The impact of including AV in the EU Geoblocking Regulation

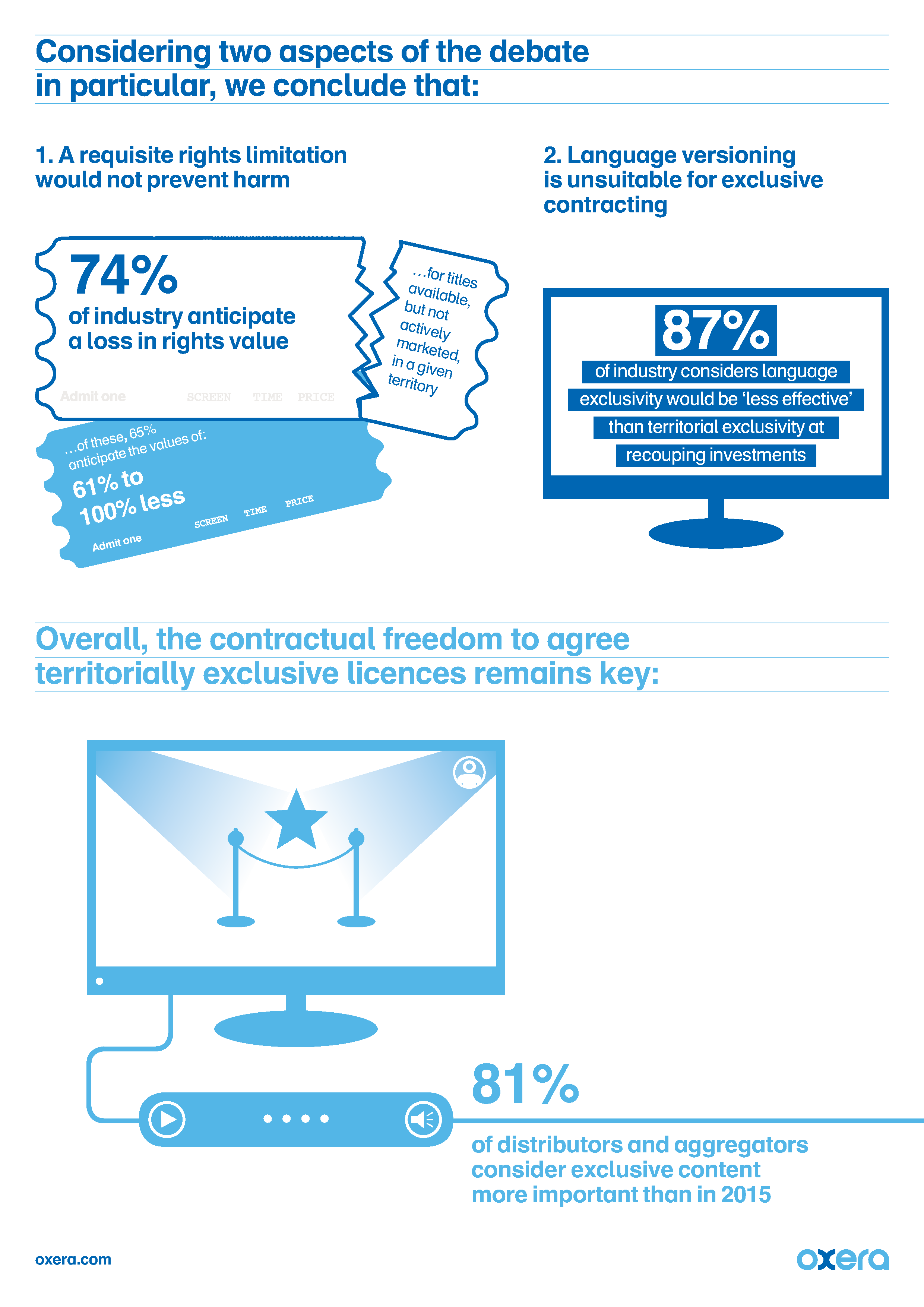

There is no one-size-fits-all approach to financing audio-visual (AV) content. Including AV within the scope of the EU’s 2018 Geoblocking Regulation—even with a requisite rights limitation—would erode the contractual freedoms that traders rely on to fund new content creation and distribution.

