Mind the vGUPPI! A new approach to vertical mergers in local markets

Recent transactions involving the merging of wholesale and retail activities (most notably the Tesco/Booker merger and the Co-op/Nisa merger) have led the UK Competition and Markets Authority (CMA) to introduce a new framework for assessing vertical mergers. What is the framework of analysis of these cases, and how can the vGUPPI tool be used in the context of grocery mergers?

The UK grocery sector is going through significant structural change, with consolidation at different levels of the supply chain. At the retail level, the proposed transaction between Asda and Sainsbury’s1 is currently under review by the CMA, and it could substantially change the supermarket landscape in the UK. At the wholesale level, the Tesco/Booker merger2 and, more recently, the Co-op/Nisa merger3 combine the wholesaling activities of a symbol group (e.g. Booker or Nisa)4 with a wholly owned national retail network (e.g. Tesco or Co-op). This consolidation has happened in a market where, according to the CMA, ‘competition for wholesale services is generally strong and … retailers overall have a range of wholesale options to choose from’,5 even after wholesaler, P&H, entered into administration in November 2017.6

The Co-op/Nisa and Tesco/Booker transactions have created some interesting questions for the merger control regime. In both of these cases, the CMA investigated the potential for the merger to substantially lessen competition in the market via two main ‘theories of harm’. In the example of the Co-op/Nisa merger, these were as follows.

- Wholesale-to-retail: the merged entity could increase its wholesale prices, or equivalently worsen other aspects of price, quality, range or service offered to retail stores supplied by Nisa, due to the possibility of recapturing sales at stores that the Co-op owns and supplies, in areas where Nisa and the Co-op are in close proximity to each other.7

- Retail-to-wholesale: the merged entity could increase its retail prices or equivalently worsen other aspects of price, quality, range or service offered at Co-op stores, due to the possibility of recapturing wholesale profits from customers diverting to Nisa-supplied retail stores in areas where the Co-op and Nisa stores are in close proximity to each other.

Both of these mechanisms are vertical theories of harm, where the merging parties might worsen the terms of their offering to the extent that customers would be encouraged to divert their purchases to alternative stores. They are commonly explored by competition authorities, especially when an upstream firm may have control over the quality or the price of the input of its competitors. Recent cases of this include the ICE/Trayport, H3G/O2 and BT/EE mergers.

The standard competition analysis for a vertical merger involves assessing:

- whether the merged entity would have the ability to increase the prices or equivalently worsen other aspects of its offering;

- if so, whether it would find it profitable to carry out this strategy (i.e. whether it would have the incentive to do so);

- whether the merger would substantially reduce competition in the affected market.

We consider the CMA’s approach to assessing each of these questions below.

Would the merged entity have the ability to increase prices or worsen other aspects of its offering?

In order for a vertical theory of harm to be plausible, the merging parties must have the ability to engage in the harmful behaviour. In terms of a wholesale-to-retail theory of harm, an ability assessment needs to consider the following questions.

- Would it be feasible, in practice, for the merged entity to vary wholesale prices, quality, range or service offered between downstream purchasers? In the context of the Co-op/Nisa merger, the CMA concluded that there would be very limited scope for the merged entity to flex its wholesale offering across individual stores owned by multi-site retailers supplied by Nisa.8 As such, in the case of groups of stores owned by a single owner, it would not be possible to provide a less favourable offering only to stores located in close proximity to Co-op stores.

- Are alternative sources of supply available to downstream firms? In markets where multi-sourcing from different wholesalers is common practice, and/or where there are a large number of competing suppliers, retailers will be able to respond to wholesale price increases by switching some or all of their purchases to other suppliers. This will limit the ability of the merged entity to impose an input price rise on downstream rivals.

In both the Tesco/Booker and Co-op/Nisa mergers, the CMA relied on the fact that competition in the UK wholesale grocery market would remain strong when concluding that, in the majority of areas, the merged entity would have limited ability to carry out such harm. This is because the targets of the strategy could easily defeat it by switching away to a range of alternative wholesale supply options.9

Would the merged entity have the incentive to increase prices or worsen other aspects of its offering?

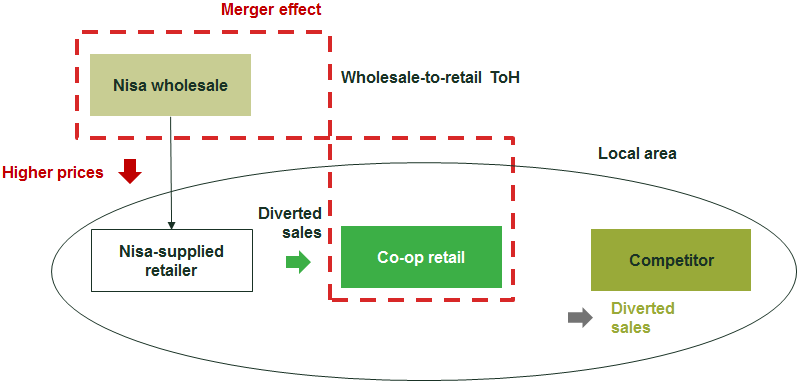

Having assessed whether the strategy would be feasible, one needs to consider the gains and losses associated with it and the extent to which the transaction would provide the merging parties with an incentive to enact it. As an illustration, Figure 1 considers the wholesale-to-retail theory of harm that was analysed in the Co-op/Nisa case.

