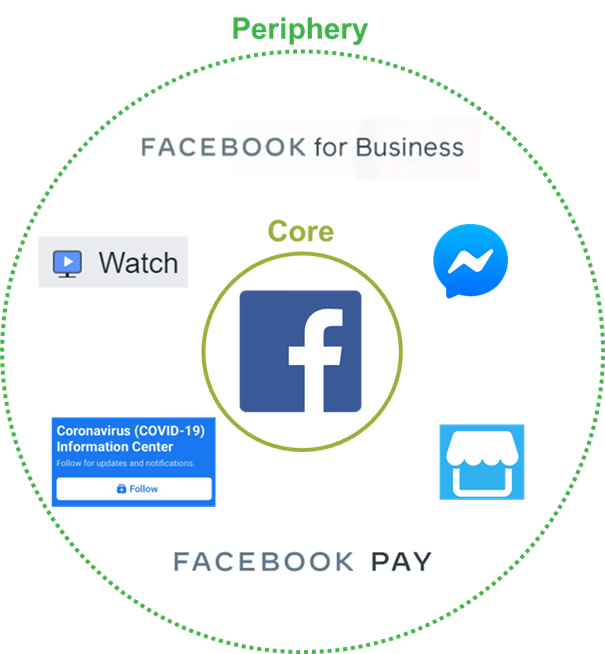

The fundamental architecture behind platforms can be described as a set of ‘core’ components with little variety (the platform) and a set of ‘peripheral’ components or features with greater variety (the additional products, content, services and functionality provided by contributors). A platform’s governance structure allows for coordination between the two. For example, Google Maps (the platform) can be used by any number of apps (the periphery). This avoids the need for app developers to ‘reinvent the wheel’ every time new apps require mapping functionality, leading to lower costs and, through specialisation and experience, a better product.4

A platform can facilitate coordination between the complementary features and services that it supports, and this increases the overall value of the platform to the user. For example, as shown in Figure 1 below, each Facebook user derives value from the newsfeed generated by their social graph (the other users with whom they have connected on the site). That value is enhanced by a messaging option, the ability to buy and sell, or the capacity to make payments within their social circle. Overall, users will derive value from the platform in different ways depending on their specific usage patterns and preferences.

Figure 1 Platforms’ core–periphery structure

The inherent modularity of the core–periphery structure gives ‘option value’ to platforms, enabling them to adapt to consumer tastes that differ between consumers and over time. Different tastes can be catered for with a new ‘app’ or feature that maintains the platform’s relevance. For example, users personalise their smartphone by deciding which apps to install after they acquire the phone.5 New apps may enable the smartphone to be used for purposes not originally envisaged by the manufacturer, and the idea for a new app does not have to come from the manufacturer itself.

Degree of platform openness and control

The degree of openness of a platform—that is, the flexibility with which the platform allows external contributors to contribute to its activities—has consequences for the nature and smooth interoperability of its products and features.