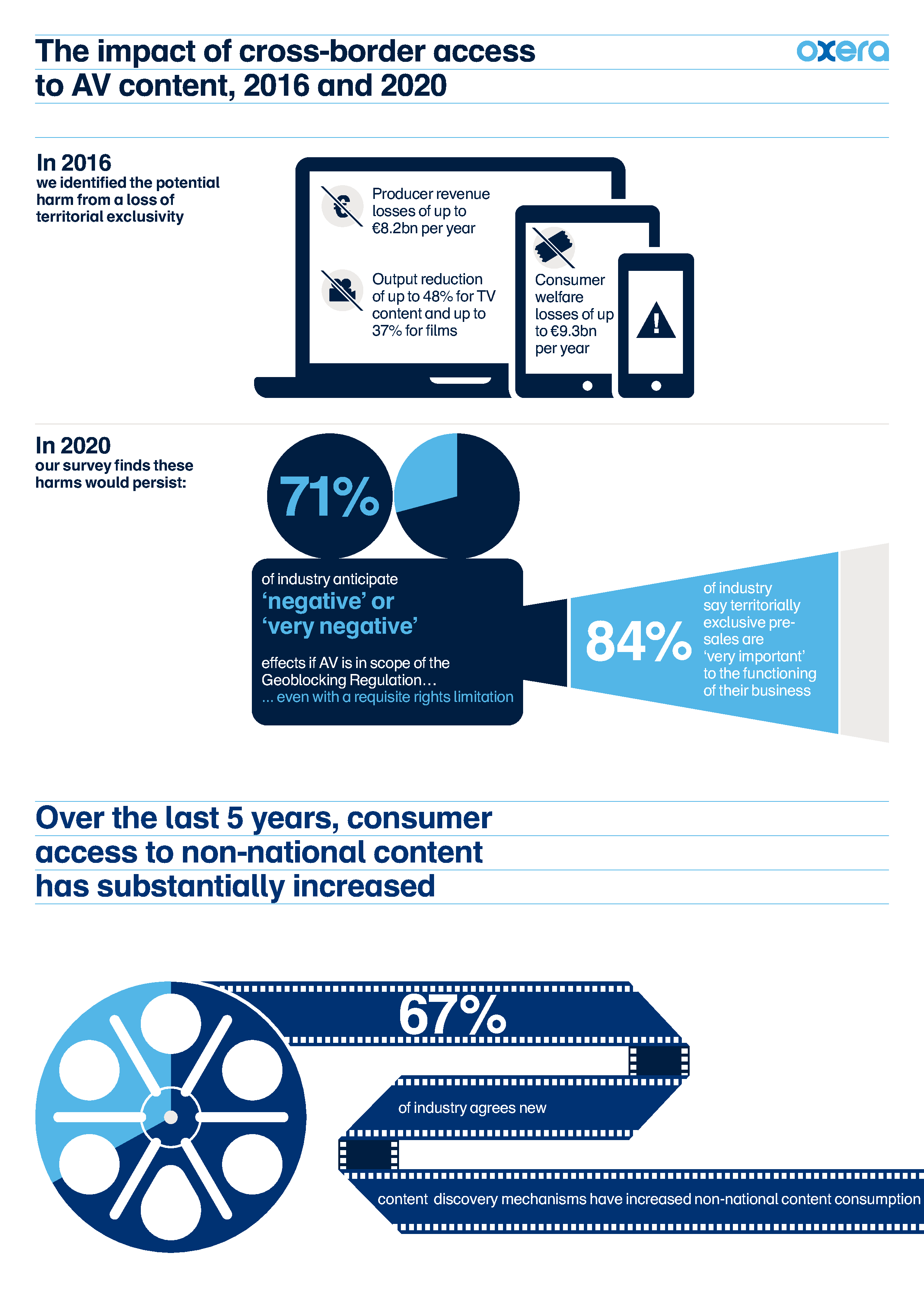

In 2016, Oxera published a report jointly with Oliver & Ohlbaum Associates that modelled the likely effects of increased cross-border access to AV services within the EU. That report highlighted the risk of a significant short-term impact on industry and consumers, with up to €9.3bn of welfare lost per annum—as well as medium- to long-term outcomes that would be worse than they are today (a welfare loss of up to €4.5bn per year).

This new study, prepared for a group of AV businesses active in Europe, extends that 2016 report by examining the supply-side effects on producers, distributors, cinemas and broadcasters if AV services were to fall within the scope of the 2018 Geoblocking Regulation, subject to a requisite rights limitation. We gathered evidence through a broad-based survey of industry participants across Europe, supplemented by a series of in-depth interviews with senior staff from a selection of key companies in Europe’s AV value chain.

Through our discussions with industry participants, we found that different traders adopt different approaches to financing, marketing, distribution and localisation of content, depending on the specific characteristics of a given work and each trader’s chosen business model. Given this diversity, it is vital that traders retain the contractual freedom to tailor their strategy to each individual work and territory.

Including AV within the scope of the Regulation—even with a requisite rights limitation—would erode that contractual freedom, impinging on traders’ ability to contract on a territorial basis. This would undermine many of the funding and value-generating mechanisms that traders use to finance new productions. This, in turn, would put investment in new content at risk, reintroducing the risks to output and consumer welfare that we identified in our 2016 report.

A language-exclusivity regime would also reduce the contractual freedom of traders at all levels of the value chain. Smaller distributors, cinemas and broadcasters may find themselves unable to afford the rights to content with multi-territory appeal; meanwhile, producers may be unable to find distributors willing to acquire the rights and invest in the localisation and promotion of content in less widely spoken local languages. For consumers, this would mean less tailored content and services; for producers, the commercial potential and incentives to invest in new works would be reduced.