Figure 1 Wholesale-to-retail theory of harm

Source: Oxera.

In this case, an analysis of the incentives of the merging parties would consider the gains from the higher wholesale prices that Nisa would charge to the stores it supplies. These would then be assessed against the losses in wholesale volume resulting from the higher price. To the extent that the wholesale price increase is passed on to Nisa’s retail prices, the merger also allows the parties to obtain further profits, insofar as Nisa’s retail customers would divert their shopping to Co-op retail stores in a particular local area.

The extent to which such a strategy would be successful depends on a number of factors. Most notably, these are:

- the margin that the merged entity makes at the wholesale level;

- the margins earned on sales that divert from independent retailers supplied by Nisa to stores owned and operated by the Co-op;

- the closeness of competition between the stores supplied by Nisa and those owned by the Co-op, and the elasticity of demand faced by Nisa stores (as these elements will inform the extent to which customers would divert to the merging party when faced with a price rise);

- the extent to which the firms relying on the upstream input can source it from an alternative provider (i.e. the elasticity of demand faced by the merged entity at the wholesale level).10

All of these factors can be synthesised into a score that measures the incentive of the merging parties to increase prices post-merger.11 This framework is a modification of the gross upward pricing index (GUPPI), which is a well-established technique to quantify horizontal merger price effects.12 The amended framework captures the vertical aspects of the transaction, and is therefore known as the vertical gross upward pricing index (vGUPPI). The calculation of the vGUPPI is outlined in the box.

The vGUPPI framework

The vGUPPI framework devised in Salop and Moresi (2012) disentangles the following three economic incentives that might arise post-merger in a vertical transaction.

vGUPPIu: pricing incentives of the upstream firm

An index of the value of the sales diverted to the downstream merging partner, divided by the revenue on volume lost by the upstream merging partner:

Where:

- DRUD is the diversion ratio from the upstream to the downstream firm;

- MD is the downstream merging firm margin;

- PD is the price of the output sold by the downstream merging firm;

- WR is the price of the input sold by the upstream merging party to its downstream rival.

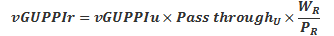

vGUPPIr: pricing incentives of the downstream competitor

A predictor of the potential impact of the vertical merger on the downstream customers:

Where:

- Pass throughU is the pass-through rate of the upstream merging firm input price onto retail prices;

- WR is the price of the input sold by the upstream merging party to the downstream merging firm;

- PR is the price of the output sold by the downstream rival.

vGUPPId: pricing incentives of the downstream merging firm

The value of the sales diverted to the upstream merging partner, divided by the revenue on the volume lost by the downstream merging partner:

Where:

- DRDU is the diversion ratio from the downstream to the upstream firm;

- MU is the upstream margin;

- WU is the price of the input sold by the upstream merging party to the downstream merging firm;

- PD is the price of the output sold by the downstream merging firm.

Source: Moresi, S. and Salop, C. (2012), ‘vGUPPI: Scoring Unilateral Pricing Incentives in Vertical Mergers’, Antitrust Law Journal, 79:1, pp. 187–214.

In the same way as its horizontal counterpart, the vGUPPI score that is relevant for the theory of harm under study should be compared against an assumed ‘tolerable’ threshold.

In horizontal mergers (i.e. mergers between competitors at the same level in the supply chain), the CMA and its predecessors have in some cases considered a 5% threshold as indicating a potential competition problem.13 Following this initial screening, the CMA can look at whether any upward pricing pressure might be offset by factors such as efficiencies, entry, innovation or product repositioning.

In the case of vertical mergers, there are a number of reasons why a higher threshold might be more appropriate. First, the vGUPPI formula calculates the upward pricing pressure at the wholesale level as a result of the merger. In order to calculate the impact of the vGUPPI on retail prices, the upstream vGUPPI must first be converted into an upstream price increase and then into a downstream price increase based on the level of wholesale-to-retail pass-through.14 Second, implementing such a foreclosure strategy is both costly at an operational level and risky if the downstream firm suffering the input cost increase has the possibility of switching all of its purchases to alternative suppliers.

In the Tesco/Booker merger, the CMA considered that a 5% threshold was conservative, and it used a 10% threshold as another reference point for the analysis.15

Would the merger substantially reduce competition in the affected market?