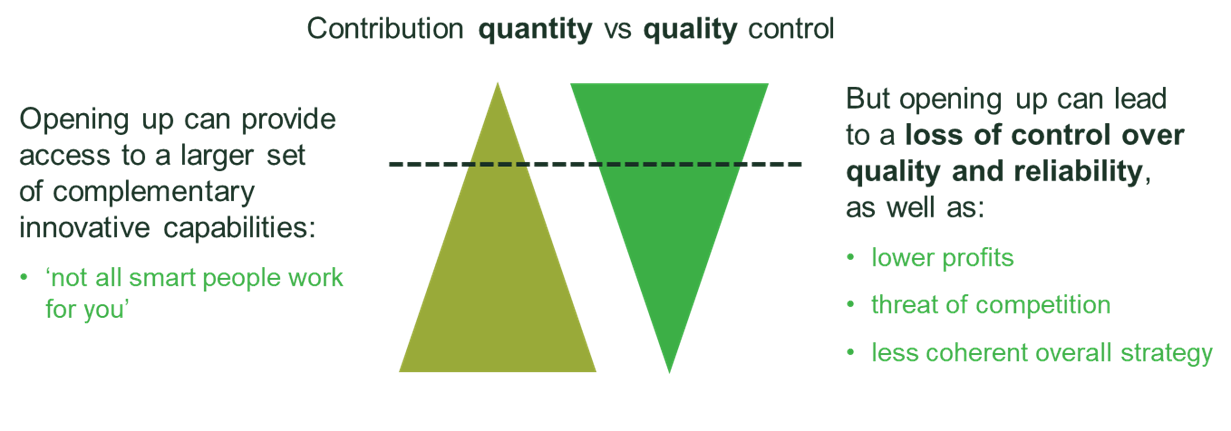

A fully closed technology would be vertically integrated and controlled by a single party, whereas a fully open technology is in the public domain and accessible to all. In reality, most platforms are partially open rather than fully closed or open. The degree of openness varies across platforms. Moving up or down the scale of openness comes with trade-offs (as illustrated in Figure 2).

Figure 2 Trade-off between contribution quantity and quality control

In general, a more open platform will attract more contributors, each providing their own complementary innovations.6 Increasing the number of contributors does not only augment the scale of innovation—there is potential for a quality effect too. As the founder of Sun Microsystems observed, ‘Not all smart people work for you.’7 The contributors who experiment on a platform may have skills and ideas that the platform lacks.

However, opening up a platform is not costless. First, increasing openness can make it more difficult for platform creators to appropriate profits from their own invention.8 Second, the loss of control that openness entails includes a loss of control over quality and the overall direction of the innovation strategy.9 Third, an open platform can provide a springboard for a complementor to become a competitor, as nearly happened when Facebook developed its own ‘homescreen’ app for Android phones.10

Platforms choose the level of openness that is best for them and the right degree of openness will vary for different platforms at different times.

Managing behaviour and interaction

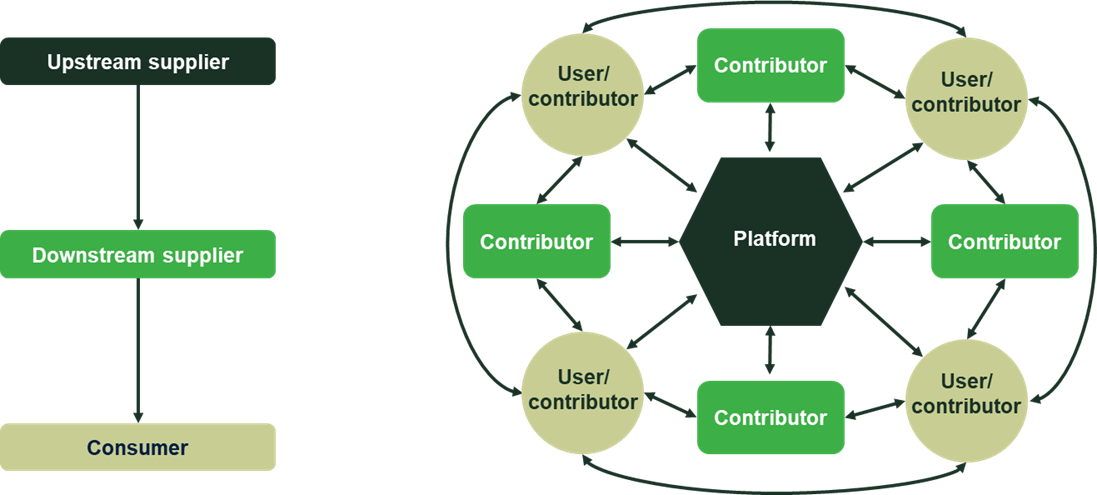

Traditional industries can be captured in a vertical ‘value chain’, where inputs come in, undergo a transformation, and are sent out as outputs (which may become inputs for another part of the value chain), as set out in Porter’s 1985 model.11

Unlike traditional industries, digital platforms do not create value in a vertical and sequential manner. Users, business partners, and both external and internal developers can all be ‘contributors’, providing the additional features, content and services that enhance value on the platform.12 Consequently, each participant in the ecosystem is highly dependent on other participants, and their actions have important implications for the value of the platform ecosystems as a whole. The contrast between the traditional value chain and the interdependence of platform ecosystems is shown in Figure 3.

Figure 3 Value creation in platform ecosystems

Platform owners wish to bring contributors on board to innovate and find new uses for the platform, but also want to manage those contributions to ensure that they enhance rather than detract from the platform’s value. This balance needs to be achieved while ensuring that the platform owners earn a sufficient return from the platform, and that contributors are also sufficiently rewarded for their efforts.

As such, platform owners will make decisions about the degree of platform openness, scope and design, pricing and revenue sharing, and control such that they:

- maintain sufficient profitability;

- keep users on board by ensuring that they receive a net benefit;

- keep contributors on board by ensuring that they earn a return.

Internalising externalities

Platforms need to create the conditions under which the actions of participants optimise the total value of the platform ecosystem, and not just a given participant’s own value alone. Platforms can coordinate across the two sides of the platform through their governance structures. For instance, advertiser-supported platforms ‘must constantly balance advertisers’ desire to expose users to more prominent and targeted advertisements with users’ preference for less intrusion’.13 As such, many platforms allow users to amend their privacy settings so that it is more difficult for the users to be targeted by advertisers. Yet if too many users opt out from targeted advertisement, the value of the platform to advertisers may decrease, impairing total platform value.

Platforms can similarly coordinate users on the same side in the case of direct network effects when users add heterogeneous value to the service. For instance, Twitter offers certain users a ‘blue tick’ to ‘let people know that an account of public interest is authentic’, which ‘typically includes accounts maintained by users in music, acting, fashion, government, politics, religion, journalism, media, sports, business, and other key interest areas’.14 This encourages such people to join the platform, which in turn increases the value of the platform to other users.

Harnessing big data to drive value creation

The rise of platforms has coincided with the rise of big data, about which much has been written in the last decade.15 The term ‘big data’ has been described as one that is a ‘buzzword for smarter, more insightful data analysis’.16 Platforms are particularly well placed to create value due to the ease with which they gather data from their users, their agility in innovation owing to their modular structure, and their network of relationships with contributors.

In general, platforms can create value using data in four key ways.

1. Create new products or improve existing products

For example, price comparison websites and credit scoring firms are able to use data on their customers to suggest, or to automatically switch them over to, new products.17 Google’s Gmail now offers to complete people’s emails for them as they are drafting them. This would not be possible if Google had not used big data to analyse how people write emails and programmed that information into an algorithm.

2. Create value through improved customer recommendations

Amazon is able to make product recommendations based on past purchases and purchases by consumers with similar purchasing behaviour. Furthermore, the targeted adverts of Facebook and Google are driven by data. The more accurate the inferences drawn from the data, the better the targeting of the adverts, increasing the value of the adverts for advertisers and users.18

3. Improve our understanding of the world as it is today—i.e. ‘nowcasting’

‘Nowcasting’ is the attempt to estimate the current value of some significant economic variable. These variables are normally released once the relevant statistical authority has conducted surveys and gathered the data, but the sooner these variables are known and can be acted upon, the better. Various authors have shown how nowcasting can be improved by including data from Google Trends in regressions.19

4. The value of data is improved by matching across multiple different datasets

Some of the navigation services many of us have come to rely upon are a result of aggregating and recombining data. Google Maps aggregates data from: (i) Android users, to provide real-time traffic updates; (ii) public transport authorities, to provide updates on public transport; and (iii) its search and review functions on shops, restaurants and other locations.20 Alibaba used data from across its ecosystem to launch Ant Financial Services, an online provider of payment and banking services. Using data from the Alibaba ecosystem, Ant has been able to assign credit scores to its users and provide financial services to a market that would otherwise not have ready access to such banking services.21

Implications for the regulatory and competition policy debate

We now set out some of the key insights from the IT and platform management literature that are relevant for the ongoing debate about digital platform regulation.