Finally, even if the competition assessment found that the merging parties would have the ability and the incentive to carry out such a strategy, any harm would need to be weighed against any merger-specific efficiencies that arose from the acquisition.

For example, in the context of a grocery merger that combines the purchasing power of a vertically integrated retailer with that of a wholesaler, purchasing efficiency might lead to lower input prices, a proportion of which one might expect to be passed through into lower prices for customers. In the context of the Co-op/Nisa transaction, an additional merger-specific customer benefit was created by the 1% rebate on variable wholesale cost that the Co-op promised Nisa members upon completion of the transaction. This was essentially a straightforward marginal input cost reduction for these retailers, resulting in a direct benefit to customers of the merged entity’s wholesale arm, but also a benefit to final consumers, since marginal cost savings tend to be more readily passed on to final consumers than fixed cost savings are.

In this case, the pass-on of lower prices to customers is unusually clear, as retailers will receive the full benefit directly in the form of lower input prices. The benefits to final consumers can then be calculated by applying the same assumptions of the vGUPPI framework, which assumes that 75% of Nisa wholesale cost changes would be passed on into retail prices.16 These consumer benefits should therefore be weighed against any potential harm deriving from the merger. However, in this case, the CMA did not ultimately identify any substantial competition concerns at phase 1, and therefore did not need to consider countervailing efficiencies or relevant customer benefits in order to clear the transaction.

Concluding remarks

The decisions in the recent Tesco/Booker and Co-op/Nisa cases laid down the foundations for the application of the vGUPPI framework to vertical mergers. While the vGUPPI is a useful screening method, it is subject to the same criticisms as similar upward pricing pressure metrics (such as UPP and GUPPI), in particular with respect to the sensitivity of its outcome to how the critical inputs in the model are calculated.

However, when applied appropriately and considered as part of a wider assessment that takes into account all the relevant evidence, the vGUPPI framework is a useful addition to the analytical toolbox for merger assessment.

1 Competition and Markets Authority (2018), ‘J Sainsbury PLC / Asda Group Ltd merger inquiry’, 18 June.

2 Competition and Markets Authority (2017), ‘Tesco and Booker: a report on the anticipated acquisition by Tesco PLC of Booker Group plc’, 20 December (‘Tesco/Booker decision’).

3 Competition and Markets Authority (2018), ‘Anticipated acquisition by Co-operative Group Ltd of Nisa Retail Ltd: decision on relevant merger situation and substantial lessening of competition’, ME/6716-17 (‘Co-op/Nisa decision’).

4 A symbol group is a form of franchise in the retail sector. Symbol groups do not own or operate stores, but rather act as suppliers of these retail stores under a common banner.

5 Tesco/Booker decision, para. 7.147.

6 For example, see Butler, S. and Davies, R. (2017), ‘Wholesaler P&H goes into administration with loss of 2,500 jobs’, The Guardian, 28 November.

7 The equivalent theory of harm applies to the Tesco/Booker transaction, where the concern involved an increase in price or equivalent decrease in quality in Booker-supplied stores due to the possibility of recapturing sales at stores in close proximity that were owned and supplied by Tesco.

8 Co-op/Nisa decision, para. 79.

9 Co-op/Nisa decision, para. 115.

10 This factor is relevant for the ability as well as the incentive to increase prices or worsen other aspects of its offering.

11 Moresi, S. and Salop, S.C. (2013) ‘vGUPPI: Scoring Unilateral Pricing Incentives in Vertical Mergers’, Antitrust Law Journal, 79:1, p. 187–214. This paper is also referred to by the CMA in Appendix C of the Tesco/Booker decision, footnote 4.

12 Farrell J. and Shapiro, C. (2010), ‘Antitrust Evaluation of Horizontal Merger: An Economic Alternative to Market Definition’, The B.E. Journal of Theoretical Economics, 10:1 (Policies and Perspectives).

13 Tesco/Booker decision, para. 9.56. A 5% GUPPI implies that the parties would have an incentive to raise prices by 5% post-merger.

14 Tesco/Booker decision, para. 9.51.

15 Tesco/Booker decision, para. 9.51.

16 Tesco/Booker decision, Appendix C.

Download

Related

Future of rail: how to shape a resilient and responsive Great British Railways

Great Britain’s railway is at a critical juncture, facing unprecedented pressures arising from changing travel patterns, ageing infrastructure, and ongoing financial strain. These challenges, exacerbated by the impacts of the pandemic and the imperative to achieve net zero, underscore the need for comprehensive and forward-looking reform. The UK government has proposed… Read More

Investing in distribution: ED3 and beyond

In the first quarter of this year the National Infrastructure Commission (NIC)1 published its vision for the UK’s electricity distribution network. Below, we review this in the context of Ofgem’s consultation on RIIO-ED32 and its published responses. One of the policy priorities is to ensure… Read More