1. One-size-fits-all regulation and a partial view of a platform’s activities will have unintended consequences

First, it is important for regulators to gain an understanding of how different platforms create value, taking into account the fact that all platform ecosystems are different, with their own specific assets, features and co-dependencies. Regulations appropriate for one platform may be counterproductive for another. Each platform creator accounts for the particular circumstances of the platform when designing governance structures so as to preserve the platform’s viability and incentivise all participants to act so as to maximise overall platform value. A regulatory view of a platform based on one set of users, eschewing this wider context, may therefore have unintended consequences.

2. Platforms are not the same as utilities

Second, while there may be lessons to learn from the designation of telecoms firms with significant market power,22 platforms differ from traditional regulated utilities such as broadband or electricity networks. Platforms are at the centre of rapidly evolving relationships and interactions between consumers and business users. This means that platform value creation can change fundamentally as the way in which people use the platform changes. Moreover, platforms are not just neutral intermediaries that help users reach and/or interact with each other. They also play an active role in the design and governance of these interactions to ensure that they provide value to users. Such a role must be taken into account when assessing whether certain regulatory remedies that are appropriate for utilities—such as open access, interoperability, data sharing and various forms of non-discrimination obligations—can be usefully adapted for application to digital platforms.

3. Data is an input

Third, data is an input to the value that platforms create. The new products, product improvements and product recommendations created by platforms are driven by data. Platforms are well placed to gather, analyse and utilise data to grow the business and create value for both business partners and consumers. The regulatory debate should take into account the fact that platforms make data governance decisions with a view to generating value, promoting innovation (including external complementary innovation), protecting privacy, and preserving strategic trade secrets.

4. Theories of harm give only a partial view

To focus on allegations that platforms extend their market power from the core to the periphery, or ‘self-preference’ their own services is to take only a partial view. The firms that build successful platforms have to be active in the management of those platforms. A key decision in that management is the extent to which the platform is open and draws on the innovation and expertise that are available from outside, or closed and keeps control of the user’s experience on the platform. Regulations or competition policy interventions designed to resolve perceptions of unfair business practices might force platforms to be more open than is optimal, to the detriment of the overall user experience.

The baby and the bathwater

Overall, the IT and platform management literature helps explain many of the strategic and commercial decisions made by platforms from the perspective of value creation. It is important for policymakers and regulators to understand such value creation processes, and this requires a theory of benefit for platforms to complement the theories of harm that view platform decisions primarily as a means of expanding market power. A richer understanding of platform business models and processes for value creation should inform any plans for policy intervention. This calls for a flexible and tailored approach that provides room for an effects-based assessment of conduct and competitive dynamics, and of the effectiveness of remedies.

As our recent report for the CCIA highlights,23 inspiration for this approach can come from the ‘checks and balances’ embedded in the institutional set-up of the European telecoms regulatory framework, as well as the recent proposals by the UK’s Digital Markets Taskforce.24 Through the adverse effects on consumers and competition test (AECC test), this Taskforce requires a holistic assessment of the market before tailored remedies can be imposed.25

Fast-moving digital markets require equally nimble regulatory authorities to oversee them. However, speed of action must not come at the expense of evidence-based market analyses, and must take account of both benefits and adverse effects. Otherwise, the benefits that digital markets have to offer will be jeopardised.

1 See, for example, Belleflamme, P. and Peitz, M. (2019), ‘The Competitive Impacts of Exclusivity and Price Transparency in Markets with Digital Platforms’, Collaborative Research Center Transregio 224, Discussion Paper No. 137; and Padilla, J., Perkins, J. and Piccolo, S. (2020), ‘Self-preferencing in markets with vertically-integrated gatekeeper platforms’, Centre for Studies in Economics and Finance, Working Paper No. 582.

2 See, for example, Baldwin, Y.C. and Woodard, C.J. (2009), ‘The Architecture of Platforms: A Unified View’, in A. Gawer (ed.), Platforms, Markets and Innovation, Edward Elgar Publishing, pp. 19–44; and Thomas, L.D.W. and Autio, E. (2014), ‘Innovation Ecosystems: Implications for Innovation Management’, in M. Dodgson, N. Philips, and D.M. Gann (eds), The Oxford Handbook of Innovation Management, Oxford University Press.

3 This article is based on a literature review commissioned from Oxera by Facebook. Since then, Oxera has published a report commissioned by the Computer and Communications Industry Association (CCIA) which covers similar themes. The report focused on how platforms use the particular practices highlighted by the Commission as areas of concern in its proposals for the Digital Markets Act (DMA) to generate value for consumers and business users. See Oxera (2021), ‘How platforms create value for their users: implications for the Digital Markets Act’, prepared for the Computer and Communications Industry Association, 12 May.

4 Baldwin, Y.C. and Woodard, C.J. (2009), ‘The Architecture of Platforms: A Unified View’, in A. Gawer (ed.), Platforms, Markets and Innovation, Edward Elgar Publishing, pp. 19–44.

5 McIntyre, D.P. and Srinivasan, A. (2016), ‘Networks, platforms, and strategy: emerging views and next steps’, Strategic Management Journal, 38:1, pp. 141–60.

6 Gawer, A. (2014), ‘Bridging different perspectives on technological platforms: Toward an integrative framework’, Research Policy, 43:7, pp. 1239–49.

7 Cited in Baldwin, Y.C. and Woodard, C.J. (2009), ‘The Architecture of Platforms: A Unified View’, in A. Gawer (ed.), Platforms, Markets and Innovation, Edward Elgar Publishing, pp. 19–44.

8 McIntyre, D.P. and Srinivasan, A. (2016), ‘Networks, platforms, and strategy: emerging views and next steps’, Strategic Management Journal, 38:1, pp. 141–60; Boudreau, K. (2010), ‘Open Platform Strategies and Innovation: Granting Access vs. Devolving Control’, Management Science, 56:10, pp. 1849–72.

9 Boudreau, K. (2010), ‘Open Platform Strategies and Innovation: Granting Access vs. Devolving Control’, Management Science, 56:10, pp. 1849–72.

10 Gawer, A. (2014), ‘Bridging different perspectives on technological platforms: Toward an integrative framework’, Research Policy, 43:7, pp. 1239–49.

11 Porter, M.E. (1985), Competitive Advantage: Creating and Sustaining Superior Performance, Simon and Schuster, New York.

12 Complements are goods and services built on a platform that enhance the value of a core good to a network via indirect network effects, such that the value of the core good to adopters is greater with the complement than without it. See Brandenburger, A.M. and Nalebuff, B.J. (1996), Co-opetition, Currency/Doubleday, New York; Yoffie, D. and Kwak, M. (2006), ‘With friends like these: the art of managing complementors’, Harvard Business Review, September; Gawer, A. (2009), Platforms, Markets and Innovation, Edward Elgar Publishing; Zhu, F. and Iansiti, M. (2012), ‘Entry into platform-based markets’, Strategic Management Journal, 33:1, pp. 88–106.

In the literature, complementors are the (typically independent) providers of complementary products to mutual customers. In reality, the platforms themselves also commonly build complementary products on the platform. See Gawer, A. and Cusumano, M.A. (2013), ‘Industry Platforms and Ecosystem Innovation’, The Journal of Product Innovation Management,31:3, pp. 417–33. Gawer and Cusumano set out how a firm, working by itself or with suppliers, can build a family of products or sets of new features by deploying reusable components. They acknowledge that such complements may also be developed externally, where this reusable component is ‘open’ to outside firms, including business partners and developers. In general, we refer to ‘contributors’ rather than ‘complementors’ to reflect this point. See also Boudreau, K.J. and Jeppesen, L.B. (2015), ‘Unpaid crowd complementors: the platform network effect mirage’, Strategic Management Journal, 36:2, pp. 1761–77; and McIntyre, D.P. and Srinivasan, A. (2016), ‘Networks, platforms, and strategy: emerging views and next steps’, Strategic Management Journal, 38:1, pp. 141–60.

13 Hagiu, A. (2015), ‘Strategic Decisions for Multisided Platforms’, MIT Sloan Management Review, 55:2, pp. 71–80.

14 Twitter (2021), ‘Verification FAQ’.

15 The ecosystem structure of platforms is particularly well-suited for collecting and aggregating data across complementors and users. As noted by Erevelles et al., getting big data requires access to ‘a large number of users’, which induces some firms to adopt an ‘open-source strategy’, and to provide services such as Internet search, email or social networking free of charge to end-users. See Erevelles, S., Fukawa, N. and Swayne, L. (2016), ‘Big Data consumer analytics and the transformation of marketing’, Journal of Business Research, 69, pp. 897–904.

16 Davenport, T.H., Barth, P. and Bean, R. (2012), ‘How “Big Data” is Different’, MIT Sloan Management Review, 54:1, p. 22.

17 For example, ClearScore, a credit scoring and reporting firm, tracks its users’ finances and offers them the most relevant credit cards and loans. See: https://www.clearscore.com/.

18 Schreieck, M., Wiesche, M. and Kremar, H. (2016), ‘Design and Governance of Platform Ecosystems – Key Concepts and Issues for Future Research’, Association for Information Systems, Research Paper 76.

19 Koop, G. and Onorante, L. (2019), ‘Macroeconomic Nowcasting Using Google Probabilities’, Topics in Identification, Limited Dependent Variables, Partial Observability, Experimentation, and Flexible Modeling: Part A (Advances in Econometrics), 40, pp. 17–40; Choi, H. and Varian, H. (2012), ‘Predicting the Present with Google Trends’, The Economic Record, 88:1s, Special Issue: Selected Papers from the 40th Australian Conference of Economists; Kurov, A., Sancetta, A., Strasser and G., Wolfe, M.H. (2016), ‘Price drift before U.S. macroeconomic news: private information about public announcements?’, ECB Working Paper, No. 1901, European Central Bank.

20 Baldwin, Y.C. and Woodard, C.J. (2009), ‘The Architecture of Platforms: A Unified View’, in A. Gawer (ed.), Platforms, Markets and Innovation, Edward Elgar Publishing, pp. 19–44.

21 Ringel, M., Grassl, F., Baeza, R., Kennedy, D., Spira, M. and Manly, J. (2019), ‘The Most Innovative Companies 2019: The Rise of AI, Platforms, and Ecosystems’, mimeo, Boston Consulting Group.

22 See Oxera’s report for the CCIA, which highlighted that a weakness of the DMA proposals was that they departed from competition law principles. In this respect, the proposals differ from the significant market power (SMP) regime within the telecoms sector, which has been successful in identifying which electronic communications markets should be susceptible to ex ante regulation in a manner consistent with the principles of competition law.

23 Ibid.

24 See Competition and Markets Authority (2020), ‘A new pro-competition regime for digital markets: Advice of the Digital Markets Taskforce’, December.

25 Ibid., Recommendation 6c.

Download

Contact

Dr Andrew Mell

Technical AdviserContributors

Related

Download

Related

Investing in distribution: ED3 and beyond

The National Infrastructure Commission (NIC) has published its vision for the UK’s electricity distribution network. Below, we review this in the context of Ofgem’s consultation on RIIO-ED31 and its published responses. One of the policy priorities is to ensure that the distribution network is strategically reinforced in preparation… Read More

Leveraged buyouts: a smart strategy or a risky gamble?

The second episode in the Top of the Agenda series on private equity demystifies leveraged buyouts (LBOs); a widely used yet controversial private equity strategy. While LBOs can offer the potential for substantial returns by using debt to finance acquisitions, they also come with significant risks such as excessive debt… Read More